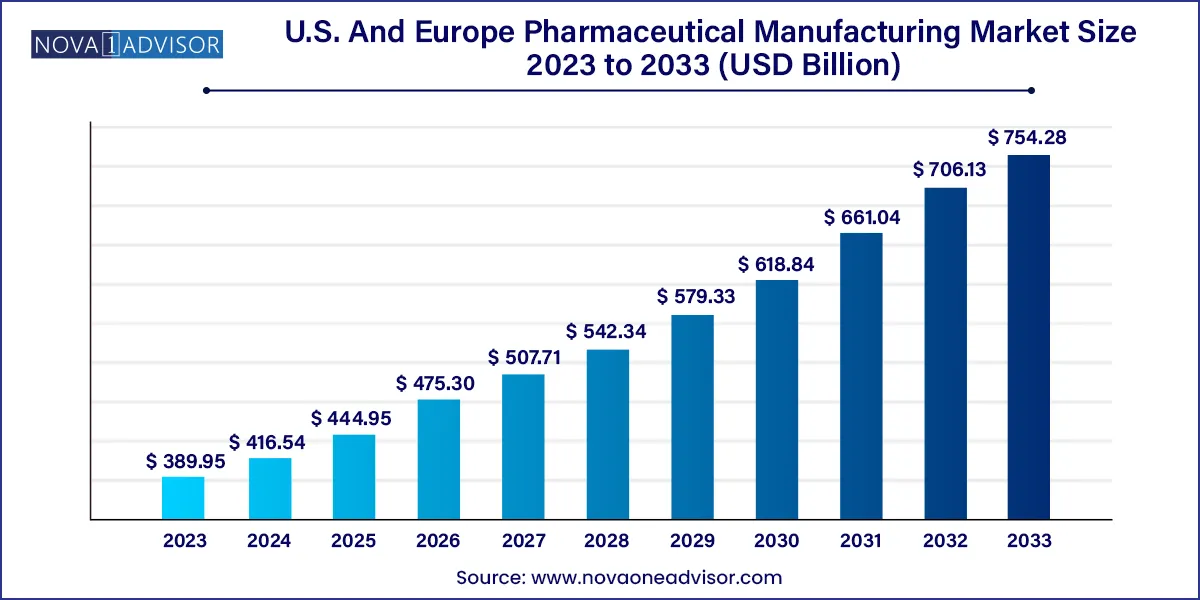

The U.S. and Europe pharmaceutical manufacturing market size was exhibited at USD 389.95 billion in 2023 and is projected to hit around USD 754.28 billion by 2033, growing at a CAGR of 6.82% during the forecast period 2024 to 2033.

The pharmaceutical manufacturing sector in the U.S. and Europe is among the most vital pillars supporting global healthcare delivery. It encompasses the industrial-scale production of therapeutic drugs, ranging from over-the-counter pain relief medicines to complex biologics such as monoclonal antibodies and gene therapies. Both the United States and Europe have historically held strong positions in the pharmaceutical value chain—leading in drug innovation, regulatory frameworks, and production capabilities.

Pharmaceutical manufacturing here is driven by a well-established infrastructure, mature supply chain ecosystems, and regulatory agencies like the U.S. FDA and the European Medicines Agency (EMA), which oversee quality, safety, and efficacy. The market supports a wide spectrum of products—from small molecule drugs synthesized through chemical processes to advanced large molecule biologics developed using living systems.

Manufacturers in these regions are not only meeting domestic healthcare needs but also playing a global role by exporting high-quality pharmaceuticals to international markets. In particular, the U.S. leads the world in pharmaceutical R&D expenditure and new drug approvals, while Europe excels in harmonized regulatory systems, contract manufacturing partnerships, and diverse therapy area coverage.

As chronic disease prevalence rises and personalized medicine takes center stage, pharmaceutical manufacturers are investing in flexible production lines, smart technologies, and innovative platforms to meet evolving demands. From digital batch tracking to modular cleanrooms and high-speed vial-filling for injectables, the future of pharma manufacturing in these two regions is rapidly modernizing—driven by technology, demand variability, and patient-centric care models.

Adoption of Continuous Manufacturing: Shift from batch to continuous manufacturing for cost savings, faster production, and reduced error rates.

Growth of Biologics and Advanced Therapies: Increased investment in monoclonal antibodies, cell and gene therapies, and mRNA vaccines.

