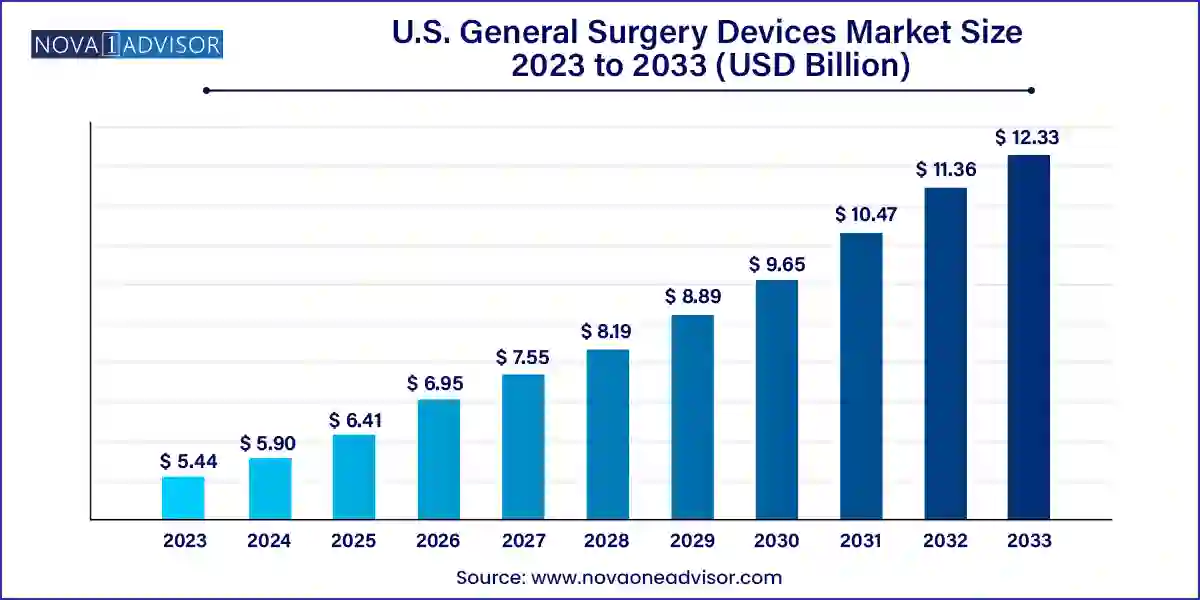

The U.S. general surgery devices market size was exhibited at USD 5.44 billion in 2023 and is projected to hit around USD 12.33 billion by 2033, growing at a CAGR of 8.53% during the forecast period 2024 to 2033.

The U.S. General Surgery Devices Market is a critical pillar within the broader healthcare infrastructure, encompassing a diverse array of instruments and technologies used across a wide range of surgical procedures. These devices facilitate open and minimally invasive surgeries and include everything from simple disposable items like gloves and syringes to advanced powered instruments, laparoscopic devices, and surgical robots.

Driven by rising surgical volumes, the growing aging population, advancements in technology, and evolving healthcare delivery models, the market has witnessed robust growth in recent years. Elective and emergency surgeries in domains such as orthopedics, cardiology, gynecology, urology, and neurology rely heavily on precise, safe, and technologically advanced surgical tools.

The U.S. is uniquely positioned as the world’s largest healthcare market, and it benefits from a high adoption rate of innovative surgical technologies. The increasing prevalence of chronic diseases, the shift toward outpatient procedures, and rising healthcare spending have fueled demand for general surgical devices. Additionally, value-based care models and the move toward minimally invasive procedures are transforming surgical practice and equipment preferences.

With ongoing innovation, particularly in robotic-assisted surgery and laparoscopic tools, manufacturers are focusing on improving ergonomics, precision, recovery time, and surgical outcomes. As healthcare providers face pressure to reduce hospital stays and minimize post-surgical complications, the demand for reliable, efficient, and cost-effective surgical solutions continues to expand.

Rising Preference for Minimally Invasive Surgery (MIS): Surgeons and patients increasingly favor MIS for its benefits in reducing recovery time, pain, and hospital stays.

Robotics and AI Integration: Robotic-assisted surgical systems with AI-enabled navigation and decision support are reshaping complex procedures.

Surge in Disposable Surgical Supplies: The emphasis on infection control and cost-effectiveness is boosting demand for single-use items like masks, gloves, gowns, and kits.

Smart Surgical Instruments: Devices embedded with sensors and real-time feedback systems are enhancing precision and reducing risk.

Growth in Ambulatory Surgical Centers (ASCs): ASCs are rising in popularity due to convenience, cost-effectiveness, and lower infection rates.

Focus on Adhesion Prevention: Products aimed at minimizing postoperative adhesions are gaining traction, especially in abdominal and gynecologic surgery.

Tele-surgery and Remote Surgical Monitoring: Innovations in connected devices and robotic platforms are paving the way for future tele-surgery models.

