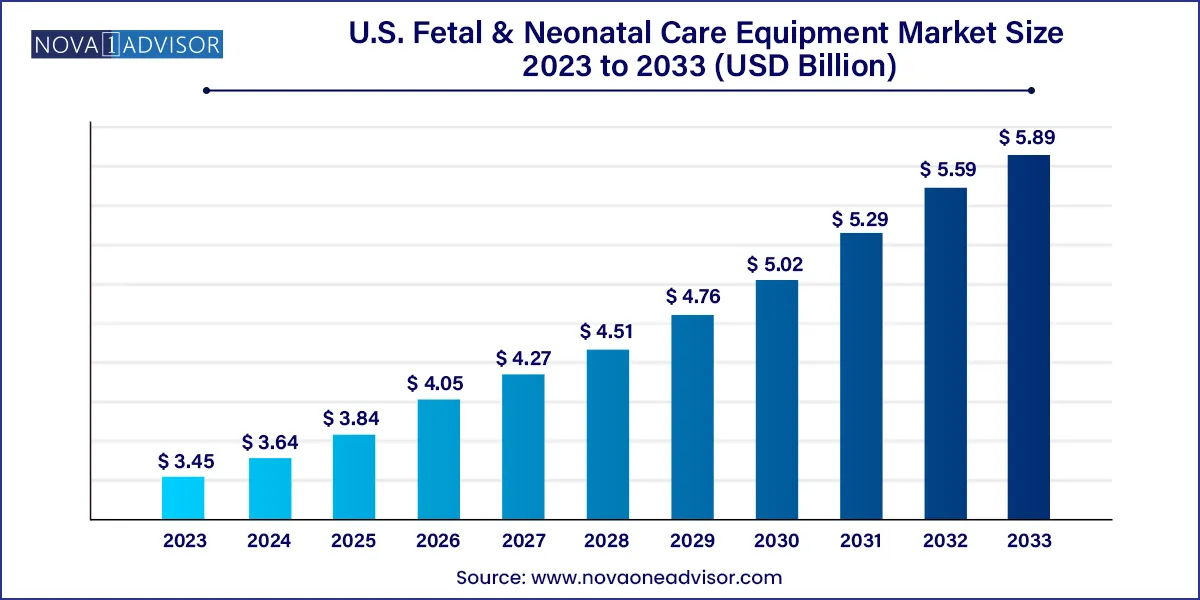

The U.S. fetal & neonatal care equipment market size was estimated at USD 3.45 billion in 2023 and is projected to hit around USD 5.89 billion by 2033, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

The U.S. fetal and neonatal care equipment market is a critical and rapidly advancing segment within the country's healthcare industry, driven by technological innovation, rising awareness of prenatal and neonatal health, and improving healthcare access. This market focuses on equipment designed to monitor, diagnose, and support the physiological needs of fetuses and newborn infants, particularly those born prematurely or with health complications requiring intensive care.

In the United States, over 10% of babies are born preterm each year, according to CDC statistics. These infants often require specialized neonatal care to support vital functions, such as respiration, thermoregulation, and circulatory monitoring. Concurrently, advanced fetal monitoring is used to assess the well-being of unborn children during pregnancy and labor, aiding in early diagnosis of abnormalities and enhancing maternal-fetal outcomes.

The integration of smart technologies, wireless monitoring, and data analytics into these systems has revolutionized neonatal intensive care units (NICUs) across U.S. hospitals. The demand is further fueled by a rising number of high-risk pregnancies associated with maternal age, pre-existing conditions such as diabetes or hypertension, and increased use of assisted reproductive technologies (ART).

Key product segments, including incubators, phototherapy units, CPAP devices, fetal monitors, and pulse oximeters, are constantly evolving in terms of design and functionality. Additionally, healthcare reforms and hospital expansions especially within large health systems are enabling greater investments in specialized pediatric and neonatal care infrastructure.

Increased adoption of non-invasive fetal monitoring technologies to reduce patient discomfort and risk during labor.

Growing preference for wireless and portable neonatal care equipment, improving mobility and flexibility in NICUs.

Integration of AI and predictive analytics into fetal and neonatal monitors for early diagnosis and clinical decision support.

Expansion of neonatal respiratory care due to rising cases of respiratory distress syndrome in preterm infants.

Product innovations in incubators and warmers, including hybrid models that combine both functionalities.

Higher investments in NICU infrastructure by major hospital chains aiming to improve patient outcomes and reduce infant mortality.

Growing focus on home-based neonatal monitoring devices, particularly for post-discharge preterm infants.

Regulatory encouragement and funding for maternal and child health by U.S. government agencies like the HHS and NIH.

| Report Attribute | Details |

| Market Size in 2024 | USD 3.64 Billion |

| Market Size by 2033 | USD 5.89 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Cardinal Health; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Medtronic; BD; Vyaire; Utah Medical Products, Inc.; Ambu A/S; Natus Medical Incorporated; Inspiration Healthcare Group plc.; Atom Medical Corp; Fisher & Paykel Healthcare Limited; Masimo; Phoenix Medical Systems (P) Ltd. |

One of the primary drivers of the U.S. fetal and neonatal care equipment market is the increasing prevalence of preterm births and related health complications. Preterm infants those born before 37 weeks of gestation are at higher risk of respiratory distress, jaundice, hypothermia, and neurological deficits. According to data from the March of Dimes and CDC, approximately 1 in 10 infants in the U.S. is born prematurely, contributing to higher NICU admissions.

Managing these vulnerable patients requires a suite of sophisticated devices, from neonatal ventilators and incubators to advanced monitoring systems. The growth in maternal age, chronic conditions such as obesity and hypertension, and increased use of in-vitro fertilization have all contributed to a rise in high-risk pregnancies. This has elevated the importance of fetal monitoring systems during delivery and neonatal care post-birth. Hospitals are investing heavily in state-of-the-art NICUs, and companies are responding by developing next-generation solutions tailored to the specific physiological needs of premature infants.

A significant challenge to the growth of the market is the high cost of fetal and neonatal care equipment, particularly for advanced monitoring, respiratory support, and hybrid incubator systems. These devices require significant capital investment, along with dedicated space, trained personnel, and ongoing maintenance. For smaller hospitals and rural healthcare facilities, the financial burden can limit access to the most advanced technologies.

Moreover, while large urban hospitals may boast state-of-the-art NICUs, access remains uneven across the country. Disparities in neonatal care are evident in low-income communities, where infants may not receive the same level of care due to infrastructure or funding limitations. Medicaid and private insurance coverage may not fully reimburse for expensive devices or extended NICU stays, further compounding the challenge. These factors create barriers to widespread adoption, especially among smaller providers and clinics.

An exciting opportunity in the U.S. market lies in the integration of digital health technologies and smart monitoring systems within neonatal and fetal care. Innovations in sensors, wireless communication, and cloud-based platforms are enabling real-time, non-invasive, and continuous tracking of vital signs in infants. This is particularly beneficial for early discharge programs and outpatient follow-ups of preterm babies.

Advanced neonatal monitoring systems now incorporate AI algorithms that can detect early warning signs of complications such as apnea, sepsis, or hypoglycemia, allowing for timely intervention. Similarly, fetal monitors are becoming more sophisticated, offering remote data sharing with obstetricians and enabling home-based monitoring in some high-risk pregnancies. The development of hybrid incubator-warmers with built-in ventilation and infection control features further demonstrates how innovation is driving differentiation. These integrated, data-driven solutions can enhance outcomes, reduce hospital stays, and support value-based care models across U.S. health systems.

Neonatal care equipment dominated the product segment in 2024, due to its essential role in supporting premature and low-birth-weight infants immediately after delivery. Within this category, incubators and respiratory support devices are particularly critical. Neonatal ventilators and CPAP devices are commonly used in NICUs to manage breathing in infants with underdeveloped lungs. Continuous monitoring tools such as blood pressure monitors, cardiac monitors, and integrated systems are also standard components of NICU infrastructure. Hospitals often invest in neonatal care bundles, combining warmers, phototherapy units, and ventilatory support, especially for level III and IV NICUs.

Fetal care equipment is the fastest-growing subsegment, particularly fetal monitors and ultrasound devices, due to rising demand for early detection of complications during pregnancy. Non-invasive and wearable fetal monitoring systems are being widely adopted in hospitals and birthing centers. Fetal MRI systems, though a niche category, are gaining interest for high-resolution imaging in complicated pregnancies, such as those involving congenital malformations. As maternal health awareness grows and prenatal check-ups become more technologically advanced, the market for fetal care solutions is expected to expand significantly.

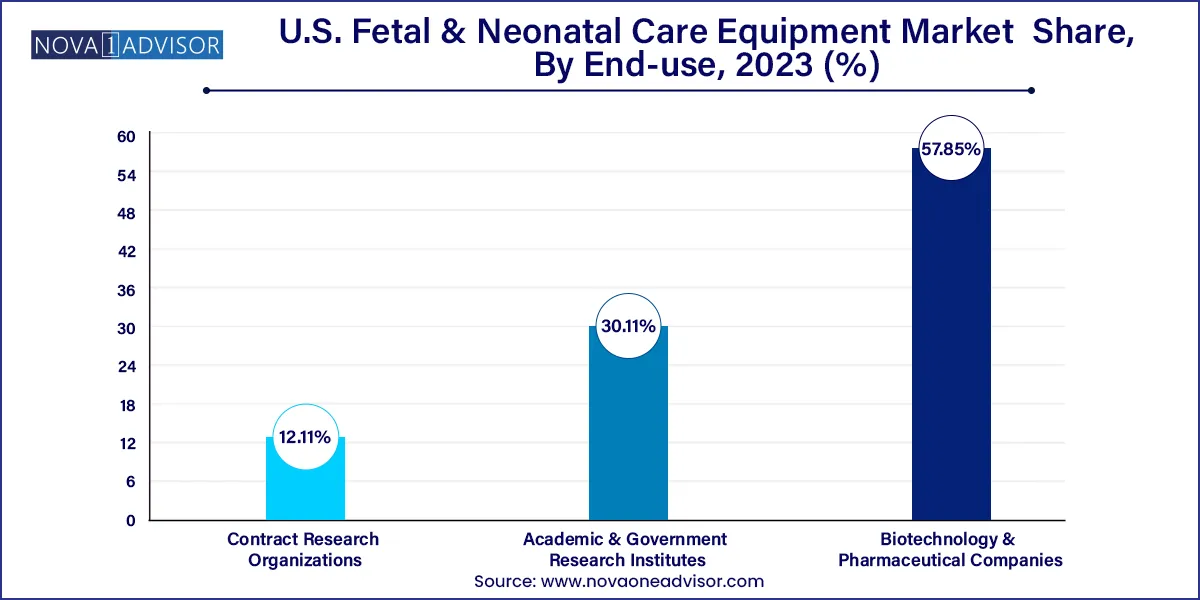

Hospitals continued to dominate the U.S. fetal and neonatal care equipment market in terms of end-use, accounting for the largest revenue share in 2024. This is primarily because most deliveries particularly high-risk ones occur in hospitals with access to emergency obstetric and neonatal care. Hospitals also house NICUs, which require continuous use of equipment such as incubators, CPAP machines, ventilators, and integrated monitoring systems. The demand for state-of-the-art technology in hospitals is also driven by the rising trend of specialized maternal-fetal medicine departments within larger health systems.

Clinics are the fastest-growing end-use segment, particularly those offering outpatient maternity care and specialized maternal wellness services. Clinics often utilize fetal monitoring, ultrasound systems, and portable diagnostic tools for routine prenatal check-ups. These facilities play a crucial role in early detection of complications and act as referral centers to hospitals when high-risk conditions are detected. Technological advancements have made fetal care equipment more compact and affordable, making it easier for clinics to integrate such solutions into their daily workflow.

The United States is a global leader in fetal and neonatal care innovation and infrastructure, driven by a robust healthcare ecosystem, cutting-edge medical technology development, and active involvement of both public and private stakeholders. The U.S. healthcare system supports a well-developed maternal and child health infrastructure, with over 600 hospitals housing NICUs of varying complexity. These range from Level I (basic care) to Level IV (most advanced care for critically ill infants).

Government initiatives such as the Maternal and Child Health Bureau (MCHB), funding through HRSA, and CDC-backed programs are focused on reducing infant mortality and improving perinatal outcomes. Moreover, academic medical centers like Johns Hopkins, Boston Children’s Hospital, and Cincinnati Children’s are at the forefront of neonatal clinical research and device innovation.

The private sector is also playing a key role, with major device manufacturers, hospital networks, and biotech startups launching collaborative initiatives to improve fetal and neonatal outcomes. In parallel, insurance providers and CMS are increasingly supporting early intervention and high-quality maternal and neonatal services as part of value-based care models.

March 2025 – GE HealthCare launched a new AI-powered fetal monitoring platform in the U.S., designed to integrate maternal-fetal data into electronic medical records for real-time labor decision support.

February 2025 – Natus Medical introduced its latest neonatal brain monitoring device, which includes advanced EEG features for use in Level III NICUs across major U.S. hospitals.

January 2025 – Dräger announced its partnership with a U.S.-based telemedicine provider to pilot remote neonatal monitoring in rural hospitals, addressing care gaps in underserved areas.

December 2024 – Philips Healthcare expanded its neonatal CPAP device portfolio, launching a compact unit specifically designed for home-use post-discharge preemies.

November 2024 – Medtronic received FDA clearance for a neonatal-specific pulse oximeter with improved sensitivity for detecting hypoxemia in low-perfusion conditions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Fetal & Neonatal Care Equipment market.

By Product

By End-use