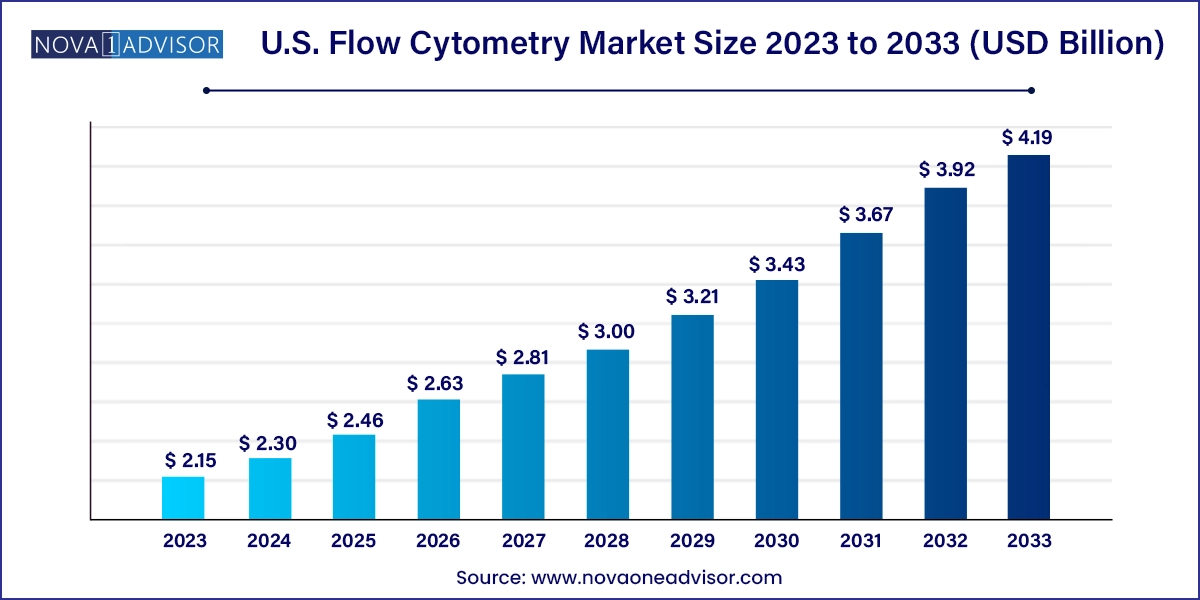

The U.S. flow cytometry market size was exhibited at USD 2.15 billion in 2023 and is projected to hit around USD 4.19 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The U.S. flow cytometry market represents a dynamic and rapidly advancing segment of the biomedical diagnostics and research industry. Flow cytometry, a laser-based technology for measuring and analyzing the physical and chemical properties of cells or particles in a fluid as they pass through a detection apparatus, has become an essential tool in clinical diagnostics, pharmaceutical R&D, immunology, hematology, and cell-based therapies.

The market has expanded significantly in recent years, supported by the surge in oncology and immunology research, the emergence of personalized and precision medicine, and the increasing demand for high-throughput diagnostics. The U.S., being at the forefront of biomedical innovation and home to major pharmaceutical and biotech players, accounts for a large share of the global flow cytometry market. From detecting rare cell populations and immune responses to monitoring stem cell therapies and vaccine development, flow cytometry is integral across academic, clinical, and commercial settings.

Technological advancements have also transformed the landscape. Traditional bulky flow cytometers have evolved into compact, high-throughput instruments with multi-parameter capabilities, automated sample preparation, and AI-powered analysis software. Applications are no longer limited to specialized labs clinical testing laboratories, hospitals, and CROs now utilize flow cytometry for rapid and sensitive diagnostics, especially in areas like hematological malignancies, HIV monitoring, and organ transplant compatibility testing.

Miniaturization and Benchtop Flow Cytometers: Compact, cost-effective systems are expanding usage in smaller labs and point-of-care environments.

AI and Machine Learning in Flow Cytometry Analysis: Integration of intelligent algorithms for automated gating, anomaly detection, and phenotyping is streamlining data interpretation.

Increased Use of Flow Cytometry in Immunotherapy: CAR-T cell therapy and immune checkpoint research heavily rely on flow cytometric techniques for efficacy and safety profiling.

Multiparameter and Spectral Flow Cytometry: Enhanced cytometers capable of analyzing 20+ parameters simultaneously are enabling deeper immune profiling.

Growth in Clinical Diagnostics Applications: Flow cytometry is becoming a routine tool in clinical laboratories for leukemia, lymphoma, and CD4/CD8 monitoring.

Rise of Reagent Subscription Models: Vendors are offering bundled reagents and service contracts for consistent revenue and improved user convenience.

Adoption of Flow Cytometry in Vaccine Development: High-content cell-based assays are aiding immunogenicity studies and post-vaccine efficacy tracking.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.30 Billion |

| Market Size by 2033 | USD 4.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Sysmex Corp; Becton, Dickinson, and Company (B.D.); Danaher Corp; Thermo Fisher Scientific,,Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Sony Biotechnology, Inc.; Beckman Coulter, Inc.; Cytek Biosciences; BioLegend, Inc.; Enzo Biochem Inc.; Cell Signaling Technology, Inc.; NeoGenomics Laboratories; Q2 Solutions (IQVIA); Elabscience Biotechnology Inc.; Stratedigm, Inc.; BioLegend, Inc.; Union Biometrica, Inc.; BennuBio Inc.; ORLFO Technologies |

A key driver fueling the U.S. flow cytometry market is the rising need for cell-level diagnostics and the development of personalized treatment protocols, especially in oncology and immunology. Flow cytometry enables the analysis of cell surface markers, intracellular cytokines, DNA content, and cell cycle progression with unmatched sensitivity and speed.

