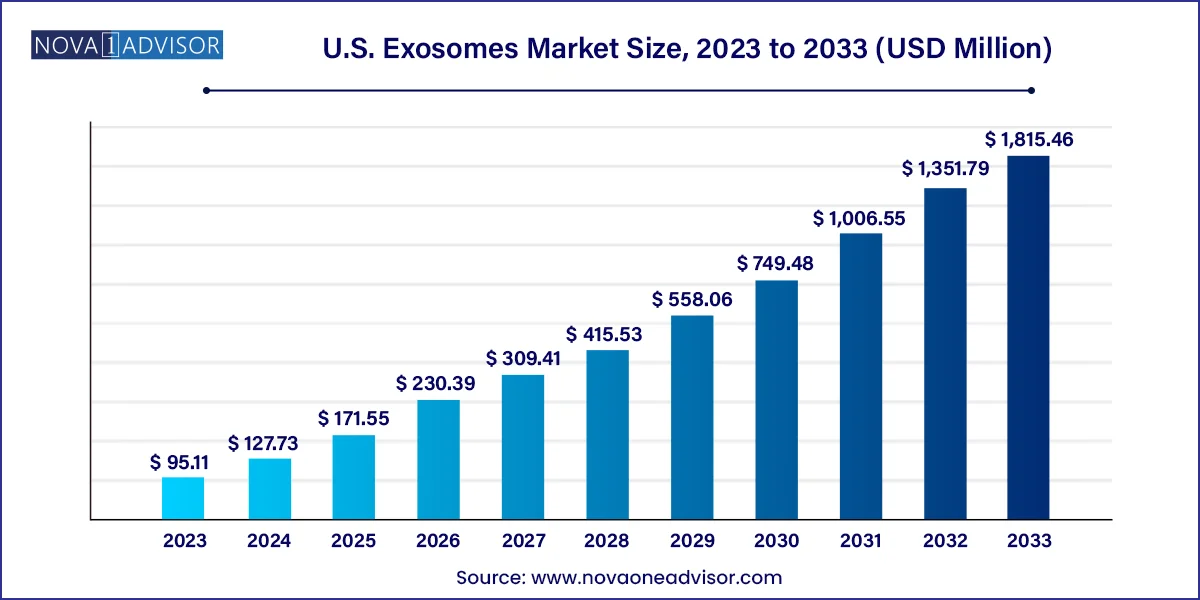

The U.S. exosomes market size was valued at USD 95.11 million in 2023 and is projected to surpass around USD 1,815.46 million by 2033, registering a CAGR of 34.3% over the forecast period of 2024 to 2033.

The U.S. exosomes market is emerging as one of the most innovative and transformative segments within the life sciences and biomedical research industries. Exosomes nanosized extracellular vesicles secreted by cells are increasingly being recognized for their role in intercellular communication, biomarker discovery, and therapeutic delivery. Initially considered cellular waste, these vesicles have now become a focal point for researchers in oncology, neurology, cardiology, and immunology.

In the United States, robust investment in biotech R&D, a high density of academic research institutions, and increasing clinical applications of exosome technologies are accelerating market growth. These vesicles carry molecular cargo such as RNA, proteins, and lipids, making them ideal candidates for minimally invasive diagnostics (liquid biopsies) and innovative drug delivery platforms. The ability to isolate and characterize exosomes from bodily fluids like blood, urine, and saliva is propelling their utility in early disease detection and personalized medicine.

Moreover, pharmaceutical and biotechnology companies are showing significant interest in using exosomes as vehicles for gene therapies and targeted drug delivery, especially in conditions like cancer and neurodegenerative diseases. Simultaneously, academic centers and diagnostic firms are expanding their research into exosomal biomarkers for non-invasive disease monitoring.

The U.S. market is also benefiting from a maturing regulatory outlook and increasing funding from public and private sectors. For example, NIH grants related to extracellular vesicle research have grown substantially over the past five years. As isolation techniques improve and downstream analysis becomes more sophisticated, exosomes are expected to redefine standards in molecular diagnostics and next-generation therapeutics.

Expansion of Exosome-Based Liquid Biopsies: Non-invasive cancer diagnostics using exosomal RNA and protein markers are gaining clinical traction.

Rise in Therapeutic Exosome Platforms: Companies are developing exosome-based drug delivery systems for targeted therapies in oncology and neurology.

