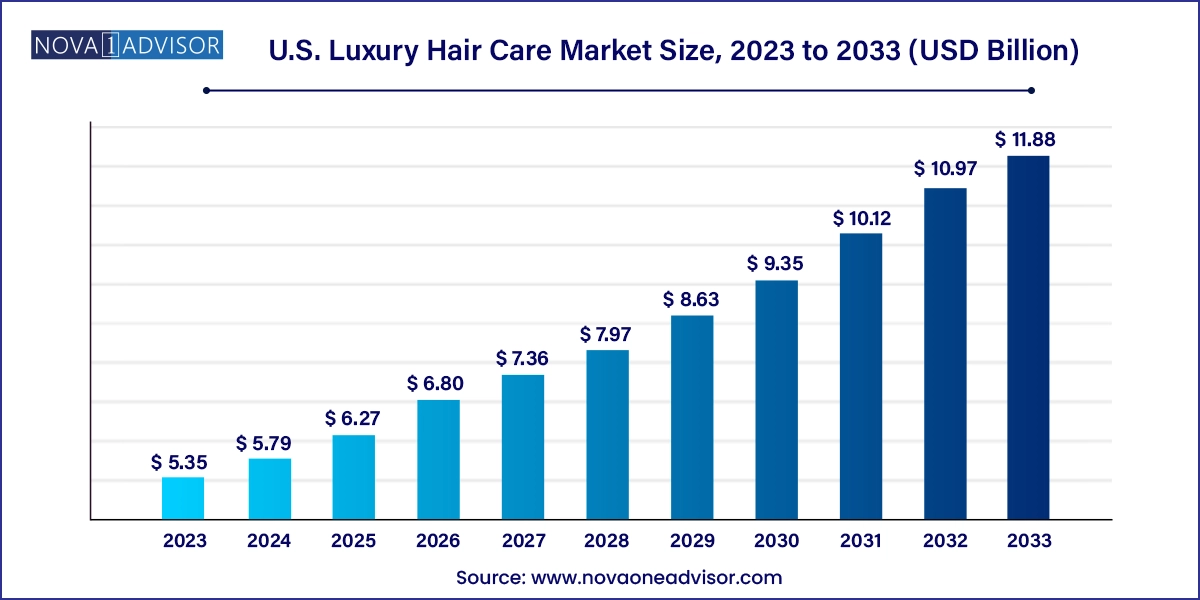

The U.S. luxury hair care market size was exhibited at USD 5.35 billion in 2023 and is projected to hit around USD 11.88 billion by 2033, growing at a CAGR of 8.3% during the forecast period 2024 to 2033.

The U.S. luxury hair care market has evolved into a high-value, high-innovation sector driven by shifting consumer perceptions of hair wellness, increased disposable incomes, and the desire for personalized, performance-driven beauty products. No longer viewed as a basic grooming necessity, hair care in the luxury segment has become synonymous with self-care, status, and holistic beauty. Modern consumers are willing to pay a premium for quality, ingredients, and efficacy, creating a thriving marketplace for prestige products that promise transformative results.

In the United States, luxury hair care spans across high-end shampoos, conditioners, oils, masks, coloring treatments, and styling products, with pricing typically starting from USD 30 and going well beyond USD 200. This market is defined by a sophisticated consumer base that seeks clinically backed, ingredient-transparent, and sensorially pleasing experiences. As beauty rituals become increasingly personalized, luxury hair care brands are innovating with ingredient formulations derived from skincare—such as peptides, hyaluronic acid, and adaptogens—to target specific concerns like scalp health, hair thinning, frizz, or environmental stress.

Prestige brands such as Oribe, Kérastase, Christophe Robin, and Augustinus Bader lead the charge, often stocked in luxury salons, high-end department stores, or direct-to-consumer platforms. Simultaneously, niche and indie labels are emerging with clean, vegan, cruelty-free, and sustainable positioning, finding their audience among health-conscious millennials and Gen Z shoppers. The market also benefits from strong endorsement by dermatologists, influencers, and celebrities, reinforcing its aspirational appeal.

Post-COVID behavioral shifts have accelerated demand for premium at-home treatments, prompting a surge in luxury hair masks, scalp scrubs, and heatless styling options. Consumers are also increasingly turning to online channels for detailed product education, reviews, and exclusive launches. In essence, the U.S. luxury hair care market is driven not just by the desire for beautiful hair, but by the broader emotional, experiential, and ethical dimensions that luxury brands successfully deliver.

