The U.S. meal kit delivery services market size was exhibited at USD 10.75 billion in 2023 and is projected to hit around USD 30.25 billion by 2033, growing at a CAGR of 10.9% during the forecast period 2024 to 2033.

.webp)

The U.S. Meal Kit Delivery Services Market has undergone a transformative journey over the past decade, evolving from a niche luxury service into a mainstream lifestyle solution embraced by millions of households. This market, once dominated by health-conscious millennials and working professionals seeking convenience, now encompasses a wide range of consumer segments, including busy families, elderly individuals, and even rural populations. Its rise is rooted in a powerful blend of convenience, culinary exploration, health consciousness, and digital accessibility.

Meal kits provide pre-portioned ingredients and detailed recipes (Cook & Eat) or ready-to-heat dishes (Heat & Eat), delivered directly to consumers’ doorsteps. These services eliminate grocery planning and food waste, offering a curated cooking experience that aligns with modern lifestyles. Companies like HelloFresh, Blue Apron, and Home Chef have become household names, constantly innovating their product lines to include keto, vegan, and diabetic-friendly meals, while also partnering with celebrity chefs and nutritionists to diversify offerings.

The U.S. is uniquely positioned as a global leader in this domain due to its robust logistics infrastructure, high digital penetration, and an evolving food culture that values personalization. The pandemic significantly accelerated adoption, with millions turning to meal kits as a safer alternative to eating out or visiting grocery stores. While growth has slightly normalized post-pandemic, consumer behavior has irreversibly shifted, favoring solutions that prioritize health, time-saving, and sustainability.

Moreover, the integration of technology—such as AI-driven personalization, nutrition tracking, and smart kitchen connectivity—is redefining the next chapter of meal kit delivery in the United States. The competition has also grown fiercer, with grocery giants like Kroger and Amazon Fresh entering the fray, further expanding consumer access and innovation in this segment.

Health and Wellness Personalization: Companies are increasingly offering personalized meal kits based on dietary needs such as keto, paleo, diabetic-friendly, and high-protein diets.

Sustainability in Packaging: There is a marked shift toward biodegradable, compostable, and recyclable packaging to appeal to environmentally conscious consumers.

Grocery Store Integration: Retailers like Walmart and Kroger are partnering with meal kit companies or developing their own lines for in-store availability.

Family-Oriented Meal Kits: Family-sized and kid-friendly meals are becoming more prominent as more parents look for quick and nutritious dinner solutions.

Celebrity & Influencer Partnerships: Brands are co-developing signature meal kits with chefs and influencers to attract diverse consumer bases.

AI and Data-Powered Recommendations: Machine learning is being used to tailor meal suggestions based on past orders, cooking habits, and dietary restrictions.

Subscription Flexibility: Users are offered more control with options to pause, skip weeks, or order one-off meals—making subscriptions more appealing.

| Report Coverage | Details |

| Market Size in 2024 | USD 11.92 Billion |

| Market Size by 2033 | USD 30.25 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Offering, Service, Platform, And Meal Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Blue Apron, LLC; Sun Basket; Freshly Inc.; Relish Labs LLC (Home Chef); Purple Carrot; Gobble; Fresh n' Lean; Hungryroot; HelloFresh; Marley Spoon Inc. |

The key driver fueling growth in the U.S. meal kit delivery services market is the increasing demand for convenient, home-cooked meals that balance nutrition, variety, and time-efficiency. As the pace of life accelerates and dual-income households become the norm, Americans are seeking ways to eat well without sacrificing hours on grocery shopping and preparation. Meal kits provide an ideal solution—delivering ingredients that are fresh, portioned, and accompanied by easy-to-follow instructions.

Consumers who once depended on takeout or fast food are now favoring meal kits for their nutritional value and customization. Services like Home Chef and EveryPlate have gained traction by offering affordable, low-prep, and health-conscious meals that even novice cooks can handle. This driver is further amplified by digital accessibility, where a few clicks on a smartphone app can schedule weekly deliveries based on lifestyle and dietary needs.

Despite the growth, the U.S. meal kit market faces a significant restraint in the form of subscription fatigue and customer churn. Many consumers initially attracted by promotional offers eventually cancel due to pricing, monotony in meals, or logistical inconveniences. With a multitude of players offering free trials, consumers tend to rotate between services without long-term commitment, thereby affecting revenue consistency for providers.

