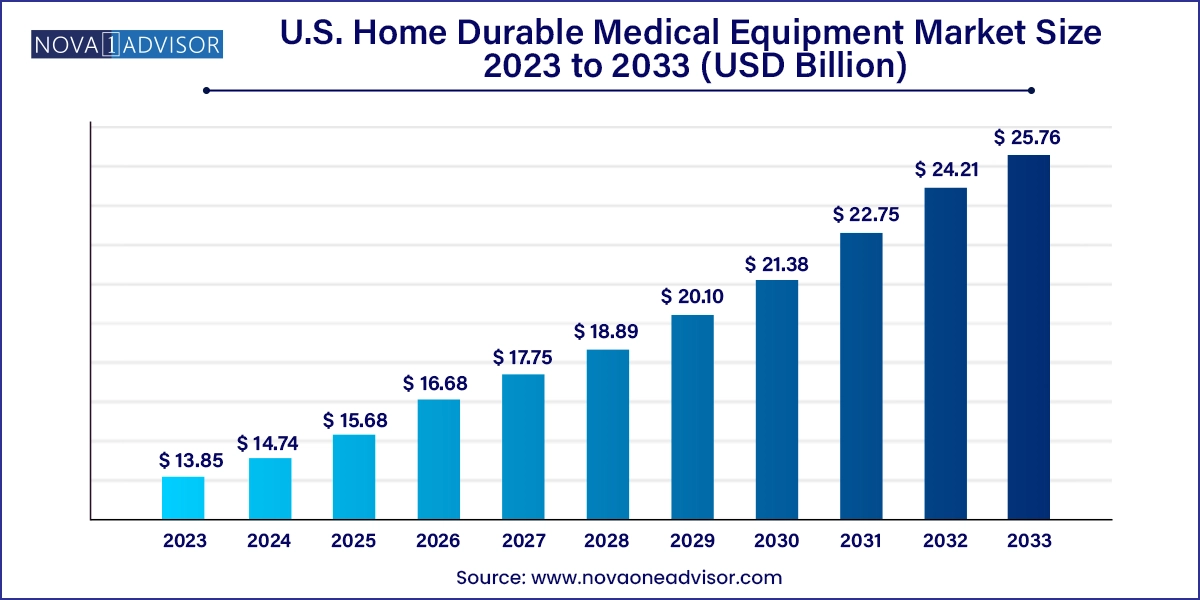

The U.S. home durable medical equipment market size was exhibited at USD 13.85 billion in 2023 and is projected to hit around USD 25.76 billion by 2033, growing at a CAGR of 6.4% during the forecast period 2024 to 2033.

The U.S. Home Durable Medical Equipment (DME) market is a critical component of the country’s evolving healthcare landscape, enabling long-term treatment, rehabilitation, and comfort management for patients within the comfort of their homes. Durable medical equipment refers to devices and supplies that are intended for repeated use, prescribed by healthcare professionals, and essential for therapeutic or diagnostic purposes. These include products such as mobility aids (wheelchairs, walkers), respiratory devices (CPAP machines, oxygen concentrators), hospital beds, patient lifts, monitoring devices, and infusion pumps, among others.

With the growing shift from institutional to home-based care, driven by rising chronic disease prevalence, an aging population, rising healthcare costs, and policy incentives favoring value-based care, the demand for home DME is surging in the U.S. The Centers for Medicare & Medicaid Services (CMS) has increasingly encouraged home healthcare utilization to reduce hospitalization costs, which in turn has bolstered coverage for many types of DME products under Medicare Part B.

Additionally, technological advancements are reshaping the DME market. Many modern DME products are now smart, portable, and user-friendly, integrating remote monitoring and digital connectivity features to support telehealth. This makes them ideal for chronic condition management, post-operative care, and geriatric care. Amid these drivers, the market is witnessing increased investment from startups, private equity firms, and large medical device companies looking to expand their presence in the homecare sector. Collectively, the U.S. home DME market is poised for significant growth and transformation in the next decade.

Rising Demand for Home-Based Chronic Disease Management: Conditions such as COPD, diabetes, and arthritis are fueling sustained demand for at-home therapeutic and mobility solutions.

Growth in Remote Monitoring Integration: Devices like glucose monitors and oxygen concentrators are being integrated with telehealth platforms for real-time patient tracking.

Increased Reimbursement Flexibility: CMS reforms and private payer expansions are easing access to reimbursable DME, especially for post-acute and geriatric care.

