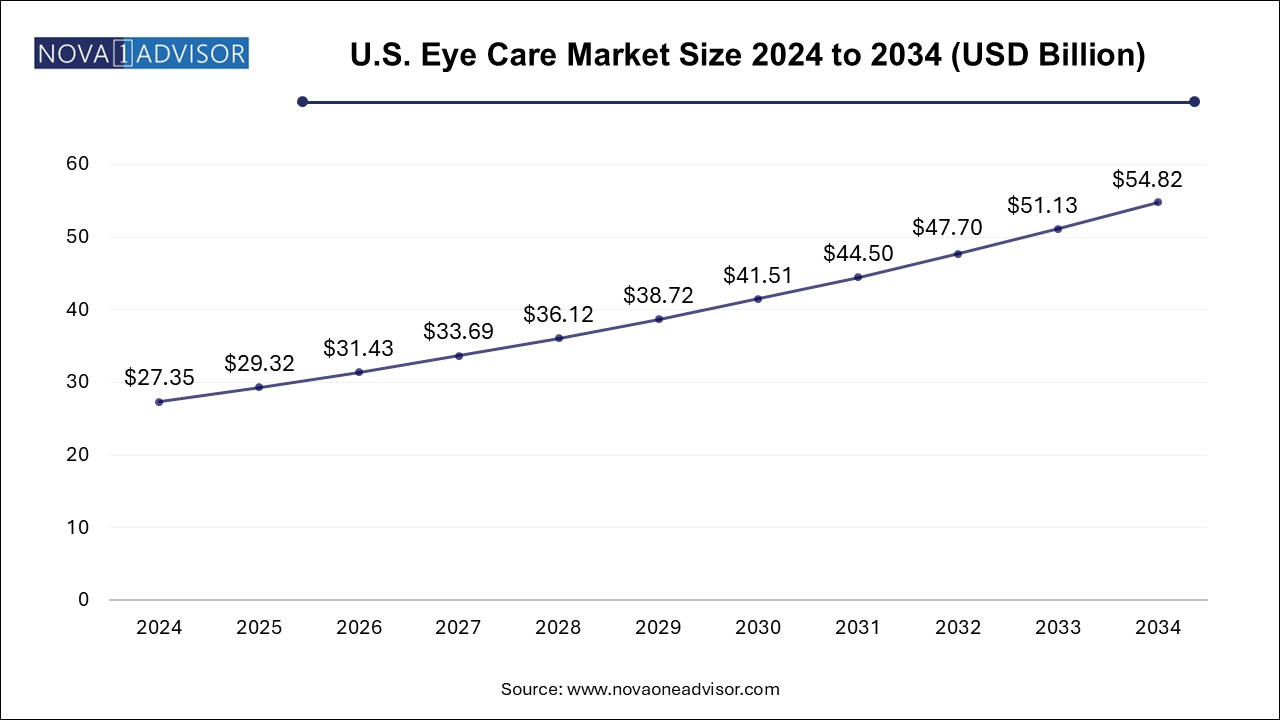

The U.S. eye care market size was exhibited at USD 27.35 billion in 2024 and is projected to hit around USD 54.82 billion by 2034, growing at a CAGR of 7.2% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 29.32 Billion |

| Market Size by 2034 | USD 54.82 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Mode of Purchase, and Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Alcon, Inc.; Johnson and Johnson Eye Care, Inc.; Bausch & Lomb Incorporated; Carl Zeiss Meditec AG (ZEISS International); HOYA CORPORATION; Rayner; STAAR SURGICAL; Novartis AG |

An aging population, with over 54 million adults aged 65 and older, contributes to increased demand for eye care services and products. Technological advancements, including minimally invasive surgical devices and advanced diagnostic tools, are enhancing treatment outcomes. Growing awareness of preventive eye care and the increasing adoption of digital devices are fueling demand for solutions like blue-light-blocking lenses. The U.S. market is further supported by robust healthcare infrastructure and strong investments in ophthalmic research and innovation.

In September 2023, Bausch + Lomb launched its Lumify Eye Illuminations line, featuring hypoallergenic products such as micellar cleansing water, lash and brow serum, and hydra-gel brightening cream. Developed with ophthalmologists and dermatologists, the line prioritizes safety, as demonstrated in over 15,000 applications. Free from harsh chemicals such as parabens, sulfates, and alcohol, these products address growing consumer preferences for gentle, effective eye care solutions.

Another notable development in the U.S. eye care market is the introduction of Iridex Corp’s next-generation Iridex 532 and Iridex 577 lasers. Launched in conjunction with the company’s 35th anniversary, these advanced platforms incorporate patented MicroPulse Technology and offer multiple treatment modes to address retinal disorders and glaucoma. Featuring an intuitive touchscreen interface, these lasers enhance clinical control and improve treatment precision. The announcement was made ahead of the Hawaiian Eye and Retina 2024 meeting, underscoring Iridex’s commitment to innovation and its legacy of providing reliable laser systems to ophthalmologists worldwide. According to David Bruce, President and CEO of Iridex, these lasers represent a pivotal step forward, combining cutting-edge technology with user-centric design to optimize patient care.

