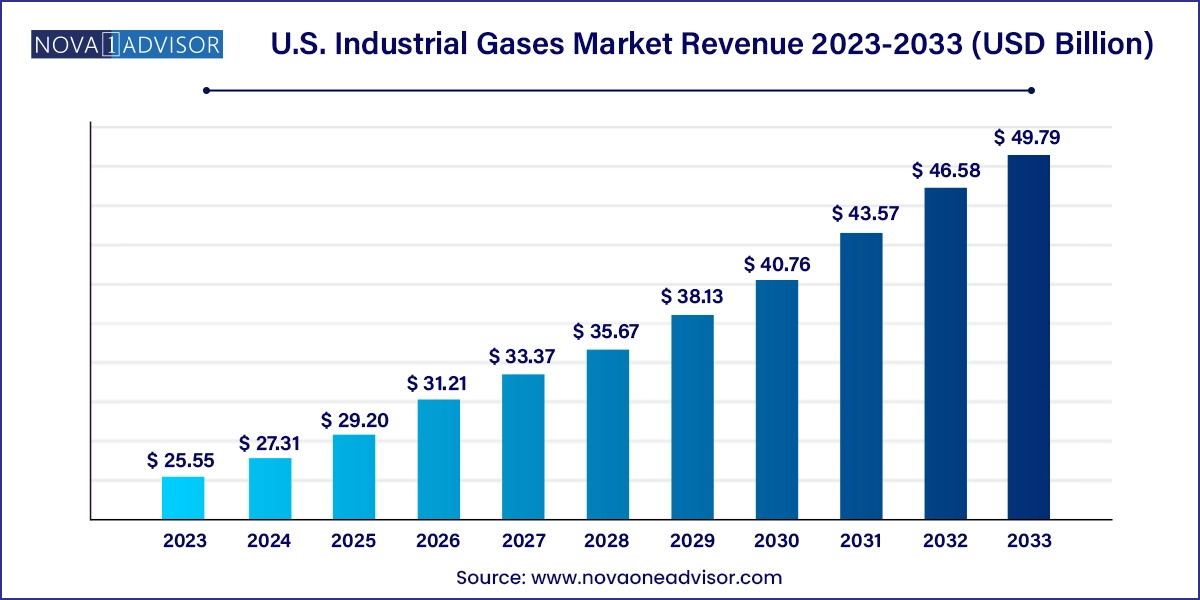

The U.S. industrial gases market size was exhibited at USD 25.55 billion in 2023 and is projected to hit around USD 49.79 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The industrial gases market in the United States plays a foundational role in supporting numerous industries ranging from healthcare and food processing to electronics and manufacturing. These gases including oxygen, nitrogen, carbon dioxide, hydrogen, argon, and acetylene are used not as commodities, but as indispensable enablers of complex industrial processes.

The U.S. market has demonstrated remarkable resilience and innovation in recent years. With shifts toward decarbonization, digital manufacturing, precision healthcare, and sustainability-focused food production, the demand for various industrial gases has evolved from traditional volume-based contracts to specialized, purpose-driven supply chains. Industrial gases are now at the heart of both legacy infrastructure and emerging technologies.

Additionally, the U.S. is witnessing an increase in customized and on-site gas generation facilities, driven by rising demand for uninterrupted, high-purity gases in semiconductor fabs, hospitals, biopharmaceutical labs, and even vertical farming units. The adaptability of industrial gas suppliers in integrating with client operations has elevated the sector from being merely supportive to becoming strategically essential.

Green Hydrogen Initiatives Gaining Momentum

Several U.S. states and energy-focused companies are pushing for hydrogen as a clean fuel, particularly green hydrogen, driving innovation in electrolysis and fuel cell infrastructure.

On-Site Gas Generation Solutions

Manufacturing units and hospitals are increasingly opting for on-site nitrogen and oxygen generation systems to reduce logistics costs and ensure uninterrupted supply.

Semiconductor and Electronics Sector Driving Ultra-High Purity Gas Demand

The growth in U.S.-based chip manufacturing under government incentives is spurring demand for ultra-high purity nitrogen, hydrogen, and argon for cleanroom environments.

Cryogenic Storage Innovation

A surge in cryogenic gas applications, especially in mRNA vaccine storage and aerospace fueling, is leading to the development of smart, energy-efficient storage solutions.

Carbon Capture and Utilization (CCU)

With growing environmental scrutiny, carbon dioxide is no longer just a by-product. CCU initiatives are now creating value streams from industrial CO₂ capture.

Cold Chain Logistics Expansion

Dry ice and cryogenic gases used in logistics especially for pharmaceuticals and perishable food are driving demand for consistent CO₂ supply.

