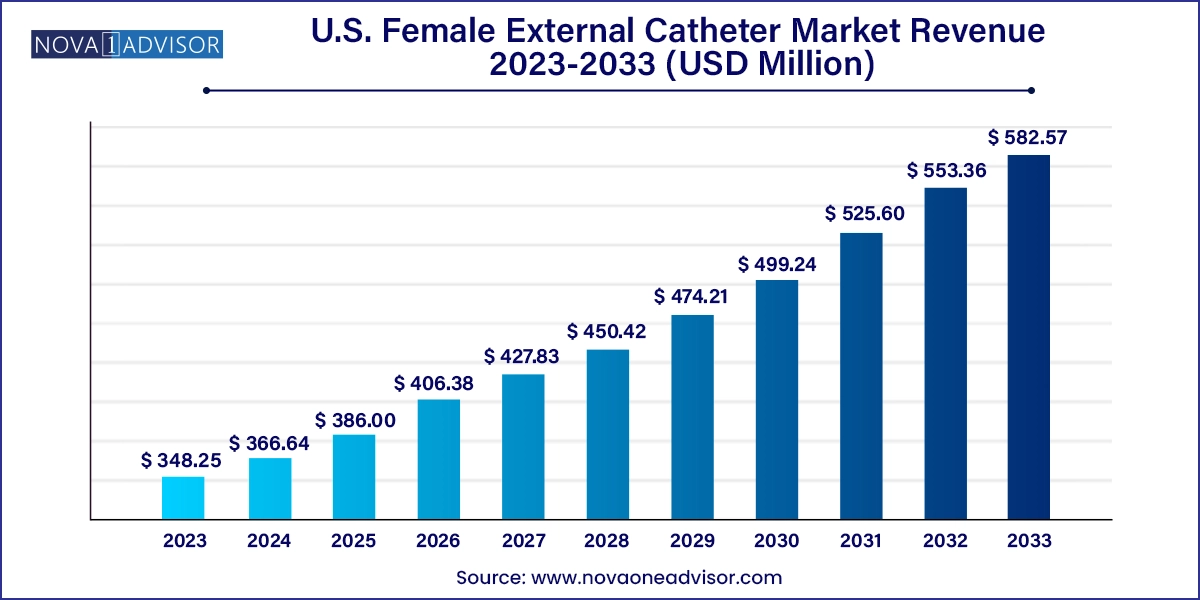

The U.S. female external catheter market size was exhibited at USD 348.25 million in 2023 and is projected to hit around USD 582.57 million by 2033, growing at a CAGR of 5.28% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 366.64 Million |

| Market Size by 2033 | USD 582.57 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.28% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Application, Area of Incontinence, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | BD; Stryker; Boehringer Laboratories, LLC.; Consure Medical; Hollister Incorporated |

The market is driven by the increasing demand for innovative and effective solutions for managing urinary incontinence and catheterization in women. Female external catheters are designed to provide a safe, comfortable, and hygienic alternative to traditional indwelling urethral catheters, which can be associated with complications such as urinary tract infections and bladder damage. Trends that are shaping the U.S. market include the growing demand for female external catheters that prioritize comfort, hygiene, and ease of use. The rise of customizable and smart external catheters reflects a growing emphasis on personalized medicine and patient-centered care, and the integration of telemedicine and remote monitoring technologies is becoming increasingly important in the management of urinary incontinence and catheterization.

Prevalence of chronic diseases, such as diabetes, Alzheimer’s, Parkinson’s, and various other conditions, is significantly increasing, leading to a considerable rise in hospital admission rates, thus driving the growth of the U.S. market for female external catheter. According to the National Diabetes Statistics Report, in 2021, more than 41 million people of all ages (12.5% of the U.S. population) had diabetes, but approximately 9.4 million adults (23.5% of adults with diabetes) were unaware that they had the condition. Notably, the prevalence of diabetes among adults aged 65 years or older increased to an alarming 30.4%. According to the America's Health Rankings report by the United Health Foundation, approximately 29.3 million adults, equivalent to 11.2% of the overall population, reported having three or more chronic health conditions in 2022. Thus, due to the increasing prevalence of chronic diseases and the subsequent surge in hospitalizations, the demand for female external catheter is expected to grow, fueling growth in the U.S. market. Further, the CDC Behavioral Risk Factor Surveillance System, in 2022 reported that West Virginia (41%), Louisiana (40.1%), Oklahoma (40.0%), and Mississippi (39.5%) had the highest rates of adult obesity in the same year. This makes the current increase in the obese population a significant factor contributing to the growth of the Female External Catheter market in this region.

The silicone segment dominated the market in 2023 as silicone-based catheters offer unparalleled comfort and durability, making them a preferred choice among patients. The smooth, soft, and gentle surface of silicone reduces irritation and discomfort, while its durability ensures longer catheter lifespan and reduced replacement frequency. The dominance of silicone-based female external catheters in the U.S. market can be attributed to their superior properties and benefits. As patient awareness about bladder health and catheter care continues to grow, it is likely that silicone-based catheters will remain the preferred choice for patients seeking comfort, durability, and ease of use.

