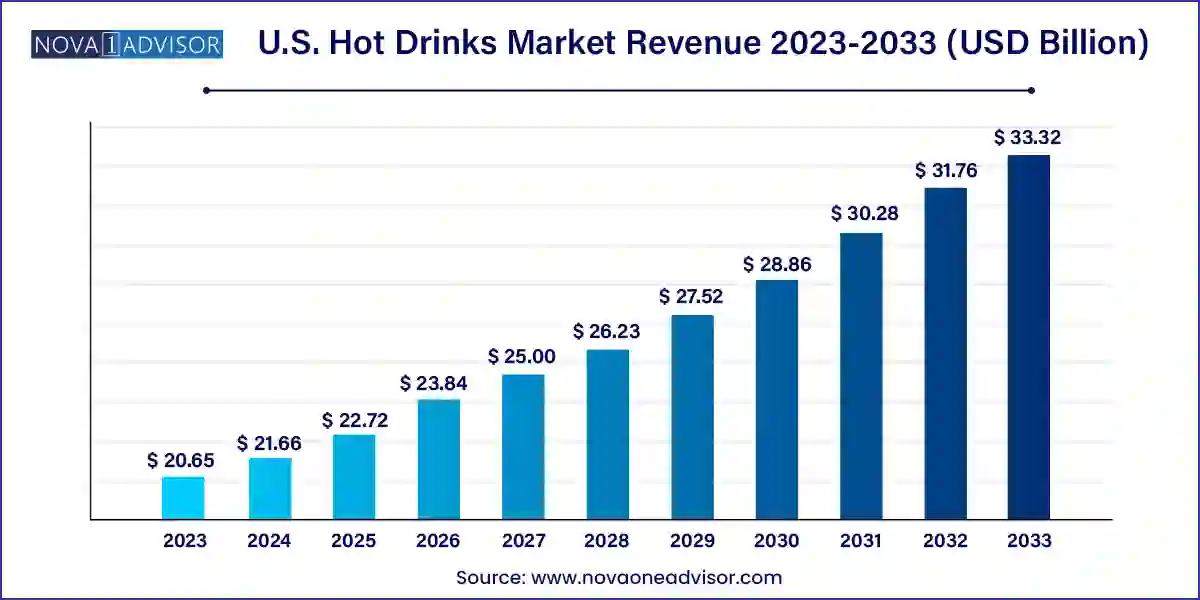

The U.S. hot drinks market size was exhibited at USD 20.65 billion in 2023 and is projected to hit around USD 33.32 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

The U.S. hot drinks market is an integral and culturally embedded segment of the broader food and beverage industry. Encompassing traditional beverages like coffee and tea, the market is supported by consistent consumer demand, seasonal preferences, and growing experimentation with ingredients, brewing methods, and serving formats. In 2024, the U.S. hot drinks market was valued at approximately USD 95 billion, with expectations to continue on a moderate but resilient growth trajectory through 2034.

Hot drinks in the U.S. are not merely consumables—they represent daily rituals, comfort, social connection, and increasingly, health-conscious choices. Coffee remains a mainstay, deeply ingrained in American lifestyle, from morning commutes to office breaks and specialty café visits. Meanwhile, tea consumption is steadily rising, driven by growing awareness around wellness, antioxidants, and alternative caffeine sources. Beyond these two pillars, emerging categories such as turmeric lattes, mushroom-infused hot drinks, and functional hot chocolate blends are gaining traction.

The market is characterized by a robust retail and out-of-home consumption network, including cafes, hotel chains, quick-service restaurants, and direct-to-consumer (DTC) subscription models. Major players such as Starbucks, Keurig Dr Pepper, and Nestlé dominate the landscape, but independent cafes, boutique roasters, and organic herbal tea startups are reshaping consumer expectations. Changing demographics, rising urbanization, and increasing demand for functional beverages are contributing to the diversification and modernization of the hot drinks market in the U.S.

Premiumization and Artisanal Offerings: Consumers are willing to pay more for premium beans, ethically sourced tea leaves, and small-batch brews that offer unique flavor experiences and transparency.

Functional Hot Drinks: The emergence of wellness-focused drinks—such as immunity-boosting herbal teas, collagen-infused lattes, and adaptogenic blends—is transforming the market.

Plant-Based and Dairy-Free Innovations: Demand for vegan and dairy-alternative creamers, including oat milk and almond milk, is shaping product development, especially in cafes and at-home kits.

Sustainable Packaging and Sourcing: Sustainability is influencing purchasing behavior, with increased interest in compostable pods, reusable filters, and ethically sourced coffee and tea.

Rise of Home Brewing Equipment: Post-pandemic habits have resulted in a surge in sales of home brewing machines, French presses, electric kettles, and temperature-controlled mugs.

Limited-Edition and Seasonal Flavors: Seasonal hot drinks like pumpkin spice lattes, peppermint mochas, and cinnamon teas continue to drive spikes in café and retail sales.