Retailing of Industrial Gases to Smaller Enterprises

With the rise of e-commerce, welding shops, artisanal food producers, and DIY laboratories are purchasing packaged gases through online platforms, enhancing reach and market diversity.

| Report Coverage | Details |

| Market Size in 2024 | USD 27.31 Billion |

| Market Size by 2033 | USD 49.79 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Messer North America, Inc.; Air Products and Chemicals, Inc.; Linde plc; Air Liquide; Matheson Tri-Gas, Inc; BASF SE; MESA Specialty Gases & Equipment; Universal Industrial Gases, Inc. |

One of the core drivers of growth in the U.S. industrial gases market is the seamless integration of gas solutions into high-tech sectors such as semiconductor manufacturing, biotechnology, aerospace, and renewable energy. Unlike in the past where gases were consumed in bulk as generic commodities, today's industries demand high-performance, customized, and continuously monitored gas solutions.

For instance, in advanced chip manufacturing, nitrogen must meet exceptionally tight purity thresholds and be delivered with absolute consistency to avoid contamination. Similarly, medical oxygen supplied to mobile ICU units or home-care setups must align with strict FDA standards, coupled with remote monitoring capabilities. This shift has prompted gas companies to evolve into solution providers, offering everything from sensors and flow control software to gas purity verification systems.

This integration not only raises the value proposition of industrial gases but also fosters long-term strategic partnerships with client industries, creating a self-sustaining cycle of innovation and demand.

Despite its criticality across sectors, the industrial gases market faces a substantial restraint in terms of infrastructure complexity and regulatory overhead. Setting up production and storage infrastructure — particularly for cryogenic gases — demands high capital investment and compliance with a labyrinth of safety, environmental, and zoning regulations.

For example, storing liquid oxygen or hydrogen on-site requires specialized cryogenic tanks, explosion-proof enclosures, and emergency venting systems. Transporting gases across state lines involves multiple agencies such as the DOT and OSHA, and must adhere to stringent documentation, labeling, and pressure control norms. These challenges are magnified for smaller and mid-sized businesses that lack in-house compliance teams or technical capacity.

Moreover, public perception around gases like hydrogen (due to its flammability) and CO₂ (due to emissions concerns) also creates hurdles for broad deployment, particularly in urban or residential areas. As a result, the rate at which newer applications can scale is often gated by infrastructure and policy hurdles.

The single most transformative opportunity within the U.S. industrial gases landscape lies in the rise of hydrogen as a clean energy carrier. Hydrogen has found its place at the intersection of energy independence, climate change mitigation, and industrial decarbonization.

Whether it's being used to power fuel-cell electric vehicles (FCEVs), generate electricity in off-grid systems, or replace coke in steelmaking, hydrogen is rapidly becoming a pillar of clean industrialization. States like California, Texas, and New York are developing hydrogen refueling stations and are offering incentives for hydrogen electrolysis projects.

What makes this opportunity even more compelling is the demand for high-purity hydrogen from multiple sectors — automotive, aerospace, defense, and even residential heating — opening up possibilities for diverse revenue streams. Gas companies that invest early in scalable hydrogen production and distribution technologies stand to become the backbones of America’s next-generation energy infrastructure.