Smart Manufacturing and Industry 4.0 Integration: Deployment of IoT, robotics, AI, and machine learning in production monitoring, predictive maintenance, and supply chain management.

Sustainability and Green Chemistry Initiatives: Focus on reducing carbon footprint, solvent recycling, and energy-efficient processes in line with ESG goals.

Rise in CDMO Collaborations: Pharmaceutical firms are outsourcing more manufacturing to contract development and manufacturing organizations (CDMOs) to scale quickly and focus on core R&D.

Flexible Manufacturing Infrastructure: Investments in modular facilities capable of handling multiple formulations or therapy types simultaneously.

Localization and Nearshoring of Supply Chains: In response to global disruptions, manufacturers are reducing dependency on imports by investing in local or regional production hubs.

| Report Coverage | Details |

| Market Size in 2024 | USD 416.54 Billion |

| Market Size by 2033 | USD 754.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.82% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Type, Drug Development Type, Formulation, Therapy Area, Route of Administration, Prescription Requirements, Age Type, Sales Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S.; Europe |

| Key Companies Profiled | Pfizer Inc.; Novartis AG, F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; GSK plc; Sanofi; AbbVie Inc.; Lonza; Samsung Biologics; Lily |

A key driver fueling the U.S. and Europe pharmaceutical manufacturing market is the surging demand for complex therapies, particularly biologics, and the broader shift toward personalized medicine. Unlike traditional small molecule drugs, biologics such as monoclonal antibodies and gene therapies require highly controlled environments, sophisticated bioreactors, and precise formulation techniques. This complexity has catalyzed investments in upgrading manufacturing capabilities, with a focus on scalability, compliance, and quality assurance.

Moreover, the rising prevalence of cancer, autoimmune disorders, and rare genetic conditions has created an urgent need for niche, patient-specific treatments. These drugs often require smaller batch runs, faster turnaround, and higher customization—all of which demand advanced manufacturing systems. This trend is compelling pharmaceutical companies and CDMOs in both the U.S. and Europe to embrace adaptive technologies, modular cleanrooms, and AI-based quality control tools to meet the evolving treatment landscape.

Despite the technological advancements, pharmaceutical manufacturing remains one of the most capital-intensive sectors. Establishing compliant facilities for either chemical synthesis or biologics production requires significant upfront investment—often in the hundreds of millions of dollars. Moreover, stringent regulatory requirements add to the timeline and cost. Facilities must adhere to Good Manufacturing Practices (GMP), regularly undergo audits, and ensure complete documentation of every process step.

The challenge becomes more pronounced with the emergence of newer therapies, where guidelines may be evolving or less established. Delays in obtaining approvals, inconsistency in interpretation across different countries, and escalating costs related to cleanroom validation, serialization, and data security can slow down production schedules and inflate budgets. For small or emerging firms, these barriers can become substantial impediments to market entry or scaling operations.

An area ripe with opportunity is the rise of modular and flexible manufacturing platforms, which are revolutionizing how pharmaceutical production is designed and implemented. These platforms allow companies to switch between products, formulations, or dosage forms without extensive retrofitting. They are particularly valuable in the context of pandemics, seasonal drug needs, or sudden shifts in therapeutic demand.

For example, a modular injectable facility can switch from producing insulin to vaccines by reconfiguring production lines in weeks rather than months. In the U.S., this is enabling better response to public health emergencies, while in Europe, it supports multi-market product rollout under diverse regulatory frameworks. The scalability of modular manufacturing is also helping reduce entry barriers for startups and biotechs, who can now operate without owning traditional factories. This adaptability also supports long-term goals of digitalization and automation, making it a strategic focus for the next wave of manufacturing expansion.

Small molecule drugs continue to dominate the pharmaceutical manufacturing landscape in both the U.S. and Europe, owing to their historical precedence, established synthesis processes, and widespread use across various therapeutic areas. These drugs are chemically synthesized and remain the backbone of treatment for conditions such as cardiovascular diseases, diabetes, and infectious diseases. The manufacturing infrastructure for small molecules is robust, with high-throughput synthesis, purification, and tableting capabilities that have been optimized over decades.