Herbal and Botanical Tea Popularity: Herbal and fruit-infused teas, especially chamomile, rooibos, and hibiscus, are experiencing growing demand due to perceived health benefits and caffeine-free appeal.

Direct-to-Consumer Channels and Subscriptions: Brands offering subscription-based delivery of curated coffee beans or tea blends are gaining popularity, creating consistent revenue streams and personalized experiences.

| Report Coverage | Details |

| Market Size in 2024 | USD 21.66 Billion |

| Market Size by 2033 | USD 33.32 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Starbucks Coffee Company, PEET'S COFFEE, Caribou Coffee, The Coffee Bean & Tea Leaf, Tim Hortons Inc., Dutch Bros Coffee, Dunn Brothers Coffee, Argo Tea, Baxter’s Coffee, Dunkin Donuts |

One of the strongest drivers for the U.S. hot drinks market is the deep integration of hot beverage consumption into daily routines, especially for coffee and tea. The average American consumes two to three cups of coffee per day, and while tea trails in volume, it is becoming increasingly associated with health, mindfulness, and lifestyle choices. Morning rituals, work breaks, evening wind-downs, and even social gatherings often revolve around a hot drink.

This cultural entrenchment ensures a consistent and predictable demand, enabling manufacturers and retailers to forecast with greater accuracy and confidence. Moreover, the comfort and emotional value associated with hot drinks have only intensified in uncertain times, like during the COVID-19 pandemic, when home coffee brewing surged. This habitual nature also makes consumers more receptive to upgrades, such as specialty beans, functional add-ons, or personalized brewing equipment—thereby boosting premium segment growth and repeat sales.

A pressing challenge in the U.S. hot drinks market is the escalating cost of key ingredients such as coffee beans and premium tea leaves, compounded by global supply chain disruptions. Coffee, which is heavily dependent on imports from regions like Brazil, Colombia, and Ethiopia, is particularly susceptible to climate-related crop failures, transportation delays, and international trade volatility. The fluctuation in global commodity prices can squeeze margins for both large companies and small roasters.

Similarly, premium tea segments that rely on organic or rare ingredients face increased costs related to certification, sourcing, and importation. Add to this the logistics hurdles in a post-pandemic global economy—rising fuel prices, labor shortages, and port congestion—and the supply chain becomes both expensive and unpredictable. These factors force brands to either raise prices (risking demand drops) or absorb costs (impacting profitability), both of which present long-term strategic dilemmas.

One of the most promising opportunities in the U.S. hot drinks market lies in the rise of functional beverages—those that offer added health benefits beyond basic nutrition. As consumers become more health-conscious, they are gravitating toward drinks that support immunity, digestion, sleep, cognitive function, and stress relief. This has led to a surge in demand for herbal teas like chamomile and ashwagandha blends, as well as functional coffee enriched with collagen, MCT oils, or nootropics.

Startups and legacy brands alike are capitalizing on this trend. For example, Four Sigmatic offers mushroom-infused coffee known for adaptogenic properties, while brands like Yogi and Traditional Medicinals have long dominated the wellness tea niche. The success of these products indicates a broadening definition of hot drinks—not just as comforting beverages, but as part of a functional health routine. This opportunity is particularly potent when combined with e-commerce, allowing niche products to reach nationwide audiences quickly.

Coffee dominated the U.S. hot drinks market in 2023, owing to its cultural ubiquity, product diversity, and high per capita consumption. With over 60% of U.S. adults consuming coffee daily, the segment continues to benefit from both traditional retail and out-of-home channels. In addition to ground coffee and instant varieties, there is strong momentum in specialty coffees, cold-brew kits, and single-origin beans. Brands such as Starbucks, Dunkin', and Keurig are central players, offering a mix of convenience and quality. Coffee’s broad consumer appeal across age groups, professions, and income levels cements its leadership in the market.

Herbal and fruit tea emerged as the fastest-growing subsegment within tea products, driven by the wellness wave and growing caffeine sensitivity. Herbal infusions like peppermint, rooibos, and hibiscus are gaining popularity among consumers seeking natural remedies for digestion, sleep, and immunity. These caffeine-free alternatives appeal particularly to younger and older demographics looking for gentler beverage options. Boutique tea companies and wellness brands are innovating with blends that incorporate superfoods, adaptogens, and Ayurvedic herbs, creating a compelling value proposition for health-conscious consumers. The segment’s rapid growth also reflects its crossover appeal as both a daily staple and a health-supporting beverage.

