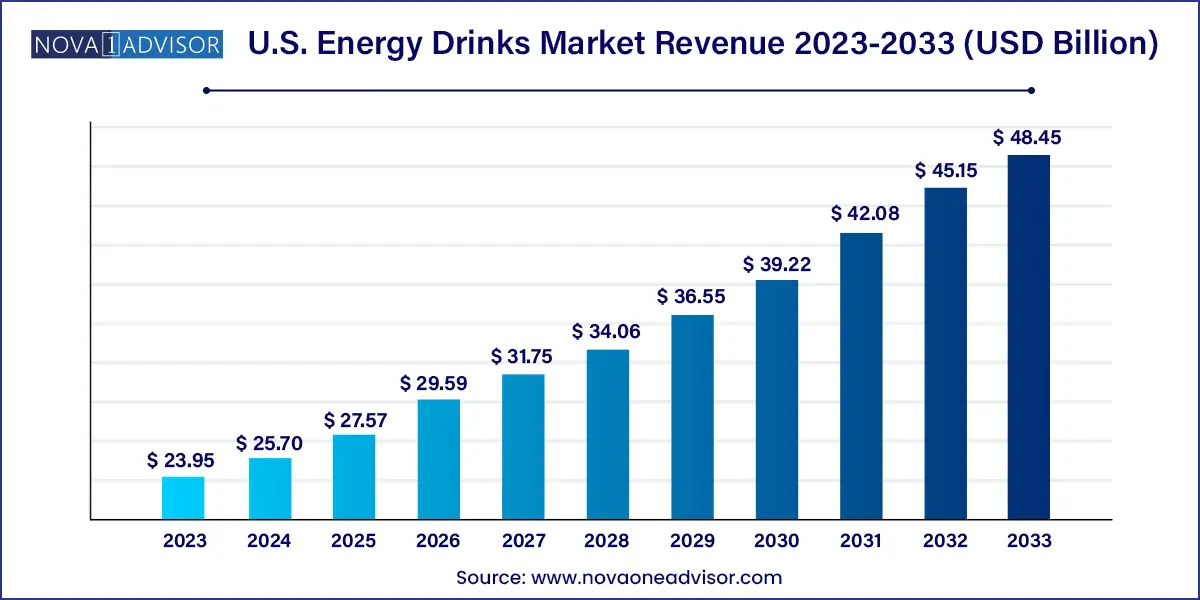

The U.S. energy drinks market size was exhibited at USD 23.95 billion in 2023 and is projected to hit around USD 48.45 billion by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

The U.S. energy drinks market stands as one of the most dynamic and competitive segments within the broader non-alcoholic beverage industry. Over the past decade, energy drinks have evolved from niche products aimed primarily at extreme sports enthusiasts and college students into widely accepted functional beverages consumed across all demographics. These drinks, formulated to boost energy, mental alertness, and physical performance, now command significant shelf space in supermarkets, convenience stores, fitness centers, and online platforms across the United States.

The market has witnessed significant transformation with the entry of new brands, flavor innovations, sugar-free alternatives, natural formulations, and advanced marketing tactics targeting specific lifestyles. While traditional energy drinks were often criticized for their high sugar and caffeine content, modern formulations are responding to consumer demand for “cleaner” labels—offering plant-based energy sources, adaptogens, electrolytes, and even nootropics for enhanced focus and mood.

Energy drinks have now become daily-use beverages for athletes, busy professionals, long-haul drivers, shift workers, and increasingly, wellness-oriented consumers seeking functional energy without jitters or crashes. The COVID-19 pandemic further catalyzed this shift, with a rise in at-home fitness and the work-from-home culture leading consumers to seek energy solutions beyond the traditional cup of coffee. Today, energy drinks are marketed as lifestyle products, with branding that cuts across fitness, gaming, music, and fashion cultures.

The U.S. continues to dominate global energy drink consumption, supported by a mature retail ecosystem, high disposable incomes, and a growing interest in performance-enhancing functional beverages. As innovation continues to reshape the category, the market is poised for sustained growth through 2034, driven by evolving consumer preferences, product diversification, and aggressive market expansion strategies.

Zero-Sugar and Functional Additives: Rising health awareness is pushing brands to develop zero-calorie, low-carb drinks with added vitamins, adaptogens, and amino acids.

