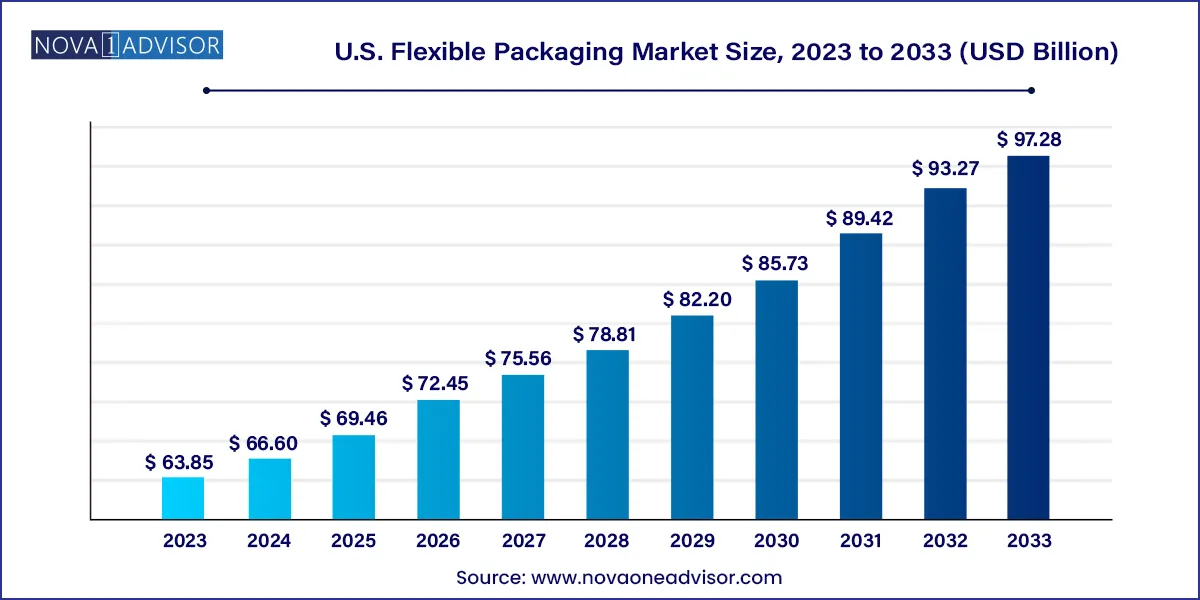

The U.S. flexible packaging market size was exhibited at USD 63.85 billion in 2023 and is projected to hit around USD 97.28 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 66.60 Billion |

| Market Size by 2033 | USD 97.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Amcor plc; Berry Global Inc.; Mondi; Sonoco Products Company; Constantia Flexibles; Sealed Air; TC Transcontinental; WINPAK LTD; Bemis Company, Inc.; Coveris Holdings S.A. |

This growth can be attributed to increasing demand for sustainable packaging solutions and rising consumer preference for lightweight, durable, and attractive packaging. Advancements in packaging technologies and the growing e-commerce sector are further driving this market growth. However, packaging industry is subject to strict regulations regarding use of certain materials and the disposal of packaging waste, which can increase production costs and limit material choices.

Regulatory agencies such as the U.S. Environmental Protection Agency, the U.S. Occupational Safety and Health Administration, the Federal Trade Commission, and the Food and Drug Administration have regulations that the flexible packaging industry players are required to follow. Compliance with these regulations is crucial for companies operating in this market and can impact market players operations.

