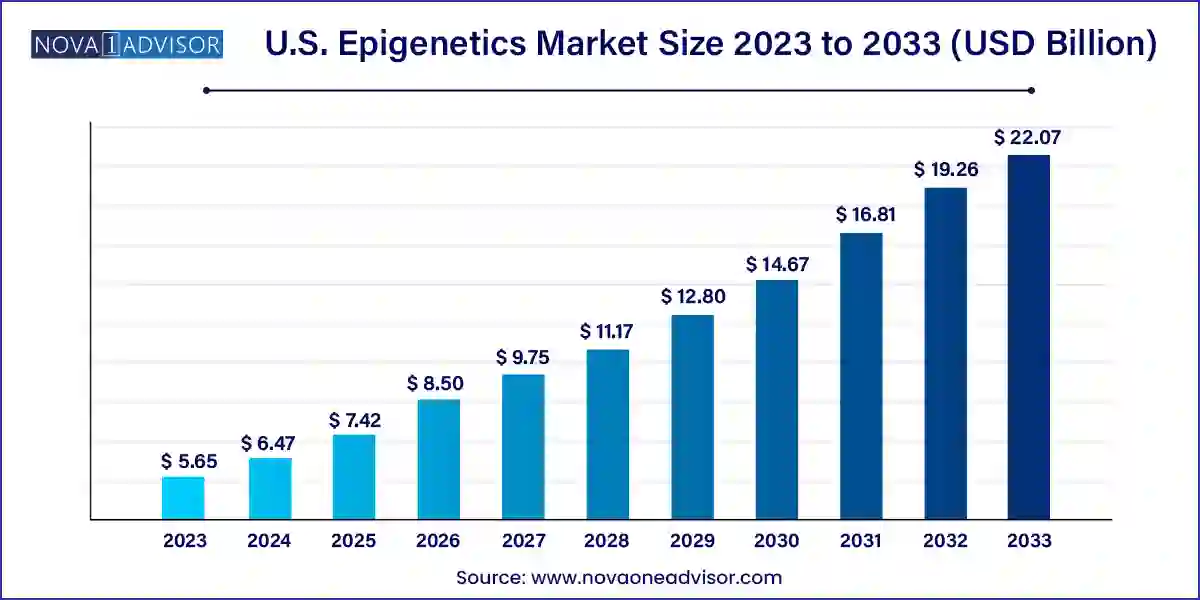

The U.S. epigenetics market size was exhibited at USD 5.65 billion in 2023 and is projected to hit around USD 22.07 billion by 2033, growing at a CAGR of 14.6% during the forecast period 2024 to 2033.

The U.S. epigenetics market has emerged as a pivotal domain within the life sciences and healthcare sector, showcasing rapid growth driven by increasing research activities, a surge in chronic disease prevalence, and the evolution of precision medicine. Epigenetics, the study of heritable changes in gene function that do not involve changes in the DNA sequence, plays a critical role in understanding the complex regulation of gene expression across a variety of physiological and pathological states. The market is marked by technological advancements in sequencing and analysis tools, an uptick in government and private funding for genomic research, and a rising focus on translational epigenetics in diagnostics and therapeutics.

In the U.S., a significant portion of epigenetics-related research and commercialization is driven by academic institutions, biotechnology firms, and collaborations between academia and pharmaceutical companies. This collaborative ecosystem fuels the development of novel epigenetic diagnostics, targeted therapies, and high-throughput screening tools. Moreover, the surge in applications of epigenetic techniques in oncology, particularly in identifying cancer biomarkers and drug development, has positioned the field at the center of next-generation medical research.

The market's maturity in the U.S. is further underpinned by strong regulatory frameworks, supportive intellectual property policies, and the presence of global industry leaders. However, despite the optimistic outlook, challenges such as high costs associated with epigenetic instruments and data complexity present substantial hurdles. Nonetheless, with the continued focus on personalized medicine and population-level genomic studies, the epigenetics market in the U.S. is projected to experience robust expansion through the coming decade.

