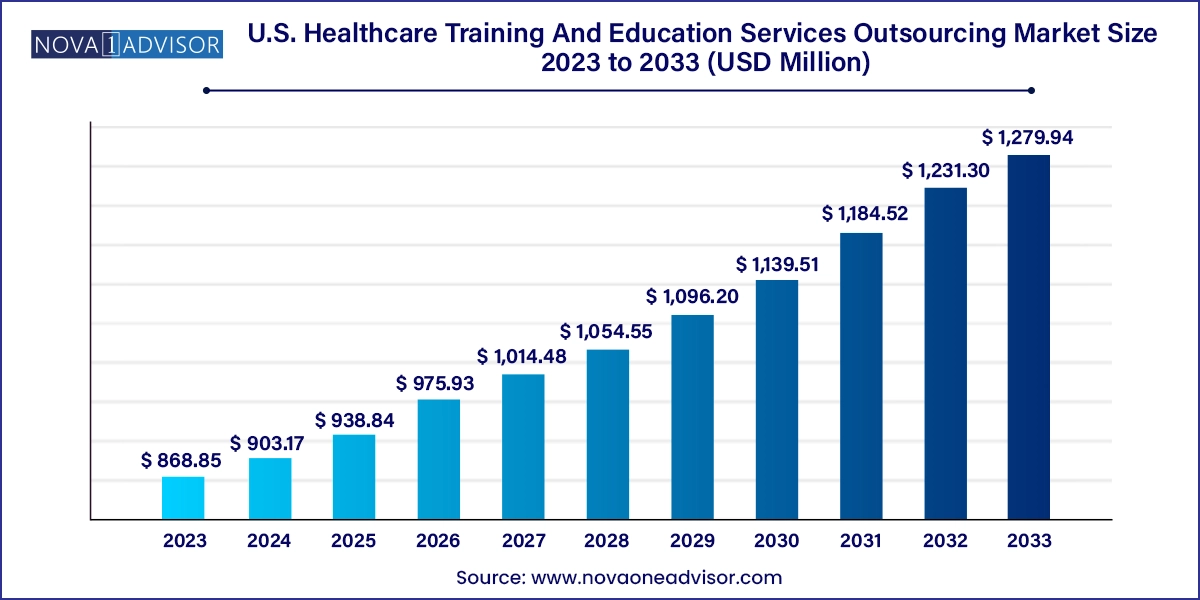

The U.S. healthcare training and education services outsourcing market size was exhibited at USD 868.85 million in 2023 and is projected to hit around USD 1,279.94 million by 2033, growing at a CAGR of 3.95% during the forecast period 2024 to 2033.

The U.S. healthcare training and education services outsourcing market has emerged as a critical support system to meet the increasing demand for skilled healthcare professionals, maintain regulatory compliance, and optimize workforce performance in a highly complex and evolving industry. As healthcare organizations, including hospitals, pharmaceutical firms, medical device companies, and biotech firms face growing pressure to adapt to rapid technological innovation, stringent regulatory environments, and dynamic patient needs, outsourcing training and education services offers a strategic solution.

Outsourcing allows these organizations to tap into external expertise, advanced learning technologies, and scalable content without investing heavily in in-house training infrastructure. Whether for clinical skills development, technical system onboarding, compliance certification, or soft skills training, outsourcing firms deliver tailored programs through online, offline, or hybrid models. The outsourced training sector also encompasses curriculum design, workforce performance assessments, eLearning platforms, simulation training, and strategic consulting.

The COVID-19 pandemic acted as a catalyst, exposing the need for agile and scalable learning systems in healthcare. From training frontline professionals in safety protocols to onboarding large volumes of staff rapidly, outsourced education providers played a vital role in workforce preparedness. Post-pandemic, as the industry grapples with workforce shortages, digital health acceleration, and increasing turnover, the demand for continuous training has escalated.

Moreover, with an expanding pool of specialized roles in health IT, remote patient monitoring, genomics, and value-based care, traditional training models are proving insufficient. Outsourced partners bring agility, regulatory insight, and instructional design expertise to bridge this gap efficiently. As a result, the U.S. healthcare training and education services outsourcing market is positioned for robust growth across all segments in the years to come.

Digital Learning Dominance: Widespread adoption of Learning Management Systems (LMS), microlearning, and simulation-based virtual training is redefining delivery methods.

Compliance-Driven Training Demand: Outsourcing of HIPAA, OSHA, FDA, and GxP compliance training has become standard among life sciences organizations.

Customized Clinical Education Modules: Tailored clinical training programs designed for specific therapeutic areas and device categories are increasingly outsourced.

Soft Skills and Leadership Development Growth: Training in communication, empathy, and patient-centered care is gaining importance in holistic health workforce development.

Integration of AI and Analytics: AI-based adaptive learning and analytics-powered performance evaluations are being integrated into outsourced platforms.

