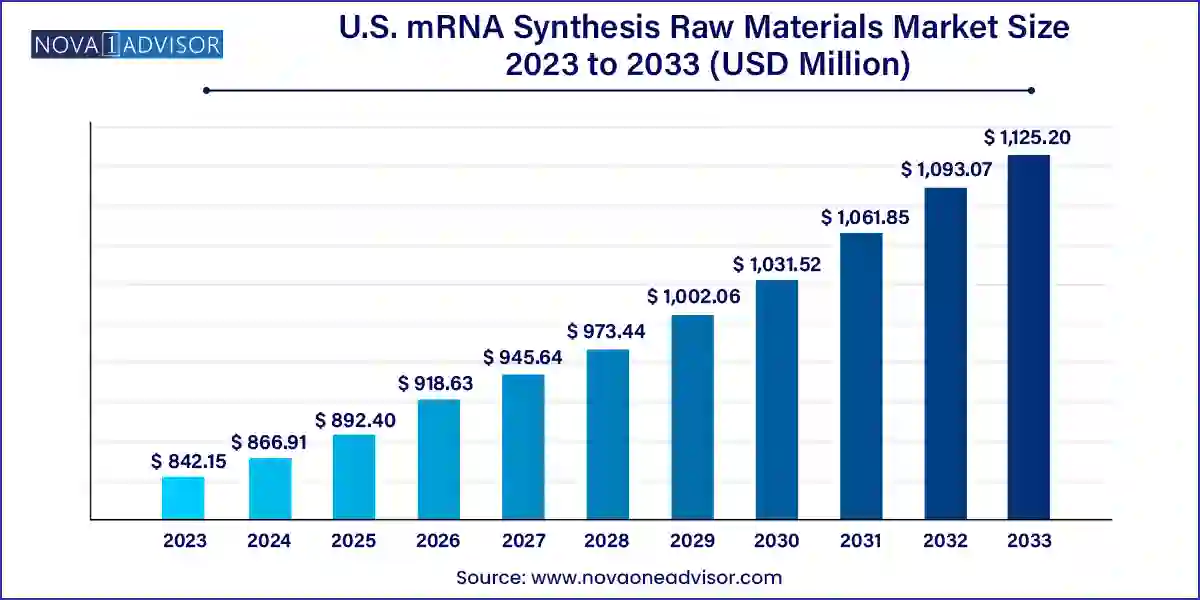

The U.S. mRNA synthesis raw materials market size was exhibited at USD 842.15 million in 2023 and is projected to hit around USD 1,125.20 million by 2033, growing at a CAGR of 2.94% during the forecast period 2024 to 2033.

The U.S. mRNA synthesis raw materials market represents a foundational pillar within the broader mRNA-based therapeutics and vaccines industry. Raw materials such as nucleotides, capping agents, enzymes, and plasmid DNA are critical to the manufacturing of messenger RNA (mRNA) used in various biomedical applications. As mRNA technologies transitioned from niche research tools to front-line clinical solutions, especially during the COVID-19 pandemic, the demand for high-purity, scalable, and compliant raw materials surged exponentially.

The market's rapid expansion was catalyzed by the emergency use authorization and subsequent commercialization of mRNA vaccines by companies like Moderna and Pfizer-BioNTech. The U.S. market, home to some of the most sophisticated biomanufacturing infrastructure and stringent regulatory oversight, has become a hotspot for mRNA innovation. These raw materials are now used not only in vaccine development but also in emerging therapeutic areas such as oncology, rare diseases, protein replacement therapies, and autoimmune disorders.

The U.S. government’s strategic interest in mRNA as a pandemic-preparedness tool, coupled with massive investments into domestic manufacturing, continues to provide strong tailwinds to the raw materials market. Additionally, contract manufacturing organizations (CMOs) and contract research organizations (CROs) are heavily involved in scaling production capabilities, further supporting market growth.

Rising Investment in End-to-End mRNA Manufacturing Platforms: Companies are integrating raw material supply chains into their operations to ensure seamless and scalable production.

Increased Demand for GMP-Grade and High-Purity Raw Materials: Regulatory standards have driven a shift toward pharmaceutical-grade capping agents and enzymatic reagents.

Shift Toward Enzymatic Capping and Improved Stability: Enzymatic methods for capping mRNA are being adopted over chemical methods for their efficiency and yield.

Automation and Digital Integration in mRNA Raw Material Production: Companies are leveraging AI-driven tools to optimize reagent use and yield prediction.

Collaborations Between Biotechs and Raw Material Suppliers: Strategic partnerships are being formed to ensure long-term supply agreements and faster time-to-market.

Exploration of Non-Viral Delivery Systems: New raw materials are being developed to support lipid nanoparticles (LNPs) and polymer-based delivery.

