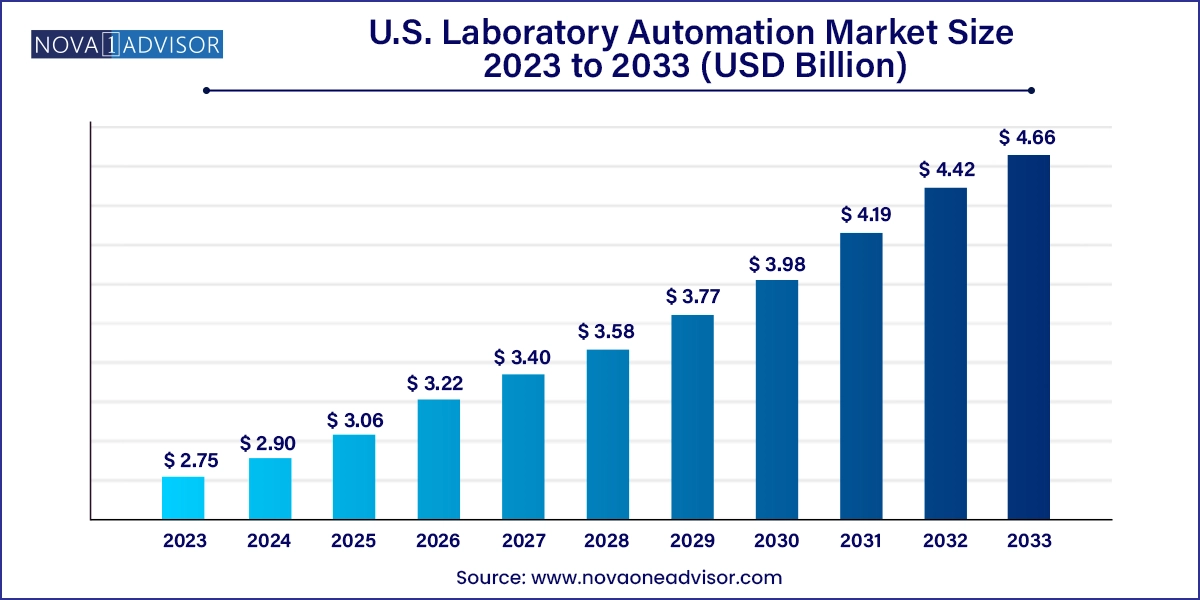

The U.S. laboratory automation market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 4.66 billion by 2033, growing at a CAGR of 5.42% during the forecast period 2024 to 2033.

The U.S. laboratory automation market is a cornerstone of modern scientific and clinical innovation, transforming laboratories from manual, labor-intensive environments into high-throughput, precision-driven ecosystems. Laboratory automation encompasses a broad spectrum of equipment, software, and processes that aim to streamline sample handling, testing, analysis, and data management across various disciplines including clinical diagnostics, pharmaceutical research, biotechnology, environmental monitoring, and academic research.

The adoption of automation in laboratories is no longer optional; it has become imperative. As labs handle increasing sample volumes due to expanded research pipelines, rising demand for diagnostic testing, and the complexity of molecular and genetic workflows, automation provides a scalable solution to enhance throughput while minimizing human error. In the U.S., which boasts some of the most advanced medical and life sciences infrastructures globally, laboratory automation plays a central role in driving operational efficiency, ensuring regulatory compliance, and accelerating innovation.

The demand for laboratory automation is fueled by several converging factors: the laboratory workforce shortage, growing emphasis on high-throughput screening (HTS) in drug discovery, and the need for reproducible results in both academic and commercial labs. The COVID-19 pandemic highlighted the urgency for automated workflows in molecular diagnostics, further propelling investment in automated liquid handling, robotic arms, conveyor systems, sample sorters, and integrated information systems. As laboratories transition toward Industry 4.0, with AI-enabled analytics, cloud-based laboratory information management systems (LIMS), and IoT-connected devices, the U.S. laboratory automation market is positioned for long-term expansion.

