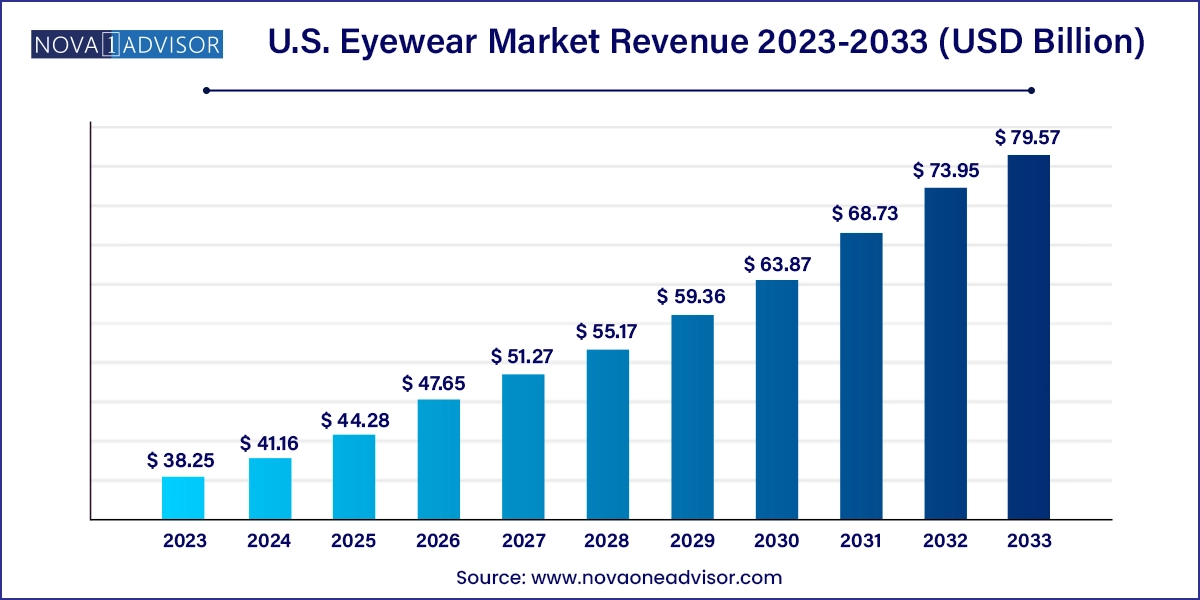

The U.S. eyewear market size was exhibited at USD 38.25 billion in 2023 and is projected to hit around USD 79.57 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2024 to 2033.

The U.S. eyewear market has evolved from being a basic vision correction utility to a dynamic industry intertwining healthcare, fashion, and lifestyle. With a growing emphasis on eye health, digital screen exposure, and style consciousness, the demand for diverse eyewear solutions has expanded significantly. This includes contact lenses, prescription spectacles, and fashion-forward sunglasses. While vision correction remains a core function, consumer behavior is increasingly influenced by branding, aesthetics, comfort, and technological integration, making eyewear not just a medical necessity but also a fashion accessory and a lifestyle choice.

The U.S. has witnessed steady growth in eyewear consumption due to factors such as an aging population, increasing cases of myopia among youth, and screen-induced eye strain. According to the Vision Council, over 75% of adults in the U.S. require vision correction, making this market both expansive and essential. Moreover, innovations in lens materials, blue light filtering, and smart eyewear are reshaping product offerings. Brands are focusing on product customization, convenience, and omnichannel retail experiences to meet the evolving demands of digitally savvy consumers.

Digitization has especially fueled the e-commerce boom in eyewear sales. Coupled with a preference for home-based try-ons and virtual fitting technologies, direct-to-consumer (DTC) brands like Warby Parker have disrupted traditional distribution models. Meanwhile, legacy players like EssilorLuxottica are fortifying their positions through vertical integration, exclusive licensing deals, and retail expansions. As a result, the U.S. eyewear market is transitioning from volume-centric sales to value-driven experiences.

Rise in Blue Light Blocking Eyewear: Increasing screen exposure due to remote work and digital learning has driven demand for eyewear with blue light filters.

Virtual Try-On & AR Integration: E-commerce platforms are incorporating AI and augmented reality tools for accurate virtual fittings and lens customization.

Eco-Friendly Eyewear: Brands are using recycled plastics, biodegradable acetate, and sustainable packaging to appeal to eco-conscious buyers.