Precision Medicine Integration: Increasing application of epigenetic data to tailor treatments to individual patients, especially in oncology and neurology.

AI and Bioinformatics Synergy: Growing use of AI-driven tools and bioinformatics pipelines to decode complex epigenetic datasets and predict gene regulation networks.

Growth of Non-Oncology Applications: Rising exploration of epigenetic mechanisms in metabolic, infectious, and cardiovascular diseases is expanding the market’s scope.

Rise of CRISPR Epigenome Editing: Research into targeted epigenome editing using CRISPR/dCas9 systems is gaining momentum, offering non-permanent gene expression changes.

Commercialization of Epigenetic Kits: Rapid expansion in the availability of ready-to-use kits for ChIP-seq, bisulfite conversion, and RNA sequencing.

Academic-Industry Collaborations: Increasing partnerships between academic institutions and biotech firms for the development of novel epigenetic biomarkers.

Expansion of Clinical Trials: Higher number of epigenetics-based clinical trials in the U.S., especially in oncology and rare diseases.

Multi-omics Research Adoption: Integration of epigenomics with genomics, transcriptomics, and proteomics for holistic disease profiling.

Government Research Grants: NIH and other agencies have increased funding for epigenetics projects focused on cancer, brain disorders, and pediatric diseases.

Growth in Liquid Biopsy Innovations: Epigenetic biomarkers in liquid biopsies are becoming key non-invasive tools for early cancer detection.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.47 Billion |

| Market Size by 2033 | USD 22.07 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Roche Diagnostics; Thermo Fisher Scientific, Inc; Eisai Co. Ltd.; Novartis AG; Element Biosciences, Inc.; Dovetail Genomics LLC.; Illumina, Inc.; Promega Corporation.; Abcam plc.; Danaher |

One of the most significant drivers propelling the U.S. epigenetics market is the increasing incidence of cancer and the urgent demand for early detection tools and effective therapies. According to the American Cancer Society, over 2 million new cancer cases are projected in the U.S. for 2025, with solid tumors accounting for the majority. Epigenetic modifications such as DNA methylation and histone modifications are often among the earliest detectable markers of tumorigenesis. This makes them valuable for both diagnostic and prognostic purposes.

Companies and research institutions are leveraging epigenetic tools to identify novel biomarkers for cancers such as breast, lung, and colorectal. Moreover, pharmaceutical companies are investing heavily in the development of epigenetic drugs (epidrugs), such as DNA methyltransferase inhibitors and histone deacetylase inhibitors, to target gene silencing mechanisms in tumors. These advancements not only improve patient outcomes but also reduce healthcare costs through targeted therapies, enhancing the market’s potential.

Despite the market’s promise, one of the most pressing challenges is the high cost associated with advanced epigenetics research and product development. Equipment for sequencing, such as next-generation sequencers and high-resolution mass spectrometry platforms, requires substantial capital investment. Moreover, consumables like reagents, enzymes, and specialized kits are priced at a premium due to their complexity and precision requirements.

In addition to financial constraints, the interpretation of epigenetic data presents a technical bottleneck. Unlike straightforward DNA mutations, epigenetic changes are dynamic, reversible, and context-dependent, making data analysis highly intricate. The lack of standardized protocols for data normalization, analysis, and storage further complicates the landscape for clinical application. This limits market accessibility for smaller institutions and slows down the translation of laboratory findings into commercial products.

A significant growth opportunity lies in the expansion of epigenetics applications beyond oncology. Increasing research into the epigenetic underpinnings of non-oncological diseases such as metabolic disorders, autoimmune diseases, and neurodegenerative conditions is opening new avenues for diagnostics and drug discovery.

For instance, studies have shown that DNA methylation changes are associated with insulin resistance and obesity, providing potential for early interventions in type 2 diabetes. Similarly, epigenetic alterations in inflammatory pathways have been linked to cardiovascular diseases like atherosclerosis. Companies are now developing non-invasive tests that utilize epigenetic biomarkers for diseases like Alzheimer's, lupus, and even infectious diseases such as COVID-19. This diversification not only expands the customer base but also stabilizes market growth across therapeutic domains.

