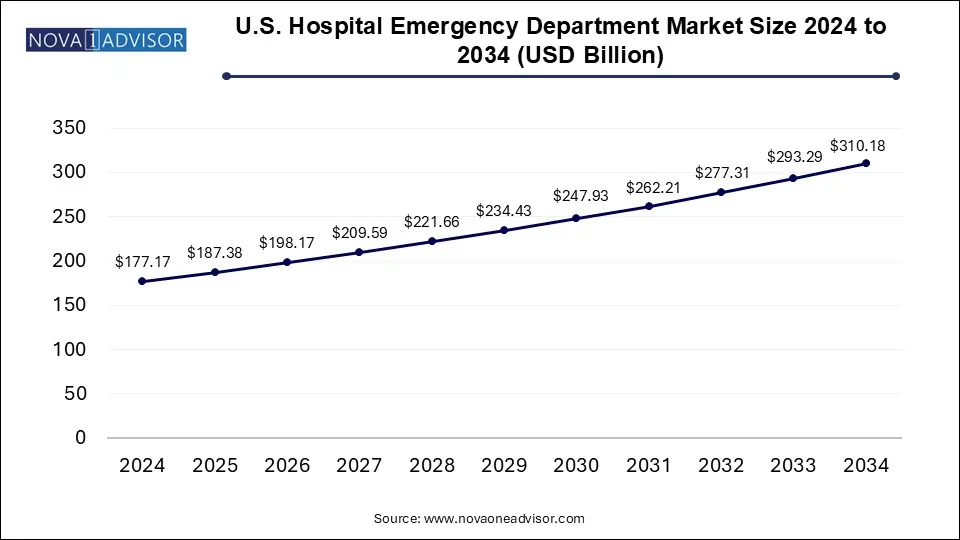

The U.S. hospital emergency department market size was exhibited at USD 177.17 billion in 2024 and is projected to hit around USD 310.18 billion by 2034, growing at a CAGR of 5.76% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 187.38 Billion |

| Market Size by 2034 | USD 310.18 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.76% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Insurance type, Condition |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Parkland Health; Lakeland Regional Health; St. Joseph’s Health; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; USA Health; Baptist Health South Florida; Montefiore Medical Center; LAC+USC Medical Center |

The major factor driving the growth of this market includes a high number of visits to hospital Emergency Departments (EDs) and the availability of insurance. According to the CDC, in 2020, there were approximately 131 million ED visits in the U.S. annually. Approximately 19% of adults and 4.7% of children visited EDs in 2020. Around 60% of the emergency care was provided during non-business hours, making the non-availability of less expensive options an important factor contributing to the high number of ED visits.

Hospital EDs provide treatment for various indications, such as cardiology, neurology, gastroenterology, infectious diseases, and psychiatry. Increasing the incidence of these conditions is rising the number of ED visits. Furthermore, the growing geriatric population in the U.S. is favoring the market growth, as the elderly often require urgent medical interventions. Many hospitals are adopting advanced technologies and tools, such as Artificial Intelligence (AI), to provide improved diagnosis and expedite routine procedures, such as devising patient treatment plans and prescriptions. The COVID-19 pandemic increased the adoption of telehealth in hospitals to multiple folds.

The use of telehealth is helping the hospital to reduce waiting time and overcrowding in the EDs. Medicare and Medicaid offer insurance for emergency health services. According to the CDC, over 40% of ED visits by adults over 65 are by ambulance, covered under Medicare Part B. Part B Medicare also covers air ambulance trips by helicopter or airplane if care is necessary. Medicare Part A covers a portion of the cost if the patient enters the emergency room and is admitted as an inpatient, while Medicare Part B covers the portion of the cost if the patient receives care from a doctor but is not admitted as an inpatient.

Based on the insurance type, the market is further bifurcated into Medicare & Medicaid and private & others. The private & others segment dominated the market with a revenue share of 46.4% in 2024 and is expected to witness the fastest growth rate over the forecast period. This is owing to the increasing number of commercial insurance providers and rising disposable income levels. For instance, a study conducted by a researcher at the University of North Carolina found that from 1996 to 2015, private insurance providers paid more for ED visits than Medicare or Medicaid. Some private payers use value-based care strategies to reduce ED visits and hospitalizations rather than cutting coverage. Humana, for example, used value-based care models in Medicare Advantage plans, which resulted in fewer ED visits.

Preventive screenings, collaboration with care teams, and effective management of chronic illnesses are all components of a value-based care model that can help reduce the number of emergency room visits. This is expected to boost the growth of the private player’s segment. The Medicare and Medicaid segment held a significant share of the market for U.S. hospital emergency departments. This can be attributed to the high number of beneficiaries covered under Medicare. According to CMS, it is estimated that around 61.5 million Americans are enrolled in Medicare in 2021. Out of these, 3.8 million were new enrollees. These total beneficiaries include 49% of people between the ages 65 and 74, followed by 26% between 84, 14% under age 65, and 11% are 85 or older.

Based on the condition, the market is segmented into traumatic, infectious, gastrointestinal, psychiatric, cardiac, neurologic, and others. The infectious conditions segment dominated the market with the largest revenue share of 38.0% in 2024. This can be attributed to increasing ER visits during flu season. According to the CDC National Hospital Ambulatory Medical Care Survey, in 2018, fever and cough accounted for 5,837,000 and 4,955,000 emergency visits in the U.S. The segment is projected to witness the highest CAGR of 6.18% during the forecast period owing to the high transmissibility of infectious diseases.