This volatility is especially challenging for smaller startups and even established brands trying to scale. Retaining users beyond the initial weeks requires constant innovation, impeccable customer service, and enhanced value perception. Moreover, meal kits are still seen by some as expensive compared to home cooking, particularly when feeding larger families. Overcoming this restraint demands creative pricing models, loyalty programs, and diversified offerings to keep users engaged.

A major growth opportunity in the U.S. meal kit delivery services market lies in the rise of health-specific and functional meals. With increasing awareness about conditions like diabetes, hypertension, food allergies, and gluten intolerance, consumers are demanding meal kits that do more than satisfy hunger—they want support for long-term health goals. This shift presents a golden opportunity for companies to offer hyper-personalized kits, designed in consultation with nutritionists and healthcare professionals.

For instance, meal kit brands can partner with fitness apps or health insurance providers to deliver plans tailored to individual biometric data. Blue Apron’s wellness meals and Sunbasket’s organic, gluten-free kits are examples of early movers in this space. Expanding further into functional meals—those aimed at boosting immunity, digestion, or mental focus—can tap into a premium customer segment willing to pay more for added value. This intersection of food, health, and data creates long-term engagement and brand loyalty.

The Cook & Eat segment dominates the U.S. meal kit delivery services market, thanks to its ability to provide a genuine cooking experience without the hassle of sourcing ingredients or planning meals. It appeals to consumers who enjoy the act of cooking as a creative or therapeutic activity but lack the time for preparation. Popular among millennials and young couples, Cook & Eat kits offer restaurant-quality meals with detailed instructions and pre-measured components. Companies like HelloFresh and Blue Apron have established themselves in this segment by offering weekly rotating menus, flexible subscriptions, and global cuisines.

In contrast, the Heat & Eat segment is experiencing the fastest growth. These ready-to-eat options cater to ultra-busy professionals, students, and even elderly consumers looking for convenience without compromising on taste or nutrition. Brands like Freshly and Factor have gained popularity by offering chef-prepared meals that simply need reheating. Their growing appeal lies in offering a premium fast-food alternative that’s healthy, portion-controlled, and time-saving—especially relevant in the post-pandemic era where hybrid work lifestyles blur mealtimes and routines.

The Multiple subscription service segment has led the market due to its predictability and value-driven pricing. These plans cater to loyal users who value routine and seek cost efficiency. Regular deliveries enable better meal planning, and companies offer additional perks like free shipping, exclusive meals, or access to nutritionists. Meal kit providers also benefit from recurring revenue and customer data, which supports better personalization and operational optimization.

However, the Single order service segment is gaining momentum rapidly. It appeals to first-time users and those looking for flexibility without long-term commitments. Particularly during holidays, promotional events, or specific health challenges, customers prefer to try one-off kits. Single kits are also used by companies to showcase limited-time menus or partner chef meals, making them a powerful acquisition tool. Increasing the availability of single-serve, customizable meals can open the door to demographics reluctant to commit to subscriptions.

Non-Vegetarian meals dominate the U.S. market due to consumer preferences for protein-rich diets and culinary variety. These kits often include chicken, beef, seafood, and pork, making them suitable for a wide range of popular American cuisines. Providers such as Blue Apron and EveryPlate consistently feature non-vegetarian dishes in their core offerings, which aligns with consumer desires for hearty, satisfying meals. The ability to replicate restaurant-style meat dishes at home is a strong pull factor for customers.

Despite this dominance, the Vegan meal segment is the fastest-growing. The rise in plant-based lifestyles, driven by health concerns, ethical beliefs, and environmental awareness, has led to increasing demand for vegan meal kits. Brands like Purple Carrot and Veestro are focused entirely on plant-based offerings, while others like HelloFresh have expanded their vegan lines. These kits typically include innovative plant proteins like tempeh, seitan, and legumes, catering to both dedicated vegans and flexitarians looking to reduce meat intake. As the plant-based food movement matures, vegan kits are becoming more flavorful, accessible, and mainstream.