In addition to their cost-efficiency and broad accessibility, small molecules are more likely to be formulated into oral solid dosage forms, which are preferred by patients and healthcare systems alike for their convenience and ease of distribution. As generic markets expand and emerging indications are addressed with novel compounds, small molecule production remains highly profitable and in demand.

On the other hand, cell and gene therapies represent the fastest-growing segment due to their ability to treat previously untreatable or rare genetic conditions. These are highly complex, personalized treatments that involve altering a patient’s genetic material or injecting modified cells to repair or replace damaged tissues. Manufacturing these therapies requires state-of-the-art facilities, biosafety compliance, and intense sterility controls.

In the U.S., FDA approvals of such therapies are accelerating, driving companies to invest in or partner with advanced CDMOs. Europe has also adopted a supportive regulatory stance with initiatives like the EMA’s PRIME scheme for breakthrough therapies. The logistical complexity of these products—many of which require cold chain infrastructure and timely administration—further fuels the need for regionally distributed and technologically advanced manufacturing capabilities.

In-house manufacturing remains dominant, especially among big pharmaceutical companies with the resources and facilities to maintain stringent control over production quality, intellectual property, and supply timelines. Giants like Pfizer, Roche, and Johnson & Johnson operate vertically integrated models that support both R&D and production under one umbrella. This allows for enhanced data integrity, rapid process iteration, and a seamless transition from lab-scale to commercial-scale manufacturing.

Such companies also benefit from economies of scale and decades-long regulatory experience, enabling them to bring drugs to market with precision. In-house manufacturing is particularly critical for proprietary or blockbuster drugs, where confidentiality and production optimization are business-critical factors.

However, the fastest-growing trend is outsourcing to CDMOs. Outsourcing enables pharmaceutical firms—especially small and mid-sized companies—to focus on discovery and clinical development while delegating production to specialists. CDMOs offer a range of services from early-phase material production to commercial-scale supply. With advances in single-use bioreactors, modular facilities, and on-demand capacity, outsourcing offers flexibility and risk mitigation.

In both the U.S. and Europe, CDMOs are expanding rapidly, adding capacity to accommodate advanced therapies and tailored solutions for different markets. Companies are also forming long-term strategic alliances with CDMOs to secure priority access, as witnessed during the COVID-19 vaccine manufacturing race.

In 2023, the oral segment held the largest market share owing to the high availability of top selling oral preparations and high consumption rate of oral formulations. In addition, the oral dosage form is the most convenient, safe, and affordable approach. A wide variety of drugs can be administered orally, such as tablets, liquids, chewable tablets, elixirs, effervescent powders, and capsules. In addition, the development of controlled-release formulations to minimize the frequency of dosing and enhanced patient compliance boosts segment growth.

A significant increase in the adoption of automated systems & barrier systems, including restricted access barrier systems (RABS), isolators, and closed RABS, in parenteral manufacturing, is expected to boost the parenteral segment growth at the fastest CAGR over the forecast period. Moreover, the introduction of a wide range of innovative packaging styles, such as ready-to-fill syringes, cartridges, and vials, has significantly transformed the parenteral manufacturing sector. For instance, in May 2023, Terumo Pharmaceutical Solutions launched a prefilled polymer syringe for low-dose applications such as ophthalmic formulations.

Tablet segment held the leading share of the market in 2023 and its high market share is due to factors such as wide acceptance of tablets by both patients & physicians, ease of manufacturing, and continuous advancements in the pharmaceutical sector that have resulted in the development of tablets with desired properties. In addition, the advent of 3D-printed tablets designed for personalized needs also augments segment growth. For instance, in February 2020, Merck announced a partnership with AMCM to conduct clinical testing on 3D-printed tablets.

Moreover, the injectable segment held the second-largest share in 2023. The increase in product approvals for auto-injectors, prefilled syringes, and biologics can be attributed to an estimated growth rate. In addition, pharmaceutical product manufacturers are increasingly using injection systems for the treatment of several diseases. For instance, in April 2023, Consegna Pharma acquired Fathom Pharma to expand its injectable online portfolio, to offer treatment for chronic pain in terminally sick patients.

The sprays segment is anticipated to expand at a lucrative growth rate in the coming years. The increasing availability of these formulations, cosmeceutical appearance, flexibility in dosage design, and low irritation to the skin are some of the advantages escalating segment uptake over the forecast period.

