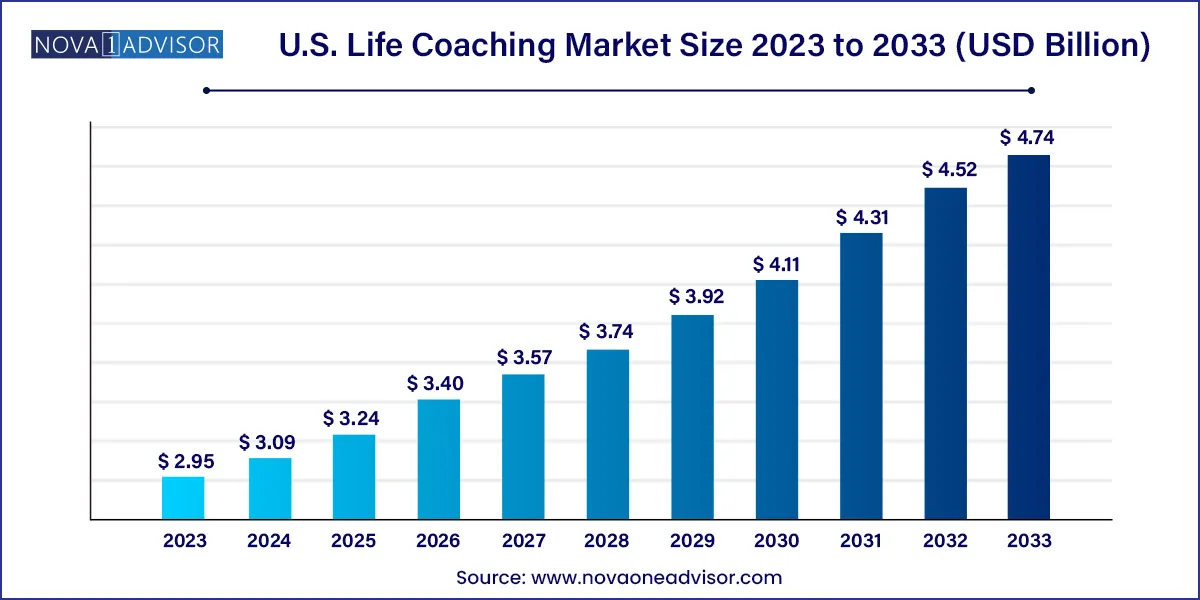

The U.S. life coaching market size was exhibited at USD 2.95 billion in 2023 and is projected to hit around USD 4.74 billion by 2033, growing at a CAGR of 4.86% during the forecast period 2024 to 2033.

The U.S. life coaching market has rapidly transformed from a niche, loosely defined service sector to a structured and increasingly mainstream industry. Life coaching, once considered a luxury for high-net-worth individuals or executives, is now a widely accepted personal development tool utilized by individuals across different demographics, professions, and age groups. The essence of life coaching lies in helping clients bridge the gap between where they are and where they want to be—whether in their careers, relationships, health, finances, or sense of purpose.

In the United States, cultural emphasis on self-improvement, emotional intelligence, and entrepreneurship has laid the groundwork for the proliferation of coaching services. From urban professionals navigating burnout to students managing academic stress and retirees seeking post-career fulfillment, life coaches offer structured guidance, accountability, and motivation. While traditional therapy focuses on healing the past, coaching emphasizes future possibilities and actionable change—an orientation that resonates with an achievement-driven culture.

The market encompasses a wide array of niches, including executive coaching, health and wellness coaching, relationship coaching, and spiritual coaching. With barriers to entry relatively low, the U.S. has seen an explosion of certified and non-certified coaches entering the profession. Meanwhile, clients are becoming more discerning, seeking evidence-based methodologies and measurable results, prompting many coaches to obtain formal certifications and training.

The digitalization of services—accelerated by the COVID-19 pandemic—has made coaching more accessible than ever. Virtual platforms allow coaches to reach clients across the country and beyond, reducing geographic limitations. As a result, the market is not only growing in size but also maturing in terms of professional standards, pricing models, and service offerings.

Mainstreaming of Coaching Services: Coaching is now seen as a common tool for personal and professional development, not just a service for executives or the elite.

Surge in Virtual Coaching Platforms: Online coaching via Zoom, proprietary apps, and web platforms has become dominant, allowing greater flexibility and national reach.

Niche Specialization: Coaches are increasingly focusing on specific client challenges such as grief recovery, divorce navigation, ADHD management, or creative career transitions.

Certification and Credentialing Demand: Clients increasingly prefer working with certified coaches, prompting professionals to pursue credentials from organizations like ICF, CTA, or NBHWC.