In addition, advancements in diagnostic tools and treatment options, such as minimally invasive surgical devices and personalized therapies, are transforming the landscape of eye care. Consumer demand for products that address both functional and cosmetic needs is also shaping market trends. For instance, hypoallergenic and nutrient-enriched products, such as Lumify Eye Illuminations, cater to the growing preference for solutions that are both effective and gentle.

The contact lenses segment dominated the market and accounted for the largest revenue share of around 36.1% in 2024. Contact lenses offer convenient alternative to traditional eyeglasses for vision correction. Their popularity stems from factors such as improved comfort, enhanced aesthetics, and technological advancements. With options ranging from daily disposables to specialized lenses for various vision conditions, contact lenses cater to a diverse consumer base seeking both functional and lifestyle-oriented solutions for their visual needs.

The ocular health products segment is expected to exhibit the fastest growth during the forecast period, driven by increasing awareness of ocular health and preventive care. These products encompass a wide range of solutions, including drops, supplements, and protective eyewear, designed to promote eye wellness and address common conditions such as dryness, irritation, and fatigue. As consumers prioritize proactive measures to maintain optimal vision and overall eye health, the demand for ocular health products is expected to continue rising, shaping the landscape of the industry.

The prescribed (Rx) products segment dominated the market and accounted for the largest revenue share of around 61.2% in 2024 and is expected to exhibit the fastest growth during the forecast period, necessitating professional diagnosis and supervision for treatment. These products, including prescription eyeglasses, specialized lenses, and medicated drops, address various vision impairments and ocular conditions. By requiring a prescription, they ensure tailored solutions and proper management, instilling trust and reliability among consumers. Despite the rise of over-the-counter options, prescribed products remain essential for addressing complex vision issues and maintaining optimal care standards.

The hospitals & clinics segment dominated the market and accounted for the largest revenue share of around 36.0% in 2024. Hospitals & clinics and clinics play a key role in distributing vision care products, especially prescribed items requiring professional diagnosis and supervision. These establishments offer comprehensive care services, including consultations, diagnostics, and treatment, ensuring personalized solutions for patients' vision needs. With access to specialized equipment and expertise, hospitals and clinics serve as trusted hubs for addressing complex conditions and providing continuity of care. Their integration of medical professionals and resources facilitates efficient distribution and ensures adherence to quality standards in the industry.

The online stores segment is projected to witness the fastest growth rate over the forecast period, driven by consumer demand for convenience and accessibility. Offering a diverse range of products, including contact lenses, and ocular health supplements, online platforms provide a seamless shopping experience and doorstep delivery. With features such as virtual try-on tools and user reviews, they enhance the purchasing journey, empowering consumers to make informed decisions about their vision care needs. As e-commerce continues to expand, online stores are reshaping the retail landscape, catering to customers that are comfortable and skilled in using digital tools seeking convenience and variety in their care purchases.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. eye care market

By Product

By Mode Of Purchase

By Distribution Channel

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Eye Care Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Aging Population

3.3.1.2. Technological advancements

3.3.1.3. Rising consumer awareness

3.3.2. Market Restraints Analysis

3.3.2.1. High treatment costs

3.3.2.2. Healthcare disparities

3.4. U.S. U.S. Eye Care Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. U.S. Eye Care Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Eye Care Market: Product Movement Analysis, USD Million, 2024 & 2034

4.3. Contact Lenses

4.3.1. Contact Lenses Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Intraocular Lenses

4.4.1. Intraocular Lenses Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Ocular Health Products

4.5.1. Ocular Health Products Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Others

4.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. U.S. Eye Care Market: Mode Of Purchase Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. U.S. Eye Care Market: Mode Of Purchase Movement Analysis, USD Million, 2024 & 2034

5.3. Prescribed (Rx) Products

5.3.1. Prescribed (Rx) Products Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Over The Counter (OTC) Products

5.4.1. Over The Counter (OTC) Products Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. U.S. Eye Care Market: Distribution Channel Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. U.S. Eye Care Market: Distribution Channel Movement Analysis, USD Million, 2024 & 2034

6.3. Hospitals & Clinics

6.3.1. Hospitals & Clinics Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Online Stores

6.4.1. Online Stores Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Retail Stores

6.5.1. Retail Stores Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6. Others

6.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map Analysis

7.4. Company Profiles

7.4.1. Alcon, Inc.

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Johnson and Johnson Eye Care, Inc.

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Bausch & Lomb Incorporated

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Carl Zeiss Meditec AG (ZEISS International)

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. Essilor International

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. CooperVision

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. HOYA CORPORATION

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Rayner

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. STAAR SURGICAL

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

7.4.10. Novartis AG

7.4.10.1. Company overview

7.4.10.2. Financial performance

7.4.10.3. Product benchmarking

7.4.10.4. Strategic initiatives