Customized Procedural Kits: Increasing demand for pre-assembled, surgery-specific kits that enhance workflow and reduce surgical prep time.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.90 Billion |

| Market Size by 2033 | USD 12.33 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.53% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Johnson & Johnson Service, Inc.; Conmed Corporation; Integra LifeSciences; Becton, Dickinson, and Company (Bd); Cadence Inc; Integer Holdings Corporation; Stryker; Boston Scientific Corporation; 3M Healthcare; Biomez, Inc., Orthofix Holdings Inc |

A primary driver of the U.S. general surgery devices market is the steady rise in surgical procedure volumes, fueled by demographic and disease-related trends. With the aging of the baby boomer population, there is a notable increase in conditions requiring surgical intervention, such as orthopedic degeneration, cardiovascular issues, and cancers. According to the American College of Surgeons, millions of procedures are conducted annually in the U.S., and the demand is projected to grow further in the coming decade.

Technological advancements have also broadened the scope of treatable conditions through surgery, further expanding procedural volumes. Innovations in laparoscopic and robotic surgery have made procedures less invasive and safer, which has lowered the threshold for surgical intervention and accelerated patient recovery. The proliferation of outpatient and same-day surgeries has also contributed to the rising utilization of surgical devices.

Despite positive growth, one of the key restraints in the market is the high cost associated with technologically advanced surgical systems, particularly robotic and computer-assisted devices. While these systems offer improved outcomes, better ergonomics, and shorter recovery times, the initial investment, maintenance, and training costs are substantial.

For example, robotic systems such as the da Vinci Surgical System can cost upwards of $2 million per unit, with additional expenses for instrument sets and servicing. Smaller hospitals and outpatient facilities may find it difficult to justify or absorb such costs, especially under constrained reimbursement environments. Moreover, some insurers may not provide additional compensation for surgeries performed with advanced technologies, dampening adoption in cost-sensitive institutions.

An emerging opportunity in the U.S. general surgery devices market is the expansion of ambulatory surgical centers (ASCs). These outpatient facilities offer a cost-effective alternative to traditional hospital-based surgery by reducing overheads, shortening procedural times, and improving operational efficiency. ASCs are increasingly performing a wide variety of general surgical procedures, including orthopedic, urologic, gynecologic, and cosmetic surgeries.

The shift toward ASCs is supported by favorable insurance reimbursements, patient preference for outpatient care, and reduced risk of nosocomial infections. For device manufacturers, this transition represents an opportunity to develop compact, mobile, and cost-efficient surgical tools tailored to the workflow of ASCs. Products like disposable procedural kits, portable energy-based devices, and space-efficient robotic systems will see increasing demand as outpatient surgeries continue to rise.

Disposable surgical supplies dominated the U.S. general surgery devices market due to their widespread use across virtually every surgical setting. This category includes items such as surgical gloves, masks, gowns, drapes, catheters, syringes, and procedural kits. These products are essential for maintaining aseptic conditions and reducing infection risks during surgeries. Their cost-effectiveness, regulatory compliance, and compatibility with infection control protocols have ensured high usage rates.

Among disposable items, examination and surgical gloves and needles and syringes account for the largest volumes, driven by both routine procedures and high-volume specialty surgeries. Additionally, disposable surgical masks and gowns saw a significant surge in demand post-COVID-19, as health systems increased inventory levels to safeguard frontline staff. The rapid turnover of disposable items, combined with their recurring use, makes this segment a steady revenue generator for manufacturers.

On the other hand, minimally invasive surgery (MIS) instruments are the fastest-growing type. Tools like laparoscopes, trocars, and organ retractors have seen increasing adoption due to the benefits of laparoscopic and endoscopic techniques in general and specialty surgeries. Innovations such as articulating laparoscopes, high-definition visualization, and integrated energy systems are enhancing MIS capabilities. The rise in bariatric, colorectal, and gynecologic surgeries using MIS platforms is accelerating demand for these instruments in both hospital and outpatient settings.

Orthopedic surgery emerged as the leading application segment within the U.S. general surgery devices market. With an aging population and rising prevalence of musculoskeletal conditions such as osteoarthritis, fractures, and sports injuries, orthopedic surgical procedures—like joint replacements and spinal surgeries—have surged in frequency. These procedures require a wide array of instruments, from bone drills and retractors to powered saws and fixation tools.

The robust demand for hip and knee replacements, particularly among the elderly, has driven the need for reliable and high-performance surgical devices. Furthermore, the increased adoption of minimally invasive orthopedic approaches and robotic-assisted systems is reshaping the surgical landscape in this field. Technologies that reduce soft tissue damage and enhance postoperative outcomes are favored by surgeons and patients alike.

