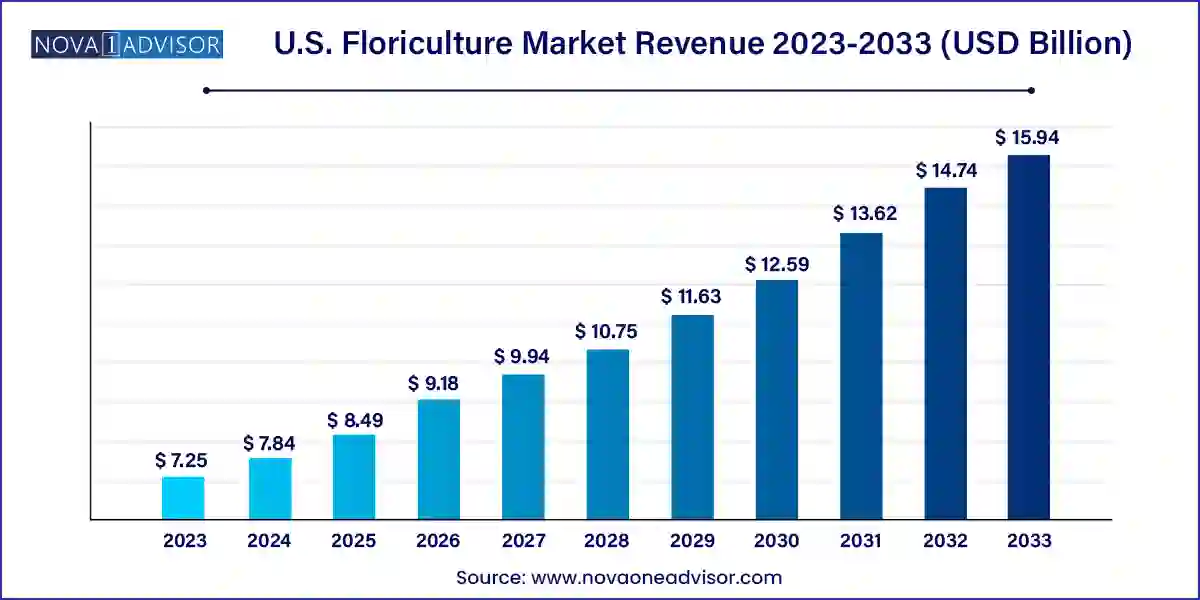

The U.S. floriculture market size was exhibited at USD 7.25 billion in 2023 and is projected to hit around USD 15.94 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

The U.S. floriculture market stands as one of the most dynamic and evolving sectors within the broader agriculture and horticulture industry. With an increasing consumer inclination towards ornamental horticulture, floriculture in the United States has evolved from being a niche agricultural practice to a robust commercial segment contributing significantly to both rural and urban economies. Floriculture involves the cultivation of flowering and ornamental plants for direct sale or for use as raw materials in cosmetic, pharmaceutical, and decorative applications. Products within this domain include cut flowers, bedding and garden plants, foliage plants, potted plants, and propagative materials.

The market’s growth is influenced by a combination of cultural, economic, and environmental factors. An increasing number of consumers are turning to floral products not only for decoration but also for wellness and gifting purposes. The rise of lifestyle-oriented purchasing, coupled with social media influences, has further fueled demand for aesthetically appealing flower arrangements and green decor in residential, corporate, and public spaces. Events, weddings, corporate gatherings, and national holidays have traditionally sustained market demand, but the recent boom in eco-conscious living and indoor gardening has catalyzed new avenues of growth.

Additionally, innovations in packaging, supply chain logistics, and cultivation technologies—such as hydroponics and greenhouse farming—are enabling growers to produce flowers year-round and minimize wastage. Market players are also leveraging e-commerce to reach wider customer bases, marking a significant shift from conventional retail florists to omnichannel platforms.

Eco-conscious floral consumption: Increased demand for organically grown, pesticide-free flowers and foliage plants due to rising environmental awareness.

Online floral retailing boom: Growth in online platforms and mobile applications has made flower gifting and delivery services more accessible and efficient.

Personalization and DIY floral arrangements: Consumers are increasingly interested in customized flower designs and kits for at-home floral crafting.

Wider adoption of sustainable packaging: Market players are adopting biodegradable wraps, recycled vases, and reusable containers to reduce environmental footprint.

Rise in flower subscription services: Monthly or weekly flower delivery subscriptions are gaining popularity among millennials and working professionals.

Integration of technology in floriculture: Use of IoT, AI, and automated irrigation systems in greenhouses to enhance yield and quality.

