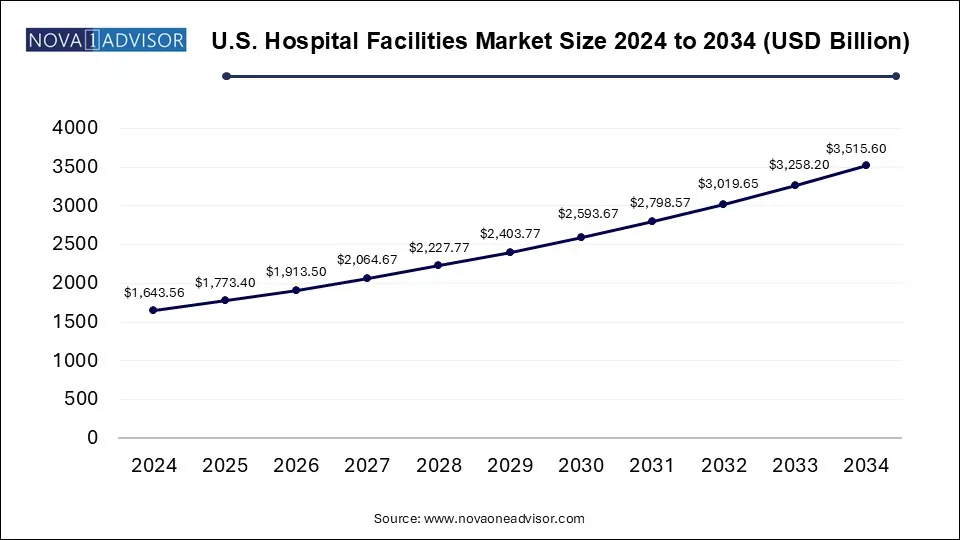

The U.S. hospital facilities market size was exhibited at USD 1643.56 billion in 2024 and is projected to hit around USD 3515.6 billion by 2034, growing at a CAGR of 7.9% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1773.4 Billion |

| Market Size by 2034 | USD 3515.6 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Patient Service, Facility Type, Service Type, Bed Size |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital |

The growing impetus for better patient care and the entry of novel healthcare technology is expected to increase the demand for well-equipped hospitals in the coming years. According to the CDC, six out of ten adults in the U.S. have a chronic disease, such as cancer, stroke, heart disease, diabetes, and others, with four in ten adults having two or more chronic conditions. These and other non-communicable chronic illnesses are the foremost causes of disability and death in the U.S. They are also a leading driver of healthcare costs and are expected to drive the market during the forecast period.

The demand and supply gap in the U.S. healthcare system is growing rapidly. This is mainly due to the growing number of patients and the limited resources available to provide the necessary care. Furthermore, an increase in the average life expectancy of citizens has created a large geriatric population in the country, which requires special medical care, creating a strain on the medical system.

The current limited number of healthcare providers and facilities cannot fulfill patient requirements, and thus the demand for healthcare facilities is growing continuously in the U.S. According to Health System Tracker, the U.S. government spent USD 4.3 trillion on national healthcare in 2021. The country spent 19.7% of its GDP on healthcare in 2020. Moreover, health spending increased by 2.7% from 2020 to 2021, which was much slower than the 10.3% increase witnessed from 2019 to 2020.

As the patient population keeps growing, the country’s healthcare expenditure is expected to grow rapidly, in turn favoring overall market growth. Over the years, there has been a significant rise in the number of surgical procedures performed in the U.S. According to an NCBI study, approximately 40 to 50 million surgical procedures are performed in the country every year.

In addition, according to the National Center for Health Statistics, over 40 million inpatient surgical procedures were performed in the U.S. in 2000, which was closely followed by 31.5 million outpatient surgeries. The procedures that were performed most frequently included surgeries of the digestive system, musculoskeletal system, cardiovascular system, and ophthalmology.

Such factors are expected to drive the demand for hospital services in the U.S. due to the availability of specialized medical staff and growing awareness about their effectiveness in healthcare settings. Furthermore, technological advancements such as AI, electronic health records, mHealth, telemedicine/telehealth, sensors & wearable technology, wireless communication systems, remote monitoring, robotics, and other notable innovations are expected to drive the market during the forecast period. For instance, Northwestern Memorial Hospital and Caption Health announced a collaboration in October 2020 to bring new AI-powered ultrasound equipment into clinical practice.

The outpatient services segment dominated the market with a share of around 51% in 2024 and is additionally poised to be the fastest-growing segment with a CAGR of 9.0% over the forecast period. The development of new technologies, such as telemedicine, telemonitoring, and diagnostic techniques has led to shorter patient stays, as physicians can provide treatment remotely, which, in turn, reduces overhead costs and patient fees.

