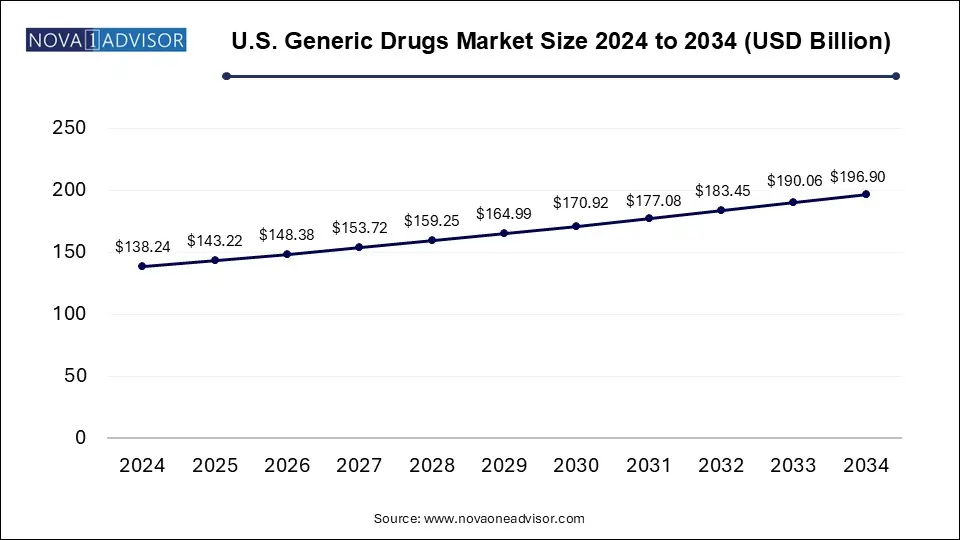

The U.S. generic drugs market size was estimated at USD 138.24 billion in 2024 and is projected to hit around USD 196.90 billion by 2034, expanding at a CAGR of 3.6% during the forecast period from 2025 to 2034. The rising prevalence of chronic diseases and increasing government funding in research and development activities in the generic drugs sector are expected to boost the expansion of the market in the coming years.

Generic drugs are non-patented medications that are bioequivalent to the original drug in terms of dosage, potency, quality, form, efficacy, intended use, side effects, and route of administration. In the United States, there has been a considerable increase in the production of generic drugs, which are less expensive than the original drugs and do not require lengthy research or testing. Furthermore, the introduction of generic drugs has increased patient access while saving taxpayers, employers, and insurers money, thus preserving the nation's healthcare system.

The United States is home to several top pharmaceutical firms. Factors such as the increasing popularity of pure generic drugs, the growing presence of key market players, the rising aging population, rising integration of Artificial Intelligence (AI), significantly fuel the U.S. generic drugs market during the forecast period.

In the United States, generic drug approvals are increasing due to the implementation of the FDA's Drug Competition Action Plan, which aims to remove the barriers faced by generic drug manufacturers. To improve the development and approval process for generic drugs, the U.S. Food and Drug Administration (USFDA) reapproved the Generic License Fee Amendment in 2017, providing the FDA with additional resources for the review of generic drugs.

Generic medicines are considered the backbone of the U.S. prescription drug market, supplying more than 9 out of every 10 prescriptions.

| Report Coverage | Details |

| Market Size in 2025 | USD 143.22 Billion |

| Market Size by 2034 | USD 196.90 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 3.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | By Drug Type, By Brand, By Route of Administration, By Therapeutic Application, By Distribution Channels |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Pfizer Inc, Teva pharmaceuticals USA, Inc, Aurobindo pharma USA, Inc, Sun pharma Inc, Abbott Laboratories Inc, Lupin pharmaceuticals, Inc, Mylan, Dr. Reddy’s, Novartis, Eli Lilly company and Others. |

Opportunity:

Increasing prevalence of various life-threatening diseases is providing the future opportunity to drive the market

The rising prevalence of various life-threatening diseases is projected to offer lucrative growth opportunities to the U.S. generic drugs market during the forecast period. The market is growing rapidly due to the rising prevalence of chronic diseases in the region including cardiovascular disease, diabetes, Alzheimer's disease, autoimmune diseases, multiple sclerosis, Parkinson's disease, and cancer. The U.S. Food and Drug Administration plays a crucial role in the generic drugs market. The FDA Generic Drug Program conducts thorough preapproval evaluations to verify that generic medications fulfill these standards. In addition, the FDA inspects manufacturing facilities to ensure they follow agency requirements on good manufacturing practices.

Restraint:

FDA regulations limit the expansion of the generic drug market

The FDA's stringent approval and distribution process restricts the expansion of the generic drug industry, The FDA works on adverse event data, the safety and efficacy of drugs, and ingredients on generic medications, failing to follow the requirements can delay the approval of the generic drug. It hindered the growth during the forecast period. It may restrict the expansion of the global U.S. generic drugs market.

Based on brand pure generic drugs are pure generic drugs than branded generic, they require less amount of time in research and development and require fewer clinical trials for approvals as compared to branded generic.

The pure generic drugs segment accounted for more than 53.25% in 2024, it required more money for its research and development process and it required many animal and human trials for its approval, it required more amount of time for its approval from the FDA.

For generic medicines and vaccines, according to current estimates, oral formulations make up around 90% of the global market for all pharmaceutical formulations designed for human consumption. Approximately 84 percent of the top-selling medications are drugs taken orally. The World Health Organization estimates that each year there are between 2 and 3 million instances of non-melanoma skin cancer and 132,000 cases of melanoma skin cancer. Since topical drug administration is the primary method of therapy for the majority of skin conditions, the market for advanced topical products is projected to grow in the upcoming years.

The diabetes segment accounted for the highest market share in the U.S. generic drug market owing to the increasing prevalence of diabetes around the world. For instance, as per the Centers for Disease Control and Prevention report for 2022, 38.4 million people, or 11.6 percent of the United States population, have diabetes. Diabetes treatment necessitates the increasing use of generic drugs. Generic drugs can significantly reduce the financial burden on low- and middle-income groups.

n the other hand, the cardiovascular diseases segment is expected to witness remarkable growth during the forecast period owing to the rising incidence of cardiovascular diseases. For instance, according to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with 1 person dying every 33 seconds from cardiovascular disease. Nearly 695,000 people in the United States died from heart disease in 2021, that's 1 in every 5 deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year. The generic drugs assist heart patients with living longer and saving money.

Generic drugs are sold in hospitals, pharmacies, and online pharmacies. The retail pharmacy holds a leading position in the distribution channel segment as increasingly people prefer to buy their medicines from retail shops On the other hand, online distribution is more trending as people prefer more online modes of shopping to avail attractive discounts and add on services.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Generic Drugs Market

By Brand

By Route of Administration

By Therapeutic Application

By Distribution Channels