Florals in wellness and therapy: Growing recognition of flowers and green plants in mental health therapy and wellness spaces.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.84 Billion |

| Market Size by 2033 | USD 15.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Kurt Weiss Greenhouses, Inc.; Costa Farms; The Queen’s Flowers; Green Circle Growers; Greenheart Farms; MONROVIA NURSERY COMPANY; Larksilk; Sun Valley Floral Farms; TERRA NOVA Nurseries, Inc.; Benary |

One of the most prominent drivers of the U.S. floriculture market is the burgeoning consumer demand for enhanced aesthetic and green living environments. In both residential and commercial sectors, flowers and ornamental plants are being used extensively to beautify spaces and create calming ambiances. Homeowners, interior designers, and property managers increasingly view floriculture products as essential components of modern decor.

The COVID-19 pandemic amplified this trend, as people spent more time indoors and turned to houseplants and floral decor to elevate their home environments. Indoor gardening became a stress-relief activity, and consumers began investing in flowers and potted plants as an affordable luxury. Similarly, offices and co-working spaces are integrating green installations and floral displays to improve employee wellbeing and productivity. This aesthetic appeal, combined with the psychological and air-purifying benefits of floriculture products, is sustaining a steady demand across both B2C and B2B segments.

Despite its growth trajectory, the U.S. floriculture market is hindered by vulnerabilities in its supply chain, especially for cut flowers. Many flowers sold in the U.S. are imported, particularly from countries like Colombia and Ecuador. These imports are susceptible to disruptions caused by geopolitical tensions, trade regulations, or environmental conditions in exporting countries. Additionally, fresh flowers are highly perishable and require stringent cold chain logistics to maintain quality and shelf life.

Logistical challenges such as limited air freight capacity, customs delays, and rising fuel costs can severely impact delivery timelines and profitability. During peak seasons such as Valentine’s Day and Mother’s Day, supply bottlenecks often lead to product shortages or inflated prices. Furthermore, domestic growers face challenges such as labor shortages and climate variability, affecting year-round production consistency. These factors collectively pose a constraint to seamless growth in the industry.

The integration of advanced technologies in greenhouse cultivation offers substantial growth opportunities for domestic floriculture producers. Greenhouse farming allows controlled environmental conditions, which can mitigate external factors such as drought, frost, or pests. With the use of hydroponics, LED grow lights, and automated irrigation systems, growers can extend flowering seasons and improve yield quality.

Smart greenhouses equipped with IoT devices provide real-time data on soil health, humidity, and temperature, enabling precision farming. This not only improves efficiency but also reduces wastage and operational costs. Startups and established players alike are investing in these smart cultivation solutions to enhance sustainability and profitability. In an era where climate change increasingly affects outdoor farming, technology-enabled greenhouse cultivation stands out as a game-changing opportunity for floriculture expansion within the U.S.

Cut flowers dominated the U.S. floriculture market in terms of revenue contribution. Within this segment, roses remain the most in-demand product, owing to their widespread use in gifting and celebrations. Roses enjoy perennial popularity across demographics and are symbolic of love and appreciation, especially during festive seasons like Valentine’s Day. Moreover, tulips and lilies are seeing increasing traction in corporate gifting and event decorations due to their sophisticated appeal. High-profile events, including celebrity weddings and luxury fashion shows, often spotlight these flowers, adding to their aspirational value.

On the other hand, the fastest growing product category is propagative floriculture materials, which include seeds, bulbs, cuttings, and plantlets used for propagation. The growth in this segment is fueled by a surge in DIY gardening and floriculture among consumers who prefer growing their own plants and flowers. This trend is further supported by educational content on platforms like YouTube and Pinterest that offer tutorials on home-based flower propagation. Propagative materials offer higher margins for growers and retailers, making it a lucrative area of expansion. In addition, bedding and garden plants are increasingly popular in urban landscaping and suburban home renovations, making them another promising category.

The Offline channels currently dominate the floriculture distribution landscape in the U.S., encompassing florists, supermarkets, garden centers, and nurseries. These outlets provide a tactile shopping experience where customers can handpick flowers, seek expert advice, and receive instant gratification. Florists, especially, offer personalized services and have cultivated trust within local communities. Garden centers affiliated with home improvement stores like Home Depot and Lowe’s also witness high foot traffic during spring and summer planting seasons.

However, online distribution is witnessing the fastest growth and is reshaping the industry. E-commerce platforms, floral subscription services, and mobile apps are transforming how consumers shop for flowers. Companies like UrbanStems, The Bouqs Co., and 1-800-Flowers have leveraged digital platforms to provide same-day or next-day deliveries with tracking capabilities. Online platforms also offer customization options, reminders for special occasions, and bulk orders, making them highly convenient. The COVID-19 pandemic acted as a catalyst for this shift as consumers turned to digital shopping for safety and convenience, and the habit has persisted even in the post-pandemic environment.