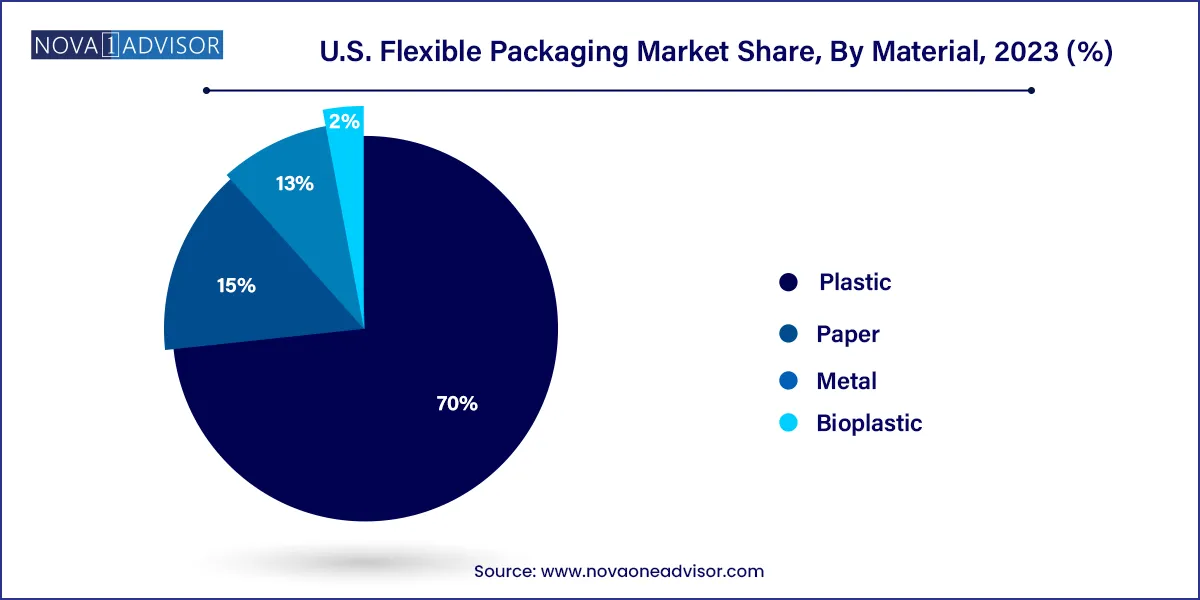

The plastics segment dominated the U.S. market in 2023 with more than 70.0% revenue share. This dominance can be attributed to the cost-effectiveness of plastics compared to glass metals and other materials as well as inherent properties such as excellent moisture and gas barrier resistance, light weight, good puncture resistance, and transparency, making them an attractive choice for manufacturers. Plastic pouches and bags are convenient for consumers due to their ease of use and re-sealable features. Plastics find application in food, beverages, pharmaceuticals, household products, and others.

The paper segment of the U.S. flexible packaging market is a significant part of the industry. Paper-based flexible packaging solutions are favored for their biodegradability and recyclability, making them an environmentally friendly option. They are commonly used in the food and beverage industry, particularly for packaging dry food items.

Bioplastics represent the fastest-growing segment in the U.S. flexible packaging market, with a projected CAGR of 5.4% from 2024 to 2033. This growth is driven by the increasing demand for sustainable and environmentally friendly packaging solutions. Bioplastics, made from renewable resources like plant starches or cellulose, offer a more eco-friendly option.

The pouches dominated the U.S. market in 2023 with more than 60.0% revenue share. This dominance can be attributed to their versatility, offering convenience with features like zippers or spouts for various products. They are widely used for packaging food products, beverages, pet food, personal care items, and even pharmaceuticals.

The bags segment is projected to have steady growth, driven by the steady growth of the healthcare, food & beverage, and personal care industries. Bags come in various styles, including flat, gusset, and re-sealable bags. Additionally, lifestyle changes and demographic factors are expected to further extend the demand for bag products.

The films and wraps segment is the fastest-growing product segment in the U.S. flexible packaging market with a CAGR of 4.9% from 2024 to 2033. These products offer several advantages, including container versatility, reduced raw material requirements, ease of disposal, and lightweight properties, all contributing to their growing popularity.

The food & beverage segment dominated the U.S. market in 2023 with more than 24.0% revenue share. This dominance is due to the wide range of applications of flexible packaging in the food industry, including frozen food, dairy products, fruits & vegetables, meat, poultry, seafood, baked goods, snack foods, and candy & confections. The choice of flexible packaging in the food business is influenced by factors beyond convenience, such as sustainability, transparency, food safety, and a reduction in food waste. Companies are increasingly focusing on flexible packaging solutions that incorporate recyclable and recycled content, driven by sustainability considerations.