Miniaturization and Microfluidics: Devices are becoming smaller and more efficient, enabling labs to process smaller sample volumes with greater precision.

Rise of Total Lab Automation (TLA): High-complexity laboratories are transitioning to fully automated systems that handle pre-analytical to post-analytical workflows seamlessly.

Cloud-Integrated LIMS and AI Analytics: Data from automated systems is increasingly being centralized and analyzed in real time using AI for enhanced decision-making.

Focus on Modular Automation: Smaller labs are adopting modular systems to automate key stages without the financial or spatial commitment of full automation.

Growth in Genomics and Proteomics Automation: Life sciences labs involved in personalized medicine and omics research are demanding automation for sample prep and analysis.

Demand for Customizable and Scalable Platforms: Labs seek platforms that can evolve with their operational scale and research complexity.

Workforce Shortages Driving Automation Adoption: Shortages of skilled lab technicians are leading hospitals and research centers to invest more heavily in automated solutions.

Increasing Use of Robotic Process Automation (RPA): Robotic arms and programmable workstations are performing repetitive tasks with improved consistency and reduced contamination.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.90 Billion |

| Market Size by 2033 | USD 4.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.42% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Process, Automation Type, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | QIAGEN; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Danaher; Agilent Technologies, Inc.; Eppendorf SE; Hudson Robotics; Aurora Biomed Inc.; BMG LABTECH GmbH; Tecan Trading AG; Hamilton Company; F. Hoffmann-La Roche Ltd |

Discrete Processing dominated the U.S. laboratory automation market in terms of adoption, particularly in clinical chemistry and immunoassay analysis settings. Discrete systems are designed to handle samples independently rather than in a continuous flow, making them highly adaptable and accurate. Within discrete processing, random access discrete processing systems are favored for their ability to perform multiple tests on a single sample without following a sequential order. This flexibility is essential for STAT (short turnaround time) labs and hospitals handling emergency diagnostics.

Moreover, centrifugal discrete processing systems are also widely deployed in diagnostics labs that require quick, parallel processing of multiple assays with minimal cross-contamination. These systems support modular design and can be easily integrated with barcode tracking, minimizing manual loading errors. With automation now extending to specimen loading, aspiration, and reagent handling, discrete processing will remain integral to high-performance labs.

Continuous Flow Processing, while slightly less dominant, is growing steadily, especially in high-throughput pharmaceutical research and academic core facilities. Continuous systems facilitate a steady stream of specimens or reagents, enabling uninterrupted analysis in sequencing, mass spectrometry, or fluidics-based workflows. Laboratories prioritizing speed, consistency, and minimal reagent wastage are increasingly turning to parallel workflow designs within continuous systems to maximize efficiency. As modular instrumentation becomes more compatible with high-volume workflows, continuous systems are gaining traction.