AI and Automation in Coaching: Some coaching apps now integrate AI to provide session summaries, track goal progress, and generate behavioral prompts in between live sessions.

Corporate Integration: More companies are including life coaching in employee wellness programs to address productivity, morale, and mental health.

Group and Subscription Models: Coaches are diversifying income through scalable offerings like group programs, courses, and monthly coaching memberships.

Focus on Mental Health Integration: Collaboration between therapists and coaches is growing, especially as clients seek holistic, mental-health-informed personal growth strategies.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.09 Billion |

| Market Size by 2033 | USD 4.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.86% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Coaching Method |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Endless Possibilities Life Coaching Services; Strategic Life Coaching; Pacific Life Coaching; Sunny Life Coach; Benchmark Consulting; BP Life Coaching Services, LLC; Solution Life Coaching Services; Thriveworks Counselling |

A powerful driver behind the U.S. life coaching market is the cultural and generational shift toward intentional living, self-improvement, and mental well-being. As society grows more complex and technology-driven, individuals are seeking ways to reclaim purpose, balance, and agency over their lives. Millennials and Gen Z, in particular, are highly proactive about self-optimization, viewing coaching as a proactive investment rather than a remedial action.

This trend has been amplified by the pandemic, which acted as a major catalyst for introspection, career shifts, and redefinition of life priorities. Many individuals who experienced burnout, job loss, or emotional fatigue turned to life coaches to redesign their personal and professional trajectories. The idea of “life by design” is resonating across generations, and life coaching has emerged as a key facilitator in this cultural realignment. Unlike therapy or psychiatry, which may carry stigma for some, life coaching is framed as aspirational and future-oriented—qualities that align well with a goal-setting and achievement-centric population.

Despite its popularity, the U.S. life coaching market is restrained by a fundamental issue: the lack of industry-wide regulation or professional standardization. Unlike psychologists, therapists, or licensed counselors, life coaches are not required to hold specific credentials or certifications to practice. This lack of oversight has resulted in a market saturated with self-proclaimed “coaches,” leading to inconsistent service quality and skepticism among potential clients.

While reputable organizations like the International Coaching Federation (ICF) provide rigorous training and certification pathways, these are not mandatory, and many coaches operate without formal qualifications. This ambiguity can diminish consumer trust and make it harder for legitimate, trained coaches to differentiate themselves. Furthermore, clients sometimes confuse coaching with therapy, leading to mismatched expectations or inappropriate case handling especially when mental health issues are involved. This structural challenge continues to limit the market’s credibility and slows down broader institutional adoption.

An exciting opportunity in the U.S. life coaching market lies in the integration of coaching services with digital wellness platforms and corporate benefits packages. As businesses increasingly prioritize mental health, employee satisfaction, and productivity, coaching is being positioned as a non-clinical, proactive tool to address common workplace challenges such as imposter syndrome, decision fatigue, leadership development, and emotional resilience.

Additionally, the rise of wellness tech has created new channels for coaches to deliver services. Apps like BetterUp, CoachHub, and Selfspace have already begun to blend personalized coaching with digital tools such as journaling prompts, mood tracking, and resource libraries. This model allows for scalable coaching experiences while maintaining a human connection. Startups in the mental wellness space are actively seeking credentialed coaches to expand their offerings—creating employment, licensing, and collaboration opportunities.

For independent coaches, partnerships with digital platforms and corporate EAPs (Employee Assistance Programs) offer predictable income streams and wider reach, bypassing the slow, client-by-client acquisition model. As digital health continues its trajectory, life coaching stands to become a key fixture in personalized wellness ecosystems.