The pharmaceutical segment is projected to experience the fastest growth in the U.S. flexible packaging market, with a projected CAGR of 4.9% from 2024 to 2033. The increased use of flexible packaging in medical and pharmaceutical contexts is contributing to this market growth. These products offer various advantages, such as the benefits of container flexibility, reduced material usage, easy disposal, and lightweight design play a crucial role, in boosting product demand over the forecast period.

The cosmetics segment also plays a significant role in the U.S. flexible packaging market. Lifestyle and demographic factors contribute to the demand for cosmetic products. The adoption of flexible metal packaging across various applications has led rigid metal packaging manufacturers to shift toward more flexible options. Lower energy consumption and reduced waste production further support this transition. Additionally, U.S. government initiatives aimed at reducing carbon emissions and energy use provide a positive outlook for the market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. flexible packaging market

U.S. Flexible Packaging Material

U.S. Flexible Packaging Product

U.S. Flexible Packaging Application

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. U.S. Flexible Packaging Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Sales Channel Analysis

3.3. Manufacturing/Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. PORTER’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. U.S. Flexible Packaging Market: Material Outlook Estimates & Forecasts

4.1. U.S. Flexible Packaging Market Estimates & Forecast, By Material, 2021 to 2033

4.2. Plastics

4.2.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

4.3. Paper

4.3.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

4.4. Metal

4.4.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

4.5. Bioplastics

4.5.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

Chapter 5. U.S. Flexible Packaging Market: Product Outlook Estimates & Forecasts

5.1. U.S. Flexible Packaging Market Estimates & Forecast, By Product, 2021 to 2033

5.2. Pouches

5.2.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

5.3. Films & Wraps

5.3.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

5.4. Rollstocks

5.4.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

5.5. Bags

5.5.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

5.6. Other Products

5.6.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

Chapter 6. U.S. Flexible Packaging Market: Application Outlook Estimates & Forecasts

6.1. U.S. Flexible Packaging Market Estimates & Forecast, By Application, 2021 to 2033

6.2. Food & Beverages

6.2.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

6.3. Pharmaceutical

6.3.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

6.4. Cosmetics

6.4.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

6.5. Other Applications

6.5.1. Market estimates and forecasts, 2021 - 2033 (USD Billion)

Chapter 7. U.S. Flexible Packaging Market - Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share/Position Analysis, 2024

7.4. Company Heat Map Analysis

7.5. Kraljic Matrix

7.6. Strategy Mapping

7.7. Company Profiles/Listings

7.7.1. Amcor PLC

7.7.1.1. Participant’s overview

7.7.1.2. Financial performance

7.7.1.3. Product benchmarking

7.7.2. Mondi

7.7.2.1. Participant’s overview

7.7.2.2. Financial performance

7.7.2.3. Product benchmarking

7.7.3. Berry Global Inc.

7.7.3.1. Participant’s overview

7.7.3.2. Financial performance

7.7.3.3. Product benchmarking

7.7.4. Sonoco

7.7.4.1. Participant’s overview

7.7.4.2. Financial performance

7.7.4.3. Product benchmarking

7.7.5. Constantia Flexibles

7.7.5.1. Participant’s overview

7.7.5.2. Financial performance

7.7.5.3. Product benchmarking

7.7.6. Sealed Air Corporation

7.7.6.1. Participant’s overview

7.7.6.2. Financial performance

7.7.6.3. Product benchmarking

7.7.7. TC Transcontinental

7.7.7.1. Participant’s overview

7.7.7.2. Financial performance

7.7.7.3. Product benchmarking

7.7.8. Winpak Limited

7.7.8.1. Participant’s overview

7.7.8.2. Financial performance

7.7.8.3. Product benchmarking

7.7.9. Bemis Company, Inc.

7.7.9.1. Participant’s overview

7.7.9.2. Financial performance

7.7.9.3. Product benchmarking

7.7.10. Coveris Holdings S.A.

7.7.10.1. Participant’s overview

7.7.10.2. Financial performance

7.7.10.3. Product benchmarking