Crossover with Wellness and Nootropic Beverages: Energy drinks are now being infused with ingredients like L-theanine, ashwagandha, and green tea extracts to target mood, focus, and calm energy.

Diversification of Flavors and Limited Editions: Brands are experimenting with exotic fruit blends, nostalgic soda flavors, and seasonal launches to maintain excitement and drive repeat purchases.

Fitness and Lifestyle Positioning: Marketing is increasingly tailored to bodybuilders, gamers, yoga enthusiasts, and other niche audiences through sponsorships and influencer marketing.

Sustainable and Transparent Packaging: There is a growing emphasis on recyclable cans, clear labeling, and carbon-neutral production processes.

Growth of Energy Shots: Concentrated energy beverages offering quick energy boosts in small doses are gaining popularity in convenience stores and among older demographics.

Hybrid Categories (e.g., Energy + Hydration or Energy + Protein): Functional hybrids that combine benefits such as hydration, recovery, or immunity with energy are carving out sub-niches.

Online and DTC Sales Expansion: Subscription models, social media-driven product launches, and influencer collaborations are helping brands scale rapidly through digital channels.

| Report Coverage | Details |

| Market Size in 2024 | USD 25.70 Billion |

| Market Size by 2033 | USD 48.45 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Type, End-use, Distribution Channel, Packaging, Form |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Red Bull; Taisho Pharmaceutical Co. Ltd.; PepsiCo. Inc.; Monster Energy; Lucozade; The Coca-Cola Company; Amway; AriZona Beverages USA; Living Essentials LLC; Xyience Energy |

One of the most significant drivers of the U.S. energy drinks market is the growing consumer preference for convenient, on-the-go functional beverages. Americans are increasingly seeking products that align with their fast-paced lifestyles and performance-driven goals. Whether it's a student cramming for finals, a fitness enthusiast heading to the gym, or an office worker needing a mid-afternoon boost, energy drinks serve as a ready-to-consume solution that delivers both functionality and flavor.

The rising focus on wellness and productivity has further propelled this demand. Energy drinks are no longer just about staying awake—they are positioned as cognitive enhancers, mood boosters, and physical performance supporters. This versatility, coupled with portability and attractive branding, has made them a staple for a broad demographic spectrum. Their accessibility in convenience stores, gas stations, gyms, and online platforms ensures constant visibility and availability, reinforcing habitual consumption.

Despite its rapid growth, the energy drinks market in the U.S. faces substantial scrutiny regarding health and safety concerns. High caffeine levels, sugar content, and the combination of stimulants used in energy drinks have been criticized by health professionals and consumer advocacy groups. Overconsumption, particularly among teens and young adults, has been linked to anxiety, sleep disorders, heart palpitations, and even emergency room visits.

While many brands have responded with zero-sugar or natural ingredient formulations, consumer skepticism still persists. Additionally, the lack of consistent federal regulation and labeling requirements for energy drink formulations has led to confusion over appropriate usage and risks. State-level calls for age restrictions, mandatory warning labels, and advertising limitations continue to pose potential barriers. Brands must therefore strike a careful balance between energy-boosting efficacy and safety messaging to retain consumer trust.

The most promising opportunity in the U.S. energy drinks market lies in clean-label innovation. As consumers move away from synthetic additives and artificial stimulants, there is growing demand for products that deliver energy using natural and plant-based sources. Ingredients like yerba mate, guarana, matcha, ginseng, and beetroot extract are now being used to create beverages that provide sustained energy without the crash.

This opens the door for premium positioning, targeting wellness-minded consumers who previously avoided the energy drink category. Natural energy drinks appeal not only to fitness audiences but also to working professionals, students, and even older consumers who are wary of traditional high-stimulant products. Clean-label transparency—such as “no artificial sweeteners,” “non-GMO,” or “vegan”—combined with sleek, modern branding, creates strong resonance with millennial and Gen Z buyers. This innovation wave also invites cross-category collaboration, such as energy-enhanced sparkling waters, cold brews, and kombucha hybrids.

The alcoholic product segment is expected to witness growth at 8.0% CAGR.