Expansion of Assessment and Credentialing Services: Outsourced competency evaluations, certification tracking, and continuous professional development (CPD) solutions are expanding.

Increased Outsourcing Among Mid-sized and Small Companies: Cost-saving and scalability benefits are driving adoption among smaller biotech and medtech firms.

| Report Coverage | Details |

| Market Size in 2024 | USD 903.17 Million |

| Market Size by 2033 | USD 1,279.94 Million |

| Growth Rate From 2024 to 2033 | CAGR of 3.95% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Delivery Mode, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Parexel International Corporation;, Thermo Fisher Scientific, Inc.; IQVIA; Medpace; LabCorp; Charles River Laboratories; ICON plc.; Syneos Health; Lonza; Catalent Inc. |

Workforce Shortages and Rapid Skill Evolution in the Healthcare Sector

The leading driver for the U.S. healthcare training and education outsourcing market is the acute workforce shortage and rapidly evolving skill requirements across healthcare and life sciences. According to the U.S. Bureau of Labor Statistics, over 2.6 million new healthcare jobs are expected to be added between 2020 and 2030. Simultaneously, staff turnover and burnout—particularly among nurses, allied health professionals, and medical technicians are rising at unprecedented rates.

Moreover, emerging roles in data science, digital health tools, AI diagnostics, and remote care demand new competencies that traditional curricula do not address comprehensively. In this context, outsourcing partners offer healthcare organizations the ability to design and deliver up-to-date, evidence-based, and modular learning pathways at scale. Whether it is onboarding new nurses in critical care or training sales reps on complex medical devices, external providers ensure consistency, quality, and speed—making them indispensable in the ongoing workforce transformation.

Data Security and Confidentiality Risks in Outsourced Training Systems

A key restraint in the outsourcing of healthcare training and education services is the risk of data breaches and compliance issues, especially when training systems involve access to sensitive patient data, proprietary technologies, or internal protocols. Online and hybrid training models often require integration with hospital information systems (HIS), electronic health records (EHRs), or internal compliance systems.

If not properly managed, these integrations pose cybersecurity risks, especially in areas such as credentialing, patient simulation software, or device operation training. Additionally, outsourcing partners may lack complete familiarity with organizational culture, leading to content misalignment. Regulatory agencies including HIPAA, FDA, and state boards enforce strict data usage rules, and violations even accidental can result in penalties. Hence, organizations are cautious in selecting vendors with robust data governance and compliance expertise.

Expansion of Training-as-a-Service (TaaS) Models for Digital Health Transformation

As healthcare shifts toward digitization, the rise of Training-as-a-Service (TaaS) platforms presents a major opportunity. These are modular, subscription-based education systems that allow healthcare organizations to access dynamic and updated training content on-demand. From training nurses on telehealth etiquette to educating pharmacists on AI-based drug interaction tools, TaaS providers offer scalable and responsive learning ecosystems.

In addition, healthcare software vendors are increasingly outsourcing the training of hospital staff on EMR systems, clinical decision support tools, and remote monitoring devices. As new technologies are deployed, outsourced education providers are bridging the adoption gap, enabling smoother digital transformation. Companies that integrate instructional design with clinical informatics and adult learning psychology are expected to dominate this space.

Training and development remains the core offering and the largest segment in the U.S. healthcare training and education services outsourcing market. This includes technical training (such as surgical device use), compliance education (like HIPAA updates), clinical upskilling (new care protocols), and soft skills development (communication and leadership). Hospitals, medtech companies, and biotech firms frequently outsource these services to ensure their staff are certified, audit-ready, and aligned with best practices.

Within this segment, clinical training is increasingly sought after as care models evolve. For example, companies now outsource training on value-based care models, telehealth procedures, and chronic disease management. Soft skills training especially in empathy, patient engagement, and collaboration—is also on the rise due to patient-centered care mandates. Compliance training, meanwhile, is often required annually, creating recurring demand for LMS-driven solutions.

Assessment and evaluation services are the fastest-growing sub-segment. Organizations are outsourcing competency tests, licensing prep modules, and performance assessments. With the help of analytics, providers can now tailor feedback and recommend personalized learning paths, aligning with continuing education and credentialing requirements.

Online training holds the lion’s share in the delivery mode segment, reflecting a broader shift to eLearning. Web-based modules, mobile learning apps, virtual simulations, and video-based microlearning tools are standard across outsourced training portfolios. Online platforms offer healthcare professionals the flexibility to learn at their pace while reducing logistical overhead. During the pandemic, online training became essential and is now the default mode in most healthcare organizations.

That said, offline training, while declining in proportion, is still critical for hands-on learning—particularly in clinical skills, surgical simulations, and device handling. Blended learning (online + onsite) models are gaining traction, especially for onboarding programs and leadership development. For example, a nurse may complete online modules on infection control before attending a hands-on lab simulation session.

