The U.S. leather goods market size was exhibited at USD 50.85 billion in 2023 and is projected to hit around USD 97.26 billion by 2033, growing at a CAGR of 6.7% during the forecast period 2024 to 2033.

.webp)

The U.S. Leather Goods Market has established itself as one of the most dynamic and diverse segments of the country’s broader fashion, automotive, and lifestyle industry. Spanning across genuine leather, synthetic leather, and emerging vegan leather alternatives, the market encompasses a wide array of product categories—ranging from handbags and wallets to footwear, apparel, pet accessories, and automotive furnishings. Driven by evolving consumer tastes, premiumization trends, and a growing inclination toward sustainable materials, the U.S. leather goods market is in the midst of a profound transformation.

While genuine leather continues to dominate in terms of perceived value, luxury appeal, and durability, the rise of synthetic and vegan leather options is rapidly reshaping consumer behavior, especially among millennials and Gen Z buyers who prioritize ethics, environment, and affordability. Furthermore, the leather goods sector has successfully capitalized on the increasing integration of fashion with technology, such as smart wallets and digitally traceable luxury handbags, enhancing both product utility and exclusivity.

Rapid Emergence of Vegan Leather Products: Innovations in pineapple fiber (Piñatex), mushroom leather (Mylo), and lab-grown leather are gaining market traction.

Rising Demand for Gender-Neutral Leather Accessories: Unisex handbags, belts, and shoes are growing in popularity, reflecting a shift in fashion narratives.

Sustainable Supply Chain Initiatives: Brands are investing in traceable leather sourcing, biodegradable dyes, and closed-loop manufacturing.

Luxury Handbags as Investment Assets: Resale platforms and authenticated second-hand markets are boosting interest in premium leather accessories.

Personalized and Monogrammed Leather Goods: Consumer desire for bespoke products has led to a surge in customizable leather wallets, belts, and phone cases.

Crossover Between Fashion and Smart Accessories: Integration of RFID-blocking wallets, tracker-enabled bags, and wireless charging belts is on the rise.

Influence of Athleisure and Streetwear on Leather Footwear: Hybrid designs combining athletic functionality with leather aesthetics are trending.

| Report Coverage | Details |

| Market Size in 2024 | USD 54.26 Billion |

| Market Size by 2033 | USD 97.26 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Type By Product, Product |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Adidas AG; Nike, Inc.; Puma SE; Fila, Inc.; New Balance Athletics, Inc.; Knoll, Inc.; Samsonite International S.A.; VIP Industries Ltd.; Timberland LLC; Johnston & Murphy; |

A significant driver behind the growth of the U.S. leather goods market is the premiumization of consumer preferences combined with the rising demand for functional yet stylish fashion. Modern American consumers are increasingly inclined toward high-quality, long-lasting goods that offer both utility and aesthetic value. Leather, with its durability and timeless appeal, sits squarely at the intersection of these priorities.

Whether in the form of structured satchels, ergonomic leather shoes, or multi-functional backpacks with laptop compartments, functional design has become a critical buying factor. Consumers no longer see leather goods as static luxury items; instead, they seek products that align with their mobile, multitasking lifestyles. This evolution is particularly pronounced in urban centers, where young professionals invest in statement pieces that transition seamlessly from work to leisure while maintaining high craftsmanship standards.

Despite its premium appeal, the leather goods industry faces substantial scrutiny over animal welfare issues and the environmental footprint of leather production. Traditional leather processing involves chromium tanning, which generates toxic wastewater and is linked to pollution in major tannery hubs worldwide. Moreover, as consumers become more aware of fashion’s ecological cost, the ethical implications of sourcing animal hides are increasingly influencing purchasing decisions.

This growing consciousness is particularly strong among younger demographics who are reshaping retail trends by favoring cruelty-free and eco-friendly products. In response, established players are under pressure to adopt more sustainable tanning techniques, reduce chemical use, and embrace circular economy practices. Failure to address these concerns may result in reputational damage, loss of market share, and regulatory hurdles in the coming decade.

A promising opportunity within the U.S. leather goods market lies in the emergence and rapid adoption of vegan and lab-grown leather alternatives, which are gaining traction as both ethical and sustainable substitutes for animal-derived leather. Materials derived from apple peels, cactus, cork, and synthetic polymers with low environmental impact are being embraced by innovative brands and environmentally conscious consumers alike.

The rise of this category is not limited to indie labels—global giants such as Adidas, Stella McCartney, and Tesla have already announced or launched vegan leather product lines. These alternatives offer comparable aesthetics and functionality without compromising values, making them particularly attractive to Gen Z and millennial consumers. As technology matures and production scales up, vegan leather products are expected to become cost-competitive with traditional leather, opening doors for mass-market adoption across fashion, furniture, and automotive categories.

Genuine leather currently dominates the U.S. leather goods market, maintaining its stronghold due to its unmatched durability, luxurious texture, and timeless fashion relevance. Preferred in high-end accessories, footwear, and automotive interiors, genuine leather continues to symbolize quality and status. American consumers, particularly in the premium and luxury segments, are loyal to legacy brands such as Coach, Ralph Lauren, and Frye, which showcase masterful craftsmanship in natural leather products.

However, vegan leather is emerging as the fastest-growing segment, driven by shifting consumer values and material innovation. Biobased and synthetic vegan leathers—such as polyurethane-coated textiles or natural fiber composites—are gaining popularity in mainstream and luxury fashion. U.S.-based companies like Matt & Nat and Desserto are pushing the boundaries of eco-leather innovation. As production becomes more sustainable and cost-effective, vegan leather is expected to capture a growing portion of market share in the next decade.