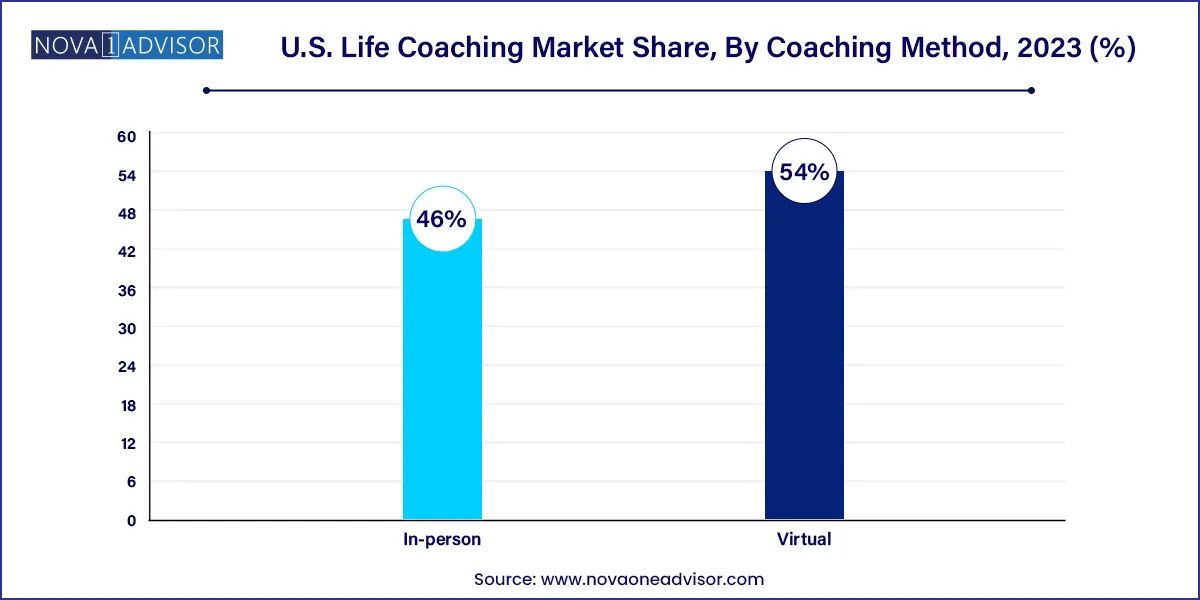

Virtual coaching has emerged as the dominant method of service delivery in the U.S. life coaching market. This rise is largely attributed to advancements in video conferencing technology, changing consumer habits, and the widespread normalization of remote services following the COVID-19 pandemic. Platforms like Zoom, Google Meet, and proprietary coaching portals have enabled coaches to seamlessly connect with clients regardless of geography, thereby removing traditional access barriers such as travel time, location constraints, and overhead costs associated with physical office spaces.

This model has proven particularly popular among millennial and Gen Z clients who are digital natives and prefer asynchronous, tech-enabled engagement. Additionally, virtual coaching allows for flexible scheduling, greater privacy, and the convenience of accessing support from home or the office. Coaches, too, benefit from a broader client base and reduced operational costs. As telehealth and digital wellness become more deeply embedded in American culture, virtual coaching is expected to maintain its dominance and drive market scalability.

Despite the digital boom, in-person coaching continues to grow steadily, especially in specific niches that benefit from deeper relational dynamics or physical presence—such as executive leadership coaching, transformational retreats, or body-mind integration programs. In-person methods often foster stronger rapport, nuanced body language interpretation, and immersive experiences that some clients value over screen-based sessions.

This segment thrives in affluent urban areas like New York City, Los Angeles, and Chicago, where clients are willing to invest in premium services. Additionally, in-person coaching is common in settings like co-working spaces, wellness centers, and university campuses. The resurgence of wellness retreats, leadership boot camps, and group coaching workshops has revitalized demand for face-to-face coaching formats. As hybrid models gain traction, many coaches are offering a combination of both virtual and in-person engagements, depending on client needs and session goals.

The United States presents a fertile and diversified environment for life coaching services, owing to its individualistic culture, entrepreneurial spirit, and well-established wellness economy. Urban centers like San Francisco, Austin, Miami, and Seattle are hotspots for innovation in the coaching industry. These cities not only have high per-capita income and tech-savvy populations but are also home to progressive communities that value holistic and non-traditional approaches to personal development.

Rural and suburban areas are increasingly accessing coaching through digital means, reducing the urban-rural divide. Additionally, college campuses, military transition programs, and senior living communities are emerging as specialized coaching markets. Public figures and celebrities openly endorsing coaching—such as Oprah Winfrey or Bill Gates—have helped normalize the concept nationwide. As the U.S. workforce continues to experience upheavals due to automation, remote work, and generational shifts, coaching is becoming a vital resource to navigate life transitions, making its adoption more widespread across industries and age brackets.

February 2025 – BetterUp, a prominent coaching platform, announced its partnership with three Fortune 500 companies to offer on-demand virtual life coaching as part of their employee benefits, targeting mid-level managers and emerging leaders.

March 2025 – Tony Robbins' coaching organization launched a tech-enabled self-paced personal transformation program, blending live coaching, journaling prompts, and AI-generated progress tracking.

January 2025 – Mindvalley, a personal growth platform with coaching services, introduced a U.S.-based coach certification academy to formalize training for its community leaders and facilitators.

April 2025 – A new U.S.-based startup, ClarityPath, secured Series A funding to launch an AI-assisted coaching platform that matches clients with certified coaches and automates check-in workflows, enhancing session outcomes and continuity.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. life coaching market

Coaching Method