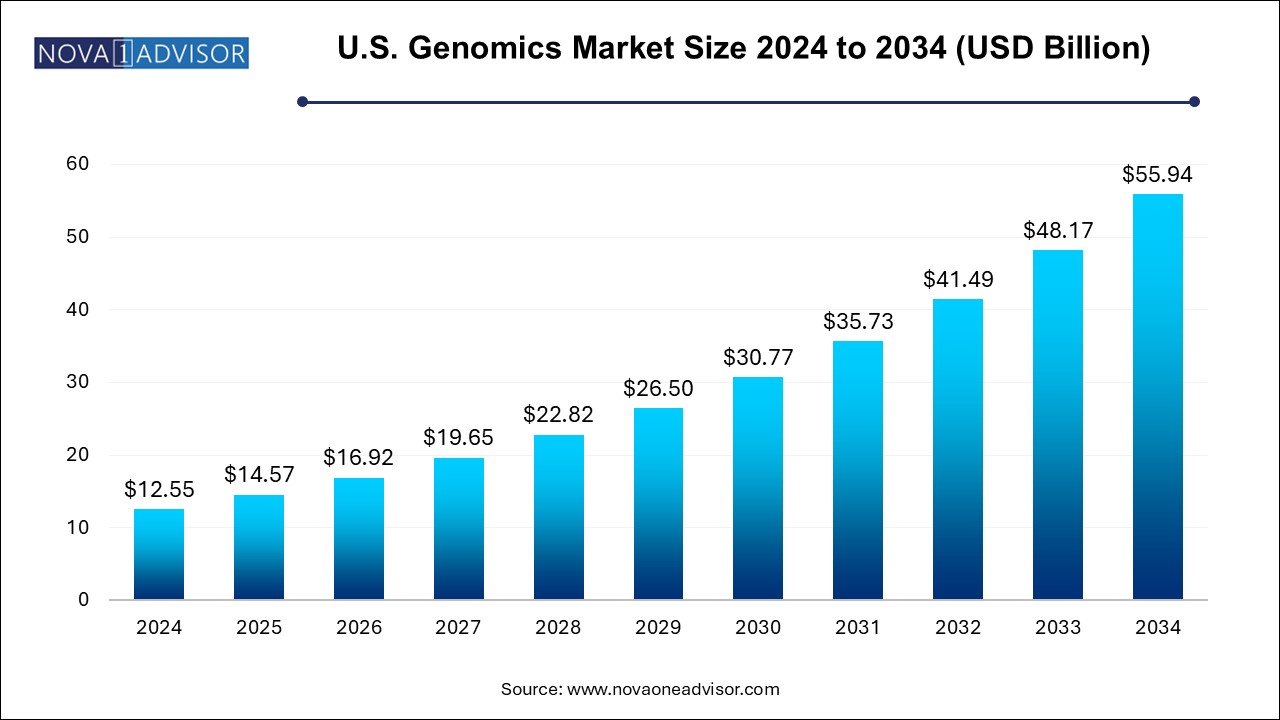

The U.S. genomics market size was valued at USD 12.55 billion in 2024 and is projected to surpass around USD 55.94 billion by 2034, registering a CAGR of 16.11% over the forecast period of 2024 to 2034.

The U.S. genomics market stands as a pivotal force driving the future of healthcare, biomedical research, and precision medicine. Genomics the study of the complete set of DNA (including all genes) in an organism is at the heart of numerous scientific and medical advancements. In the United States, the market has seen exponential growth, fueled by a combination of technological innovation, substantial government and private investment, the rise of personalized medicine, and increasing clinical integration of genomic insights.

From its early roots in the Human Genome Project to the current era of affordable, real-time sequencing technologies and bioinformatics platforms, the U.S. has remained at the forefront of global genomics innovation. Genomics is now being used not only to understand the molecular basis of diseases but also to guide treatment decisions, monitor therapeutic responses, and even prevent diseases through early risk prediction.

The U.S. healthcare ecosystem, with its blend of academic excellence, biotech startups, research consortia, and pharmaceutical giants, provides a fertile environment for genomic research and application. Technologies like next-generation sequencing (NGS), CRISPR gene editing, RNA interference, single nucleotide polymorphism (SNP) analysis, and microarrays are widely adopted across hospitals, research institutions, and drug development programs.

Furthermore, national initiatives such as the NIH's All of Us Research Program and growing collaborations between genomics companies and health systems are expanding the application of genomics beyond research labs into routine clinical practice. As such, the market is poised to continue evolving rapidly in both scope and scale, reshaping the landscape of medicine and biomedical science in the U.S.