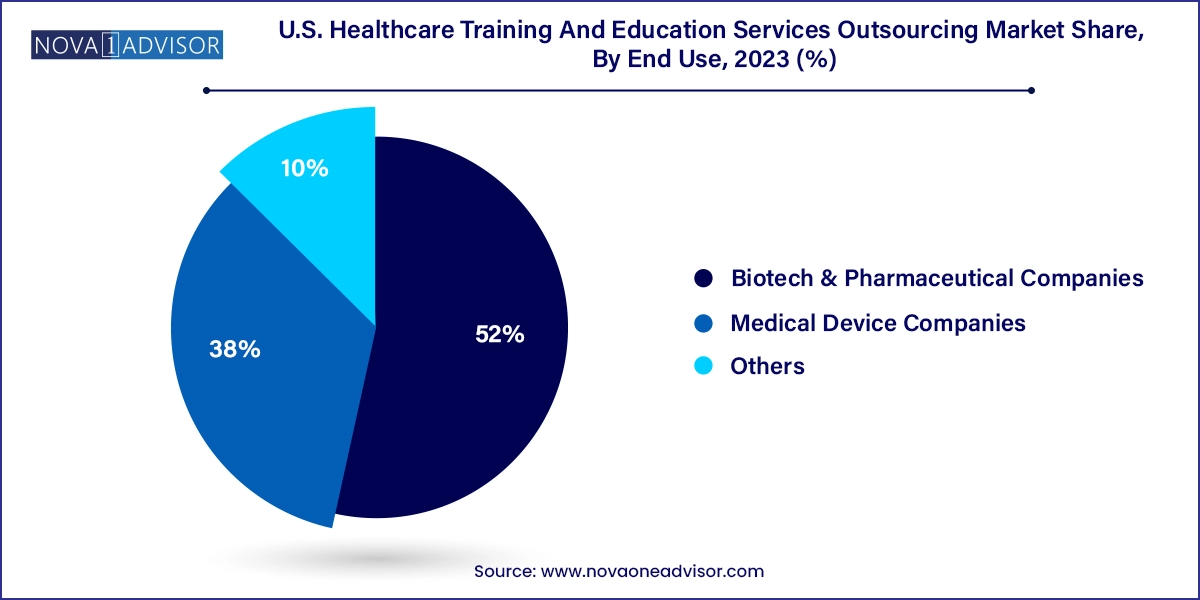

Biotech and pharmaceutical companies represent the largest end-use segment, driven by the constant need to train R&D teams, sales reps, and regulatory staff. These companies require product-specific training during clinical trial phases, as well as post-marketing compliance modules. Outsourcing training allows them to manage large geographic workforces with diverse educational needs. Product launch readiness, FDA audit preparedness, and cross-border compliance training are common deliverables from vendors.

Medical device companies are the fastest-growing end-use category. As devices become more technologically complex—incorporating AI, software, and digital connectivity—training becomes essential for both internal teams and external clinical users. Device manufacturers are increasingly outsourcing instructional design, simulation development, and user training videos to specialized providers. Many are also launching accredited training programs to support hospitals using their systems, creating a competitive edge.

Across the United States, the demand for outsourced healthcare training is growing uniformly but varies by healthcare concentration, regulatory complexity, and regional workforce gaps:

Northeast: Home to academic medical centers and pharmaceutical hubs like Boston and New York, the Northeast shows high outsourcing levels for clinical research training, leadership development, and compliance modules for international pharma companies.

Midwest: Known for its health systems and medtech companies (e.g., in Minnesota and Illinois), the Midwest is experiencing a surge in medical device training outsourcing.

South: With a mix of urban centers and rural areas, the South relies heavily on online and hybrid training models to address care delivery disparities. Growth is driven by federal grants and private insurers supporting telehealth training and community health workforce development.

West: California leads in digital health innovation. Companies and hospitals in the region outsource IT system training, EMR onboarding, and innovation adoption education at scale. Silicon Valley firms are major consumers of outsourced consulting and education in healthcare informatics and AI integration.

February 2025 – Relias LLC, a major U.S. healthcare education firm, announced its expanded collaboration with a California-based hospital network to deliver AI-powered adaptive learning programs for nursing staff.

January 2025 – HealthStream launched a new microlearning-based compliance training library tailored for outpatient care providers, targeting small and mid-sized clinics across the South and Midwest.

November 2024 – GP Strategies Corporation unveiled a digital simulation lab training platform for medical device firms, allowing for real-time equipment handling training in a virtual environment.

October 2024 – UL Solutions partnered with a biotech company to co-develop a GxP regulatory training suite for clinical research teams across three U.S. sites.

August 2024 – MedTrainer Inc. released its latest mobile-first LMS for physician practices and ambulatory care centers, featuring multi-language compliance modules.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare training and education services outsourcing market

Service

Delivery Mode

End Use

Regional