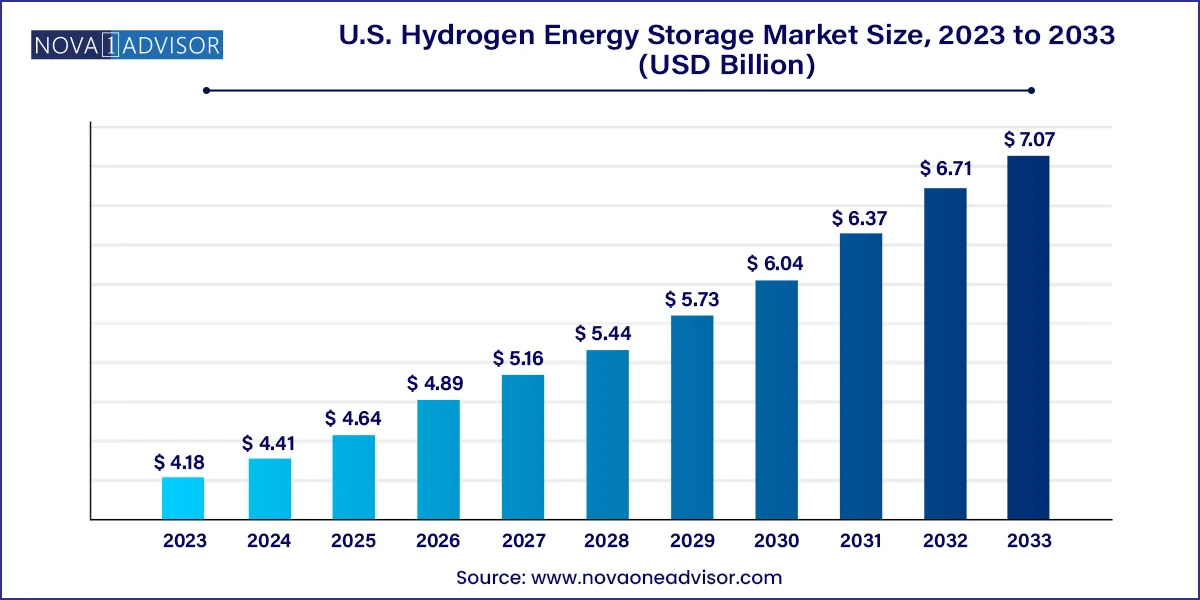

The U.S. hydrogen energy storage market size was valued at USD 4.18 billion in 2023 and is projected to surpass around USD 7.07 billion by 2033, registering a CAGR of 5.4% over the forecast period of 2024 to 2033.

The U.S. Hydrogen Energy Storage Market is emerging as a pivotal segment in the country’s clean energy transformation. As the United States intensifies efforts to decarbonize its energy, transportation, and industrial sectors, hydrogen has surfaced as a strategic energy carrier capable of complementing intermittent renewable power sources, enhancing grid resilience, and enabling deep decarbonization. Among its various applications, hydrogen’s unique capability to store energy in molecular form—either as a gas, liquid, or solid—positions it as an essential component of long-duration and seasonal energy storage strategies.

Hydrogen energy storage involves the use of excess electricity, typically generated from renewable sources, to produce hydrogen via electrolysis. This hydrogen can then be stored and later used in fuel cells, turbines, or industrial processes. Compared to batteries, hydrogen provides longer discharge durations, higher scalability, and better integration with sectors that require both power and molecules—such as transportation fuels and chemical production.

The U.S. government, through initiatives like the Bipartisan Infrastructure Law and the Department of Energy’s (DOE) Hydrogen Energy Earthshot, is aggressively investing in infrastructure and innovation to develop a national hydrogen economy. These initiatives prioritize low-carbon hydrogen production, storage, distribution, and utilization. Public-private partnerships, DOE-backed pilot projects, and tax credits through the Inflation Reduction Act (IRA) have all catalyzed development across hydrogen value chains, including energy storage.

Hydrogen storage is becoming indispensable for grid operators seeking to stabilize renewable power inputs, for utilities looking to defer infrastructure upgrades, and for industries aiming to replace fossil fuels in energy-intensive processes. As production scales up and technologies become more cost-effective, the U.S. hydrogen energy storage market is positioned for rapid and sustained growth.

Integration of hydrogen with renewable energy projects: Electrolyzers are being co-located with wind and solar farms to convert excess power into storable hydrogen.

Development of salt cavern and underground storage: Geological formations are being explored for long-duration hydrogen storage in regions like Utah and Texas.

Expansion of DOE-funded hydrogen hubs: Hydrogen hubs under development will feature dedicated infrastructure for storage, distribution, and end-use sectors.

Investment in advanced storage materials: Research is growing in metal hydrides, MOFs (metal-organic frameworks), and solid-state hydrogen storage solutions.