Urology and gynecology surgery is the fastest-growing segment, thanks to the expanding use of laparoscopic and robotic techniques in hysterectomies, prostatectomies, and incontinence procedures. The aging demographic, rising incidence of urologic cancers, and patient preference for less invasive approaches have propelled growth. Device makers are introducing integrated surgical platforms specifically optimized for pelvic and abdominal access, and this trend is expected to continue as personalized surgery becomes mainstream.

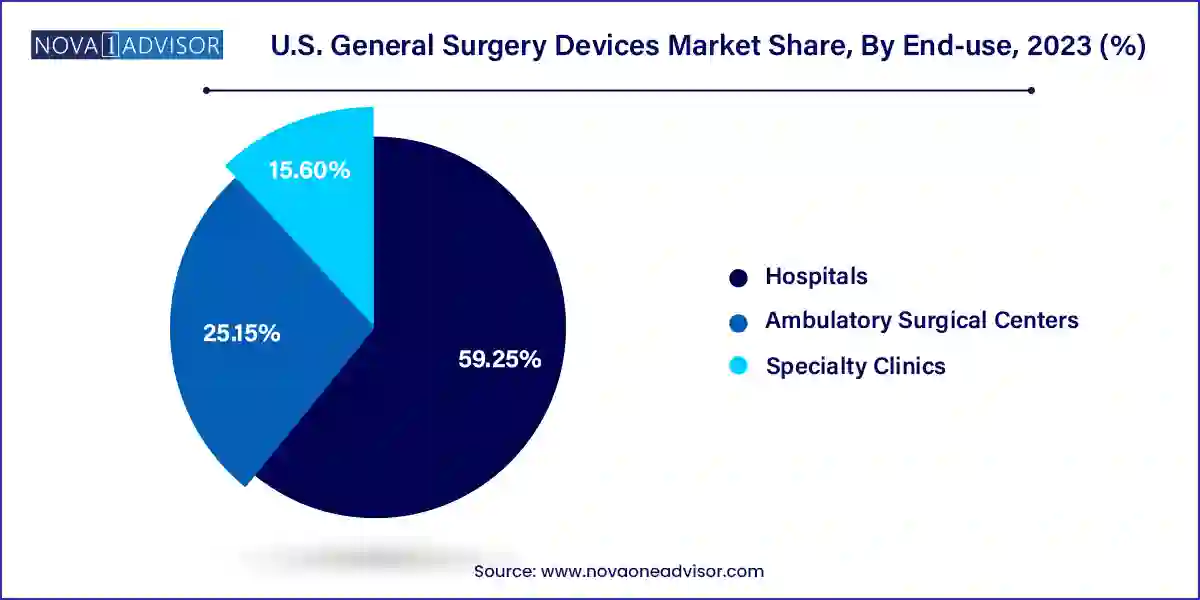

Hospitals continue to dominate the U.S. general surgery devices market, given their extensive procedural volume, access to capital for advanced equipment, and ability to perform complex surgeries. Tertiary care centers, trauma centers, and academic hospitals often serve as centers of excellence for various surgical specialties. These facilities typically invest in cutting-edge tools, robotic systems, and training platforms to maintain surgical outcomes and accreditation standards.

Hospitals also benefit from having dedicated surgical suites, multidisciplinary teams, and 24/7 emergency services, enabling them to cater to both planned and urgent surgical needs. As hospitals increasingly integrate digital operating rooms and hybrid surgical platforms, the demand for interoperable and upgradable surgical devices is on the rise.

Meanwhile, ambulatory surgical centers (ASCs) are the fastest-growing end-use segment, reflecting broader healthcare shifts toward cost efficiency, convenience, and improved patient experience. ASCs increasingly conduct a wide range of surgeries—including cataract, hernia, orthopedic, and cosmetic surgeries with shorter stays and fewer complications. This growth is prompting manufacturers to design device solutions that are portable, scalable, and compatible with outpatient care models.

The United States remains the largest and most technologically advanced market for general surgery devices globally. Key drivers of growth include an expansive hospital network, large insured patient population, high healthcare spending, and a culture of surgical innovation. The country’s regulatory rigor under the FDA ensures high device quality and patient safety, while public-private collaboration fuels R&D across academic institutions and medical device firms.

Major metropolitan hubs such as New York, Los Angeles, Chicago, and Boston are leading regions in surgical device usage due to the concentration of specialty hospitals, academic medical centers, and surgical innovation programs. The U.S. is also a key destination for clinical trials and device testing, providing manufacturers with opportunities to validate and launch next-generation solutions.

The rise of value-based healthcare, bundled payments, and increasing competition from ASCs and specialty clinics is reshaping procurement patterns. Healthcare providers are prioritizing cost-effective, multifunctional, and outcome-driven devices. Additionally, the push toward surgical robotics, tele-surgical systems, and AI-enhanced platforms is expected to transform surgical practice and procurement decisions across U.S. institutions over the next decade.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. general surgery devices market

Type

Application

End Use