Surge in Portable and Compact DME Equipment: Lighter, foldable, and more ergonomic devices are gaining popularity for convenience and mobility.

Expansion of Direct-to-Consumer (DTC) Models: Manufacturers are reaching patients through e-commerce platforms with bundled packages and subscription services.

Adoption of Smart Beds and Patient Monitoring Devices: IoT-based beds, fall alerts, and sensor-equipped equipment are improving patient safety and caregiver efficiency.

Focus on Inclusive and Adaptive Equipment Design: Customization for obese, pediatric, or physically disabled patients is expanding the utility and inclusivity of DME.

Rising Use of Rental and Lease-Based Models: Cost-conscious patients and temporary users are increasingly opting for rental services instead of outright purchases.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.74 Billion |

| Market Size by 2033 | USD 25.76 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Compass Health Brands; Invacare Corporation; Rotech Healthcare Inc.; Medline Industries, LP; Masimo; ResMed |

The strongest driver of the U.S. home DME market is the growing aging population and their strong preference for aging in place. According to the U.S. Census Bureau, by 2034, Americans aged 65 and older will outnumber those under 18 for the first time in history. With this demographic shift comes a surge in mobility issues, respiratory conditions, post-surgical recovery needs, and chronic illnesses like arthritis, cardiovascular disease, and diabetes.

Most elderly individuals prefer to remain in their homes rather than move into long-term care facilities. This has led to rising demand for home-modified equipment such as stairlifts, home-use hospital beds, CPAP machines, and walkers. Durable medical equipment makes independent living more viable and dignified for these individuals, while also reducing hospital readmission rates. Moreover, family caregivers and home health aides are more empowered to manage care when equipped with appropriate DME tools. As the baby boomer generation continues to age, demand for home DME is projected to rise exponentially.

Despite strong growth potential, the U.S. home DME market is restrained by high upfront costs and uneven insurance coverage, particularly for advanced or non-standard equipment. Devices such as powered wheelchairs, bariatric hospital beds, and specialty breathing equipment can cost several thousand dollars. While Medicare and Medicaid offer reimbursement for many devices, the process often requires strict eligibility criteria, documentation, and prior authorizations—a deterrent for patients in urgent need.

Furthermore, many DME items used for convenience, lifestyle improvement, or partial support (such as customized grab bars, upgraded wheelchairs, or smart monitoring systems) are not fully covered under Medicare. This creates an out-of-pocket burden for patients and families, especially among middle-income households not eligible for financial aid. The cost barrier is further compounded by frequent maintenance, repairs, and lack of standardized pricing across providers. To maximize access, regulatory reforms and innovative financing models will be key to overcoming these affordability gaps.

A significant opportunity for the U.S. home DME market lies in technological innovation, particularly the integration of DME with remote patient monitoring (RPM) and telehealth services. As healthcare delivery increasingly shifts to the home, the need for connected, data-driven, and responsive equipment is growing. Devices that can track patient usage, monitor vitals, and send alerts to clinicians are redefining chronic disease management and recovery.

Examples include smart oxygen concentrators, connected infusion pumps, wireless blood pressure monitors, and CPAP machines with sleep tracking capabilities. This convergence supports timely interventions, personalized care, and improved outcomes—all while reducing healthcare costs. Additionally, these innovations create a compelling value proposition for payers and providers looking to adopt value-based care models. As reimbursement expands to include RPM and digital health under Medicare and private insurers, the growth of smart DME is poised to reshape the future of at-home care.

Across the U.S., adoption of home DME varies by regional healthcare infrastructure, demographic patterns, income levels, and prevalence of chronic conditions. The Northeast region leads in adoption, supported by a dense population of aging residents, high per capita healthcare spending, and robust post-acute care networks. States like New York, Massachusetts, and Pennsylvania have seen significant growth in home health services, backed by comprehensive Medicare Advantage penetration and strong provider networks. Large urban areas also support DME retail stores and service providers, enhancing accessibility.

Conversely, the Southwest region, including states like Texas and Arizona, is witnessing the fastest growth in home DME utilization. This growth is driven by population inflows, a rise in senior retirement communities, and higher rates of obesity and chronic disease. Texas, in particular, has seen strong expansion in home health agencies, supported by flexible Medicaid plans and innovation in telehealth. The combination of growing demand and favorable regulatory ecosystems makes the Southwest a key hotspot for future DME expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. home durable medical equipment market

Regional