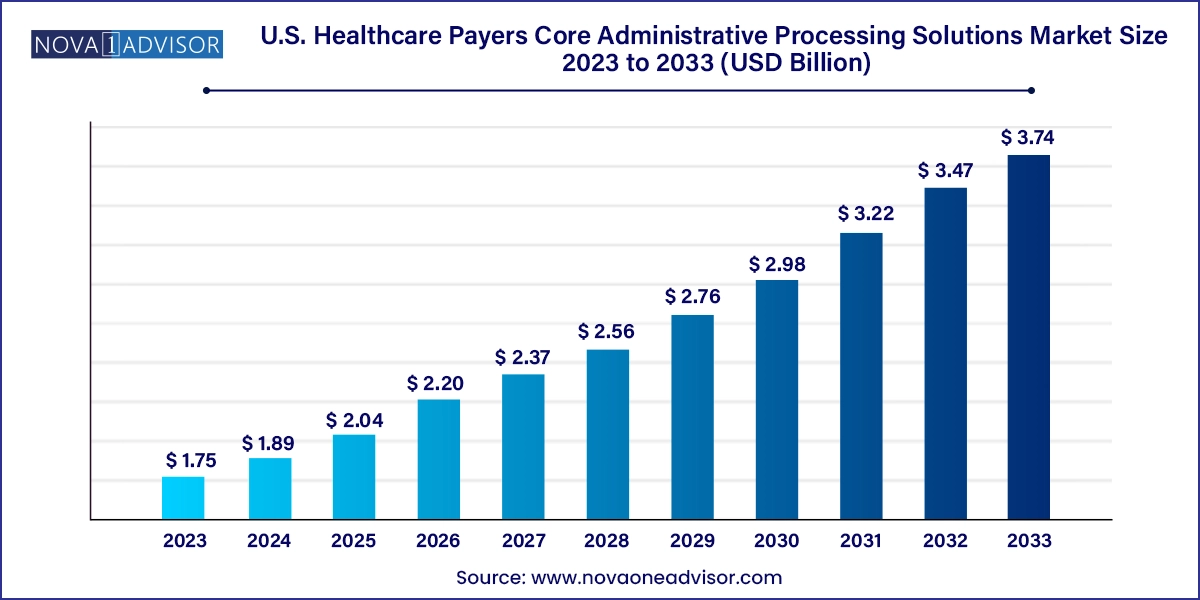

The U.S. healthcare payers core administrative processing solutions market size was exhibited at USD 1.75 billion in 2023 and is projected to hit around USD 3.74 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

The U.S. Healthcare Payers Core Administrative Processing Solutions (CAPS) market is undergoing a critical transformation, driven by the growing need for cost efficiency, regulatory compliance, and digital modernization within the health insurance sector. CAPS refers to a set of software and services that help healthcare payers manage essential administrative tasks, including claims adjudication, member and provider enrollment, premium billing, benefits configuration, payment processing, and customer service functions. These platforms form the operational backbone of both public and private health insurers.

In the United States where the healthcare payer landscape includes commercial insurers, Medicare Advantage plans, Medicaid managed care organizations (MCOs), and employer-sponsored health plans the demand for scalable and agile CAPS systems is higher than ever. Payers are seeking to consolidate legacy systems, minimize administrative overhead, and deliver faster, more accurate services to both providers and members. The implementation of value-based care models, increasing mergers and acquisitions among health plans, and pressure to enhance member experiences have accelerated CAPS adoption.

Legacy CAPS platforms, often decades old, are being replaced or upgraded to modern, cloud-enabled, interoperable solutions. These newer systems integrate artificial intelligence (AI), robotic process automation (RPA), and advanced analytics to support real-time decision-making and enhance operational visibility. Furthermore, rising demand for omnichannel member engagement and seamless provider collaboration necessitates the use of integrated CAPS platforms that break down silos across departments.

The market includes a combination of software vendors, system integrators, and managed service providers, each offering either standalone modules (like claims or enrollment systems) or end-to-end integrated suites. With substantial investment in healthcare IT infrastructure, increasing payer-provider convergence, and shifting regulatory frameworks, the U.S. CAPS market is poised for significant evolution and growth.

Shift to Cloud-Based Deployment Models: Payers are moving away from costly on-premise infrastructure to flexible, scalable cloud solutions that offer better performance and compliance updates.

Integration with Digital Front-End Tools: CAPS platforms are increasingly being integrated with digital front-end member engagement tools such as chatbots, mobile apps, and portals.

