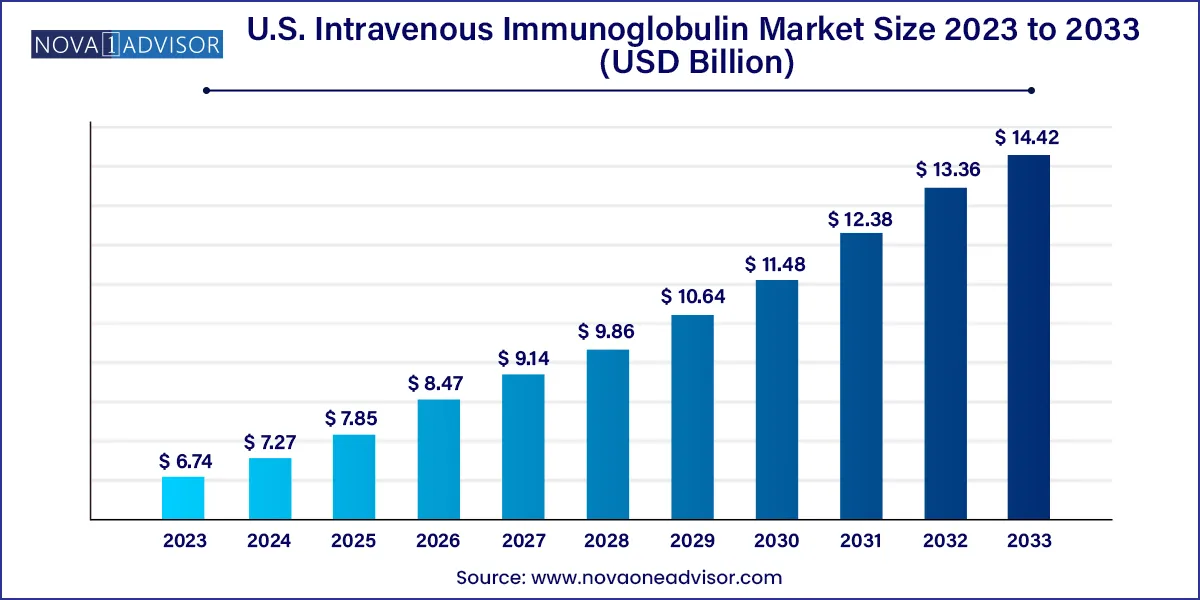

The U.S. intravenous immunoglobulin market size was exhibited at USD 6.74 billion in 2023 and is projected to hit around USD 14.42 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.27 Billion |

| Market Size by 2033 | USD 14.42 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Biotest AG; Octapharma AG; LFB Biotechnologies S.A.S; China Biologics Products Holdings, Inc.; Grifols; S.A.; Kedrion S.P.A.; CSL ; Takeda Pharmaceutical Company Limited; Bio Products Laboratory Ltd.; Pfizer, Inc.; ADMA Biologics, Inc. |

Some of the major factors propelling the U.S. IVIG market are the increase in demand for immunoglobulin replacement therapies for the treatment of Primary Immunodeficiency Diseases (PIDD) and the approval of new products, which is improving the availability of treatment options for patients.Home infusion therapy adoption accelerated at an exponential rate, which can be attributed to the safer administration of treatments at home along with the weak immunity of immunocompromised patients. The trend is anticipated to continue post-pandemic.

The COVID-19 pandemic has led to key shifts in the market dynamics of the industry. The U.S. IVIG market witnessed a shortage of immunoglobulin products, which can be attributed to the heightened demand for plasma products during the early stages of the pandemic for the treatment of SARS-CoV-2 patients. This created significant stress on the plasma supply chain, which was worsened by the reduction in plasma donations during the pandemic. Plasma fractionations require time, and supply disruptions became apparent in early 2021.Companies are exploring the use of IGIV therapies as a potential treatment. Approval in the upcoming years can lead to higher treatment adoption.

The cost of treatment with immunoglobulin is expensive and impedes the overall adoption of IVIG in the U.S. For instance, as per NCBI in 2021, the average cost per session in the U.S. was around USD 9,720, which translates to a monthly cost of USD 41,796 for 4.3 sessions. The average cost of treating a CIDP patient every year exceeds USD 136,000, thereby making access to treatment for patients without insurance or Medicare difficult.

Changing needs of patients has led to an increased focus by key players on obtaining approval and launching novel products in the market to cater to the rising number of patients requiring IVIG. In July 2021, Octagam 10% was approved by the FDA for the treatment of dermatomyositis in adults. The launch of Octagam 10% is anticipated to have a significant impact on patients with dermatomyositis, improving the armamentarium of available treatments.

