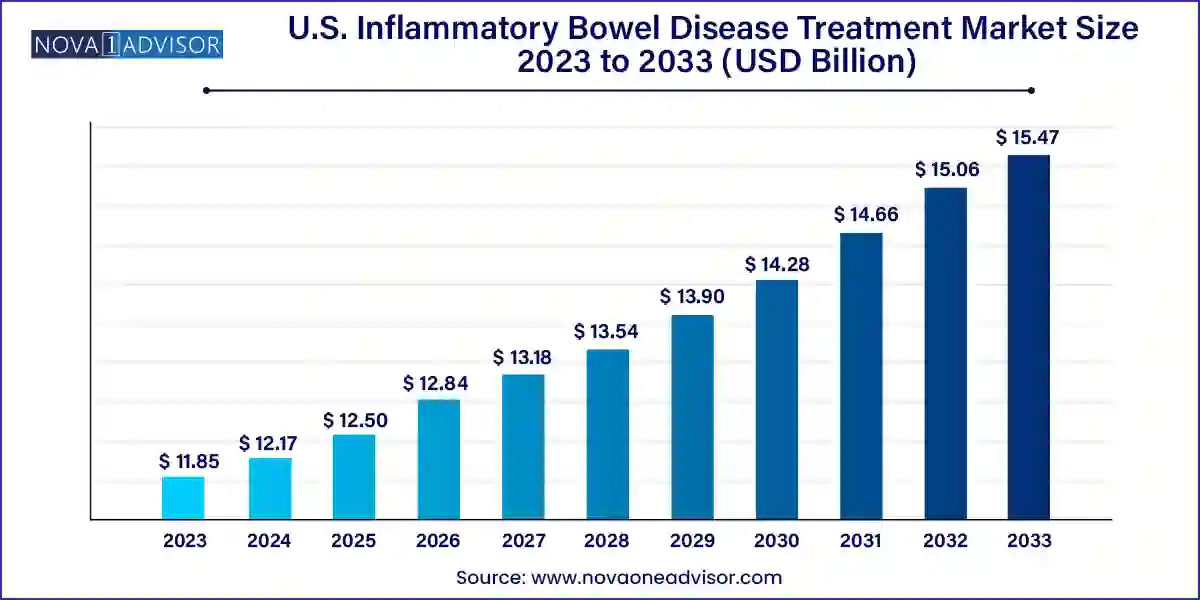

The U.S. inflammatory bowel disease treatment market size was exhibited at USD 11.85 billion in 2023 and is projected to hit around USD 15.47 billion by 2033, growing at a CAGR of 2.7% during the forecast period 2024 to 2033.

The U.S. Inflammatory Bowel Disease (IBD) Treatment Market represents a dynamic and rapidly evolving segment of the broader gastrointestinal therapeutic landscape. Inflammatory Bowel Disease, which primarily encompasses Crohn’s Disease and Ulcerative Colitis, affects millions of Americans and imposes a significant burden both clinically and economically. The market for its treatment in the United States is witnessing growth fueled by advancements in biologics, an increasing patient population, improved diagnostic techniques, and greater disease awareness.

According to estimates from the Centers for Disease Control and Prevention (CDC), approximately 3 million adults in the U.S. were diagnosed with IBD in 2022, a number that has steadily increased over the past two decades. This trend can be attributed to a combination of lifestyle-related factors, such as changes in diet, increasing prevalence of obesity, antibiotic usage, and environmental influences.

Treatment options have significantly diversified over the past decade, moving beyond conventional corticosteroids and aminosalicylates to targeted biologics and small molecule drugs. Major pharmaceutical companies and biotech firms are actively investing in the development of innovative therapies, particularly those that focus on inhibiting specific immune pathways associated with inflammation. This has led to the introduction of anti-TNF agents, JAK inhibitors, and IL inhibitors with demonstrated efficacy in managing moderate to severe cases of IBD.

Another important trend is the shift toward personalized medicine, where treatment plans are tailored according to a patient’s specific genetic, biochemical, and microbiome profiles. This personalized approach is expected to be a significant growth area within the market as research deepens in molecular profiling.

With an increasing emphasis on value-based care, stakeholders including hospitals, insurers, and payers are focusing more on long-term disease control, quality of life improvements, and cost efficiency. Furthermore, growing adoption of telemedicine and online pharmacies has also opened new channels for IBD treatment distribution, expanding patient access and convenience.

Rise in Biologic Drug Usage: Patients are increasingly being treated with biologics such as TNF inhibitors and IL inhibitors, which are effective for long-term remission and maintenance therapy.