Furthermore, there has been a gradual shift to outpatient or daycare surgeries among patients in recent years. Minimally invasive surgeries have made it possible for daycare surgeries to flourish. This is expected to boost the outpatient service segment’s growth. In terms of patient services, the U.S. hospital facilities market is segmented into outpatient services and inpatient services.

Meanwhile, the inpatient services segment is expected to expand owing to the rising number of hospitalizations and the high cost of care for inpatients. According to the Centers for Disease Control and Prevention (CDC) in 2024, septicemia, heart failure, osteoarthritis, pneumonia, and diabetes with complications were the top five reasons for inpatient stays in the U.S.

The inpatient services segment is projected to have moderate growth during the forecast period. Inpatient services are the primary source of revenue for hospitals. However, due to the introduction of novel techniques, such as better diagnostics and interventional surgeries, the recovery time for patients is being reduced. Thus, the average time for an inpatient is reduced, which, in turn, is expected to decrease the share of the inpatient services segment in the near future.

The cardiovascular segment dominated the market, accounting for a share of around 20% in 2024. The segment is further expected to dominate the market over the forecast period. Growing adoption of sedentary lifestyle practices is leading to a rise in the incidence of obesity in the U.S., thus increasing the risk of heart diseases. Thus, an increasing number of patients suffering from CVDs is expected to propel segment growth.

The cancer care segment is also expected to account for a significant market share over the forecast period. Cancer is the second leading cause of death in the U.S. after CVDs. According to the HCUP, there were about 2.8 million cancer-related hospitalizations in 2017. Out of these, around 1.0 million hospitalizations had cancer as a principal diagnosis and 1.7 million had cancer as a secondary diagnosis.

According to the National Center for Biotechnology Information, in 2024, 609,360 cancer deaths and over 1.9 million new cancer cases were projected to occur in the U.S. which also includes 350 deaths approximately due to lung cancer, the leading cause of cancer deaths. The increasing costs of cancer treatment, the rising number of specialized oncology departments & oncologists, and the supportive reimbursement framework are among the key factors expected to propel segment growth.

Based on service type, the market is segmented into acute care; cardiovascular; cancer care; neurorehabilitation & psychiatry services; pathology lab, diagnostic, and imaging; obstetrics & gynecology; and others. The acute care segment is expected to witness the fastest CAGR of 8.78% from 2023 to 2030, owing to the rising demand for primary care services and the increasing prevalence of acute infections. For instance, as per a survey distributed by the CDC, a total of 523,000 emergency department visits for infectious and parasitic diseases led to hospital admissions in 2018.

The public/community hospitals segment dominated the market with a share of over 53.0% in 2024. Community hospitals hold the highest number of patient beds and offer a wide variety of care areas through different services. They are non-profit organizations meant for public services and are supported by philanthropic groups, businesses, and crowd-funded societies. On the basis of facility type, the market is further divided into public/community hospitals, state-owned & federal hospitals, and private hospitals.

The state-owned & federal hospitals segment held the second-largest share of the market. State-owned hospitals primarily aim to target patients who require acute care, including infection control and accident/trauma cases. Federal hospitals play an essential role in providing health services to patients having limited access to quality care. According to the AHA, in 2021, there were 206 federal hospitals in the U.S.

Increasing access to public healthcare is expected to drive segment expansion. Dr. Reddy's Laboratories Ltd. launched the Regadenoson injection, a substance used in imaging the heart muscle to check blood flow and approved by the U.S. Food and Drug Administration, in the U.S. market in 2023. The injection is a pharmacologic stress agent for radionuclide myocardial perfusion imaging (MPI) in patients unable to undergo adequate exercise stress.

On the other hand, the private hospital segment is anticipated to witness lucrative expansion with a CAGR of 8.7% over the forecast period. Private hospitals have gradually advanced their technology to better serve patients in need of critical care, such as cancer patients. The growing number of private hospitals and consolidation of healthcare facilities are expected to bolster the growth of the segment.

Based on bed size, the market is segmented into 0-99, 100-199, 200-299, and 300-more. The 0-99 segment dominated the market in 2024 with a revenue share of 53.2%. This segment comprises small hospitals that primarily serve rural or remote areas with low population density. These hospitals play an important role in providing access to basic healthcare services to communities although some hospitals in this segment fulfill specialized needs of the services based on the local population. Their primary focus is on delivering essential medical care.

The 100-199 segment is anticipated to register the fastest CAGR of 8.13% over the forecast period. These hospitals are better equipped to offer a wider range of services and specialties compared to the smaller facilities. With a higher bed capacity, they can accommodate more patients and address a broader spectrum of medical needs.