Customized & Subscription-Based Eyewear: Personalized frames and recurring delivery of lenses through subscription models are gaining popularity.

Growth in Unisex Designs: Gender-neutral styles are becoming a mainstream trend, especially among Gen Z and Millennial consumers.

Smart Eyewear Evolution: Wearables like Ray-Ban Stories, developed by Luxottica and Meta, are introducing audio, video, and smart assistant functions into conventional frames.

Affordable Designer Collaborations: Premium aesthetics at accessible price points, driven by designer-label and fast-fashion co-branded frames.

Brick-and-Mortar Revival: Physical stores with digital integration are returning post-pandemic to offer hybrid retail experiences with in-store optometry.

| Report Coverage | Details |

| Market Size in 2024 | USD 41.16 Billion |

| Market Size by 2033 | USD 79.57 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, End-Use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Johnson & Johnson Vision Care, Inc.; ESSILORLUXOTTICA; CooperVision; Carl Zeiss AG; Bausch & Lomb Inc.; Safilo Group S.p.A.; Charmant Group; CIBA VISION; De Rigo Vision S.p.A; Fielmann AG; HOYA Corporation; JINS, Inc.; Marchon Eyewear, Inc.; Marcolin S.p.A; QSpex Technologies; Rodenstock GmbH; Seiko Optical Products Co., Ltd.; Shamir Optical Industry Ltd.; Silhouette International Schmied AG; Warby Parker; Zenni Optical, Inc. |

A leading growth catalyst in the U.S. eyewear market is the rising incidence of vision disorders such as myopia, hyperopia, astigmatism, and presbyopia. Studies show that by 2050, nearly 50% of the global population is expected to be myopic, with the U.S. experiencing a significant share. The American Academy of Ophthalmology links this rise to excessive digital device usage, especially among children and young adults. Consequently, parents are more inclined to purchase corrective lenses or specialized frames for their children, boosting demand for both spectacles and contact lenses. This shift has not only increased volumes but also stimulated innovation in lens design, material flexibility, and eye health features, making corrective eyewear a booming vertical within the industry.

Despite broad accessibility, the U.S. eyewear market faces constraints due to the high pricing associated with premium products. Designer sunglasses, smart eyewear, and custom prescription lenses can cost several hundred dollars per pair, limiting adoption among price-sensitive consumers. Additionally, limited insurance coverage for vision care and eyewear purchases exacerbates this challenge, particularly for uninsured or underinsured demographics. While DTC models have lowered pricing through disintermediation, premium segments still dominate retail shelf space, discouraging budget-conscious buyers and impacting the market’s growth potential in certain segments.

Smart eyewear offers the next frontier of opportunity for players in the U.S. market. Integration with AR/VR capabilities and smart features—like voice commands, music playback, and real-time notifications—offers eyewear companies an entirely new value proposition. The collaboration between Meta and Ray-Ban for “Ray-Ban Stories” is a prime example of how tech integration is revolutionizing the product landscape. These smart glasses not only cater to tech-savvy individuals but also support functionalities in sports, fitness, remote communication, and accessibility for the visually impaired. As consumer electronics converge with fashion and medical devices, the smart eyewear vertical stands to unlock new customer segments, from gamers to remote workers and enterprise field staff.

Brick & Mortar channels currently dominate distribution, especially for prescription eyewear. Physical stores enable vision testing, professional fitting, and immediate adjustments. Optical retail chains, such as LensCrafters and Visionworks, are heavily invested in hybrid formats—where customers can digitally schedule appointments or receive post-purchase support online. The importance of in-person ophthalmological consultation ensures the ongoing relevance of physical stores.

E-Commerce, however, is the fastest-growing channel, revolutionizing how consumers access eyewear. With the rise of home-based eye exams, virtual try-ons, and direct shipping, brands like Warby Parker and Zenni Optical have set new standards in online eyewear retail. E-commerce is particularly favored for repeat contact lens orders and fashion sunglasses, where prescription services are not always necessary. Augmented reality has made virtual fittings more accurate, reducing the risk of poor fit or style mismatch.