Skincare-Grade Haircare Products: Formulations featuring niacinamide, peptides, and ceramides are blurring the lines between hair care and skincare.

Scalp Health as a Beauty Priority: Products focusing on scalp detox, microbiome balance, and follicle stimulation are gaining popularity.

Rise of Clean and Green Beauty: Consumers are demanding cruelty-free, vegan, sulfate- and paraben-free luxury products.

Customization and Personalization: Brands are leveraging AI and quizzes to deliver personalized hair care regimens for unique hair needs.

Gender-Neutral Branding: Many luxury brands are launching unisex lines appealing to diverse consumer identities.

Influencer and Celebrity Branding: A-list endorsements and influencer partnerships are driving visibility and conversion.

Direct-to-Consumer (DTC) Growth: Exclusive online platforms and brand-owned websites are becoming critical distribution channels.

Tech-Driven Experiences: Virtual hair diagnostics, AR try-ons for hair coloring, and subscription-based hair care services are expanding.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.79 Billion |

| Market Size by 2033 | USD 11.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, Price Range |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | L’Oréal Groupe, Living proof, Aveda (Estée Lauder Companies), Briogeo Hair, Rucker Roots, MOROCCANOIL, K18HAIR, Procter & Gamble (Ouai), Shiseido Company, Limited, Advent International (Olaplex) |

Growing Consumer Willingness to Spend on Performance-Driven, Wellness-Centric Haircare

One of the most powerful forces fueling the U.S. luxury hair care market is consumers’ increasing willingness to invest in high-performance, wellness-oriented products. Hair is no longer viewed in isolation but as a reflection of overall well-being, confidence, and identity. Consumers now consider the quality, composition, and ethical sourcing of ingredients before making a purchase—treating hair care as seriously as skincare. Ingredients such as biotin, amino acids, apple stem cells, and caviar extract have become status symbols within the beauty regimen. The U.S. consumer—especially in urban and affluent segments—is increasingly seeking salon-level results at home, leading to a surge in at-home luxury rituals involving hair masks, serums, and heat protectants. This behavioral shift is setting a strong foundation for continued category expansion.

Price Sensitivity and Limited Accessibility to a Broader Audience

Despite its aspirational appeal, the U.S. luxury hair care market is limited by its high entry price point, which restricts broader market penetration. While affluent urban consumers may regularly spend upwards of USD 100 on a shampoo-conditioner duo, middle-income and price-sensitive consumers are often deterred by the steep pricing. Moreover, in regions outside of major cities, luxury hair care brands have limited retail presence, which reduces accessibility. Although online platforms mitigate this challenge to an extent, the lack of tactile experience and sampling opportunities affects purchasing confidence. As inflationary pressure and economic uncertainty impact consumer spending habits, discretionary beauty expenditures—especially in the luxury category—face a degree of volatility.

Rising Demand for Premium Scalp Care and Functional Luxury Products

An emerging opportunity in the market lies in the premiumization of scalp care. American consumers are now deeply interested in root-level solutions that target not just hair strands, but scalp issues such as buildup, itchiness, and sensitivity. This shift mirrors the evolution of skincare, where prevention and deep treatment replaced surface-level fixes. Brands such as Act+Acre and Briogeo are already capitalizing on this by offering clarifying exfoliants, microbiome-balancing serums, and oil detox treatments. The opportunity also extends to functional luxury—products that address specific problems like postpartum hair loss, graying, or UV damage, thus appealing to aging, postpartum, and ethnically diverse consumer groups. Brands that combine clinical research with sensory luxury stand to dominate this evolving segment.

The sales for luxury hair care market through specialty stores accounted for a revenue share of 31.6% in 2023. benefiting from strong brand presence, expert staff, and experiential merchandising. Retailers such as Sephora, Ulta Beauty, and Bluemercury offer a curated experience where consumers can sample, test, and receive consultations before investing in high-ticket items. Specialty stores also offer exclusivity, loyalty programs, and luxury-focused brand partnerships, which enhance both conversion and retention. For prestige brands, these outlets serve as premium touchpoints for branding and in-store storytelling.

The online sales of luxury hair care products in the U.S. are expected to grow at a CAGR of 8.9% from 2024 to 2033. Direct-to-consumer platforms for brands like Prose, Crown Affair, and Virtue Labs allow for personalization, real-time reviews, and subscription-based refills. Online shoppers increasingly rely on YouTube reviews, TikTok tutorials, and Instagram reels to make purchase decisions, while e-retailers offer sample bundles and flash sales that mimic in-store experiences. The ongoing integration of AR, live consultations, and hair type diagnostics is making online luxury hair care shopping more intuitive and rewarding.

