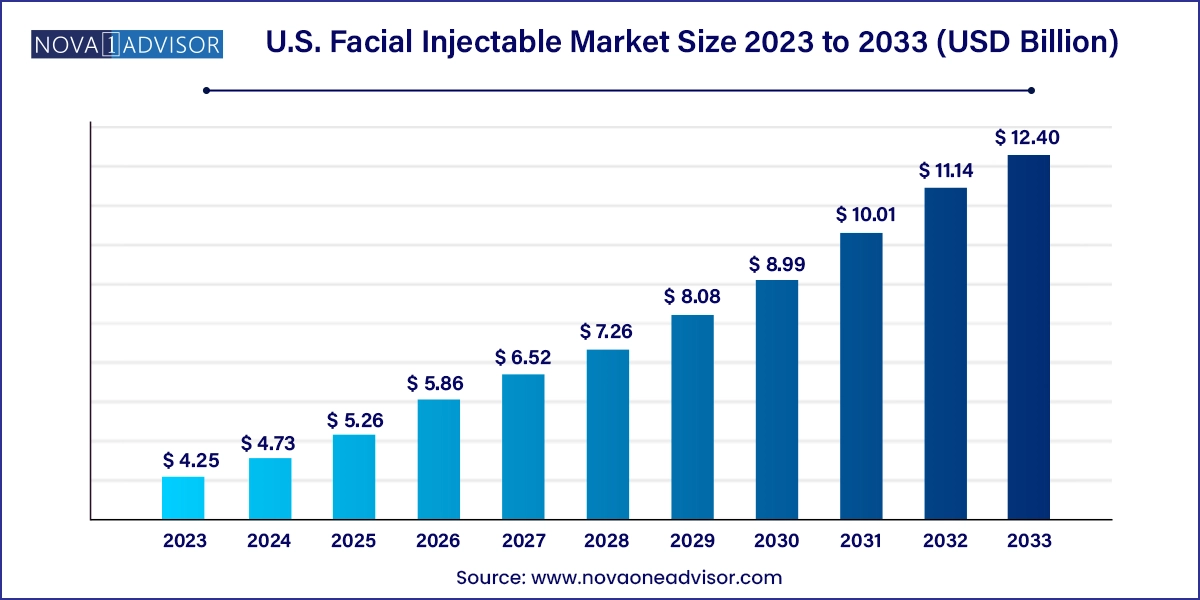

The U.S. facial injectable market size was exhibited at USD 4.25 billion in 2023 and is projected to hit around USD 12.40 billion by 2033, growing at a CAGR of 11.3% during the forecast period 2024 to 2033.

The U.S. facial injectable market has rapidly evolved into one of the most dynamic sectors in aesthetic medicine, driven by an increasing demand for minimally invasive cosmetic procedures, rising social acceptance of aesthetic enhancement, and ongoing technological innovation. Facial injectables, also known as dermal fillers and neuromodulators, are non-surgical procedures designed to reduce wrinkles, restore volume, enhance facial contours, and provide overall skin rejuvenation. The market encompasses a broad array of products including Botulinum Toxin Type A, Hyaluronic Acid (HA), Calcium Hydroxylapatite (CaHA), Poly-L-lactic Acid (PLLA), and Collagen-based fillers.

The rise of social media, selfie culture, and a strong emphasis on beauty and wellness in U.S. culture have contributed significantly to consumer interest in facial injectables. Notably, the demographic is expanding beyond the traditional 40+ segment, with Millennials and Gen Z patients driving new procedural volumes. Furthermore, men are increasingly seeking aesthetic enhancements, reflecting the market’s shift from niche to mainstream.

Medical spas (MedSpas), dermatology clinics, and aesthetic centers across the country are offering advanced injectable treatments, and the industry is characterized by frequent FDA approvals, robust R&D, celebrity-endorsed marketing, and bundled treatment packages. Advances in formulation (longer-lasting fillers), application (micro-cannulas), and digital consultation platforms are also boosting the market’s expansion. With patient safety, personalization, and minimally invasive care at the forefront, the U.S. facial injectable market is poised for continued growth.

Millennial and Gen Z Adoption Surge: Younger patients are turning to preventative injectables like "Baby Botox" and subtle fillers to delay signs of aging.

Growth in Male Aesthetic Procedures: A growing number of male clients are seeking jawline sculpting, chin augmentation, and wrinkle treatments.

Social Media and Influencer Impact: Instagram and TikTok influencers are driving demand by showcasing their aesthetic journeys and outcomes.

Combination Therapies on the Rise: Practitioners are increasingly using a blend of toxins and fillers to create natural-looking results through full-face rejuvenation.