The latex segment is expected to register the fastest CAGR of 5.59% during the forecast period. Silicone-based catheters have traditionally been the dominant material segment, but some patients may prefer latex-based catheters due to concerns about silicone allergies or sensitivity. Further, The Food and Drug Administration (FDA) has issued guidelines and regulations regarding the use of latex-containing medical devices, which has led to increased adoption of latex-based catheters as a safer alternative.

Diabetes dominated the market in 2023due to the growing prevalence of diabetes-related incontinence and advances in technology in the U.S. As the market continues to evolve, companies will need to focus on developing innovative products that address compliance and cost-effectiveness challenges while leveraging digital health solutions to improve patient outcomes. Further, companies are also investing in research and development to create more comfortable, convenient, and effective catheters for patients with diabetes-related incontinence.

The segment is also expected to register the fastest CAGR of 5.98% during the forecast period driven by the steady and increasing prevalence of diabetes year over year. For instance, according to the Centers for Disease Control and Prevention (CDC), between 2021 and 2022, diabetes rates increased by 6%, rising from 10.9% to 11.5% of adults, with nearly 31.9 million adults affected.

Stress Urinary Incontinence (SUI) dominated the market in 2023. The dominance of the segment can be attributed to the growing awareness about urinary incontinence and its impact on mental and physical health. The rise in geriatric population, increasing obesity rates, and sedentary lifestyle are also contributing factors to the growing demand for SUI products. Moreover, advancements in technology have led to the development of innovative products that cater to the specific needs of women suffering from SUI.

According to a comprehensive analysis of data collected between 2015-2018, published in the official journal of the American Urogynecologic Society, a staggering 61.8% of adult women in the U.S. suffer from urinary incontinence (UI), translating to approximately 78.3 million women. Moreover, 32.4% of all women reported experiencing UI symptoms at least once a month. Of those afflicted with UI, a significant proportion presented with specific types of incontinence: 37.5% experienced stress urinary incontinence, 22.0% suffered from urgency urinary incontinence, 31.3% had mixed symptoms, and 9.2% experienced unspecified incontinence.

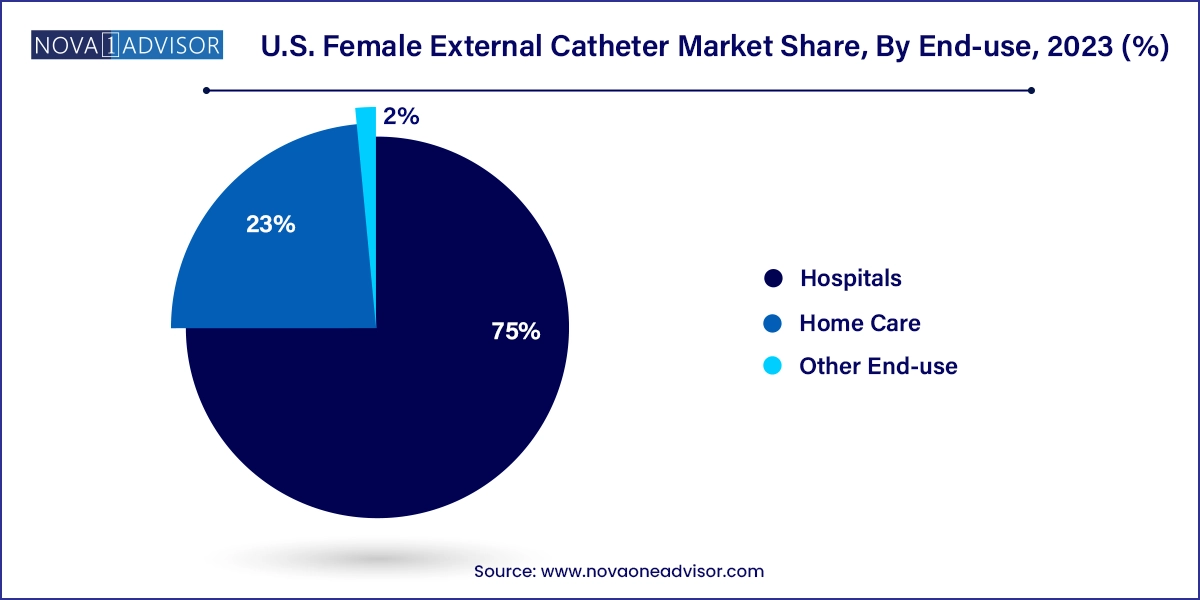

Hospitals dominated the market share 75.0% in 2023. due to their high patient volume, increasing prevalence of urinary incontinence, and government initiatives driving adoption of evidence-based treatments. As the market continues to evolve, companies must prioritize innovation, digital health solutions, and patient engagement to stay competitive and capitalize on growth opportunities.

Further, home care segment is expected to register the fastest CAGR of 7.41% during the forecast period due to its growing demand for convenience, comfort, and cost-effective solutions. As the market continues to evolve, companies must prioritize innovation, digital health solutions, and patient education to stay competitive and capitalize on growth opportunities. Key players in the home care segment include BD, Consure Medical, among others. These companies are investing in research and development to stay ahead of the competition and capitalize on market growth opportunities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. female external catheter market

Material

Application

Area of Incontinence

End-use