Hydrogen blending with natural gas: Utilities are experimenting with hydrogen-natural gas blends for storage and pipeline-based distribution.

Focus on green and blue hydrogen: Storage demand is being driven by low-carbon hydrogen production methods that need scalable containment solutions.

Emergence of dual-use applications: Hydrogen storage systems are being designed for both electricity generation and industrial feedstock applications.

| Report Attribute | Details |

| Market Size in 2024 | USD 4.41 Billion |

| Market Size by 2033 | USD 7.07 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, physical state, application. |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Cummins Inc.; Chart Industries; Steelhead Composites, INC.; Air Products Inc.; Plug Power, Inc.; Worthington Industries; American Clean Power Association; Genh2 discover hydrogen; FuelCell Energy Inc.; Bloom Energy Corp. |

A key driver accelerating the U.S. hydrogen energy storage market is the federal government’s concerted push to establish hydrogen as a critical clean energy vector. Through a combination of strategic planning, infrastructure funding, and tax incentives, the U.S. is laying the groundwork for a robust hydrogen economy—and storage plays an integral role in this vision.

The Hydrogen Energy Earthshot, announced by the Department of Energy in 2021, aims to reduce the cost of clean hydrogen to $1 per kilogram within a decade. To achieve this, a comprehensive approach encompassing production, storage, transportation, and usage is being implemented. Storage is vital in ensuring hydrogen is available where and when it’s needed—especially for use in transportation fleets, grid backup, and industrial decarbonization.

Further, the Bipartisan Infrastructure Law allocates $8 billion to develop regional clean hydrogen hubs, many of which include dedicated hydrogen storage capacity. The Inflation Reduction Act of 2022 also introduced tax credits for clean hydrogen production, indirectly incentivizing storage infrastructure development by boosting demand for low-carbon hydrogen. These policies collectively provide a favorable ecosystem for growth, making hydrogen storage a national priority.

Despite growing momentum, hydrogen energy storage in the U.S. faces a significant barrier: the high costs associated with storage technologies and the infrastructure needed to support them. Whether storing hydrogen as a high-pressure gas, cryogenic liquid, or embedded in solid materials, the capital and operational costs remain high compared to more mature storage solutions such as lithium-ion batteries or pumped hydro.

Storing hydrogen as a gas requires compression to up to 700 bar, involving energy-intensive and costly equipment. Liquefaction, which allows for higher energy density, demands extremely low temperatures (−253°C), resulting in high energy losses during the cooling process. Material-based storage technologies are still in the R&D phase and have yet to be commercialized at scale.

Moreover, the lack of existing storage infrastructure—such as salt caverns, storage tanks, or dedicated pipelines—creates logistical hurdles for project developers. Safety regulations, permitting delays, and a shortage of skilled labor further constrain large-scale deployment. Addressing these issues will require continued public funding, targeted R&D support, and coordinated efforts to standardize safety and performance benchmarks.

As the U.S. electrical grid incorporates higher shares of variable renewable energy sources—especially solar and wind—the need for long-duration energy storage (LDES) has grown exponentially. Lithium-ion batteries, while effective for short-term applications, lack the duration and capacity needed to stabilize the grid during prolonged periods of low renewable output or extreme weather events.

Hydrogen offers a compelling solution. It can store energy for days, weeks, or even seasons, making it ideal for grid-scale applications that require flexibility, resilience, and scalability. Unlike batteries that degrade over time, hydrogen can be stored indefinitely and used across sectors, providing unparalleled versatility.

Utility-scale projects are being piloted to evaluate hydrogen’s potential for firming capacity, frequency regulation, and peak shaving. In Utah, the Advanced Clean Energy Storage project—a joint initiative between Mitsubishi Power and Magnum Development—will use underground salt caverns to store green hydrogen produced from renewable energy. This hydrogen will later be used to generate electricity during peak demand periods or grid outages. As extreme weather events become more frequent, such projects highlight hydrogen storage’s ability to serve as a grid reliability backbone.

The Industrial segment led the market and accounted for the largest revenue share of 41.06% in 2023. Tas industries like ammonia production, steelmaking, and oil refining continue to explore hydrogen as a clean alternative to fossil fuels. Hydrogen storage enables these sectors to shift from gray to green hydrogen without compromising operational reliability. Storage solutions in this segment are typically large-scale and co-located with hydrogen production facilities, ensuring a continuous and stable energy supply for high-temperature and high-pressure processes.

Steelmakers like SSAB and chemical manufacturers such as Air Liquide are exploring hydrogen-based operations with dedicated storage systems. Additionally, hydrogen is increasingly used in CHP (combined heat and power) plants, which benefit from stored hydrogen to provide flexible and low-emission energy to industrial facilities. As decarbonization mandates strengthen, industrial hydrogen storage is expected to remain a cornerstone of market growth.

