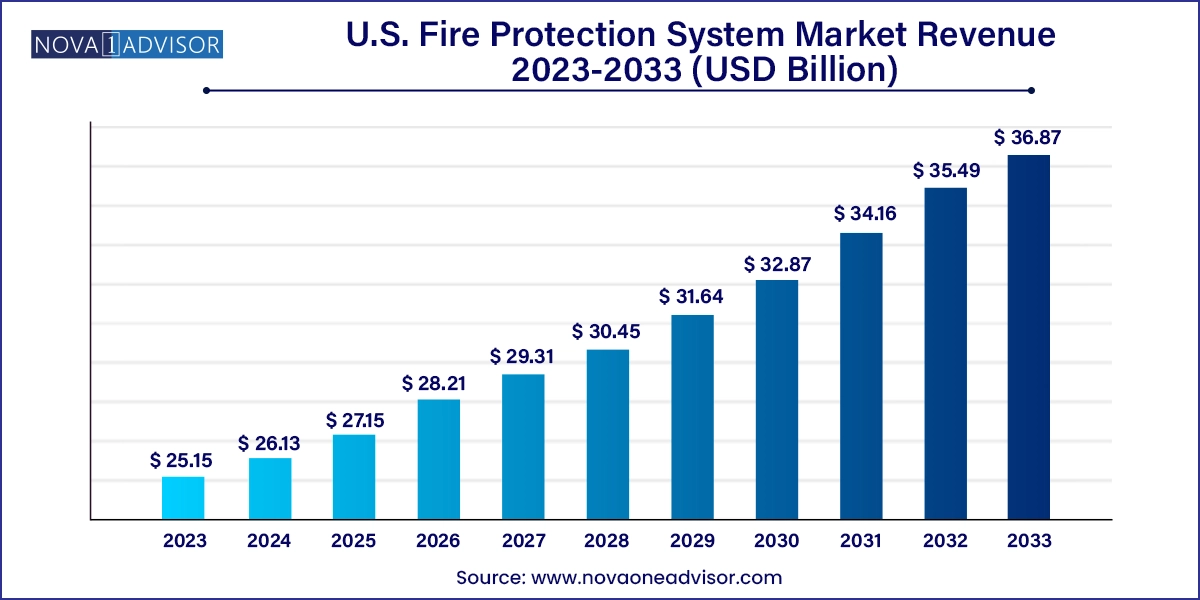

The U.S. fire protection system market size was exhibited at USD 25.15 billion in 2023 and is projected to hit around USD 36.87 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2024 to 2033.

The U.S. fire protection system market represents a critical infrastructure sector that supports life safety, property protection, and regulatory compliance across a diverse set of environments, from residential buildings to complex industrial plants. As urbanization continues to rise and technological innovations reshape building management systems, the demand for intelligent, responsive, and integrated fire protection systems has intensified. These systems include a wide range of components such as fire detection, suppression, analysis, response mechanisms, and sprinkler systems—all aimed at early detection, effective response, and damage control in fire-related incidents.

The market has experienced robust growth in recent years due to stringent government regulations, rising fire hazards in urban environments, and growing awareness around the importance of fire safety in both commercial and residential settings. From skyscrapers in New York to industrial warehouses in Texas, modern fire protection systems are not only mandated but increasingly seen as essential investments to ensure business continuity and occupant safety. The adoption of smart technologies—like AI-driven sensors, wireless alert systems, and automated suppression tools—is further transforming how fires are managed in real time.

Moreover, the increasing frequency of fire-related accidents and fatalities has led to a surge in investment across public and private sectors to upgrade legacy systems and install new-age safety mechanisms. With the support of national standards such as those set by the National Fire Protection Association (NFPA), the U.S. market is driven by both innovation and compliance, creating a fertile ground for sustained growth and competitive dynamics.

Integration of Smart Technologies: The incorporation of IoT, AI, and cloud-based systems for real-time fire monitoring and data analytics is revolutionizing fire safety solutions in the U.S.

Wireless Fire Detection Systems: Wireless fire detection is gaining traction in historical or hard-to-wire buildings, offering flexible deployment and reduced installation costs.

Rise in Green Building Initiatives: Sustainable fire safety systems that meet LEED certification requirements are becoming more prevalent as green construction expands.

Growth of Maintenance-as-a-Service (MaaS): Instead of just purchasing systems, commercial clients increasingly opt for ongoing service contracts for predictive maintenance and compliance.

AI-powered Fire Analysis Tools: Predictive tools leveraging AI to assess fire risks and optimize safety protocols are enhancing fire analysis capabilities.