Commercialization of Exosome Isolation Kits: High-purity, reproducible, and user-friendly kits are enabling wider adoption across labs.

Integration with Omics Technologies: Combining exosomes with genomics, proteomics, and transcriptomics for biomarker discovery is becoming standard.

AI-Driven Exosomal Data Analysis: Machine learning algorithms are being used to detect disease signatures in complex exosomal datasets.

Partnerships Between Pharma and Biotech Startups: Big pharma is collaborating with emerging players for exosome drug development.

Emergence of Exosome GMP Manufacturing Platforms: Contract development and manufacturing organizations (CDMOs) are investing in scalable production capabilities.

Regulatory Framework Development: The FDA and other agencies are engaging stakeholders to define safety and efficacy standards for therapeutic exosomes.

Increased Clinical Trials: An expanding pipeline of clinical-stage exosome diagnostics and therapies is accelerating industry validation.

Research into Plant and Bacterial Exosomes: Scientists are exploring novel sources of exosomes beyond human cells for broader applications.

| Report Attribute | Details |

| Market Size in 2024 | USD 127.73 million |

| Market Size by 2033 | USD 1,815.46 million |

| Growth Rate From 2024 to 2033 | CAGR of 34.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered |

Product, application, workflow, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; Bio-Techne; RoosterBio, Inc; Aragen Bioscience, Capricor Therapeutics; Coya Therapeutics; Aegle Therapeutics Corporation; Aethlon Medical |

The primary driver of the U.S. exosomes market is the increasing demand for non-invasive diagnostics and precision therapeutics. As healthcare shifts toward early detection and personalized treatment, exosomes offer an unprecedented opportunity to revolutionize how diseases are diagnosed and managed.

For instance, exosomal RNA biomarkers in blood are showing promise in detecting cancers like prostate, pancreatic, and breast cancer at early stages—well before symptoms appear. Diagnostic companies are commercializing liquid biopsy platforms based on exosome content, providing alternatives to invasive tissue biopsies.

In therapeutics, exosomes are being engineered to deliver drugs, mRNA, and siRNA to specific tissues, crossing biological barriers such as the blood-brain barrier something few drug delivery systems can do efficiently. This opens the door to treating previously inaccessible neurological conditions such as Alzheimer's and Parkinson's diseases.

The ability to combine diagnostics and drug delivery in a single exosome-based system enhances their clinical and commercial appeal, making this driver a cornerstone of long-term market growth.

Despite its promise, the exosome market is hindered by technical complexities related to isolation, scalability, and standardization. Current methods like ultracentrifugation, filtration, and immunoaffinity capture often suffer from trade-offs between purity, yield, and reproducibility.

Inconsistent isolation methods result in batch-to-batch variability, impacting the reliability of downstream analysis. Moreover, lack of standardized protocols across laboratories complicates regulatory approval processes and inter-study comparisons.

Manufacturing therapeutic-grade exosomes at scale is another major hurdle. Ensuring GMP compliance, long-term storage stability, and reproducible loading of therapeutic agents requires technological breakthroughs and infrastructure investments. Until these challenges are addressed, full-scale commercialization across clinical settings remains limited.

A major opportunity in the U.S. exosomes market lies in the expansion of exosome applications in neurodegenerative diseases. The ability of exosomes to cross the blood-brain barrier makes them uniquely suited for delivering therapeutics directly to neural tissue. This opens new possibilities for treating Alzheimer’s, Parkinson’s, Huntington’s, and other central nervous system (CNS) disorders.

Research has shown that exosomes derived from neural stem cells or mesenchymal stem cells can modulate neuroinflammation, promote neuron survival, and deliver genetic payloads such as siRNA or CRISPR-Cas9 components. Several biotech firms are advancing preclinical and early-stage clinical programs targeting the CNS using exosome platforms.

Additionally, exosomal biomarkers are being investigated for early diagnosis and progression monitoring in Alzheimer’s disease—potentially transforming the standard of care in neurology. As the aging U.S. population drives up demand for effective CNS therapies, this represents a high-growth, underpenetrated segment.