This is particularly important for cancer diagnostics, where distinguishing between different leukemia or lymphoma subtypes using immunophenotyping is crucial for treatment selection. Similarly, in organ transplantation and autoimmune disorders, flow cytometry helps in HLA compatibility testing and immune response monitoring. The technology's capacity to deliver rapid, actionable insights from limited biological material aligns with the growing push toward precision medicine, where treatments are tailored based on a patient’s cellular profile.

Despite its capabilities, a significant barrier to widespread adoption of flow cytometry lies in its high acquisition and operational costs. Advanced instruments with multi-color detection, cell sorting capabilities, and high-throughput performance can exceed hundreds of thousands of dollars, not including the cost of reagents, calibration kits, maintenance, and software licenses.

Additionally, flow cytometry demands specialized technical expertise, both for operating the instruments and interpreting complex, multi-dimensional data. Smaller hospitals and clinics may find it financially and logistically unfeasible to deploy in-house systems, limiting adoption to larger diagnostic labs or research facilities. While newer benchtop cytometers offer lower-cost entry points, the expense associated with high-end applications continues to challenge market growth in more decentralized care environments.

One of the most lucrative opportunities in the U.S. flow cytometry market is its expanding role in immunotherapy and cell/gene therapy development. The FDA’s growing list of approved CAR-T cell therapies, along with pipeline products in oncology, autoimmune diseases, and rare genetic disorders, has significantly increased the demand for immune profiling and cell viability testing.

Flow cytometry is indispensable for characterizing engineered T cells, monitoring in vivo expansion, evaluating target engagement, and assessing cytokine release syndrome risk. Moreover, stem cell sorting and viability testing are critical for ensuring the safety and consistency of cell-based products. As personalized biologics become more common in both clinical trials and FDA-approved therapies, flow cytometry stands to become a standard quality control and biomarker discovery platform, particularly in the hands of biotech startups, CDMOs, and large pharma companies.

Instruments dominated the U.S. flow cytometry market, with cell analyzers and sorters forming the backbone of both research and clinical laboratories. Cell analyzers are extensively used for multiparametric analysis of cell populations, including immune cell profiling, apoptosis, and viability assessment. Cell sorters, while more specialized, are vital in stem cell research, gene editing workflows, and rare cell isolation applications.

However, reagents and consumables are the fastest-growing segment, offering recurring revenue streams and supporting a wide range of tests. This category includes fluorescent-labeled antibodies, viability dyes, buffer solutions, and bead standards. The increasing complexity of multiparameter panels and demand for highly specific markers has led to a rise in custom conjugates and high-performance dyes, further driving this segment. Subscription models and pre-optimized kits are making reagent selection more user-friendly, especially for emerging users.

Cell-based flow cytometry held the majority share, as it remains the preferred method for analyzing physical and biochemical characteristics of live or fixed cells, especially in clinical diagnostics and immunology. It allows for multiparameter analysis at the single-cell level, critical for understanding heterogeneous cell populations in cancer and immune responses.

Bead-based flow cytometry is expanding rapidly, especially in multiplex immunoassays and cytokine profiling. Bead-based platforms use microspheres tagged with fluorescent markers to simultaneously detect multiple analytes from a single sample. These assays are increasingly used in biopharma for biomarker validation, pharmacokinetic studies, and preclinical screening, due to their high throughput and reproducibility.

Clinical applications dominated the market, particularly in cancer diagnostics, immunodeficiency testing, and organ transplantation compatibility. Flow cytometry is routinely used to monitor CD4 counts in HIV patients, identify leukemia subtypes, and quantify immune recovery after chemotherapy. Clinical labs and hospitals increasingly rely on FDA-cleared systems to deliver accurate and fast results for hematological assessments.

Among all subcategories, pharmaceutical research, especially in drug discovery and stem cell monitoring, is the fastest-growing application. Drug developers use flow cytometry in compound screening, mode-of-action studies, and safety assessments. In stem cell applications, flow cytometry supports identity, purity, and viability testing, critical for IND submissions and batch release. As cell and gene therapy trials increase, so does the demand for flow cytometry in clinical development and biomarker studies.

Pharmaceutical and biotechnology companies led the end-use segment, driven by the need for high-throughput screening, immunoassays, and in vitro toxicity testing. These companies deploy advanced flow cytometers to support research, preclinical development, and quality control. Investment in new biologics and personalized therapeutics further supports market growth in this space.

Clinical testing laboratories are the fastest-growing end-users, especially as hospitals outsource complex assays or expand in-house molecular diagnostics. Reference labs and specialty diagnostic companies are adopting automated flow cytometry systems to support volume-driven testing for hematology, oncology, and infectious diseases, aided by centralized data management and AI integration.

In the U.S., flow cytometry adoption varies by geography based on academic research density, biopharma clustering, and healthcare infrastructure.

The Northeast region dominates the market, owing to the presence of top academic institutions (Harvard, MIT, Yale), major cancer centers (Memorial Sloan Kettering, Dana-Farber), and a high concentration of biotech and pharmaceutical companies. These organizations lead cutting-edge cancer immunology, cell biology, and clinical translational research where flow cytometry is essential.

The Southwest, particularly Texas and Arizona, is the fastest-growing region. Factors include the rapid expansion of biotech clusters, investments in clinical trial networks, and healthcare systems prioritizing precision diagnostics. Texas Medical Center, for instance, is among the largest in the world, with heavy usage of flow cytometry in both patient care and clinical trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. flow cytometry market

Product

Technology

Application

End-use

Regional