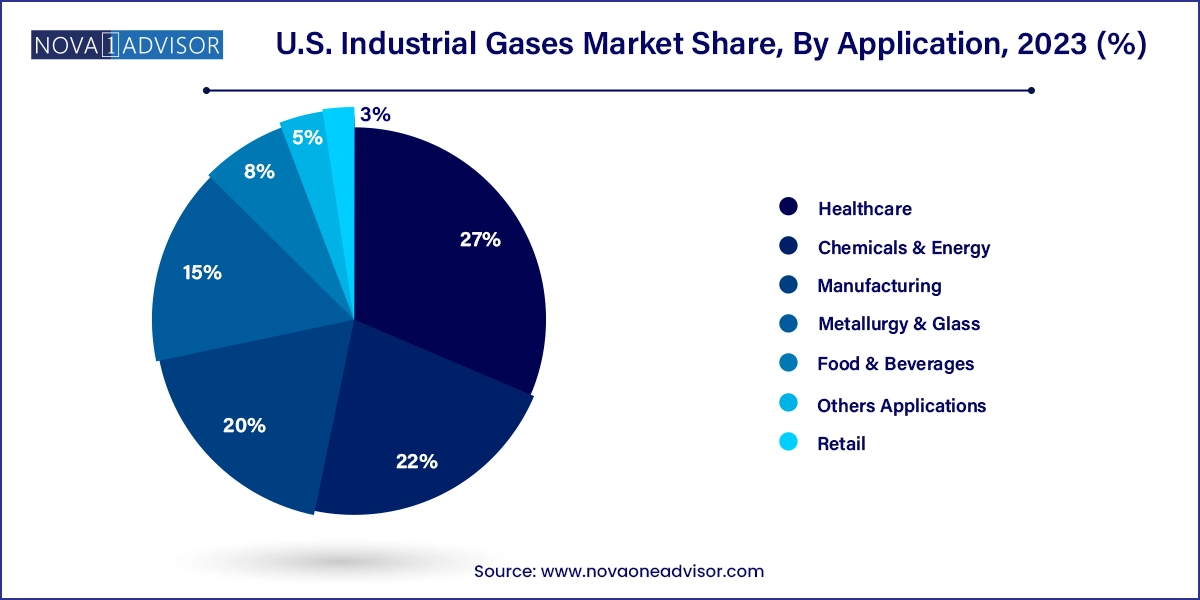

In the U.S., healthcare continues to be the largest consumer of industrial gases. Hospitals, rehabilitation centers, ambulances, and homecare setups rely extensively on gases like oxygen (for respiration), nitrogen (for cryopreservation and surgical tool sterilization), and nitrous oxide (for anesthesia). The pandemic not only accelerated infrastructure investments in oxygen plants and storage systems but also increased awareness around the importance of medical gas purity and safety.

Medical gases are now highly regulated and require 24/7 supply assurance, making logistics and distribution an operational priority. The demand for liquefied medical oxygen has led to partnerships between gas companies and regional health departments to set up mini-storage depots and modular generation plants. This level of dependency ensures that healthcare remains the cornerstone of the U.S. industrial gas demand profile.

As the U.S. retools its industrial base for the 21st century, the chemicals and energy segment is emerging as a high-growth arena for industrial gas consumption. In the chemical sector, gases are used in refining processes, pH control, inert atmospheres, and as raw materials for synthesis. In the energy sector, gases like hydrogen, oxygen, and carbon dioxide are now being used in renewable energy storage, enhanced oil recovery (EOR), and waste-to-energy plants.

Additionally, the movement toward electrification of industry is leading to increased demand for industrial gases in battery manufacturing, solar panel production, and electrolyzer development. These technologies require high-purity gases in ultra-clean environments, pushing gas suppliers to innovate and invest in new purification and monitoring systems.

Oxygen continues to be the dominant industrial gas by volume in the U.S. due to its widespread use in healthcare, metallurgy, chemical synthesis, and environmental treatment. Medical-grade oxygen is an essential therapeutic in intensive care units, emergency response kits, and high-altitude aviation. Beyond healthcare, oxygen is a vital input in steel manufacturing for decarburization and in wastewater treatment facilities where it enhances aerobic digestion. It also plays a role in gas welding, rocket propulsion, and even ozone generation. This wide applicability ensures that oxygen maintains the largest market share, especially as healthcare infrastructure expands in both urban and rural regions.

In the context of industrial processes, oxygen-enriched combustion is gaining popularity due to its ability to increase fuel efficiency and reduce nitrogen oxide emissions, which aligns with environmental targets set by state and federal agencies. Additionally, portable oxygen solutions for home healthcare and sports recovery are opening up direct-to-consumer channels for oxygen suppliers.

Hydrogen Emerged as the Fastest-Growing Product Category, Driven by Energy and Electronics Demand

Hydrogen is registering exponential growth in the U.S. due to its expanding role in clean energy and precision manufacturing. Industries are shifting toward hydrogen as a clean-burning fuel for both transportation and energy generation. Electrolytic hydrogen is now being integrated into power grids as a form of energy storage, while fuel-cell vehicles (buses, forklifts, long-haul trucks) are gaining commercial momentum. In the electronics and semiconductor industries, hydrogen is used as a reducing agent and carrier gas during chip fabrication and thermal treatments.

As public and private initiatives coalesce around the hydrogen economy, new infrastructure such as hydrogen pipelines, storage tanks, and production plants (using electrolysis or methane reforming with carbon capture) are being commissioned across the country. This momentum is making hydrogen not only the fastest-growing segment but also a keystone of the U.S.' future energy ecosystem.

The United States offers a highly mature yet constantly evolving landscape for industrial gases. What sets it apart is the depth of its industrial diversity from aerospace in the West, automotive in the Midwest, semiconductors in the Southwest, and biotech clusters along the East Coast. Each of these domains uses industrial gases in unique ways, creating a mosaic of demand profiles.

Policy incentives such as the Inflation Reduction Act and the CHIPS and Science Act are further boosting demand for clean energy gases and ultra-pure specialty gases used in semiconductor manufacturing. Moreover, the increasing trend of reshoring manufacturing and investing in domestic food processing facilities is expanding regional gas distribution networks.

Gas producers are also exploring circular economy models, such as capturing industrial CO₂ emissions for reuse in beverage carbonation or algae cultivation. With sophisticated logistics, supportive policy environments, and a culture of innovation, the U.S. continues to lead in setting benchmarks for industrial gas quality, safety, and sustainability.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. industrial gases market

Product

Application