Customized Treatments with AI and Imaging Tools: Clinics are deploying facial analysis software and augmented reality to predict post-treatment outcomes.

Longer-Lasting, Biostimulatory Fillers: Products such as PLLA and CaHA are being favored for their ability to stimulate collagen production for sustained effects.

FDA Approvals and New Product Launches: Ongoing regulatory greenlights are expanding the available product range and encouraging market competition.

Increasing Popularity of MedSpas: These hybrid centers blend luxury and medical care, becoming primary locations for non-invasive facial injectable services.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.73 Billion |

| Market Size by 2033 | USD 12.40 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | AbbVie, Inc.; REVANCE AESTHETICS; Merz North America, Inc.; Galderma Laboratories; L.P.; Suneva Medical Inc.; Cytophil, Inc.; Prollenium Medical Technologies |

A key driver of the U.S. facial injectable market is the growing consumer preference for non-surgical, minimally invasive aesthetic procedures. Consumers are increasingly opting for procedures that deliver noticeable results without the downtime, risks, or cost associated with surgical interventions like facelifts. Facial injectables meet this need by offering immediate results with minimal recovery time.

This trend is bolstered by a cultural shift toward “maintenance aesthetics,” where individuals regularly undergo small tweaks to preserve a youthful appearance over time. The convenience, affordability, and reversibility of injectables appeal to a broad consumer base, including working professionals and first-time patients. Data from the American Society of Plastic Surgeons indicates that injectables now outpace surgical procedures by nearly 5 to 1 in terms of volume, illustrating the public’s overwhelming tilt toward non-invasive solutions.

Despite its popularity, the market is challenged by the potential for adverse outcomes and the variability in provider expertise. Common complications include bruising, swelling, asymmetry, and, in rare cases, vascular occlusion leading to tissue necrosis or vision impairment. While most adverse effects are temporary, they can deter first-time users and lead to reputational damage for clinics.

Moreover, the proliferation of minimally trained or non-certified providers, especially in low-cost MedSpas, has raised concerns over patient safety. The lack of standardized training and regulatory oversight in some U.S. states exacerbates this issue. Patients often lack the knowledge to distinguish between board-certified professionals and poorly trained injectors, leading to uneven experiences. These safety concerns, if left unaddressed, could dampen the otherwise positive growth trajectory of the industry.

A major opportunity in the U.S. facial injectable market lies in the integration of digital health technologies and virtual consultations, enabling broader patient outreach and enhanced pre-treatment planning. AI-powered facial analysis tools are being used to recommend tailored treatment plans, while mobile platforms allow patients to consult providers, track progress, and manage appointments.

With telehealth normalization post-COVID-19, many aesthetic clinics now provide pre-procedure consultations, skincare assessments, and follow-ups via video calls. Furthermore, digital simulation tools can provide 3D visuals of potential results, increasing patient confidence and satisfaction. This technology-first approach is especially effective in capturing the younger, tech-savvy demographic and streamlining operations for busy clinics. Providers who successfully integrate these tools can improve patient engagement, treatment outcomes, and competitive differentiation.

Botulinum Toxin Type A dominated the product segment of the U.S. facial injectable market, primarily due to its widespread use for dynamic wrinkle treatment. Botox (Allergan) and its competitors like Xeomin (Merz) and Dysport (Ipsen) have become household names, utilized to temporarily relax muscles responsible for frown lines, crow’s feet, and forehead wrinkles. Their results are predictable, with minimal side effects and a fast onset, making them a favorite for both patients and providers. The demand for toxin injections remains high, not just for aesthetic purposes, but also for off-label therapeutic uses such as treating TMJ disorders and excessive sweating.

Hyaluronic Acid (HA)-based fillers are the fastest-growing segment, especially due to their versatility, reversibility, and safety profile. HA fillers such as Juvederm, Restylane, and Belotero are used in lip augmentation, cheek volume restoration, nasolabial fold correction, and tear trough enhancement. With soft, natural-looking results and the ability to dissolve HA using hyaluronidase, these products offer flexibility to both first-time and returning patients. Additionally, HA fillers now come in specialized variants ranging in viscosity and longevity allowing practitioners to target specific facial areas with high precision, boosting their popularity.

Facial line correction dominated the application segment, driven by high demand for wrinkle treatments among middle-aged and older adults. These procedures primarily target forehead lines, glabellar lines, and crow’s feet using botulinum toxin and HA fillers. The simplicity of the procedure, minimal discomfort, and subtle rejuvenation effects have made wrinkle correction a staple in aesthetic practices. Combined with minimal downtime, these treatments appeal to working professionals seeking discreet, lunchtime enhancements.