Rising adoption of next-generation sequencing (NGS) for clinical diagnostics, oncology, and rare disease detection.

Integration of artificial intelligence (AI) and machine learning in genomic data interpretation and drug discovery.

Growth of direct-to-consumer (DTC) genomics services, enhancing public awareness and engagement in genomic health.

Increasing government and private funding for population-scale genomics initiatives.

Proliferation of cloud-based genomic data platforms to manage and analyze large-scale data sets securely.

Expansion of CRISPR and gene editing applications in therapeutic research and agriculture.

Boom in biomarker discovery for precision oncology and immunotherapy companion diagnostics.

Rise in use of multi-omics platforms, integrating genomics with transcriptomics, proteomics, and metabolomics for systems biology.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.57 Billion |

| Market Size by 2034 | USD 55.94 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 16.12% |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application & technology, deliverable, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Illumina Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies; Luminex Corporation; Myriad Genetics Inc.; BGI Genomics Co. Ltd.; Bio Rad Laboratories Inc.; Caris Life Sciences; Danaher Corp.; Eurofins Scientific SE |

A key driver propelling the U.S. genomics market is the rising demand for precision medicine, where treatment decisions are tailored to an individual’s genetic makeup. As the understanding of gene-disease associations deepens, clinicians are increasingly relying on genomic testing to identify actionable mutations and optimize therapeutic strategies.

For example, in oncology, tumor profiling through genomic sequencing can reveal biomarkers such as EGFR, KRAS, or BRCA mutations that inform targeted therapies. This has led to the widespread adoption of companion diagnostics and comprehensive genomic panels in cancer centers nationwide. Additionally, pharmacogenomics—the study of how genes influence drug response—is being integrated into prescribing practices to reduce adverse drug reactions and improve outcomes.

Government support for genomics-driven precision medicine, including initiatives from the FDA, NIH, and CMS, is further encouraging the incorporation of genomics into routine care. As technology becomes more accessible and clinicians become more genomics-literate, the demand for integrated genomic solutions is expected to continue growing exponentially.

Despite its rapid advancement, the U.S. genomics market faces a significant restraint in the form of data complexity, storage, and privacy concerns. Sequencing technologies generate enormous amounts of data, and interpreting this data in clinically meaningful ways remains a challenge.

Managing multi-terabyte data sets requires high-performance computing infrastructure and advanced bioinformatics tools. More importantly, integrating genomic data with electronic health records (EHRs) and clinical workflows can be technically cumbersome. Moreover, the lack of standardized data formats and reporting structures makes it difficult to compare and share genomic information across institutions.

Privacy and security are also major issues, particularly with direct-to-consumer testing and clinical genomics. Misuse or unauthorized access to genomic data can have serious implications for patient confidentiality and trust. Regulatory frameworks such as HIPAA offer protection, but genomic-specific policies and consent models are still evolving. These challenges, if not addressed proactively, can slow the adoption of genomics in mainstream healthcare.

An emerging opportunity within the U.S. genomics market lies in the integration of artificial intelligence (AI) and machine learning (ML) for data interpretation and drug discovery. With the volume and complexity of genomic data increasing exponentially, AI tools offer scalable solutions for pattern recognition, predictive modeling, and biomarker identification.

Startups and established companies are investing heavily in AI-powered platforms that can analyze whole-genome or exome data and produce actionable clinical insights within hours. These tools are being used to identify genetic drivers of disease, stratify patients for clinical trials, and discover new therapeutic targets with unprecedented speed.

In drug discovery, AI-integrated genomics enables in silico modeling of gene-protein interactions, expediting the identification of lead compounds. Partnerships between genomics companies and pharmaceutical firms are increasingly centered around AI-driven genomics, offering opportunities to reduce R&D timelines and increase drug success rates. As AI algorithms improve and regulatory bodies provide guidance for clinical use, this convergence will unlock vast potential across diagnostics and therapeutics.

Functional genomics was the dominant application segment in 2024, owing to its foundational role in understanding gene expression, regulation, and function. Technologies such as RNA interference (RNAi), real-time PCR, and transfection methods are widely used across research institutes and pharmaceutical companies for gene validation, target discovery, and expression analysis. Real-time PCR, in particular, has become a staple in both research and diagnostics due to its cost-effectiveness, reliability, and speed. Microarray analysis remains relevant for gene expression profiling and SNP detection in large-scale studies.