The 399 and more segment is anticipated to witness a lucrative CAGR over the forecast period. They are equipped with modern technology, specialized medical staff, and research capabilities, driving advancements in medical science. These are the factors attributed to the growth of this segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. hospital facilities market

By Patient Service

By Facility Type

By Service Type

By Bed Size

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Patient service

1.1.2. Facility type

1.1.3. Service type

1.1.4. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Patient service

2.2.2. Facility type

2.2.3. Service type

2.3. Competitive Insights

Chapter 3. U.S. Hospital Facilities Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. U.S. Hospital Facilities Market Analysis Tools

3.4.1. Industry Analysis - Porter’s Five Forces

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. U.S. Hospital Facilities Market: Patient Service & Trend Analysis

4.1. U.S. Hospital Facilities Market: Key Takeaways

4.2. U.S. Hospital Facilities Market: Patient Service Movement & Market Share Analysis, 2022 & 2030

4.3. Inpatient Services

4.3.1. Inpatient services market estimates and forecasts, 2018 to 2030 (USD Billion)

4.4. Outpatient Services

4.4.1. Outpatient services market estimates and forecasts, 2018 to 2030 (USD Billion)

Chapter 5. U.S. Hospital Facilities Market: Facility Type & Trend Analysis

5.1. U.S. Hospital Facilities Market: Key Takeaways

5.2. U.S. Hospital Facilities Market: Facility Type Movement & Market Share Analysis, 2022 & 2030

5.3. Public/Community Hospitals

5.3.1. Public/Community Hospitals market estimates and forecasts, 2018 to 2030 (USD Billion)

5.4. State Owned & Federal Hospitals

5.4.1. State owned & federal hospitals market estimates and forecasts, 2018 to 2030 (USD Billion)

5.5. Private Hospitals

5.5.1. Private hospitals market estimates and forecasts, 2018 to 2030 (USD Billion)

Chapter 6. U.S. Hospital Facilities Market: Service Type & Trend Analysis

6.1. U.S. Hospital Facilities Market: Key Takeaways

6.2. U.S. Hospital Facilities Market: Service Type Movement & Market Share Analysis, 2022 & 2030

6.3. Acute Care

6.3.1. Acute care market estimates and forecasts, 2018 to 2030 (USD Billion)

6.4. Cardiovascular

6.4.1. Cardiovascular market estimates and forecasts, 2018 to 2030 (USD Billion)

6.5. Cancer Care

6.5.1. Cancer care market estimates and forecasts, 2018 to 2030 (USD Billion)

6.6. Neurorehabilitation & Psychiatry Services

6.6.1. Neurorehabilitation & psychiatry services market estimates and forecasts, 2018 to 2030 (USD Billion)

6.7. Pathology Lab, Diagnostics, And Imaging

6.7.1. Pathology lab, diagnostics, and imaging market estimates and forecasts, 2018 to 2030 (USD Billion)

6.8. Obstetrics & Gynecology

6.8.1. Obstetrics & Gynecology market estimates and forecasts, 2018 to 2030 (USD Billion)

6.9. Others

6.9.1. Other market estimates and forecasts, 2018 to 2030 (USD Billion)

Chapter 7. U.S. Hospital Facilities Market: Bed Size Estimates & Trend Analysis

7.1. Segment Definitions

7.2. U.S. Hospital Facilities Market: Segment Dashboard

7.3. U.S. Hospital Facilities Market: Bed Size Movement & Market Share Analysis

7.4. 0-99

7.4.1. 0-99 Market, 2018 - 2030 (USD Billion)

7.5. 100-199

7.5.1. 100-199 Market, 2018 - 2030 (USD Billion)

7.6. 200-299

7.6.1. 200-299 Market, 2018 - 2030 (USD Billion)

7.7. 300-more

7.7.1. 300-more Market, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Market Participant Categorization

8.2.1. The Johns Hopkins Hospital

8.2.1.1. Company overview

8.2.1.2. Financial performance

8.2.1.3. Product benchmarking

8.2.1.4. Strategic initiatives

8.2.2. Mayo Clinic

8.2.2.1. Company overview

8.2.2.2. Financial performance

8.2.2.3. Product benchmarking

8.2.2.4. Strategic initiatives

8.2.3. Cleveland Clinic

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. Cedars-Sinai

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. Massachusetts General Hospital

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. UCSF HEALTH

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. NewYork-Presbyterian Hospital

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Brigham and Women's Hospital

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. Ronald Regan UCLA Medical Center

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. Northwestern Memorial Hospital

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives