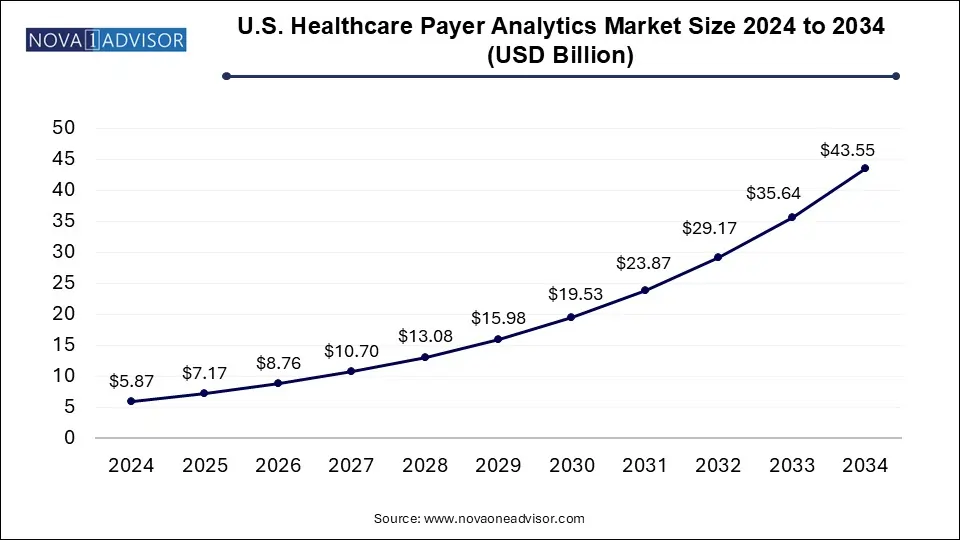

The U.S. healthcare payer analytics market size was exhibited at USD 5.87 billion in 2024 and is projected to hit around USD 43.55 billion by 2034, growing at a CAGR of 22.2% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 7.17 Billion |

| Market Size by 2034 | USD 43.55 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 22.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Analytics Type, Component, Delivery Mode, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | CitiusTech, Inc.; Oracle; Cerner Corporation; SAS Institute, Inc.; Allscripts Healthcare, LLC; McKesson Corporation; MedeAnalytics, Inc.; HMS; IBM; Optum, Inc. |

The increasing rate of digitization in the healthcare industry is the primary factor driving growth in the analytics for the payers’ market. The use of electronic medical records has been widespread, more so during COVID-19, the increase in adoption rates of such technologies is propelling growth. The digital records and digital technology being adopted by the health system across the U.S. create a huge amount of data that can be used to derive meaningful results and observations to decrease cost, optimize treatment and mitigate risks.

Increase in the healthcare expenditure has risen over the years, according to the National Health Expenditure for 2020 was $4.1 trillion, accounting for 19.7% of the total GDP. The increase is not only supporting the growing infrastructural needs but is also helping in accommodating the increasing patient volumes. The increase in the incidence of diseases and the growing need for better healthcare solutions are key drivers for the growth of the market. There has been a shift in the industry since the passing of the Affordable Care Act, under which the hospital systems are now more focused on value-based care rather than the volume of patients being treated.

The adoption of healthcare analytical solutions has also resulted in massive growth in the market. Advanced analytical techniques are helpful in better decision making, helping administrators to make informed decisions about the business and the patients with healthcare plans, improving their efficiency, and for the overall profitability of the organization. During the pandemic, the adoption of healthcare analytics grew across the industry, this not only help in identifying patients who were at greater risk but also identified potential risks related to the further spread of the virus by ensuring timely treatment of these individuals. Healthcare analytics also helps in analyzing the potential benefits and problems when implementing a new strategy for the organization, determining its chances of success.

The use of big data analytics has also propelled the growth of this market, the data generated with the high volume of patients through electronic records and various other sources like connected technologies and devices. All of this data is raw and unstructured, requiring analysis to derive meaningful observations. The industry is increasingly using business intelligence (BI) tools to make sense of this data. The digital form of data is being continually generated by pharma companies, healthcare providers, payers, patients, etc., use of BI tools not only recommends the best action to take in the treatment process but also helps mitigate the risk of disease.

The COVID-19 pandemic generated a huge opportunity for the healthcare payer analytics market. The industry saw an increase in adoption of digital solutions like telemedicine, adoption of EHRs grew, the plethora of data that was generated during the pandemic was overwhelming even for the healthcare analytics industry, the amount of data generated was unprecedented, and there have been improvements in the record-keeping and data analytics and the industry is continuously evolving and improving to accommodate all the challenges that the pandemic is presenting it with.

The descriptive analytics segment had the largest market share of 35.8% in 2024. This analytics type is the most widely used in process optimization as well as administrative activities. This method analyzes past as well as present data to bring forth meaningful information or a pattern that can significantly impact future decisions. Specifically, for COVID, it has been used to determine how contagious the virus is by studying the rate of positive COVID tests in a given population over a specific time.

The fastest growing segment is predictive analysis, with a CAGR of 26.4% for the forecast period. Predictive data analytics helps care providers to course the best treatment plan for the patients for better outcomes. Personalized care has been gaining a lot of momentum and predictive analysis has proved useful to understand the specific treatment needs of each patient and enables providers to offer the best treatment plans.

On-premises delivery model dominated the market with a share of 48.6% in 2024. The healthcare industry is evolving in terms of technology, the use of on-premise models has largely been adopted by the industry, and it has many benefits like better access to data, reduced chances of theft of data, reduced cost, and ease of maintenance. On-premises storing of data has the biggest downside of storage capacity limitations making it a huge hurdle in the growth of this segment.

Cloud-based storage and improvement in privacy concerns have made the cloud-based delivery model the fastest-growing sub-segment anticipated to register the fastest growth rate of 25.7%. The rapid adoption of this delivery model by healthcare organizations has resulted in the rapid growth of the sub-segment. The biggest hindrance posed by the on-premise storage is easily managed by a cloud-based solution, since there are no capacity limitations, the data that can be stored is huge and requires minimal setup by the organization, which has resulted in the growth of the market.

The financial application segment dominated the market with a revenue share of 35.7% in 2024, the increased rate of adoption by government and private facilities alike has been the main factor driving the growth of the market. A number of financial applications can save millions in fraudulent claims, claims settlement, and risk analysis for insurance companies. According to National Healthcare Anti-Fraud Association, healthcare frauds in the U.S. amount to nearly $80 billion per year. The use of healthcare analytics can not only reduce incidences of fraud but can also optimize insurance plans and recover losses.

Financial is anticipated to register the fastest growth rate of 23.1%, it is expected to grow at a substantial rate during the forecast period. Increased implications related to financial aspects have been a primary driving factor for the growth of the healthcare payer analytics market. With the help of this application payers which includes insurance companies, third-party payers, etc. can optimize their plans for the maximum benefit of patients and also save funds by recognizing fraudulent claims.

In the component segment, the services had the largest market share of 42.0% as of 2024. Outsourcing of data has been the recent trend in this segment, this not only offers the establishments to get the data analyzed from industry experts but also saves the cost of training and educating their staff to do the same.

In 2024, services accounted for the largest revenue share of 42.0%, the services segment was recorded to have the fastest growth rate of 22.7%, the lack of appropriate staff for analytics in the industry is a major driver for the growth of this segment. Due to this the analytics part is often outsourced and is thus helping the service sector grow, in turn helping the growth of healthcare payer analytics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare payer analytics market

By Analytics Type

By Component

By Delivery Model

By Application