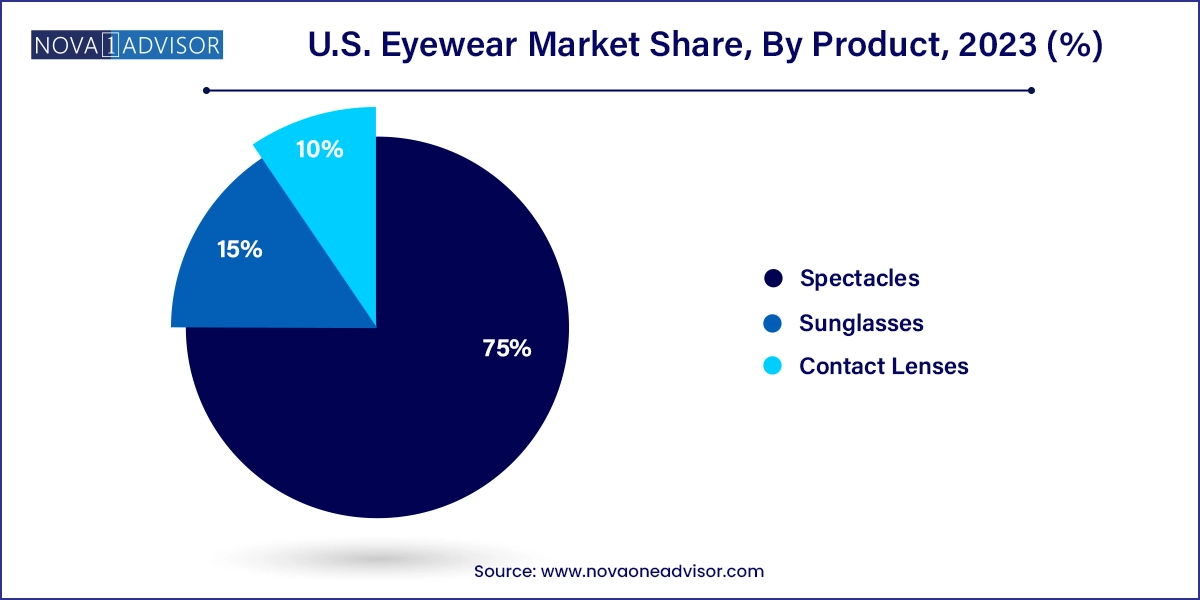

Spectacles dominate the U.S. eyewear market, owing to their widespread use among individuals with refractive errors. Spectacle frames, available in a variety of styles and materials, serve both functional and fashion needs. Premium spectacle frames, typically made of titanium, acetate, or stainless steel, are particularly sought after in urban markets and professional settings. Square and rectangle shapes are the most commonly adopted, aligning with contemporary fashion aesthetics. On the other hand, round and oval frames cater to niche tastes and retro revival trends. The growing demand for lightweight, hypoallergenic materials has also given rise to innovation in spectacle design. Spectacle lenses have become highly customizable, offering options like photochromic, bifocal, anti-reflective, and blue light protection.

Sunglasses are the fastest-growing product segment, driven by their dual appeal as fashion accessories and eye protection tools. Polarized sunglasses, known for reducing glare and enhancing visual comfort, are increasingly favored for driving, sports, and outdoor activities. Lens material also plays a pivotal role, with polycarbonate being preferred for its lightweight, impact-resistant properties. Brands like Oakley and Maui Jim leverage polycarbonate lenses for their performance-centric products. At the same time, CR-39 lenses remain popular for fashion sunglasses due to their excellent optical quality. Innovations like transition sunglasses that auto-adjust to lighting conditions have also garnered consumer interest.

In the U.S., eyewear consumption patterns are deeply influenced by lifestyle, healthcare access, and fashion trends. Metropolitan regions like New York, Los Angeles, and Chicago lead in demand for designer eyewear and smart glasses, while suburban and rural areas rely heavily on vision correction products through insurance-covered plans. The U.S. Department of Health’s initiatives to improve vision screening in schools and senior communities also support consistent demand.

States like California and Florida show high demand for sunglasses due to climatic factors, while northeastern states demonstrate a preference for premium and branded spectacles. The U.S. also serves as a testing ground for global eyewear launches, making it a strategic market for international players to introduce AI-integrated or biometric-enabled eyewear. The growing presence of retail health clinics in pharmacies like CVS and Walgreens, offering eye exams and eyewear sales, adds further distribution depth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. eyewear market

Product

Distribution Channel

End-use