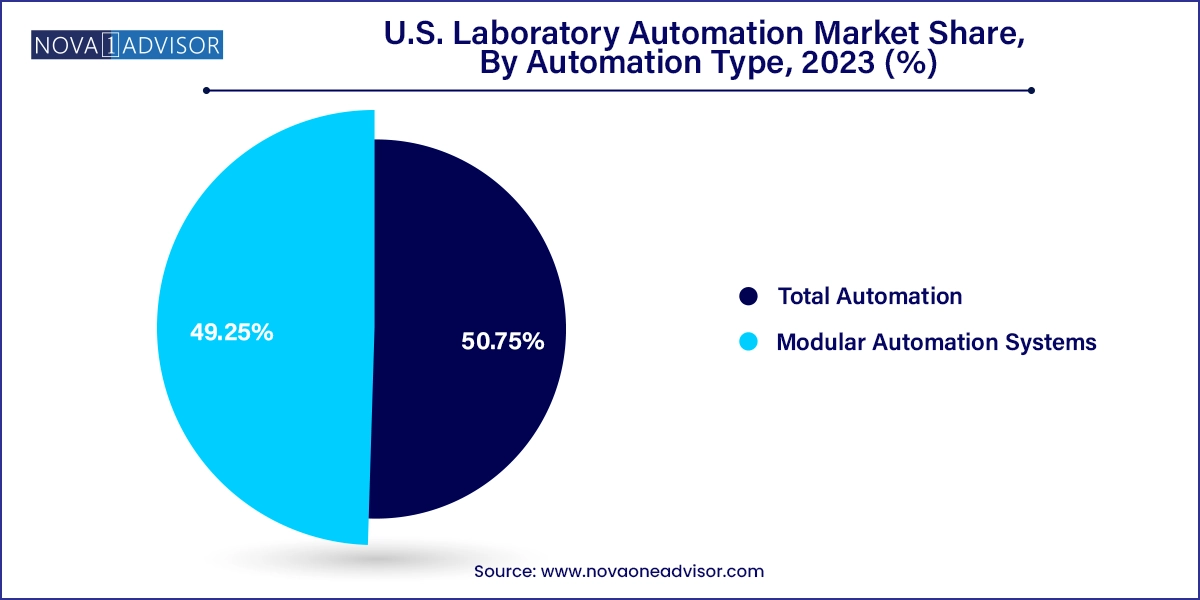

Total Laboratory Automation (TLA) dominated the automation type segment, particularly in large diagnostic labs and centralized hospital testing centers. TLA systems include end-to-end automation from pre-analytical steps like sample sorting and centrifugation to analytical stages including liquid handling and post-analytical storage. These systems offer unmatched efficiency, often reducing turnaround time by over 40% and error rates by more than 70%. They are particularly beneficial for labs running over 3,000 tests daily, such as reference labs or academic hospital systems.

In contrast, Modular Automation Systems are the fastest-growing automation type, largely due to their accessibility and flexibility. These systems allow labs to automate specific stages of the workflow such as sample prep, reagent handling, or data acquisition without committing to a full overhaul. This makes them ideal for labs with limited budgets or physical space constraints. Modular systems are also scalable, enabling labs to gradually expand their automation footprint. Startups and mid-sized labs find modular systems to be the best entry point into automation, supported by easier integration and faster ROI.

Clinical Chemistry Analysis remains the largest end-use segment within the U.S. laboratory automation market, owing to its application in routine blood panels, metabolic panels, and enzyme-linked testing. The sheer volume of tests performed in this domain spanning from cholesterol levels to liver function makes it a prime target for automation. Instruments such as auto-analyzers, pipetting robots, and automated spectrophotometers are central to this segment. These systems enhance accuracy and reduce manual workload, which is vital for maintaining turnaround times in hospital environments.

On the other hand, Immunoassay Analysis is the fastest-growing end-use segment, fueled by the expanding scope of infectious disease testing, hormonal analysis, and oncology biomarkers. The COVID-19 pandemic catalyzed demand for high-throughput, accurate immunoassays, leading to widespread automation of ELISA, chemiluminescent, and lateral flow assay platforms. Immunoassays require precise reagent dispensing, incubation timing, and signal detection all of which benefit from advanced automation. As multiplex assays become more common, automation will be central to ensuring reproducibility and throughput.

The U.S. laboratory automation market demonstrates significant regional variability, influenced by healthcare infrastructure, research funding, hospital networks, and academic institutions.

The Northeast region dominates the market, led by states like Massachusetts, New York, and Pennsylvania, which house top-tier academic medical centers, pharmaceutical giants, and NIH-funded research laboratories. Boston alone has a dense concentration of biopharma R&D centers and clinical trial labs heavily invested in laboratory automation systems.

Meanwhile, the Southwest region is the fastest-growing, especially in states like Texas and Arizona, where healthcare expansion and biomanufacturing hubs are fueling demand. With large hospital systems, growing diagnostic labs, and increasing support for biotech startups, this region is seeing aggressive investment in lab automation for both clinical and industrial use. Additionally, cost advantages and supportive infrastructure make the Southwest a burgeoning hub for lab technology deployment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. laboratory automation market

Process

Automation Type

End-use