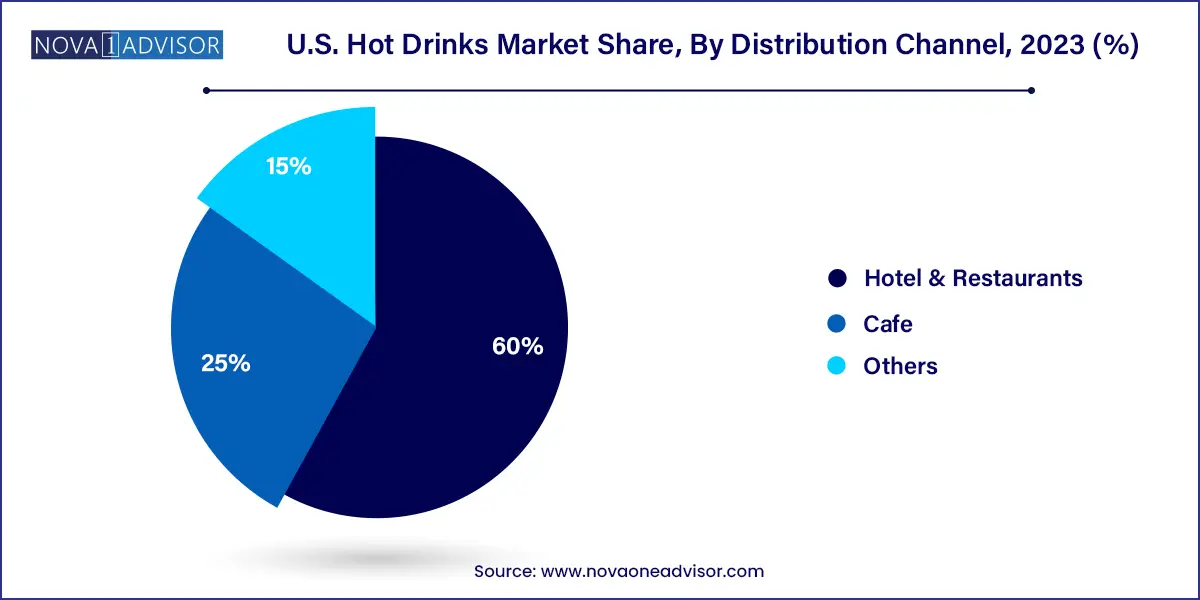

Cafes continued to dominate hot drink sales by volume and consumer engagement in 2023, thanks to their ability to offer experiential value, customization, and social ambiance. The café model, led by chains like Starbucks, Peet’s Coffee, and local independent roasters, thrives on consumer willingness to pay a premium for personalized beverages, ambiance, and convenience. The adoption of mobile ordering, loyalty programs, and seasonal promotions has further reinforced cafes as the go-to choice for urban and suburban consumers. Even with growing home-brewing trends, the café segment benefits from daily footfall, brand loyalty, and impulsive consumption behaviors.

Hotel and restaurant channels are emerging as a strong growth avenue, particularly as the hospitality and travel industry rebound from pandemic-induced slowdowns. Branded coffee and tea programs in hotels, resorts, and fine dining restaurants have seen an upswing in demand. Consumers expect high-quality hot drinks as part of their dining and accommodation experiences, prompting hotels to collaborate with premium or local brands. Moreover, wellness-oriented establishments are expanding their hot drinks offerings to include herbal teas, matcha lattes, and therapeutic brews. This segment’s growth reflects the evolving consumer expectation for quality and diversity, even in traditionally overlooked service environments.

In the U.S., hot drink consumption patterns vary significantly based on age, lifestyle, region, and access to retail channels. Coffee enjoys near-universal penetration, with higher consumption in northern states and urban centers where colder climates and busy lifestyles drive frequent purchases. Cities like Seattle, New York, and San Francisco are known for their robust café cultures and boutique roasting scenes, which have also influenced national trends.

Tea, traditionally seen as a niche category, has become mainstream in wellness-oriented coastal regions like California and Massachusetts, where consumers are more likely to opt for green, herbal, or botanical blends. Moreover, college campuses and tech workplaces are seeing increased adoption of functional teas and non-coffee alternatives, fueled by younger demographics seeking caffeine control and health benefits.

Meanwhile, rural and suburban areas still favor traditional coffee blends, instant tea bags, and budget offerings, though grocery chains have begun expanding premium SKUs in these areas as well. Online shopping, especially for functional or international tea brands, is bridging geographic gaps, allowing consumers from all parts of the country to access niche products that might not be available in local retail.

February 2025 – Starbucks announced a nationwide rollout of its new line of herbal tea lattes infused with calming ingredients like lavender and chamomile, targeting the sleep and stress relief segment.

January 2025 – Keurig Dr Pepper expanded its at-home brewing portfolio by acquiring a majority stake in a startup that specializes in compostable coffee pods, signaling a shift toward sustainable brewing.

December 2024 – Peet’s Coffee launched a subscription model that includes exclusive small-batch roasts and monthly rotating blends, coupled with storytelling content to enrich consumer engagement.

November 2024 – Celestial Seasonings introduced a new line of functional herbal teas for digestive wellness, featuring ingredients like ginger root, fennel, and probiotics, distributed through major pharmacies and wellness retailers.

October 2024 – Four Sigmatic launched “Cognitive Cocoa,” a mushroom-based hot chocolate infused with lion’s mane and ashwagandha, targeting the growing market for nootropic beverages.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. hot drinks market

Product

Distribution Channel