Customized Residential Fire Systems: An uptick in demand for personalized, compact fire safety solutions for residential users, especially in urban high-rise living.

Enhanced Fire Codes and Regulatory Pressure: Continuous updates to local and national fire codes drive both retrofits and new system installations across the U.S.

Edge Computing in Fire Systems: Real-time local processing through edge computing is enabling faster response times, especially in industrial applications.

| Report Coverage | Details |

| Market Size in 2024 | USD 26.13 Billion |

| Market Size by 2033 | USD 36.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Service, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corporation; GENTEX CORPORATION; Siemens AG; Robert Bosch GmbH; Halma plc; Eaton; Hitachi Ltd.; Iteris, Inc. |

One of the most significant driving forces of the U.S. fire protection system market is the increasing stringency of government regulations and building safety codes. The National Fire Protection Association (NFPA) and Occupational Safety and Health Administration (OSHA) enforce comprehensive fire safety standards that require both new and existing structures to install certified fire protection systems. These regulations are particularly rigorous in high-risk environments such as hospitals, educational institutions, oil & gas facilities, and chemical manufacturing plants. As a result, businesses are compelled to invest in advanced and regularly maintained fire safety systems, ensuring compliance while also enhancing safety. Non-compliance can result in hefty fines, litigation, and even forced shutdowns—factors that encourage proactive investment.

Despite the clear benefits, the high upfront costs associated with installing comprehensive fire protection systems act as a deterrent for many small to mid-sized enterprises and homeowners. These costs can be especially burdensome when integrating advanced technology such as AI-enabled detectors or wireless alarm networks. In addition, ongoing maintenance requirements, compliance checks, and software updates add to the total cost of ownership. While large commercial entities may easily absorb these expenses, smaller facilities often delay or underinvest in fire safety upgrades, which creates gaps in market penetration and may limit revenue growth potential in certain market segments.

The rapid growth of smart buildings and automated infrastructure presents a lucrative opportunity for fire protection system providers. In the U.S., cities like Seattle, Austin, and San Francisco are undergoing significant transformations toward intelligent infrastructure, which includes integrated building management systems (BMS) that coordinate HVAC, lighting, security, and fire protection. Fire systems embedded into these networks can respond dynamically to sensor inputs and real-time environmental changes, thereby improving response times and reducing damage. Companies offering scalable, open-architecture fire safety solutions that easily integrate with existing BMS platforms are poised to gain considerable market share in this evolving landscape.

Fire Detection systems dominated the U.S. fire protection system market in 2023, owing to widespread implementation in commercial and industrial buildings. These systems, comprising smoke detectors, heat detectors, and gas leak sensors, serve as the frontline defense mechanism against fire-related hazards. The segment continues to benefit from regulatory mandates and growing public consciousness about early fire detection. The increasing adoption of smart detectors that can differentiate between actual fires and false alarms further bolsters growth. Additionally, these systems are increasingly networked into broader emergency communication platforms, making them indispensable in modern safety strategies.

On the other hand, the Fire Sprinkler System segment is emerging as the fastest-growing segment, driven by its adoption in both new construction and retrofitting projects. Recent developments in high-performance sprinkler heads and eco-friendly fire suppression fluids have enhanced the segment’s appeal. The U.S. residential sector, in particular, has seen a surge in demand, influenced by local building code updates that encourage or require sprinkler systems in new homes. Furthermore, innovations such as pre-action and deluge systems tailored for specific use-cases like data centers and energy facilities are pushing the envelope in this segment.

Installation and Design Services held the largest share of the service segment, given the complexity of modern fire protection systems and the demand for tailor-made solutions. These services involve architectural planning, integration with building management systems, and certification testing—making them essential for compliance and efficiency. Companies often work closely with construction and engineering firms to ensure that systems are not only effective but also minimally intrusive and scalable. Demand is particularly strong in large-scale commercial projects like shopping malls, airports, and multi-tenant office buildings where customized design plays a critical role.

Conversely, Managed Services are projected to grow at the fastest pace, as organizations look to outsource fire safety monitoring, diagnostics, and system updates. Managed service providers offer 24/7 support, predictive analytics, and real-time alerts, significantly reducing response times during emergencies. Cloud-based dashboards and mobile interfaces are also empowering facility managers with visibility and control over their fire safety protocols. This model is especially appealing to sectors such as healthcare and education, where dedicated internal safety teams may not be feasible or cost-effective.

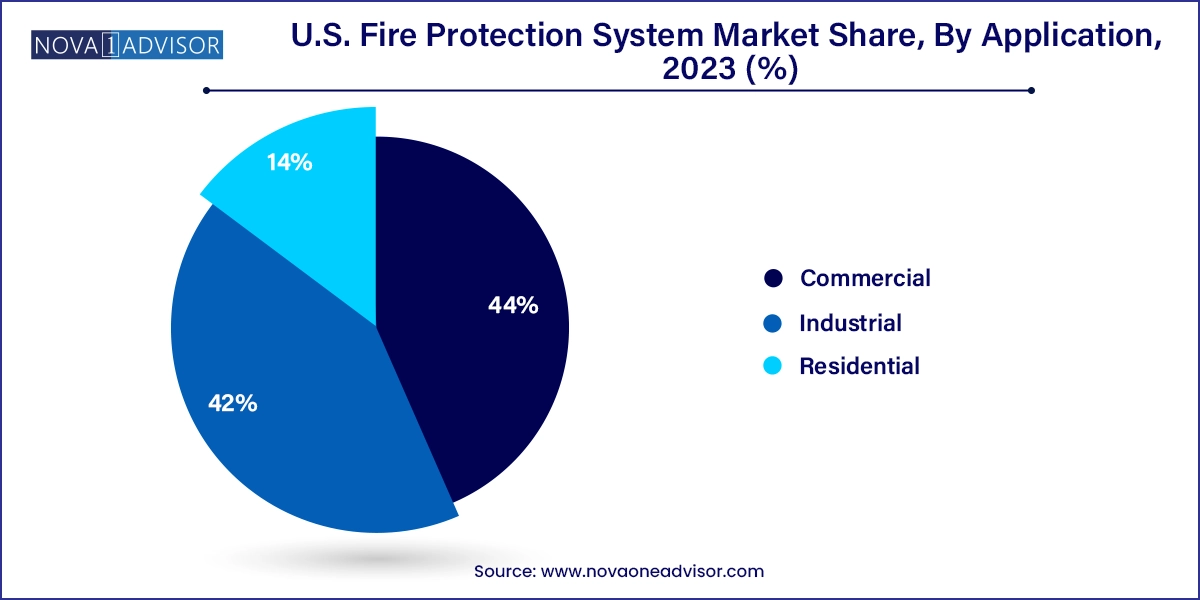

The Commercial segment is the dominant application category, encompassing offices, retail establishments, educational institutions, and hospitality venues. High footfall, valuable property, and stricter compliance regulations necessitate comprehensive fire protection coverage. These environments require sophisticated multi-layered systems that combine detection, suppression, and emergency communication. Retail chains like Walmart and office complexes like those in Manhattan often employ integrated fire protection platforms, enhancing coordination between systems and facilitating faster emergency response.

Meanwhile, the Residential segment is witnessing the fastest growth, propelled by heightened awareness, insurance incentives, and updated housing regulations. Fire incidents in densely populated residential zones have led to increased interest in smart, user-friendly solutions tailored to home settings. Innovations such as portable extinguishing systems, interconnected smoke alarms, and mobile-controlled alert systems are making fire safety more accessible for homeowners and tenants. Community-driven initiatives and state-backed subsidies for home fire safety equipment further support this surge.

The U.S. market for fire protection systems is characterized by a mix of federal regulation, regional building codes, and localized market dynamics. States such as California and New York lead in terms of both policy and market activity, driven by urban density and past fire tragedies. California, in particular, has seen extensive investment following wildfires and urban fires that highlighted vulnerabilities in both residential and commercial infrastructure.

Texas and Florida are also emerging as significant contributors, driven by large-scale industrial expansion and urban development. In states like Illinois and Massachusetts, older infrastructure is undergoing retrofitting, with fire protection upgrades often forming part of broader energy-efficiency and smart-building initiatives. Public-private collaborations, grant-funded safety upgrades in schools and hospitals, and high adoption in urban housing projects collectively sustain demand across the country.

March 2024 Honeywell announced the launch of a new AI-enabled fire safety platform designed specifically for large commercial buildings. The platform integrates video surveillance, real-time air quality data, and threat prediction capabilities to enhance response times and mitigate false alarms.

February 2024: Johnson Controls unveiled a cloud-based fire suppression management system for industrial clients in the U.S., allowing centralized control and predictive maintenance capabilities.

December 2023: Siemens USA completed the installation of its Desigo Fire Safety System in multiple Boston-based healthcare facilities, aimed at delivering faster detection and coordinated evacuation support.

October 2023: Tyco Fire Protection Products, a subsidiary of Johnson Controls, expanded its line of low-flow sprinklers for sensitive environments like data centers and museums, emphasizing water conservation and asset protection.

August 2023: United Technologies partnered with a leading U.S. construction company to integrate smart fire safety systems in newly developed residential communities in Florida.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. fire protection system market

Product

Service

Application