Expansion into Non-COVID Applications: Oncology, cardiovascular, and metabolic disorders are becoming key targets for mRNA-based therapies.

| Report Coverage | Details |

| Market Size in 2024 | USD 866.91 Million |

| Market Size by 2033 | USD 1,125.20 Million |

| Growth Rate From 2024 to 2033 | CAGR of 2.94% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd.; Jena Bioscience GmbH; Merck KGaA; Yeasen Biotechnology (Shanghai) Co., Ltd.; BOC Sciences; Thermo Fisher Scientific, Inc.; Maravai LifeSciences; New England Biolabs; Creative Biogene; HONGENE; Evonik Industries AG |

The most compelling driver of the U.S. mRNA synthesis raw materials market is the widespread adoption of mRNA technologies for both vaccines and therapeutics. The success of mRNA COVID-19 vaccines validated the platform’s utility, efficacy, and scalability, paving the way for accelerated R&D in other therapeutic areas. Moderna, for instance, is now advancing mRNA-4157, an individualized neoantigen therapy for melanoma, while Pfizer is developing mRNA-based flu and shingles vaccines.

This burgeoning pipeline has placed enormous pressure on upstream raw material supply. GMP-grade nucleotides, plasmid DNA, and enzymes like polymerases and RNase inhibitors are now essential commodities. The need for large-scale, consistent, and contamination-free raw materials has never been higher, with manufacturers investing in vertically integrated facilities to minimize supply chain risks. Moreover, government programs like the Biomedical Advanced Research and Development Authority (BARDA) continue to fund domestic production of essential inputs.

Despite the high demand, the mRNA raw materials supply chain remains complex and vulnerable to disruptions. The synthesis of GMP-grade reagents like capping analogs, high-purity nucleotides, and supercoiled plasmid DNA involves sophisticated processes that require specialized infrastructure and expertise. Any variability in raw material quality can compromise product efficacy and safety.

Moreover, the industry faces logistical challenges in sourcing specialty enzymes and reagents at scale, with a limited number of suppliers globally. This concentration creates bottlenecks, particularly when multiple pharmaceutical clients simultaneously scale up production. Lead times, batch-to-batch variability, and regulatory compliance are ongoing concerns. Smaller players often struggle to maintain robust quality control systems, limiting their ability to compete in clinical-grade applications.

One of the most promising opportunities in the U.S. mRNA raw materials market lies in the growth of personalized and precision mRNA therapies. These therapies require custom-designed mRNA sequences targeting patient-specific mutations or disease markers, especially in fields like oncology and rare genetic disorders. Each customized mRNA molecule demands a tailored set of raw materials, including modified nucleotides and specialized enzymes.

For example, BioNTech is developing tumor-specific mRNA therapies in collaboration with U.S.-based partners. As more of these personalized treatments move through clinical trials, demand will rise for small-batch, high-fidelity raw materials with guaranteed sterility and traceability. Companies that can develop modular, agile production platforms for raw materials stand to gain substantial market share. The ongoing convergence of synthetic biology, AI, and automation will further enhance the ability to produce such specialized inputs efficiently.

Nucleotides dominated the U.S. mRNA synthesis raw materials market due to their fundamental role in building the RNA strand. Modified nucleotides, such as pseudouridine and N1-methyl-pseudouridine, have become standard in therapeutic mRNA to enhance translation efficiency and minimize innate immune response. These modified bases are critical for the success of commercial mRNA vaccines and are widely adopted by industry leaders. Companies are heavily investing in domestic production of nucleotide triphosphates to ensure supply chain resilience, making this segment both high in demand and profitability.

Enzymes represent the fastest-growing segment, driven by the innovation and specificity required for mRNA synthesis and purification. Enzymes such as T7 RNA polymerase, RNase inhibitors, and DNase play crucial roles in ensuring accurate transcription, stability, and removal of unwanted genetic material. The demand for highly pure, scalable enzymes that can function in GMP environments has surged. For example, RNase contamination can degrade final mRNA products, making the use of robust RNase inhibitors indispensable. Furthermore, enzymatic capping systems are replacing older chemical capping methods, further boosting this segment’s growth.

