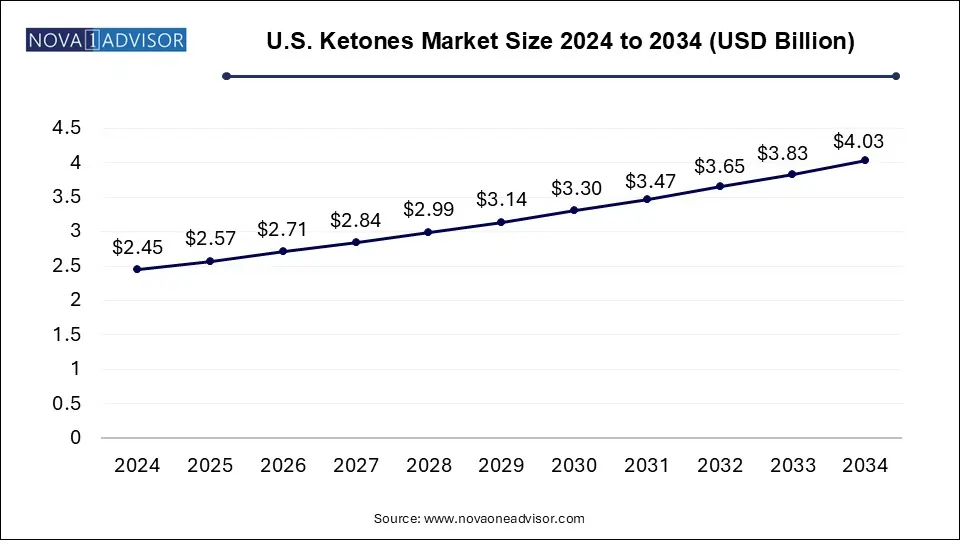

The U.S. ketones market size was exhibited at USD 2.45 billion in 2024 and is projected to hit around USD 4.03 billion by 2034, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.57 Billion |

| Market Size by 2034 | USD 4.03 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | BASF SE; Ineos; KetoLogic; Perfect Keto; KetoneAid; Sapien Products LLC; Boli LLC; Zenwise; Limitless Venture Group, Inc. |

This growth is attributed to the rising geriatric population in the country and the increasing per capita income of consumers. In addition, the benefits of ketone supplements in the treatment of type-2 diabetes are likely to have a positive impact on market growth. Furthermore, the wide application scope of the product in several other applications, such as cosmetics & personal care products, and its eco-friendly nature are expected to fuel the market growth in the coming years.

Ketones are organic compounds characterized by a carbonyl group bonded to two carbon atoms. In the U.S., the growing demand for personal grooming products is expected to drive the expansion of the ketones market. The increasing popularity of dietary supplements is contributing to a surge in ketone product consumption, further boosting the market's growth. In addition, athletes and sports enthusiasts are increasingly incorporating ketone supplements into their routines, fueling further market development.

The use of ketones in personal care and cosmetic items is also becoming more prevalent, stimulating market growth. As consumers lean toward skin-friendly, natural, and herbal ingredients, the demand for ketone-based products is anticipated to rise. This shift in consumer preferences, combined with a greater awareness of the health benefits associated with ketone use, is expected to propel the market forward. Furthermore, as lifestyles evolve rapidly, individuals are becoming more conscious of their health and wellness, leading to higher demand for products promoting skin and hair health. This growing awareness and the proven rejuvenating effects of ketones will provide new opportunities for market growth.

The ketones market is set to benefit from the increasing focus on the positive impacts these products have on skin and hair, with the demand for effective, natural solutions continuing to rise.

The pharmaceuticals application segment dominated the U.S. Ketones market and accounted for the largest revenue share of 27.0% in 2024. This growth is attributed to the increasing demand for ketone-based supplements for health benefits, especially for weight management, cognitive health, and metabolic disorders. In addition, wide product usage as an excipient in the production of pain-relieving drugs, which are used to treat conditions, such as osteo & rheumatoid arthritis, ankylosing spondylitis, back pain, muscle pain, and toothache, drives the growth of the market. Furthermore, rising consumer awareness and the expanding adoption of ketone therapies in medical treatments further fuel market expansion.

The food & beverage segment is anticipated to register the fastest CAGR of more than 5.5% over the forecast period. This can be attributed to the rising demand for nonalcoholic beverages and increasing consumption of frozen dairy products, such as cheese, butter, ice cream, and yogurt, in the U.S. Furthermore, the demand for ketone supplements and products that support metabolism, weight loss, and energy levels is rapidly increasing, spurring growth in this market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. ketones market

By Application

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. U.S. ketones Market Variables, Trends & Scope

3.1. U.S. ketones Market Outlook

3.2. Industry Value Chain Analysis

3.3. Application Overview

3.4. Regulatory Framework

3.4.1. Policies and Incentive Plans

3.4.2. Standards and Compliances

3.4.3. Regulatory Impact Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. U.S. ketones Market: Application Outlook Estimates & Forecasts

4.1. U.S. ketones Market: Application Movement Analysis, 2024 & 2030

4.1.1. Cosmetics & Personal Care

4.1.1.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.2. Food & Beverages

4.1.2.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.3. Pharmaceuticals

4.1.3.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.4. Adhesives

4.1.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.5. Chemical Manufacturing

4.1.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.6. Electroplating

4.1.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.7. Others

4.1.7.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Competitive Landscape

5.1. Recent Developments & Impact Analysis, By Key Market Participants

5.2. Vendor Landscape

5.2.1. Company Categorization

5.2.2. List of Key Distributors and Channel Partners

5.2.3. List of Potential Customers/End Users

5.3. Competitive Dynamics

5.3.1. Competitive Benchmarking

5.3.2. Strategy Mapping

5.3.3. Heat Map Analysis

5.4. Company Profiles/Listing

5.4.1. BASF SE

5.4.1.1. Participant’s Overview

5.4.1.2. Financial Performance

5.4.1.3. Product Benchmarking

5.4.1.4. Strategic Initiatives

5.4.2. Ineos

5.4.2.1. Participant’s Overview

5.4.2.2. Financial Performance

5.4.2.3. Product Benchmarking

5.4.2.4. Strategic Initiatives

5.4.3. KetoLogic

5.4.3.1. Participant’s Overview

5.4.3.2. Financial Performance

5.4.3.3. Product Benchmarking

5.4.3.4. Strategic Initiatives

5.4.4. Perfect Keto

5.4.4.1. Participant’s Overview

5.4.4.2. Financial Performance

5.4.4.3. Product Benchmarking

5.4.4.4. Strategic Initiatives

5.4.5. KetoneAid

5.4.5.1. Participant’s Overview

5.4.5.2. Financial Performance

5.4.5.3. Product Benchmarking

5.4.5.4. Strategic Initiatives

5.4.6. Sapien Products LLC

5.4.6.1. Participant’s Overview

5.4.6.2. Financial Performance

5.4.6.3. Product Benchmarking

5.4.6.4. Strategic Initiatives

5.4.7. Boli LLC

5.4.7.1. Participant’s Overview

5.4.7.2. Financial Performance

5.4.7.3. Product Benchmarking

5.4.7.4. Strategic Initiatives

5.4.8. Zenwise

5.4.8.1. Participant’s Overview

5.4.8.2. Financial Performance

5.4.8.3. Product Benchmarking

5.4.8.4. Strategic Initiatives