Adoption of JAK Inhibitors: With oral availability and targeted action, JAK inhibitors are gaining momentum, especially for patients unresponsive to other biologics.

Digital Health Integration: The use of digital monitoring tools, apps, and telehealth for tracking flare-ups, medication adherence, and symptom progression is expanding.

Pipeline Richness: The market is buoyed by a strong clinical pipeline with multiple novel drug classes and mechanisms under phase II and III trials.

Pediatric Patient Care Improvements: New guidelines and approval of certain biologics for children and adolescents are expanding the patient base.

Microbiome-Based Therapies: There is growing interest and research investment into manipulating the gut microbiota for therapeutic benefit.

Health Equity Initiatives: Public and private efforts to improve care access for underserved populations are driving diagnosis and treatment rates.

Combination Therapy Strategies: Physicians are increasingly exploring combination regimens involving biologics and immunomodulators for better outcomes.

Expansion of Online Pharmacies: E-commerce penetration in pharmaceuticals is easing access to specialty drugs and promoting adherence.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.17 Billion |

| Market Size by 2033 | USD 15.47 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 2.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Drug Class, Route of Administration, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Biogen; Novartis AG; Eli Lilly and Company; UCB S.A.; Celltrion Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc. |

One of the primary drivers propelling the U.S. IBD treatment market is the rising incidence and prevalence of both Crohn’s Disease and Ulcerative Colitis. Several epidemiological studies have pointed to a consistent upward trajectory in the number of diagnosed cases over the last two decades. Sedentary lifestyles, western dietary patterns rich in processed foods, environmental pollution, and the overuse of antibiotics in early life have been associated with increased susceptibility.

Additionally, improved diagnostic capabilities and greater public awareness have contributed to early identification and management of IBD. Institutions like the Crohn’s & Colitis Foundation have played a crucial role in awareness campaigns and education, encouraging patients to seek timely medical intervention. This rise in the patient pool is directly contributing to higher demand for medications, consultations, and long-term disease management strategies.

While the emergence of biologics and small-molecule therapies has revolutionized IBD treatment, their high cost remains a significant barrier, especially in a complex healthcare reimbursement environment like that of the United States. Many of the advanced treatment options, such as infliximab, vedolizumab, and upadacitinib, are priced at tens of thousands of dollars annually.

Though insurance coverage helps mitigate some of this burden, not all patients have comprehensive plans. Additionally, the cost of repeated diagnostic tests, hospital visits, and potential surgical interventions further compounds the financial impact. This economic barrier can lead to treatment non-adherence, delayed intervention, and deteriorating patient outcomes—posing a challenge for both providers and payers.

The increasing approval and adoption of biosimilars offer a significant opportunity to reshape the U.S. IBD treatment market. Biosimilars are essentially "generic" versions of biologics, offering comparable efficacy and safety profiles but at a lower cost. With patent expiries of major biologics like Humira (adalimumab), multiple biosimilars have entered the U.S. market.

These biosimilars are anticipated to reduce the cost of therapy, making advanced treatment options accessible to a broader patient population. The U.S. FDA has already approved several IBD-related biosimilars in recent years, and market competition is intensifying. Health systems, insurers, and large hospital networks are increasingly favoring biosimilars as part of cost-containment strategies, thereby opening the door for newer entrants and generic-focused pharmaceutical companies.

Crohn's Disease held the dominant market share within the type segment, primarily due to its complex disease presentation and chronic progression, necessitating long-term and combination treatments. The nature of Crohn’s characterized by transmural inflammation that can affect any part of the gastrointestinal tract—requires aggressive pharmacological intervention. Biologics and immunosuppressants are commonly used to manage flare-ups and maintain remission, leading to higher treatment costs and more intensive care plans. This has naturally translated into a larger share for Crohn’s disease in the U.S. market.

However, Ulcerative Colitis is witnessing faster growth due to rising diagnostic rates and expanded drug approvals. The advent of JAK inhibitors and newer biologics specifically approved for Ulcerative Colitis has driven market momentum. As treatment becomes increasingly targeted, patients with moderate to severe ulcerative colitis now have more options beyond corticosteroids and 5-ASAs. Furthermore, clinical trials are exploring gene-targeted therapies for Ulcerative Colitis, which is expected to further propel this segment.

TNF inhibitors are the largest contributors to revenue in the drug class segment. Medications such as infliximab and adalimumab have become mainstays of IBD therapy due to their potent anti-inflammatory action and well-established clinical safety profile. TNF inhibitors are often the first line of biologic therapy for moderate to severe cases, backed by strong guidelines and physician confidence.