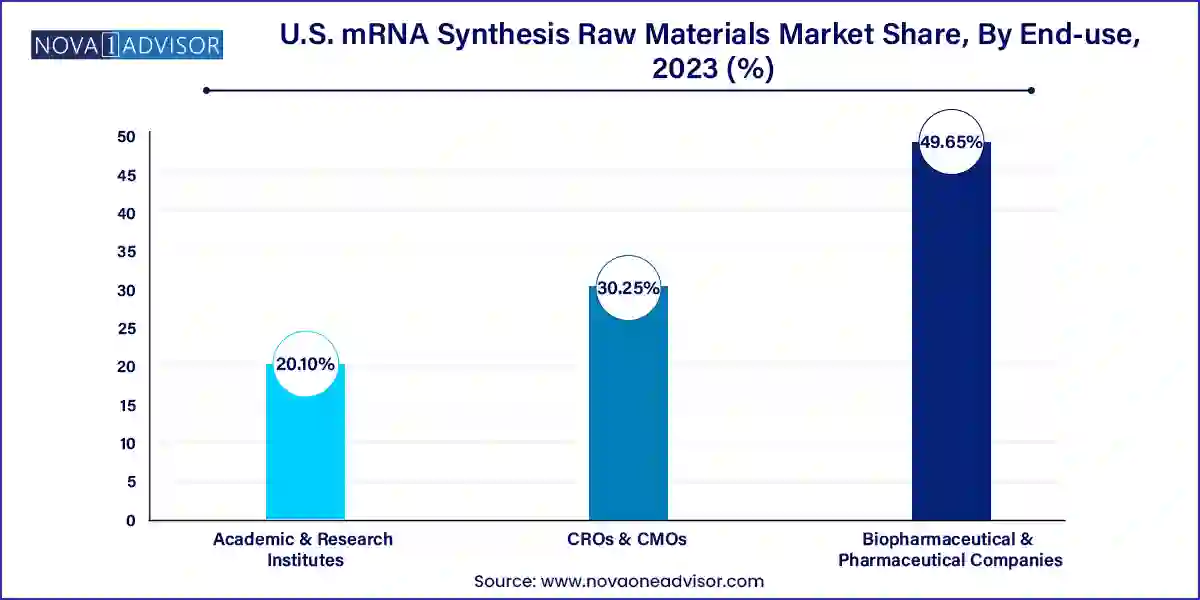

Biopharmaceutical and pharmaceutical companies dominate the end-use segment, accounting for the majority of raw material consumption. These companies not only require raw materials for commercial production but also for extensive R&D and clinical development. The drive to establish in-house manufacturing capabilities has further increased direct procurement from raw material suppliers. Strategic partnerships, exclusive supply agreements, and in some cases, acquisitions of raw material manufacturers, underscore the criticality of this segment.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are the fastest-growing end-users. These entities are pivotal in supporting small to mid-sized biotechs lacking internal production infrastructure. With the rise in outsourcing trends, CROs and CMOs are scaling up capabilities in both preclinical and clinical-grade mRNA production. Their growing involvement necessitates ready access to flexible and compliant raw materials, propelling market demand within this segment.

Vaccine production was the leading application segment in the wake of the COVID-19 pandemic, with billions of doses of mRNA vaccines produced within a short timeframe. This necessitated unprecedented quantities of raw materials, creating a lasting impact on procurement strategies and capacity planning. The ability to rapidly produce vaccine candidates using synthetic RNA sequences has revolutionized vaccine R&D and opened the door for next-generation vaccines targeting influenza, RSV, HIV, and more.

Therapeutics production is emerging as the fastest-growing application, reflecting the pipeline expansion in areas like oncology, protein replacement, and metabolic disease. Companies like Translate Bio and Moderna are already exploring treatments for cystic fibrosis, Fabry disease, and cancers through mRNA platforms. This diversification beyond vaccines has resulted in the need for flexible, high-quality raw materials suitable for a variety of delivery systems and dosing regimens. As more clinical candidates approach regulatory approval, the demand for GMP-grade, application-specific raw materials is expected to soar.

The U.S. stands as the epicenter of mRNA technology development, supported by world-class infrastructure, regulatory clarity, and a strong innovation ecosystem. Federal funding, particularly from agencies such as the NIH, DARPA, and BARDA, continues to drive public-private partnerships aimed at domestic mRNA capacity building. States like Massachusetts, California, and North Carolina host dense clusters of biotech firms, research labs, and specialized raw material manufacturers.

In recent years, the U.S. government has prioritized the onshoring of critical raw materials through initiatives like the Defense Production Act. These policies incentivize domestic production of plasmid DNA, modified nucleotides, and critical enzymes to ensure self-sufficiency during public health emergencies. Moreover, collaborative networks among academia, industry, and federal agencies are accelerating the development of scalable, cost-effective production platforms.

March 2025 – TriLink BioTechnologies announced the launch of a new suite of CleanCap® analogs for enzymatic capping, optimized for higher yields in therapeutic mRNA applications.

February 2025 – Danaher Corporation (via Cytiva) completed the expansion of its Marlborough, MA site, adding new capacity for high-purity enzymes and nucleotides.

December 2024 – Aldevron (a subsidiary of Danaher) began operations at its new GMP plasmid DNA facility in Fargo, North Dakota, aimed at supplying mRNA vaccine developers.

November 2024 – Thermo Fisher Scientific entered into a strategic agreement with Moderna to supply custom raw materials for the company’s next-generation mRNA therapeutics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mRNA synthesis raw materials market

Type

Application

End-use