Focus on Real-Time Claims Processing: Instant adjudication and predictive analytics are becoming key differentiators for payers seeking to reduce turnaround times and improve accuracy.

Modular System Adoption: Insurers prefer modular CAPS components to tailor workflows and manage upgrades without overhauling entire systems.

Expansion of Value-Based Administration Capabilities: CAPS are evolving to support bundled payments, shared savings, and quality measurement tools aligned with value-based care.

Increased Adoption of AI and RPA: Automation is being deployed for tasks such as eligibility verification, claims editing, and payment integrity.

Regulatory Compliance Drives Innovation: Compliance with evolving CMS and HIPAA regulations is pushing vendors to embed governance features into CAPS offerings.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.89 Billion |

| Market Size by 2033 | USD 3.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Deployment |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | HealthEdge Software, Inc.; Optum; Cognizant; HealthAxis; Plexis Healthcare Systems; Mphasis; SS&C Technologies; Conduent; RAM Technologies; Evolent; Invidasys; Advantasure; VBA software; Advalent Corp |

A pivotal driver in the U.S. CAPS market is the growing demand for streamlined claims adjudication and payment processing. Claims management remains one of the most resource-intensive functions for health insurers, with billions of dollars processed monthly across millions of medical encounters. Errors in claims processing lead to denied payments, administrative burden, provider dissatisfaction, and ultimately, increased cost of care delivery.

Modern CAPS solutions offer automated claims editing, intelligent routing, and configurable rule engines that allow payers to adjudicate claims faster and with greater accuracy. Integrated payment solutions also help reduce delays in member reimbursements and provider settlements. By reducing manual intervention and rework, advanced CAPS help payers maintain provider networks and member trust while keeping administrative costs in check.

In the era of consumerization and competition among health plans, the speed and accuracy of claims processing has a direct impact on member satisfaction and Net Promoter Scores (NPS), making it a critical area of innovation and investment for payer organizations.

Despite the need for modernization, a significant barrier in the CAPS market is the high complexity and cost associated with migrating from legacy administrative systems. Many large payers operate on decades-old platforms built on outdated architectures that are deeply entrenched within organizational workflows. These systems often involve significant custom code, making them difficult to replace without major disruptions to operations.

Migrating to a new CAPS solution involves not only software procurement but also substantial investment in training, change management, data migration, and integration with other enterprise systems such as electronic health records (EHRs), CRM platforms, and financial systems. Additionally, payers must ensure compliance with federal and state regulations throughout the migration, which can delay implementation.

These transition risks and upfront costs deter some organizations particularly small to mid-sized payers from adopting new platforms, even when the long-term benefits are apparent. Until vendors offer more incremental or hybrid deployment models, this remains a significant restraint on broader market adoption.

An emerging opportunity in the CAPS market is the expansion of government-sponsored healthcare programs such as Medicare Advantage, Medicaid managed care, and ACA exchanges. As of 2025, more than 50% of Medicare beneficiaries are enrolled in Medicare Advantage plans, and Medicaid MCOs manage care for over 70% of Medicaid enrollees across the U.S.

These public-private partnerships require payers to manage complex enrollment cycles, eligibility redeterminations, state-specific billing requirements, encounter data submissions, and performance reporting. Modern CAPS platforms with modular configurations and support for government-specific workflows are in high demand.

Vendors that offer scalable, policy-compliant, and interoperable CAPS solutions tailored to Medicare Advantage and Medicaid plans stand to capture a significant market share. Additionally, federal incentives and state modernization grants further support CAPS adoption among payers operating in these sectors.