Kits dominated the product segment due to their convenience, standardization, and expanding clinical research applications. Among all sub-categories, ChIP Sequencing Kits and Bisulfite Conversion Kits were particularly in demand. ChIP-seq kits enable researchers to analyze protein-DNA interactions and have been extensively used in transcriptional regulation studies. Bisulfite conversion kits, on the other hand, remain fundamental to analyzing DNA methylation status, an essential aspect of cancer and developmental biology.

The fastest-growing product category is services, driven by increasing outsourcing of sequencing and analysis tasks to specialized CROs. Many research institutions and pharmaceutical companies prefer service providers to handle high-throughput epigenetic studies due to the complexity and cost associated with setting up in-house capabilities. This trend is expected to accelerate with the proliferation of multi-omics data requirements.

DNA Methylation technology held the largest share due to its pivotal role in gene regulation and disease progression studies. Techniques such as methylation-specific PCR and bisulfite sequencing have become staples in both academic and translational research. In cancer diagnostics, DNA methylation markers are increasingly used to identify tumor-specific changes in body fluids, further cementing this technology’s dominance.

The fastest-growing segment is Chromatin Structures, reflecting a shift towards understanding the three-dimensional organization of the genome. Technologies like ATAC-seq and Hi-C are providing novel insights into gene regulation by mapping chromatin accessibility and spatial genome architecture. These insights are particularly valuable in neurodevelopmental disorders and complex diseases where gene-environment interactions are prominent.

Oncology remained the dominant application in the U.S. epigenetics market, primarily due to the high burden of cancer and the critical need for early diagnosis and personalized therapies. Solid tumors such as breast, lung, and prostate cancers are areas where epigenetic profiling has had the most significant impact. Companies are increasingly launching epigenetics-based companion diagnostics to guide treatment decisions for targeted therapies.

The non-oncology segment is the fastest-growing, especially within infectious and inflammatory diseases. For example, epigenetic dysregulation has been implicated in immune response modulation during sepsis and viral infections. The COVID-19 pandemic further underscored the value of epigenetic markers in identifying disease severity and immune response signatures, accelerating investments in this domain.

Academic Research Institutes dominate the end-use segment, driven by ongoing government and private funding initiatives. The NIH’s Roadmap Epigenomics Program and various university-led consortia have established the U.S. as a global leader in epigenetic research. Universities and public laboratories frequently lead innovation, especially in basic science and early-stage development of new tools and methods.

The fastest-growing end-user segment is Pharmaceutical and Biotechnology Companies. These companies are increasingly integrating epigenetics into their drug discovery and development pipelines. The use of epigenetic biomarkers for patient stratification, drug efficacy analysis, and adverse effect prediction is expanding rapidly. With growing interest in targeted and epigenetic therapies, this segment is expected to capture a greater share in the coming years.

The U.S. maintains its status as the global nucleus of epigenetic innovation and commercialization. The confluence of leading academic institutions, regulatory agencies like the FDA, and a robust pharmaceutical industry makes it an ideal environment for epigenetics research and product development.

States like California, Massachusetts, and Maryland are epicenters of epigenetics-related activity. California’s Bay Area is home to several startups, research centers, and universities focused on epigenomics. Meanwhile, Boston’s biotech cluster continues to produce innovations through partnerships between companies and hospitals such as Dana-Farber and Massachusetts General Hospital.

The U.S. government, through the NIH and other agencies, has provided significant funding to multi-year epigenomics projects, including those investigating the human brain, cancer epigenomes, and pediatric disorders. At the same time, the private sector is witnessing a rise in venture capital investment in epigenetics-based startups, particularly in the areas of liquid biopsy, neurodegeneration, and gene therapy.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. epigenetics market

Product

Technology

Application

End-use