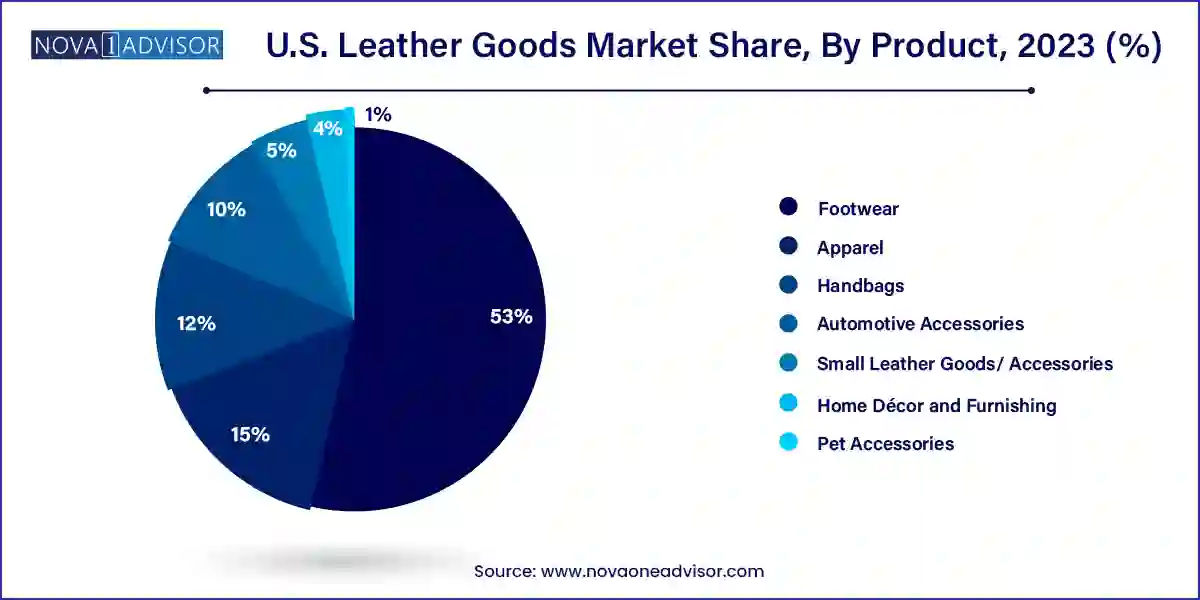

The leather footwear market accounted for a share of nearly 41% in 2023. owing to its vast application in both fashion and performance segments. From casual loafers and boots to athletic shoes with leather overlays, the segment benefits from widespread consumer adoption. Men’s and women’s footwear drive the bulk of demand, with a notable presence of genuine and synthetic leather in brands like Timberland, Johnston & Murphy, and Nike’s lifestyle lines. The durability and aesthetic value of leather make it an ideal material for both luxury and mass-market footwear.

Interestingly, pet accessories have emerged as one of the fastest-growing segments, reflecting a broader trend of pet humanization. Leather pet collars, leashes, and toys are gaining popularity among premium pet owners seeking durable and fashionable options for their companions. U.S.-based niche players like Found My Animal and Max-Bone are capitalizing on this trend by offering artisanal and ethically sourced leather pet accessories. As disposable income allocated to pet care increases, this segment is poised for strong growth, particularly in urban and high-income demographics.

The United States is a mature yet evolving market for leather goods, with distinct demand drivers across demographics, regions, and income levels. Coastal cities such as New York, Los Angeles, San Francisco, and Miami exhibit high demand for designer and luxury leather products, often driven by fashion-conscious consumers and tourists. The presence of flagship stores, fashion weeks, and high-income residents fuels steady sales in these urban hubs.

In contrast, Midwestern and Southern regions reflect strong demand for functional and heritage-style leather goods such as work boots, belts, and western apparel. Brands like Ariat, Wolverine, and Red Wing dominate these markets with their rugged and utility-driven leather offerings. Additionally, emerging cities like Austin, Nashville, and Denver are fostering local leather artisans and makers, contributing to a growing culture of craftsmanship and domestic production.

Consumer attitudes toward leather are also influenced by generational shifts. Baby boomers and Gen X remain loyal to genuine leather for its durability and status appeal, while millennials and Gen Z are more experimental, embracing vegan alternatives and niche brands with strong social values. This generational diversity is shaping a fragmented yet opportunity-rich market landscape.

March 2025 – Coach (Tapestry Inc.) unveiled its Coachtopia line, a collection of leather goods made with circular economy principles, including upcycled leather and recycled materials, targeting younger sustainability-focused consumers.

February 2025 – Allbirds launched its first vegan leather sneaker, made from a novel plant-based polymer that reduces carbon emissions by 88% compared to animal leather.

January 2025 – Tesla confirmed the rollout of all-vegan leather interiors for its Model S and Model X vehicles, emphasizing ethical luxury and environmental commitment.

December 2024 – Everlane introduced a new range of recycled leather handbags, combining traceable leather scrap materials with fair-trade production practices.

October 2024 – Nike announced a partnership with material science startup Natural Fiber Welding to explore fully recyclable leather-like materials for future product lines.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. leather goods market

Type

Type By Product

Product