JAK inhibitors, however, are the fastest-growing drug class, mainly driven by recent FDA approvals and the appeal of oral administration. For example, in 2023, the FDA approved upadacitinib (Rinvoq) for treating Ulcerative Colitis, marking a shift toward small molecules that offer patient convenience and favorable efficacy in treatment-resistant cases. JAK inhibitors are also being studied in combination regimens, further expanding their market potential.

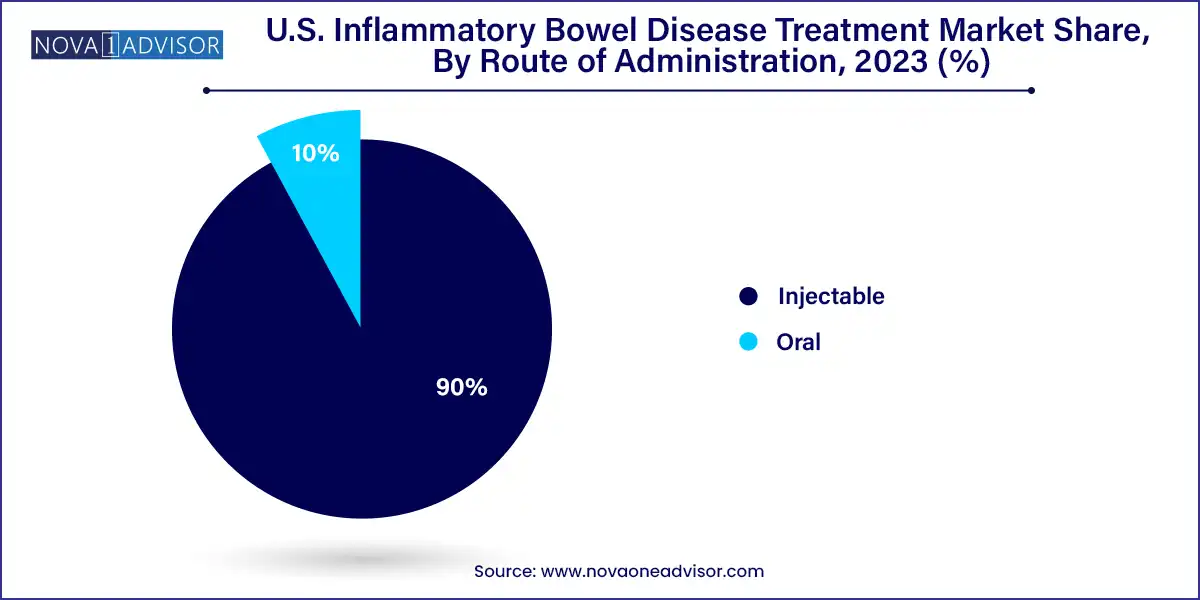

The injectable route remains dominant, given that most biologics, including TNF inhibitors and anti-integrin agents, are administered subcutaneously or intravenously. These drugs are considered standard therapy for moderate to severe IBD and often require hospital or clinic visits for administration, contributing to the revenue share of injectables.

Meanwhile, oral formulations are emerging as a fast-growing category. JAK inhibitors and certain corticosteroids are available in oral forms, offering better adherence and patient convenience. As telehealth consultations increase and more oral formulations enter the market, this segment is expected to show robust growth, particularly in the outpatient setting.

Hospital pharmacies currently dominate the market, driven by the high use of injectable biologics which are typically administered under clinical supervision. These settings also allow for closer monitoring of adverse effects, infusion-related reactions, and efficacy making them essential in managing IBD cases.

Online pharmacies are rapidly gaining ground, supported by consumer preferences for home delivery, ease of refill, and digital consultation services. The COVID-19 pandemic accelerated this shift, and new e-commerce policies around controlled drug delivery have further legitimized the role of online distribution. Many major health systems now integrate e-pharmacy into their telemedicine platforms, broadening access.

The United States remains the most lucrative market globally for IBD treatment, owing to several factors including high disease burden, advanced healthcare infrastructure, innovation-driven pharmaceutical industry, and strong regulatory frameworks supporting drug approvals. Major states such as California, New York, and Texas exhibit high patient volumes, driven by urban lifestyles and diagnostic access.

Additionally, healthcare disparities across regions are narrowing due to expanding Medicaid coverage and public-private health initiatives. For instance, in southern and rural U.S., programs focusing on digestive health screening are helping identify more cases at earlier stages, leading to increased treatment adoption. The U.S. market is also distinct in terms of reimbursement practices, where both private insurance and government health plans like Medicare play pivotal roles in patient access to therapies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. inflammatory bowel disease treatment market

Type

Drug Class

Route of Administration

Distribution Channel

Regional