Shampoos accounted for a share of 31.0% in 2023. This dominance is rooted in the fact that shampoo is the cornerstone of every hair care routine, forming the first point of contact in any regimen. Consumers increasingly demand shampoos that do more than cleanse—they expect scalp exfoliation, volume boosting, anti-frizz effects, and nourishment from premium ingredients. Luxury shampoos such as Kérastase Resistance Bain, Oribe Gold Lust, and Shu Uemura Ultimate Reset exemplify this multifunctional approach. Innovations in sulfate-free, fragrance-optimized, and color-safe shampoos have further strengthened consumer appeal, particularly in salons and high-end beauty retailers.

The hair coloring products market in the U.S. is projected to grow at a CAGR of 9.3% from 2024 to 2033. Oils such as argan, marula, and moringa—previously viewed as niche—are now integrated into daily hair rituals for deep conditioning, styling, and protection. Brands like Fable & Mane, Augustinus Bader, and Gisou have built entire portfolios around high-performing oils, marketed through sensorial campaigns and rooted in ancestral traditions. Additionally, consumers are embracing pre-wash oiling and overnight treatments, expanding the use cases for hair oils. As modern luxury intersects with cultural nostalgia, this segment is set to accelerate.

Luxury hair care products ranging from USD 30 to USD 65 accounted for a share of 39.9% in 2023. The products offered by companies in this price range are often preferred by the customers for two main factors associated with them, the fragrances and unique ingredients used in the formulation of the product. For instance, BAIN OLÉO-RELAX is a moisturizing shampoo characterised with presence of ingredients such as Coconut Oil, Extracted oil from the Shorea robusta seed, Rosa Canina fruit oil. The Kérastase Paris brand offers it for $42 in 250 ml packaging.

The demand for products ranging from USD 65 to USD 100 is expected to grow at a CAGR of 8.9% from 2024 to 2033. Products in the price range are slightly differentiated from the previous range and usually these products tend to provide solution for specific hair care related problem. For instance, Oribe's Gold Lust Transformative Masque is available for $70 in 150 ml packaging. It is marketed as one of the effective modern remedies to rebuild damaged hair through use of white tea and jasmine extracts.

The United States is one of the most vibrant and lucrative luxury beauty markets globally, and hair care is no exception. Urban centers such as New York, Los Angeles, San Francisco, and Miami have long served as trend epicenters, fostering early adoption of luxury products. Here, consumers prioritize efficacy, exclusivity, and aesthetics—driving high uptake of premium hair care brands. In affluent suburbs and emerging secondary cities like Austin, Nashville, and Charlotte, demand is being driven by digital awareness, boutique salon experiences, and influencer outreach.

U.S. consumers are also highly attuned to wellness and clean label movements, often scrutinizing ingredients and ethical practices. Luxury brands that demonstrate transparency—whether in sourcing, formulation, or packaging—earn strong loyalty. There is also growing demand for inclusive formulations tailored to textured hair, aging concerns, and postpartum recovery, which are being addressed by emerging niche brands. The rise of hair-focused clinics, dermocosmetic solutions, and health-beauty hybrids further reinforces the sophistication of the U.S. market. With high per capita spending on beauty and an appetite for innovation, the U.S. will remain the dominant country in the global luxury hair care landscape.

Augustinus Bader (February 2024): The brand launched its new “Hair Revitalizing Complex,” a premium hair supplement and serum designed to target aging hair at the follicular level. The product integrates stem cell science and has gained traction across major luxury beauty retailers.

Olaplex (March 2024): Olaplex introduced a clarifying shampoo with patented bond-building technology for professional and at-home use. The launch is accompanied by an education campaign aimed at salon professionals and direct consumers.

Kérastase (January 2024): Kérastase partnered with top U.S. salons to roll out its “Fusio-Dose” treatment range nationwide, offering customized luxury treatments blending active concentrates and boosters.

Fable & Mane (December 2023): Fable & Mane expanded into Nordstrom and announced a limited-edition Ayurvedic hair oil, inspired by traditional Indian scalp rituals. The campaign focused on heritage, wellness, and storytelling.

Sephora (November 2023): Sephora unveiled a “Luxury Hair Wall” in its flagship stores across New York and California, showcasing top-tier brands such as Virtue, Crown Affair, and Sisley Hair Rituel.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. luxury hair care market

Product

Distribution Channel

Price Range