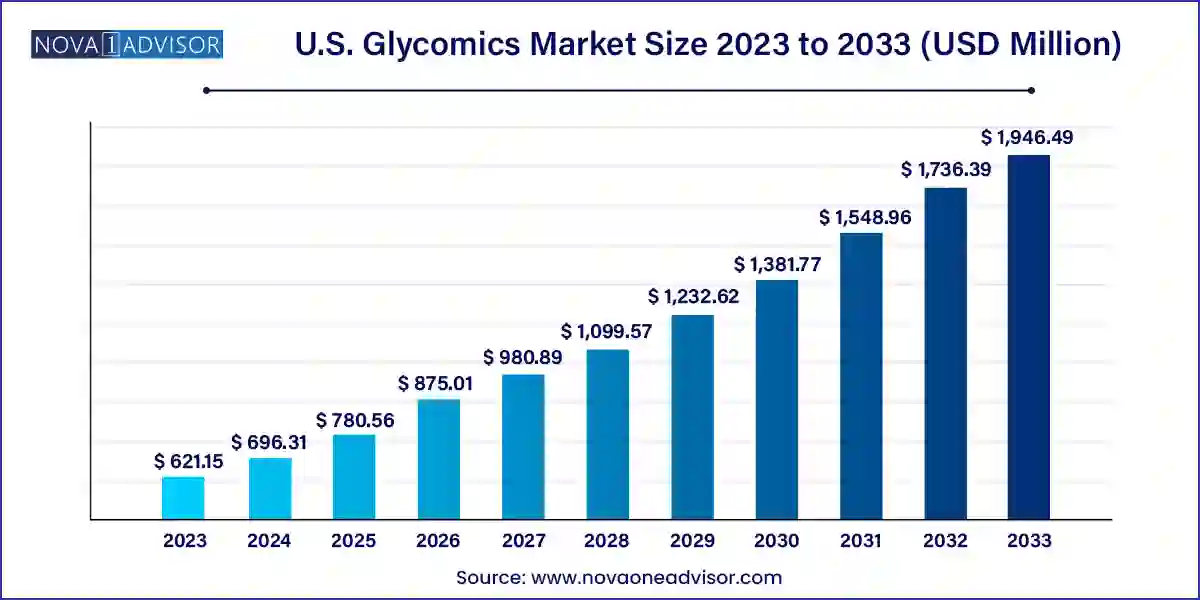

The U.S. glycomics market size was exhibited at USD 621.15 million in 2023 and is projected to hit around USD 1,946.49 million by 2033, growing at a CAGR of 12.1% during the forecast period 2024 to 2033.

The U.S. glycomics market is undergoing a transformative evolution, driven by advancements in molecular biology, biotechnology, and analytical instrumentation. Glycomics, the comprehensive study of glycan structures and functions in biological systems, plays a pivotal role in understanding a broad range of physiological and pathological processes. This includes immune response modulation, cell signaling, disease progression, and microbial interactions. With increasing interest in glycan biomarkers, therapeutic glycoproteins, and glycoengineered drugs, glycomics is becoming integral to modern drug discovery, diagnostics, and personalized medicine.

The U.S. stands at the forefront of glycomics research and commercialization, thanks to its robust research infrastructure, presence of leading biopharmaceutical and biotechnology firms, and consistent public and private investments. Significant contributions from academic and research institutions are also fueling breakthroughs in glycoproteomics, glycan analysis, and enzymatic modifications. As glycomics tools and technologies continue to mature, their integration into routine clinical and industrial applications is expanding, leading to a dynamic and growing market landscape.

Integration of Glycomics in Precision Medicine: Leveraging glycobiology insights to develop customized therapies for cancer and autoimmune diseases.

Increased Use of Glycan-Based Biomarkers: Early detection and prognosis of diseases using glycan alterations as diagnostic tools.

Technological Advancements in Mass Spectrometry and HPLC: Enhancing the resolution and sensitivity of glycan profiling.

Automation and Miniaturization of Glycomics Platforms: Developing high-throughput platforms for faster and scalable glycan analysis.

Collaborative Academic-Industry Research Initiatives: U.S. universities partnering with pharma companies to develop glycosylated therapeutics.

Growth in Glycoengineered Biologics: Biopharmaceutical companies focusing on glycosylation optimization to improve efficacy and half-life of protein-based drugs.

AI-Driven Glycomics Analysis: Employing machine learning algorithms for glycan structure prediction and data interpretation.

| Report Coverage | Details |

| Market Size in 2024 | USD 696.31 Million |

| Market Size by 2033 | USD 1,946.49 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.1% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Danaher; New England; Biolabs ; Bruker; Agilent Technologies; Waters Corporation; Creative Proteomics; BioAge Labs; Frontier Medicines; Monte Rose Therapeutics |

The increasing interest in glycan-based therapeutics is a major driver for the U.S. glycomics market. Glycans are involved in numerous biological processes, and their role in modulating immune response and disease progression is increasingly recognized. Glycoengineered monoclonal antibodies and vaccines have shown improved efficacy, reduced immunogenicity, and longer half-lives. For example, the success of glycosylated monoclonal antibodies like rituximab and trastuzumab underscores the clinical and commercial significance of glycomics.

Moreover, companies are investing heavily in glycoengineering to enhance the pharmacokinetics and pharmacodynamics of therapeutic proteins. With the rise of biosimilars and biobetters, glycan profiling has become critical in maintaining consistency and quality in production. This shift is further supported by regulatory bodies that mandate detailed glycan characterization for biopharmaceutical approvals.

