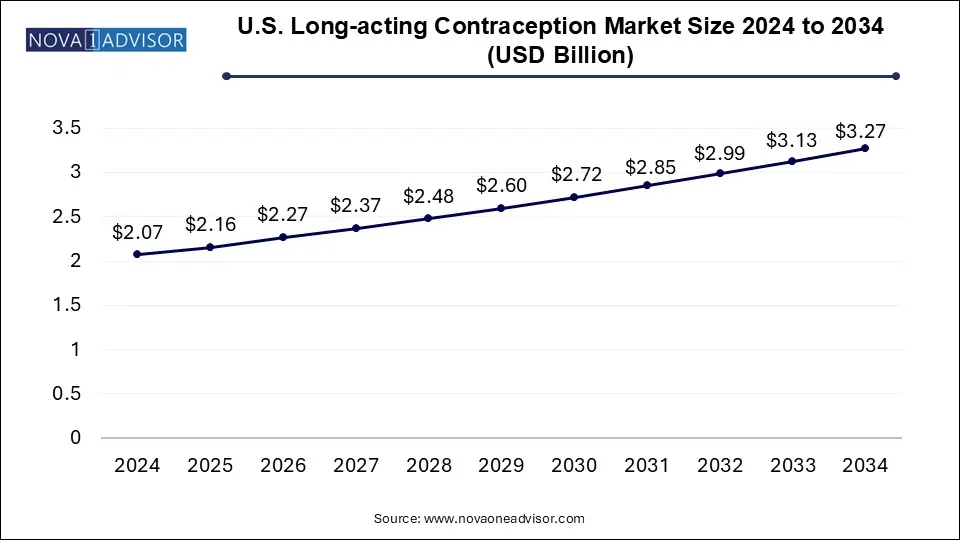

The U.S. long-acting contraception market size was exhibited at USD 2.07 billion in 2024 and is projected to hit around USD 3.27 billion by 2034, growing at a CAGR of 4.71% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.16 Billion |

| Market Size by 2034 | USD 3.27 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 4.71% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Merck & Co., Inc.; Pfizer Inc.; The Cooper; Allergan (AbbVie Inc.); Bayer AG |

The rising adoption of Intrauterine Devices (IUDs) owing to high effectiveness and increasing awareness about sexual health are expected to boost the use of various birth control methods. In recent years, the demand and usage of Long-Acting Reversible Contraception (LARC) have increased in the U.S. The use of LARCs was higher among women aged 30 to 39 years (12.7%) and 20 to 29 years (13.7%), as compared to women aged 40 to 49 years (6.6%) and 15 to 19 years (5.8%) during 2021 to 2023, as per the National Center for Health Statistics. Thus, higher adoption among middle-aged women is propelling the market growth.

LARCs do not require ongoing effort from the patient, compared to short-term reversible contraceptive methods. Users are not required to remember to take pills daily, thus, removing the possibility of related errors. Furthermore, IUDs are not repetitive and can last for 3 to 5 years. IUDs are nearly 20 times more effective than oral pills, patches, and vaginal rings. These advantages over other modern and traditional contraceptive methods are the primary factors driving the adoption of LARC.

The American College of Obstetrics and Gynecologists regards LARCs, such as IUDs, as the gold standard in birth control. IUDs are one of the most effective birth control methods with over 99% effectiveness. According to Kaiser Family Foundation, IUD utilization among women aged 15 to 44 years, who have used contraceptives within the previous 30 days, increased from 12% in 2013-2015 to 14% in 2015-2017. This was primarily due to high effectiveness and ease of use.

Presently available LARCs are safe and long-lasting. They have high patient acceptability, fewer contraindications for use, and are recommended, in certain cases, due to their improved bleeding control. As the understanding and awareness about products, such as ParaGard & Kyleena, is growing among the U.S. population, their demand & popularity are witnessing substantial growth.

The U.S. government is undertaking active efforts and initiatives to improve access to contraceptives. Affordable Care Act mandates full coverage of preventive services without any consumer sharing. Preventive services consist of prescription contraceptives and other related medical services. This has led to a considerable drop in out-of-pocket expenses, thereby improving accessibility. This is anticipated to fuel the market growth.

On the basis of product, the market is segmented into IUD, subdermal implants, and injectables. The IUD segment accounted for the largest market share of over 61.0% in 2024. High effectiveness in the prevention of pregnancy and improving access owing to the U.S. Affordable Care Act are primary factors responsible for the prominent share of the segment. The IUD segment is further bifurcated into hormonal and nonhormonal IUD products. The hormonal IUD segment accounted for the maximum share owing to improving awareness among women about reproductive health. In addition, recent advancements in available brands, such as Liletta, are expected to boost its adoption.

The subdermal implants segment is projected to witness the second-fastest CAGR during the forecast period. This growth is credited to the product’s cost efficiency, more than 99.0% effectiveness, and quick return of natural fertility after removal. A Contraceptive CHOICE study published in November 2017 reported higher acceptance of implants among the adolescent population. Thus, the high adoption of subdermal implants among teenagers is also likely to boost segment growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. long-acting contraception market

By Product