The residential segment, while currently small, is experiencing the fastest growth. Residential hydrogen storage systems—especially when paired with rooftop solar and small-scale electrolysis units—are gaining traction among homeowners seeking energy independence and resilience. In California, early adopters are trialing home hydrogen fuel cell systems that store and reconvert excess solar energy. Innovations in compact storage tanks and solid-state hydrogen storage materials are making these systems more feasible. With growing concerns over blackout risks and energy costs, residential hydrogen energy storage is likely to grow rapidly in forward-thinking states with supportive policies.

The Solid segment dominated the market and accounted for the largest market share of 51.83% in 2023. due to its technical simplicity, broad compatibility with existing infrastructure, and suitability for distributed and mobile applications. High-pressure gas cylinders and on-site storage tanks are widely used in hydrogen fueling stations, research facilities, and distributed energy systems. These systems can be quickly installed, scaled, and integrated with electrolyzers, making them ideal for short-to-medium duration energy storage.

Gas storage also supports early-stage hydrogen pilot projects, including microgrids, FCEV refueling stations, and off-grid renewable energy integration. Its dominance is further supported by a mature supply chain, established regulatory standards, and relatively low CAPEX compared to more complex storage formats.

Nevertheless, liquid hydrogen storage is the fastest-growing segment, particularly for large-scale and long-distance energy transportation applications. Liquefied hydrogen offers much higher energy density than gaseous hydrogen, making it suitable for large-scale backup power systems, industrial complexes, and export-oriented hydrogen supply chains. In early 2025, NASA initiated liquid hydrogen storage upgrades at Kennedy Space Center, with implications for both aerospace and energy storage use cases. With companies like Plug Power investing in liquefaction infrastructure, the market for cryogenic hydrogen is set to expand significantly in the coming years.

The material-based segment accounted for the largest market share of 40.85% in 2023. These systems utilize advanced materials—such as metal hydrides, borohydrides, and metal-organic frameworks (MOFs)—that absorb and release hydrogen at lower pressures and higher densities compared to gaseous systems. Though still in the developmental stage, these storage systems offer improved safety, reduced energy consumption, and greater energy density. In 2024, the DOE funded several material-based hydrogen storage projects through its Advanced Materials R&D initiative, signaling increased government support. As technology advances, material-based storage solutions are expected to find applications in aerospace, portable electronics, and residential energy systems.

The compression segment accounted for a significant revenue share in 2023, primarily due to its wide commercial availability, mature technical foundation, and compatibility with existing hydrogen refueling and distribution infrastructure. High-pressure hydrogen gas storage systems—typically operating at 350 to 700 bar—are commonly used in fuel cell vehicle refueling stations, backup power systems, and pilot hydrogen hubs. They are relatively easier to deploy and integrate, making them a practical choice for near-term applications.

The United States is advancing a comprehensive strategy to build out its hydrogen economy, and storage is central to that vision. Nationally, projects are being concentrated around major clean hydrogen hubs funded by the DOE, such as those in Texas, California, and the Midwest. These hubs are designed to support integrated hydrogen supply chains—including production, storage, and end-use—tailored to regional energy demands.

In Utah, the Advanced Clean Energy Storage project is pioneering large-scale underground storage using salt caverns for green hydrogen produced from solar and wind. This facility will serve utilities like the Los Angeles Department of Water and Power (LADWP), offering multi-day storage and on-demand power generation.

Meanwhile, California is investing in hydrogen storage for fuel cell vehicle infrastructure, with over 50 refueling stations and associated storage systems under development. In the Northeast, companies are working on blending hydrogen into natural gas pipelines, which requires reliable, localized hydrogen storage.

Federal support includes R&D grants, tax credits, and regulatory harmonization efforts to enable rapid deployment of safe and cost-effective hydrogen storage systems across the country. With its vast geography, advanced industrial base, and ambitious clean energy targets, the U.S. is well-positioned to lead in hydrogen energy storage innovation and deployment.

March 2024 – The U.S. Department of Energy awarded $1.6 billion to support the development of hydrogen storage facilities within the seven clean hydrogen hubs, focusing on underground and cryogenic storage.

February 2024 – Plug Power began construction of its first green hydrogen liquefaction plant in Georgia, which will include cryogenic storage facilities with a capacity of 15 metric tons per day.

January 2024 – Mitsubishi Power and Magnum Development broke ground on an expansion of the Advanced Clean Energy Storage project in Utah, adding a second salt cavern for long-duration hydrogen storage.

December 2023 – Nikola Corporation announced a partnership with Chart Industries to develop liquid hydrogen storage trailers for mobility and distributed energy markets.

November 2023 – Air Products announced its investment in a large-scale hydrogen liquefaction and storage plant near Houston, Texas, aimed at serving both industrial and mobility customers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Hydrogen Energy Storage market.

By Technology

By Physical State

By Application