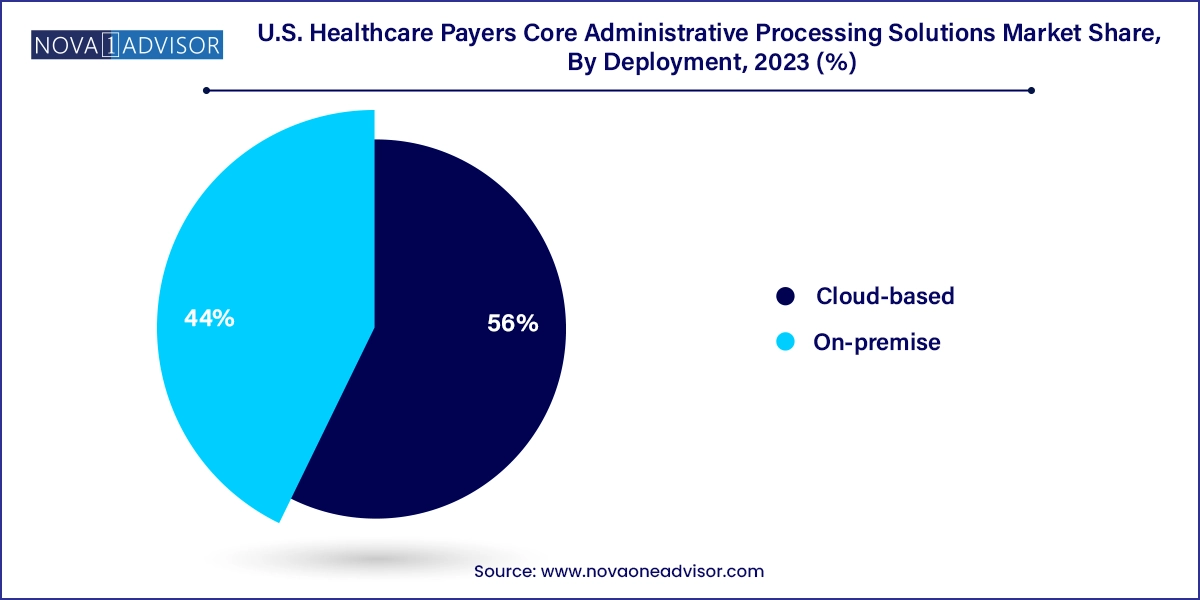

On-premise deployment continues to dominate among legacy insurers, especially large Blue Cross Blue Shield organizations and regional payers with significant data privacy requirements or custom-built infrastructures. These organizations often manage sensitive health and payment data in-house and prefer full control over their environments. On-premise systems also offer greater configurability and performance control for high-volume transaction processing.

However, cloud-based deployment is the fastest-growing segment, driven by the need for scalability, rapid deployment, disaster recovery, and cost containment. Cloud-native CAPS platforms offer continuous updates, simplified compliance management, and easier integration with emerging digital health ecosystems. As vendors expand support for FHIR standards and CMS interoperability mandates, cloud-based systems are becoming increasingly attractive to both new payers and those looking to sunset their on-premise platforms. Moreover, SaaS and subscription-based pricing models help reduce capital expenditures, making cloud the preferred choice for small to mid-size payers and tech-forward insurers.

Software solutions dominate the U.S. CAPS market, forming the core of administrative operations for healthcare payers. Within software, integrated platforms are particularly dominant, as they consolidate multiple functions—including member enrollment, claims processing, provider management, and billing—into a single system. Large health plans and payers operating across multiple states prefer integrated solutions for their ability to reduce data silos, enhance workflow efficiency, and improve regulatory reporting. These platforms are increasingly cloud-enabled and embedded with analytics, enabling payers to derive insights across the member lifecycle.

At the same time, standalone modules are the fastest-growing segment, as smaller payers and new entrants adopt modular solutions to address specific operational gaps. Claims adjudication, for example, is often deployed as a standalone solution to replace manual processes or legacy claim engines. Standalone systems offer a cost-effective and low-risk entry point for payers unwilling to overhaul their entire IT stack. Vendors are responding to this demand by offering flexible APIs, low-code customization, and quick-deployment models that align with payer needs for agility.

In the United States, the CAPS market is being shaped by national healthcare reform, payer consolidation, and digital transformation strategies. States such as California, Texas, Florida, and New York host some of the largest health plans and Medicaid MCOs, all of which rely on sophisticated CAPS platforms to handle complex member populations and benefit designs. The CMS Interoperability Rule, No Surprises Act, and Medicare Advantage Star Ratings program continue to push payers toward automated, auditable, and interoperable administrative systems.

Large commercial payers including Anthem (Elevance Health), UnitedHealth Group, and CVS Aetna are investing heavily in core administrative modernization, often combining homegrown IT systems with vendor-supported modules. Regional payers and not-for-profits are partnering with third-party vendors to implement configurable, state-specific CAPS solutions. Furthermore, growing regulatory scrutiny around claims accuracy, payment integrity, and member rights is prompting many payers to evaluate their administrative infrastructure and modernize accordingly.

The U.S. government is also a significant influence on the CAPS market through Medicare and Medicaid contracts, making government alignment a critical success factor for CAPS vendors. As digital health technologies mature and payer-provider collaborations deepen, the U.S. market will continue to evolve into an environment that rewards automation, interoperability, and member-centric design.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare payers core administrative processing solutions market

Type

Deployment