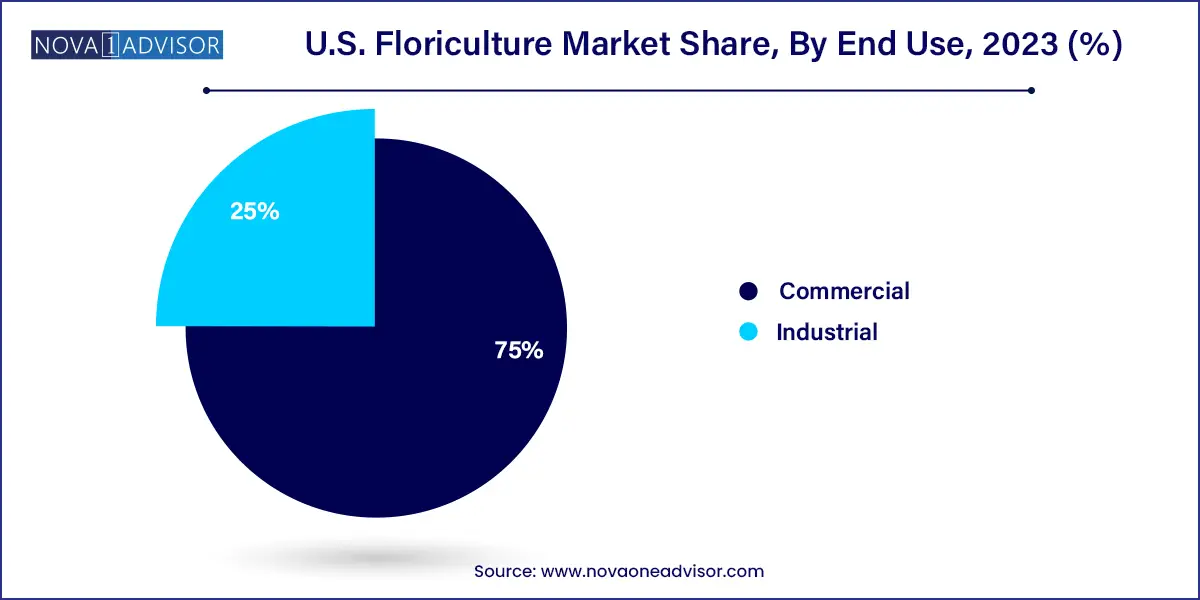

The commercial sector holds the largest share in the end-use category. This includes hotels, event planners, interior designers, corporate offices, and hospitality venues that utilize flowers for aesthetic enhancement and guest experiences. Flowers are used extensively for hotel lobbies, conference decor, weddings, exhibitions, and public ceremonies. Companies often subscribe to weekly or monthly floral services for boardrooms and client-facing areas, reinforcing a premium brand image. Event management firms, in particular, account for bulk procurement, especially for themed parties, destination weddings, and seasonal installations.

Conversely, the industrial sector is witnessing rapid growth, particularly in cosmetics and pharmaceutical industries that use floral extracts. Ingredients from florals like lavender, rose, and calendula are being incorporated into essential oils, perfumes, skincare products, and wellness formulations. With the clean beauty trend gaining momentum, cosmetic companies are sourcing organic floriculture products for new launches. Moreover, scientific research is increasingly highlighting the therapeutic benefits of floral extracts, spurring innovation in aromatherapy and herbal medicine. This opens up long-term opportunities for floriculture beyond the conventional decorative uses.

The U.S. floriculture market is geographically diversified, with certain states emerging as leaders in production and consumption. California dominates the production landscape, contributing nearly three-fourths of all cut flowers grown domestically. The state's mild Mediterranean climate and extensive greenhouse infrastructure make it ideal for year-round cultivation. Cities like Los Angeles and San Francisco also serve as key consumption hubs, given their high-income urban populations and thriving event industries.

Florida follows as another major contributor, particularly for foliage plants and tropical flowers. The state’s tourist-driven economy fuels demand in the hospitality and events sector. In the Midwest, states like Michigan and Ohio are seeing growing consumer interest in bedding and garden plants, fueled by suburban expansion and home improvement trends. The Northeastern U.S., especially New York and Massachusetts, demonstrates high consumption of premium floral products through online and boutique channels. These state-level dynamics reflect a broad yet nuanced growth potential across the country.

April 2025: The Bouqs Co. announced a new eco-conscious floral collection aimed at Gen Z consumers, featuring sustainably sourced flowers and compostable packaging.

February 2025: UrbanStems expanded its AI-driven delivery forecasting system to improve same-day delivery success in major metros including New York and Chicago.

November 2024: 1-800-Flowers.com launched an experiential retail store in Austin, Texas, integrating floral workshops and smart vending kiosks.

September 2024: BloomNation, a florist empowerment platform, partnered with Shopify to launch a plug-and-play solution for local florists looking to go online.

July 2024: Ball Horticultural Company introduced a new line of disease-resistant potted plants suitable for indoor environments, aimed at millennial consumers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. floriculture market

Product

Distribution Channel

End Use