Significant increases in the number of motor vehicle accidents and increasing incidence of spinal cord injury, TBI, unintentional falls, and concussion are expected to drive the growth of the traumatic conditions segment. Traumatic Brain Injury (TBI) is a major cause of disability and death in the U.S. As per the National Hospital Ambulatory Medical Care Survey, there were 0.3 million ED visits due to accidents and 35 million ED visits due to injury in the U.S. This is likely to favor segment growth.

On the other hand, gastrointestinal and cardiac conditions segments are expected to grow at a moderate rate in the market for U.S. hospital emergency departments during the forecast period. According to the Nationwide Emergency Department Sample, in 2018, a total of 7.07 million and 3.6 million ED visits took place due to diseases of the digestive and circulatory systems, respectively. The U.S.'s rising burden of digestive and cardiac diseases will likely favor both segments' growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. hospital emergency department market

By Insurance Type

By Condition

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.2. Estimates and Forecast Timeline

1.3. Research Methodology

1.3.1. Information procurement

1.3.2. Purchased Database

1.3.3. Internal Database

1.3.4. Secondary Sources

1.3.5. Primary Research

1.3.6. Details of Primary Research

1.4. Information or Data Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Validation

1.5.1. Volume Price Analysis

1.6. List of Secondary Sources

1.7. List of Abbreviations

1.8. Research Objectives

1.8.1. Objective - 1

1.8.2. Objective - 2

1.8.3. Objective - 3

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. High number of emergency department visits

3.2.1.2. Availability of insurance

3.2.1.3. Growing initiatives by hospitals

3.2.2. Market Restraint Analysis

3.2.2.1. Overcrowded emergency departments with a prolonged waiting period

3.2.2.2. Rising preference for convenient care

3.2.3. Industry Challenges

3.2.3.1. Possible harm to patients due to lack of medical history

3.2.3.2. Duplicate testing costs and unnecessary testing costs

3.2.3.3. Staffing issues

3.2.4. Industry Opportunities

3.2.4.1. Increasing use of telehealth for emergency departments

3.3. U.S. Hospital Emergency Department Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and social landscape

3.3.2.3. Technology landscape

3.3.2.4. Legal landscape

3.3.2.5. Technology landscape

3.4. Regulatory Framework & Reimbursement Scenario

3.4.1. Regulatory Framework

3.4.2. Reimbursement Scenario

Chapter 4. U.S. Hospital Emergency Department Market: Insurance Type Estimates & Trend Analysis

4.1. Segment Definitions

4.2. U.S. Hospital Emergency Department Market: Insurance Type Segment Dashboard

4.3. U.S. Hospital Emergency Department Market: Insurance Type Movement & Market Share Analysis

4.4. Medicare & Medicaid

4.4.1. Medicare & Medicaid Market Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Private & Others

4.5.1. Private & Others Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. U.S. Hospital Emergency Department Market: Condition Estimates & Trend Analysis

5.1. Segment Definitions

5.2. U.S. Hospital Emergency Department Market: Condition Segment Dashboard

5.3. U.S. Hospital Emergency Department Market: Condition Movement & Market Share Analysis

5.4. Traumatic

5.4.1. Traumatic Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Infectious

5.6. Gastrointestinal

5.6.1. Gastrointestinal Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Psychiatric

5.7.1. Psychiatric Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Cardiac

5.8.1. Cardiac Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Neurologic

5.9.1. Neurologic Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Others

5.10.1. Others Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Competitive Landscape

6.1. Company Profiles

6.1.1. Parkland Health

6.1.1.1. Company overview

6.1.1.2. Financial performance

6.1.1.3. Service benchmarking

6.1.1.4. Strategic initiatives

6.1.2. Lakeland Regional Health

6.1.2.1. Company overview

6.1.2.2. Financial performance

6.1.2.3. Service benchmarking

6.1.3. St. Joseph's Health

6.1.3.1. Company overview

6.1.3.2. Financial performance

6.1.3.3. Service benchmarking

6.1.3.4. Strategic initiatives

6.1.4. Natchitoches Regional Medical Center

6.1.4.1. Company overview

6.1.4.2. Financial performance

6.1.4.3. Service benchmarking

6.1.4.4. Strategic initiatives

6.1.5. Schoolcraft Memorial Hospital

6.1.5.1. Company overview

6.1.5.2. Financial performance

6.1.5.3. Service benchmarking

6.1.6. Clarion Hospital

6.1.6.1. Company overview

6.1.6.2. Service benchmarking

6.1.6.3. Strategic initiatives

6.1.7. USA Health

6.1.7.1. Company overview

6.1.7.2. Financial performance

6.1.7.3. Service benchmarking

6.1.8. Baptist Health South Florida

6.1.8.1. Company overview

6.1.8.2. Financial performance

6.1.8.3. Service benchmarking

6.1.9. Montefiore Medical Center

6.1.9.1. Company overview

6.1.9.2. Financial performance

6.1.9.3. Service benchmarking

6.1.9.4. Strategic initiatives

6.1.10. LAC+USC Medical Center

6.1.10.1. Company overview

6.1.10.2. Service benchmarking

6.2. Company Categorization

6.3. Company Market Position Analysis

6.4. Strategy Mapping

Chapter 7. Recommendations/Key Market Insights