Prescription medicines accounted for the highest market share and are anticipated to expand at a compound annual growth rate of 6.19% during the forecast period. The increasing reimbursement for prescription drugs, rising sales of prescription medicines, and surge in approval of prescription drugs is anticipated to propel segment expansion. For instance, in 2020, the U.S. FDA approved 20,000 prescription drugs for marketing and about 66% of U.S. adults take prescription drugs.

The increasing demand for self-medication and cost-effective treatment is supporting the OTC drugs segment growth over the forecast period. In addition, factors like penetration of generics, rising consumer awareness, favorable government initiatives, and entry of local manufacturers are also driving segment uptake. According to the Consumer Healthcare Products Association (CHPA), there are around 80 therapeutic categories of over-the-counter drugs ranging from dermatology applications, weight control drugs, cold & cough, and others.

An increase in the geriatric population along with rising life expectancy drives the demand for pharma products and this is responsible for higher revenue share of the geriatric segment. The geriatric population is at higher risk of developing chronic and life-threatening diseases. Around 80% of the adult population over 65 years suffers from at least one chronic disorder. Chronic obstructive pulmonary disease (COPD), Alzheimer’s disease, dementia, depression, heart failure, chronic kidney diseases, diabetes, ischemic heart diseases or coronary heart diseases, arthritis, high cholesterol, and hypertension are among the few common medical conditions reported in the geriatric population.

The adult segment held a significant revenue share of the market. The high incidence of lifestyle-associated and chronic disorders in the adult population coupled with increasing awareness about early treatment of diseases among adults are supporting segment expansion. Moreover, the rise in overall spending on drugs per person has increased, which further drives segment growth.

The retail segment dominated the U.S. and Europe pharmaceutical manufacturing market in 2023 due to the rising penetration and generics and OTC medications owing to their cost effectiveness fueled the demand for retail segment. Moreover, retail pharmacies are collaborating with health professionals and healthcare facilities to improve clinical outcomes and remain competitive with other businesses in the market. For instance, in June 2023, LloydsPharmacy expanded its partnership with Deliveroo to include additional 150 Lloyds stores in the collaboration.

The non-retail segment is anticipated to exhibit a significant growth rate during the forecast period. Hospital pharmacies and other research & institutional drug suppliers are some of the non-retail pharmacies. Factors like high hospital admissions owing to high disease burden, favorable reimbursement policies, increasing research activities, and rapid penetration of online pharmacies are contributing to the growth of non-retail segment.

The cancer segment captured a significant revenue share in 2023 and is anticipated to hold a lucrative share during the projected period. Increased prevalence of cancers, high cost of production of cancer drugs, and increasing approval of novel products are anticipated to support the segment share. In addition, many clinical tests related to immune-oncology and surge in healthcare spending on cancer treatment also contributed to the segment growth.

Factors such as high burden of respiratory disorders like pneumonia, COVID-19, COPD, asthma, and other infectious diseases are contributing to the lucrative growth rate of the respiratory disease segment. In addition, the rising efforts from the leading market participants to develop therapeutics for respiratory conditions is escalating the segment uptake. For instance, in March 2023, VeriSIM Life launched its pharmaceutical subsidiary PulmoSIM Therapeutics to address unmet needs in the management of respiratory conditions.

The U.S. led the overall market due to the presence of many strong market players coupled with various strategic initiatives undertaken by them in the country. Moreover, the strategic pharma collaborations among well-established and emerging participants also fuels the region’s expansion. In addition, high R&D expenditures, large number of drug efficacy studies conducted, and the presence of a large number of CMOs are supporting the country’s high market.

Also, the country has favorable government policies for the pharmaceutical sector and supportive domestic environment for the commercialization of new therapeutics. For instance, in April 2023, BeiGene Ltd., a global biotechnology company, established a new manufacturing and clinical R&D center in New Jersey.

Europe region is projected to witness the fastest growth rate over the forecast period. The higher investments from multinational companies in the region, increasing adoption of outsourced services, and supportive regulatory framework are expected to drive the market over the forecast period. In addition, rising demand for innovative therapeutics and constant research activities in the region is anticipated to cater to lucrative demand for Europe.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. and Europe pharmaceutical manufacturing market

Product Type

Drug Development Type

Formulation

Route of Administration

Therapy Area

Prescription Requirements

Age Type

Sales Channel

Regional