One of the primary challenges facing the U.S. glycomics market is the inherent complexity of glycan structures and their analytical requirements. Unlike DNA and proteins, glycans exhibit branched, non-linear structures with diverse isomeric forms, making them difficult to characterize. Glycan analysis often requires multiple, labor-intensive steps including derivatization, labeling, and separation using sophisticated instruments like MALDI-TOF-MS and HPLC.

The need for specialized expertise and high-end instrumentation poses accessibility and cost challenges, especially for smaller labs or emerging biotech firms. Additionally, the lack of standardized protocols across laboratories can result in inconsistent outcomes. These factors collectively hinder the widespread adoption of glycomics technologies despite their immense scientific value.

An emerging opportunity in the U.S. glycomics market lies in the application of glycomics for cancer diagnostics. Aberrant glycosylation patterns are recognized as hallmarks of cancer, offering a valuable avenue for biomarker discovery. Glycan-based biomarkers are being developed for early detection of cancers such as prostate, ovarian, and pancreatic cancers. For instance, changes in N-linked glycan structures have been correlated with tumor progression and metastasis.

In clinical diagnostics, glycan profiling is being explored to stratify patients, monitor therapeutic responses, and predict disease outcomes. The integration of glycomics data with other omics platforms (genomics, proteomics, metabolomics) is enhancing the accuracy and scope of precision oncology. As technologies become more accessible and clinically validated, the use of glycomics in cancer screening and prognostics is expected to surge.

Enzymes dominated the U.S. glycomics market in the product category due to their crucial role in glycan modification and degradation. Enzymes like glycosidases and glycosyltransferases are fundamental to studying glycan structures and synthesizing glycoproteins. Their use in enzymatic digestion and labeling of glycans makes them indispensable in both academic and industrial research. The growing demand for customized glycoengineering, particularly for therapeutic proteins and antibody drug conjugates, is further driving the adoption of glycomics enzymes.

Kits are the fastest-growing product category, particularly glycan labeling and purification kits. These kits simplify complex procedures, reduce hands-on time, and improve reproducibility across experiments. As the field expands beyond elite research institutions into commercial labs and CROs, demand for ready-to-use kits is increasing. The rise in biopharmaceutical R&D, especially in biosimilar development, is creating a surge in adoption of standardized kits for glycan profiling.

Drug discovery and development remains the leading application area within the U.S. glycomics market. Glycosylation plays a significant role in the pharmacological behavior of therapeutic proteins, and its optimization is central to the design of new drugs. Pharmaceutical and biotech companies are integrating glycomics into early-stage screening, lead optimization, and quality control processes. Notably, glycan analysis is crucial for maintaining biosimilarity and functionality in monoclonal antibody development.

Diagnostics is emerging as the fastest-growing application, particularly due to increased interest in glycan biomarkers. The sensitivity and specificity of glycan-based assays are proving advantageous for early detection of cancers, autoimmune diseases, and infectious diseases. Clinical labs are increasingly incorporating glycan analysis platforms to complement genetic and protein-based diagnostics. The potential for non-invasive, glycan-based tests also aligns with the trend toward minimally invasive healthcare solutions.

Academic and research institutes dominate the end-user segment owing to their foundational role in advancing glycomics science. Major universities and medical schools in the U.S. are driving innovation through federally funded programs, exploring glycan biology in cancer, immunology, and infectious diseases. These institutions also collaborate with industry partners, generating translational research that supports commercial applications.

Biopharmaceutical companies are the fastest-growing end users, spurred by the need to ensure glycan consistency in drug manufacturing and compliance with regulatory guidelines. Companies are increasingly establishing in-house glycoanalytics capabilities or partnering with CROs specializing in glycomics. This trend is particularly strong among firms engaged in monoclonal antibody production, vaccine development, and cell therapy research.

The United States is a global leader in glycomics research and commercialization, supported by a well-developed infrastructure for life sciences and molecular biology. Federal initiatives such as the NIH Common Fund’s Glycoscience Program have laid the groundwork for tool development, standardization, and data sharing in glycomics. The presence of major funding agencies, elite research universities, and venture capital-backed biotech startups forms a fertile ecosystem for glycomics innovation.

Key U.S. cities like Boston, San Diego, and the San Francisco Bay Area serve as glycomics hubs, with a concentration of research institutions, CROs, and biopharma companies. The regulatory environment is also becoming increasingly supportive, with agencies like the FDA emphasizing the role of glycosylation in biotherapeutic efficacy and safety. As demand for high-resolution glycan analysis rises across therapeutic and diagnostic applications, the U.S. market is poised for sustained growth and innovation.

March 2025: Thermo Fisher Scientific launched an advanced glycan analysis HPLC system tailored for biopharmaceutical quality control.

January 2025: Agilent Technologies partnered with a leading academic institute to develop glycoprotein analysis protocols for cancer biomarker research.

November 2024: Bruker Corporation introduced an updated MALDI-TOF mass spectrometer designed for high-throughput glycan profiling in clinical labs.

September 2024: New England Biolabs announced a breakthrough enzyme cocktail for efficient glycan release, improving workflow times in glycoprotein analysis.

June 2024: Bio-Techne expanded its reagent product line with new glycoprotein standards to support regulated biologics development.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. glycomics market

Product Scope

Application Scope

End-use