Epigenomics emerged as the fastest-growing segment, driven by the expanding understanding of how epigenetic modifications influence gene expression and disease susceptibility. Techniques like bisulfite sequencing and chromatin immunoprecipitation (ChIP-Seq) are gaining traction in cancer epigenetics, neurodegenerative disorders, and autoimmune disease research. High-resolution melt (HRM) and MeDIP are also widely used for methylation analysis. Epigenomics is particularly critical for early cancer detection, where changes in DNA methylation often precede mutations, making it a fertile ground for biomarker development and diagnostic innovation.

Products dominated the U.S. genomics market in 2024, particularly consumables and reagents used in high-throughput sequencing, PCR, and microarray workflows. The recurring nature of consumables in research and diagnostics ensures consistent demand. Instruments and software systems also held a significant share, with companies offering integrated platforms for sequencing, data analysis, and visualization. Proprietary systems such as Illumina’s NovaSeq, Thermo Fisher’s Ion Torrent, and Bio-Rad’s real-time PCR machines are widely deployed across academic, clinical, and commercial settings.

Services are the fastest-growing deliverable segment, led by NGS-based services, computational analytics, and biomarker translation. As sequencing costs decline and complexity increases, many institutions prefer outsourcing genomic analysis to specialized service providers. Core genomics services, including library preparation, sequencing runs, and variant annotation, are in high demand. Meanwhile, computational services that handle data cleaning, mapping, and interpretation using cloud-based tools are becoming critical for non-bioinformatics-focused organizations. Personalized service offerings for biomarker discovery and clinical report generation are also seeing rapid uptake.

Pharmaceutical and biotechnology companies dominated the end-use segment, given their extensive use of genomics in drug discovery, companion diagnostics, and clinical trial design. Genomic profiling enables these companies to identify patient subgroups, validate targets, and optimize dosing strategies. Most precision oncology drugs now require genomic companion diagnostics for regulatory approval and clinical adoption. Genomics is also being integrated into pharmacovigilance to monitor post-market safety signals.

Hospitals and clinics are the fastest-growing end-use segment, as genomics transitions from research to clinical practice. Genetic testing is now common in oncology, cardiology, rare disease diagnostics, and reproductive health. Academic medical centers and community hospitals alike are incorporating sequencing-based tests into standard workflows, supported by insurance coverage and clinical guidelines. As clinical genomics expands beyond specialized centers to mainstream healthcare settings, the demand for user-friendly platforms and integrated reporting tools is rising.

The United States maintains undisputed global leadership in genomics, supported by cutting-edge infrastructure, policy initiatives, and commercial activity. The U.S. is home to the highest number of genomics companies, research institutions, and sequencing laboratories globally. It also boasts a mature venture capital ecosystem that fuels innovation in startups and spinouts.

Regions like Massachusetts, California, and North Carolina are genomic innovation hubs, hosting institutions such as the Broad Institute, Stanford University, and the NIH, along with major industry players. U.S. government initiatives like the All of Us Research Program aim to sequence over a million Americans to drive personalized healthcare. Meanwhile, the FDA and CMS have established frameworks for genomic diagnostics and reimbursement, supporting the clinical adoption of genomics.

Healthcare providers, from national hospital networks to regional clinics, are increasingly deploying genomic testing tools for patient care. U.S.-based biobanks, cloud infrastructure companies, and AI firms are creating an integrated genomics ecosystem. Additionally, educational and workforce development efforts are ensuring that clinicians, researchers, and bioinformaticians can support the country’s genomics expansion.

March 2025 – Illumina, Inc. launched a new ultra-high-throughput sequencing platform capable of whole genome sequencing at under $100 per sample, aimed at population-scale genomic projects.

February 2025 – Tempus Labs expanded its genomic testing capabilities to include germline testing and whole genome sequencing for oncology applications across U.S. cancer centers.

January 2025 – Pacific Biosciences (PacBio) announced a partnership with a major U.S. hospital network to deploy its long-read sequencing technology for rare disease diagnostics.

December 2024 – Color Genomics received FDA authorization for its hereditary cancer panel, supporting broader clinical adoption through CMS reimbursement coverage.

November 2024 – Grail, Inc. began commercial rollout of its multi-cancer early detection (MCED) test, which uses methylation-based sequencing for detecting over 50 types of cancers from a single blood draw.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Genomics market.

By Application & Technology

By Deliverables

By End-use