Non-alcoholic energy drinks dominated the U.S. market, representing the vast majority of sales and consumer demand. These include traditional carbonated and flavored drinks designed to increase alertness and reduce fatigue. Brands like Red Bull, Monster, Celsius, and Bang have entrenched their presence with extensive retail penetration and loyal followings. Non-alcoholic energy drinks are consumed by students, workers, athletes, and casual drinkers alike, reflecting their broad appeal. Their market dominance is underpinned by aggressive promotional campaigns, celebrity endorsements, and sports sponsorships.

Alcoholic energy drinks are the fastest-growing niche, although still a small segment of the total market. These beverages blend alcohol with energy-boosting ingredients like caffeine, guarana, or taurine and are targeted at nightlife or party-centric consumers. Brands are experimenting with low-alcohol variants, hard seltzer hybrids, and flavors designed for social occasions. The growth is fueled by younger demographics seeking functional alternatives to traditional alcoholic drinks, though regulatory constraints around mixing alcohol with stimulants remain a challenge.

Organic energy drinks are projected to witness growth at 9.2% CAGR.

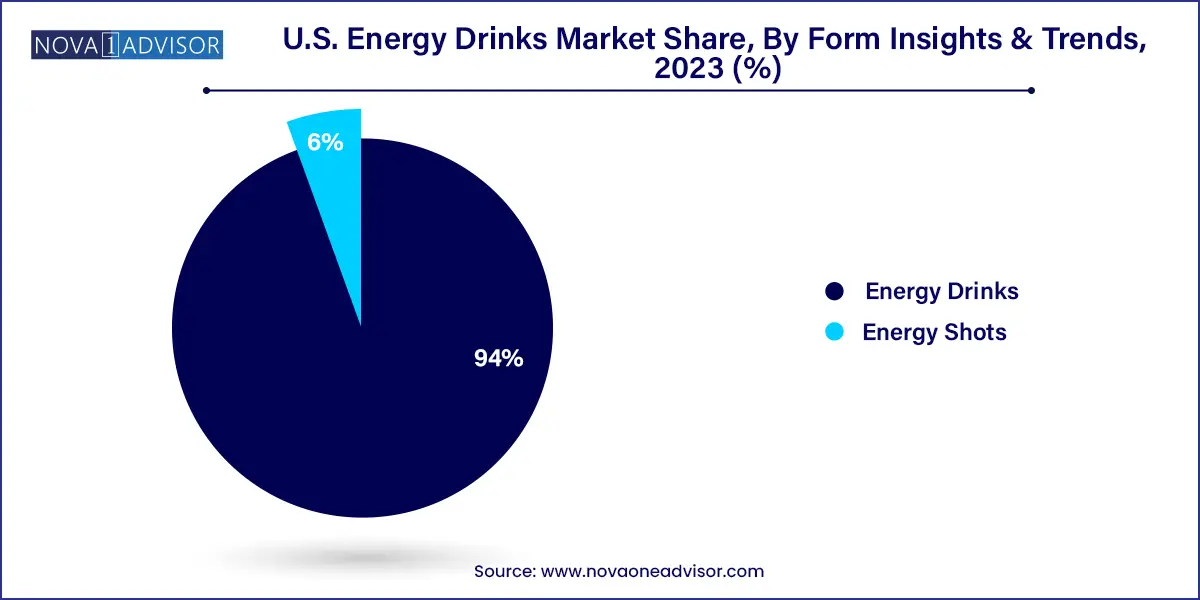

Energy drinks dominated the form segment, accounting for the majority of market revenue and shelf space. These are the standard 8 to 16 oz canned beverages widely consumed across convenience stores, gyms, offices, and college campuses. They are marketed with vibrant branding and wide-ranging flavors, often emphasizing muscle performance, mental focus, or endurance. These drinks offer a tangible, satiating experience and allow for greater innovation in terms of taste and functional ingredients.

Energy shots are the fastest-growing form, especially among older consumers and professionals looking for fast, compact energy solutions without the volume or calories of full-sized drinks. These 2 oz shots are convenient, portable, and easy to consume on the go. Brands like 5-hour Energy have created a strong niche in this category, and new entrants are exploring shots that offer specialized functions such as focus, recovery, or immunity. The form factor is particularly appealing for multi-tasking lifestyles and travel use cases.

Teenagers & kids are expected to boost the U.S. energy drinks market at 7.0% CAGR.