Lip augmentation is emerging as the fastest-growing application, fueled by increasing demand among younger women, social media influences, and celebrity culture. Influencers frequently document their lip filler experiences, creating a powerful marketing loop. HA-based lip fillers offer natural-looking plumpness, hydration, and shape enhancement, and are often marketed with descriptors like “hydrating” or “subtle” to appeal to first-time users. As Gen Z continues to embrace cosmetic enhancement earlier than previous generations, lip augmentation’s growth is expected to remain strong.

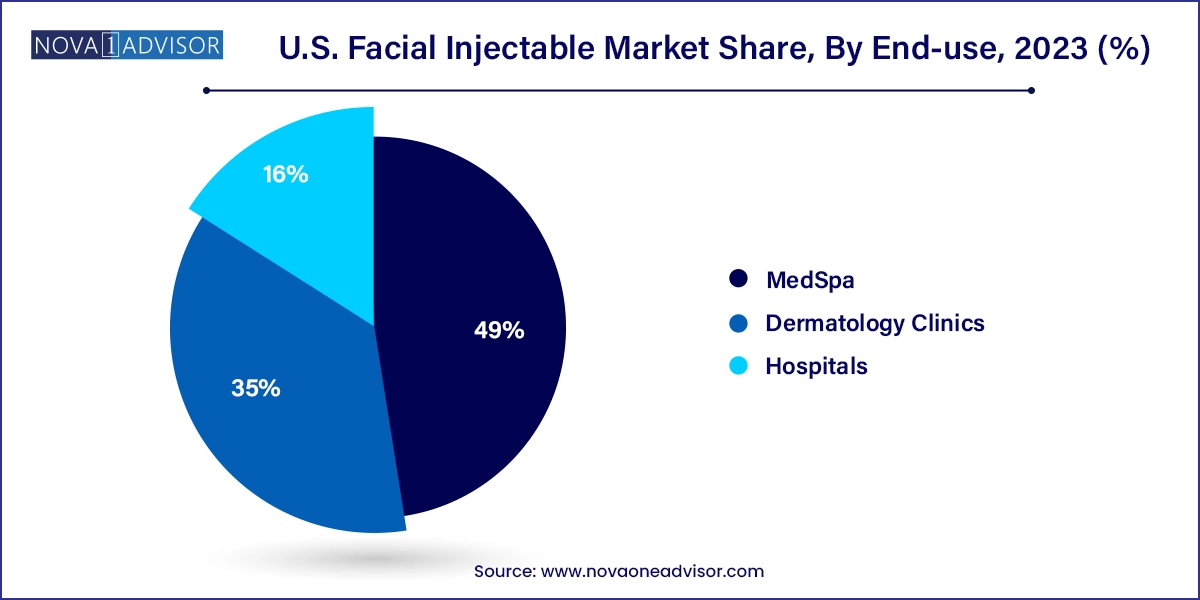

MedSpas dominated the end-use segment, becoming the epicenter of facial injectable procedures in the U.S. These establishments combine a luxurious spa experience with licensed medical procedures, offering convenience, comfort, and results in a boutique setting. MedSpas are particularly favored for their personalized service, promotional packages, and loyalty programs. They also have shorter wait times compared to hospitals and clinics, making them more appealing to time-sensitive clientele. Many MedSpas operate under the supervision of dermatologists or plastic surgeons, ensuring safety while enhancing customer experience.

Dermatology clinics are the fastest-growing segment, gaining traction due to rising awareness about safety, precision, and aftercare in cosmetic procedures. Patients increasingly prefer board-certified dermatologists for injectables, particularly for complex or corrective cases. Clinics often emphasize clinical outcomes, long-term care, and adherence to safety protocols, attracting cautious or high-end consumers. Additionally, dermatology practices are increasingly offering hybrid cosmetic-medical services, such as combining acne scar treatment with fillers, which expands their patient base.

Within the United States, significant variations exist in aesthetic demand and procedural volume. The West region, particularly California, dominates the U.S. facial injectable market. California’s cities—Los Angeles, San Diego, and San Francisco—are cultural hubs for beauty, fashion, and cosmetic innovation. The prevalence of influencers, celebrities, and high-income earners in this region sustains a robust aesthetic industry. A dense concentration of MedSpas, cosmetic dermatology clinics, and early adopters contributes to a thriving market.

Meanwhile, the Southwest region, including Texas and Arizona, is the fastest-growing area. Texas in particular is seeing a major uptick in MedSpa openings and dermatological practices offering injectables. Urban centers like Houston, Dallas, and Austin are increasingly attracting a younger demographic interested in cosmetic enhancements. In addition, the more affordable cost of living and procedures in these areas make aesthetic treatments more accessible to middle-income groups, driving market expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. facial injectable market

Product

Application

End-use

Regional