Kits & reagents dominate the market, primarily due to their widespread use in academic, diagnostic, and pharmaceutical research. These products simplify the exosome isolation process and offer reproducibility, speed, and compatibility with downstream applications. Companies like Thermo Fisher Scientific and Qiagen have developed kits for specific fluids such as serum, urine, and cell culture media, catering to both diagnostics and research needs.

Services are the fastest-growing segment, especially as more biopharmaceutical firms outsource complex exosomal analysis and GMP manufacturing. Contract research organizations (CROs) and specialized service providers offer everything from biomarker profiling to therapeutic exosome formulation. As demand for custom assays and regulatory-compliant services increases, this segment is expected to grow exponentially in the coming years.

Isolation methods remain the dominant workflow stage, given that high-purity exosome extraction is critical for successful downstream analysis. Among these, ultracentrifugation continues to be the most widely used, particularly in academic and research settings. However, newer techniques such as immunocapture on beads and filtration-based methods are gaining popularity for their faster turnaround and lower equipment needs.

Downstream analysis is the fastest-growing segment, driven by the expanding application of exosomal RNA and protein content in disease monitoring and drug development. Technologies like RNA analysis with NGS and PCR, and protein analysis using ELISA and mass spectrometry, are increasingly adopted to gain insights into disease signatures and therapeutic effects. These advancements are critical for translating exosome research into actionable clinical and commercial products.

Cancer applications dominate the U.S. exosome market, reflecting the intense focus on oncology diagnostics and targeted drug delivery. Exosomal biomarkers are increasingly used for tumor detection, mutation tracking, and resistance monitoring. Companies are integrating exosomes into multi-modal cancer diagnostic panels, while researchers explore exosome-based delivery of chemotherapy or immunotherapy agents to tumors.

Neurodegenerative diseases are the fastest-growing application, largely due to exosomes’ ability to cross the blood-brain barrier and deliver payloads to specific brain regions. In addition, exosomal RNA and protein content offer promising avenues for early diagnosis and progression tracking of diseases like Alzheimer's and Parkinson’s. This trend is expected to accelerate as more CNS-targeting exosome therapies enter preclinical and clinical development.

Pharmaceutical and biotechnology companies are the leading end-users, given their investment in exosome-based drug development and biomarker research. These firms require reliable, scalable platforms for exosome isolation, analysis, and delivery. Many are also partnering with CROs for specialized assay development and manufacturing services.

Academic and research institutes represent the fastest-growing end-user segment, driven by increased grant funding and widespread scientific interest. University labs across the U.S. are at the forefront of exosome research, contributing to innovation in isolation techniques, disease modeling, and therapeutic discovery. As these efforts transition into clinical translation, this segment will continue to play a vital role in the market.

The United States holds a dominant position in the global exosomes market, attributed to its strong scientific research infrastructure, high healthcare expenditure, and robust pipeline of biotech innovation. Academic centers like Harvard, Stanford, and Johns Hopkins are spearheading exosome research in diagnostics and therapy. At the same time, U.S.-based pharmaceutical companies are increasingly investing in exosome-based therapeutics, with multiple IND filings and early-phase trials underway.

The U.S. is also home to leading exosome technology companies and contract service providers, further reinforcing its market dominance. Regulatory engagement from the FDA on exosome therapeutics is ongoing, with multiple pre-IND meetings and feedback loops between agencies and developers. Moreover, national research initiatives such as NIH’s Extracellular RNA Communication Consortium are fueling scientific breakthroughs and public-private partnerships in the field.

March 2025: Codiak BioSciences entered a collaboration with a major U.S. pharmaceutical company to co-develop exosome-based immune-oncology therapies, focusing on exosomal mRNA delivery systems.

February 2025: Lonza Group announced the expansion of its GMP-compliant exosome manufacturing capabilities at its U.S. facility, targeting therapeutic developers in oncology and neurology.

January 2025: Evox Therapeutics reported positive preclinical data for its proprietary exosome delivery platform targeting CNS disorders, including Parkinson’s, prompting plans for a U.S.-based Phase I trial.

December 2024: Thermo Fisher Scientific launched a next-generation exosome isolation and RNA extraction kit, optimized for downstream NGS and qPCR analysis.

November 2024: Exopharm Ltd. received FDA clearance for an Investigational New Drug (IND) application for its exosome-based regenerative therapy for musculoskeletal disorders.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Exosomes market.

By Product

By Workflow

By Application

By End-use