Based on end-use, adults dominated the market with over 51.0% share in 2023 owing to the increasing work population. As professionals juggle demanding work schedules, they seek quick energy boosts to stay productive, combat fatigue, and maintain mental alertness. Adult athletes, gym-goers, and fitness enthusiasts have significantly driven the market demand to seek better physical vitality. They prefer caffeine and taurine to enhance endurance, stamina, and physical performance. These ingredient-based energy drinks are particularly appealing to active adults.

Teenagers & kids are expected to account for the fastest-growing end use segment in 2023 owing to the widespread promotion by celebrities and influencers. Celebrities and social media influencers actively promote energy drinks, particularly among teenagers. Their endorsements create aspirational appeal and influence consumption patterns. In addition, parents appreciating beverages that align with health values have led to the increased production and marketing of organic and low-sugar energy drinks.

The on-trade distribution channel is projected to witness growth at a CAGR of 5.2%.

Offline distribution channels dominate, especially convenience stores, gas stations, and supermarkets, which account for a large volume of impulse purchases. These outlets offer immediate access, chilled options, and visibility through in-store promotions or product placement. Gym vending machines, university canteens, and airports also represent strong sales points. Traditional channels benefit from established supplier relationships and robust logistics networks.

Online distribution is the fastest-growing channel, fueled by the rise in e-commerce, subscription models, and digital marketing. Brands like Celsius and Ghost have successfully used social media and influencer-led content to grow their D2C presence. E-commerce platforms like Amazon, Instacart, and company-owned websites offer value packs, bundles, and exclusive flavors. Online shopping appeals particularly to wellness consumers looking for transparency, reviews, and detailed ingredient breakdowns. With the flexibility of auto-ship services, the online channel is becoming a key battleground for brand loyalty and customer retention.

The bottles segment is expected to grow substantially at a CAGR of 6.0%.

Cans have dominated the U.S. energy market with the largest share of 92.4% and are expected to continue growing lucratively during the forecast period due to their high convenience, portability, and sustainability. Their lightweight design appeals to busy consumers seeking quick energy boosts on the go. Additionally, cans offer better protection against light, air, and moisture, ensuring a longer shelf life for the drink. Their high recyclability aligns with growing environmental consciousness, making them a preferred choice for eco-conscious customers.

The bottles segment is expected to be significant during the forecast period due to modern consumers’ increased preference for convenience and sustainability. They prefer packaging options that are easy to carry and can be reused. Brands that use eco-friendly materials and highlight recyclability resonate with environmentally conscious consumers. Sustainable packaging practices contribute to positive brand perception. Although aluminum cans dominate the energy drinks market due to their lightweight, protective properties, and recyclability, they often face shortages and supply chain challenges. In such cases, bottles are utilized as a preferred alternative that ensures consistent product availability even during material shortages.

The drink form secured 94.0% of the market share in 2023 as energy drinks continue emphasizing performance enhancement, appealing to fitness enthusiasts, esports participants, and active individuals. Energy drinks, with their blend of caffeine, vitamins, and other functional ingredients, cater to consumers seeking beverages with the desire for sustained energy, mental alertness, and improved physical performance. With their stimulating properties, energy drinks are a viable substitute for traditional alcoholic beverages, including wine and beer.

Moreover, the rise of specialty coffee culture has influenced energy drink preferences. Consumers have increased preference towards the nuances of coffee flavors, which has led to further expansion of the market with a sophisticated formulation of coffee with energy drinks.

January 2025: Celsius Holdings announced a strategic partnership with Amazon to develop an exclusive flavor line for Prime members, further boosting its digital presence.

February 2025: Monster Beverage launched its “Smart Energy” line with added nootropics and L-theanine to promote focus and calm energy, targeting work-from-home professionals.

March 2025: Red Bull expanded its U.S. operations by opening a new distribution center in Indiana, aiming to improve logistics efficiency and reduce carbon footprint.

January 2025: Alani Nu released its “Energy for Her” series, a female-focused collection featuring flavors like Cotton Candy Grape and Electric Rose, designed with minimal sugar and plant-based ingredients.

February 2025: 5-hour Energy introduced its dual-action “Energy + Immune” shot, combining caffeine, zinc, and vitamin C, tapping into the growing functional wellness category.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. energy drinks market

Product

Type

End-use

Distribution Channel

Packaging

Form