IVIG replacement therapy is used for the treatment of several autoimmune, neurological, and hematological diseases, as well as immunodeficiency. The U.S. FDA has approved the use of IVIG in various disorders; however, it is also used in many off-prescription disorders, such as Guillain-Barre syndrome, myasthenia gravis, and multifocal motor neuropathy. Due to the efficacy and safety offered by IVIG, the preference for IVIG is increasing. For instance, the quantity of IVIG units used for the treatment of CIDP has significantly increased.

The primary immunodeficiency diseases segment held the largest market share of 21.32% of the U.S. IVIG market in 2023, attributable to the high cost of treatment and the rising number of patients requiring treatment. According to the American Academy of Allergy, Asthma, & Immunology, over 300 different types of PIDDs have been observed. PIDD has an incidence rate of 1 in 1,200 in the U.S., i.e., nearly 270,000 cases. The presence of organizations such as the Immune Deficiency Foundation, which aim at enhancing the diagnosis and treatment of PIDDs through research, education, and advocacy, is anticipated to improve the adoption of IVIG therapy among patients.

CIDP is anticipated to grow at the fastest rate as IVIG treatment is effective in 85% of CIPD patients, which is anticipated to increase its adoption. Key players are focusing on developing novel formulations for the maintenance and treatment of CIPD. For instance, in July 2023, Takeda announced positive results for HYQVIA, indicated for the treatment and maintenance of CIPD from the Phase 3 clinical trial. The company submitted regulatory applications in Europe and the U.S. in 2023.

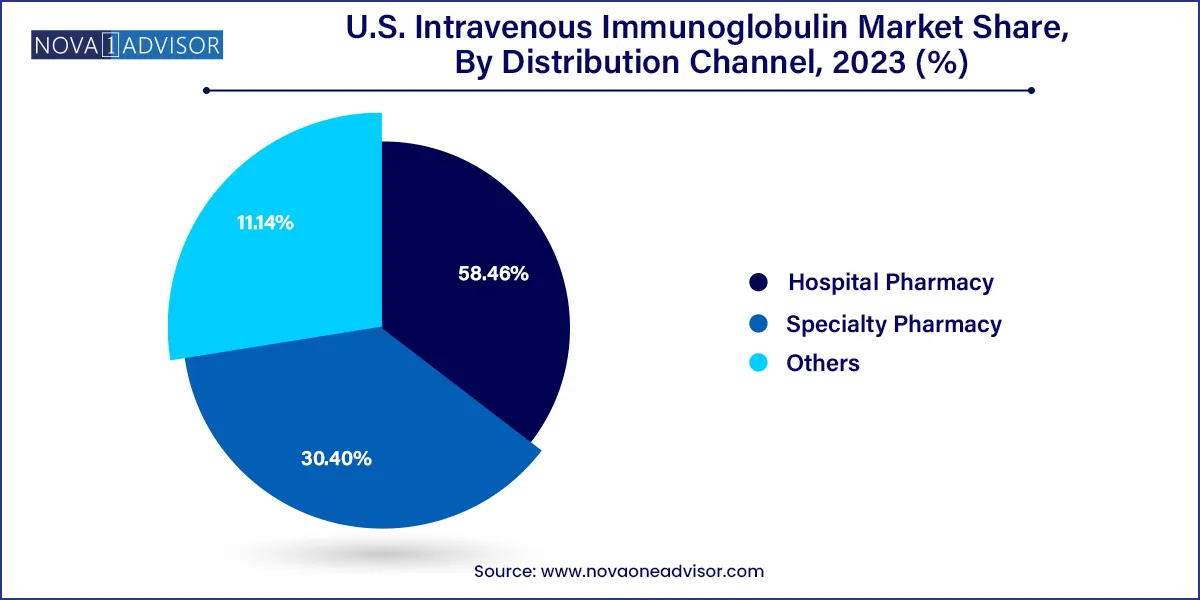

The hospital pharmacies segment accounted for the largest revenue share of 58.46% of the U.S. IVIG market in 2023, owing to the large number of hospitals and easy availability of products in the hospitals. The easy availability of products in hospitals has propelled the growth of this segment. Moreover, hospital-owned outpatient pharmacies have an advantage over traditional retail pharmacies, as they have access to a patient's electronic health record. As a result, patients can obtain the required medications without a doctor’s prescription. These factors can be attributed to the growth of this segment.

On the other hand, the specialty pharmacy segment is estimated to witness significant growth over the foreseeable future. Specialty pharmacies facilitate easy treatment at home, thus this segment is anticipated to gain significant market share during the forecast period. Specialty drugs represent a significant and emerging part of the future pharmacy business. As per May 2021 data from CVS, specialty drugs accounted for 52% of the overall expenditure of pharmacies in 2020. Moreover, there has been a 98% increase in new therapies for associated conditions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. intravenous immunoglobulin market.

Application

Distribution Channel