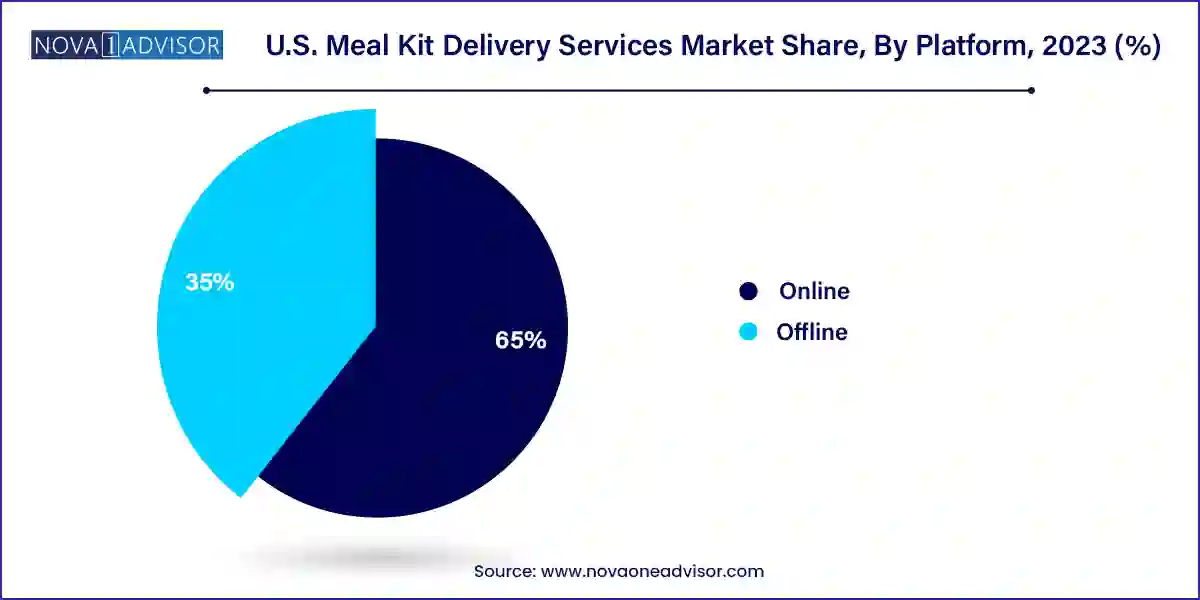

Online platforms remain the backbone of the U.S. meal kit delivery services market, allowing users to browse menus, schedule deliveries, and manage subscriptions via websites or apps. Digital-first operations allow for better inventory management, customer analytics, and AI-based personalization. Brands like Sunbasket and Green Chef use data insights to suggest meals aligned with user preferences. The convenience of online ordering, combined with app integrations like calendar syncing and recipe tutorials, creates a superior user experience.

While still small in comparison, the Offline platform is growing quickly through partnerships with grocery stores and physical retailers. For example, Kroger’s in-store Home Chef meal kits allow customers to make impulse purchases, while Amazon Fresh locations offer selected meal kits on shelves. This hybrid model appeals to consumers who prefer the tangibility of in-store shopping or those who seek instant meal solutions without waiting for delivery. It also broadens accessibility to non-digital demographics and enhances brand visibility beyond the subscription base.

The U.S. represents the most mature and dynamic meal kit delivery services market globally. Its growth is underpinned by a highly digitized consumer base, widespread logistics networks, and evolving food culture. Urban centers like New York, San Francisco, and Chicago remain high-demand regions due to dense populations and fast-paced lifestyles. However, the market is expanding into suburban and rural areas as delivery coverage improves.

The U.S. government’s increased focus on health and nutrition—alongside initiatives to reduce food waste—has indirectly supported meal kit adoption. Furthermore, the presence of innovation hubs, venture capital funding, and strong e-commerce ecosystems has enabled rapid experimentation and product development. U.S. consumers continue to shape the global narrative for what meal kit services can offer in terms of convenience, personalization, and health integration.

In March 2025, HelloFresh announced a new “Green Eats” subscription plan with fully recyclable packaging and carbon-neutral shipping across the U.S.

Blue Apron partnered with WW (formerly Weight Watchers) in January 2025 to launch co-branded meal kits focused on calorie control and weight management.

Home Chef, a Kroger subsidiary, expanded its in-store meal kit presence to over 2,000 Kroger locations in February 2025, doubling its physical footprint.

Sunbasket introduced an AI-powered meal recommendation engine in April 2025, using dietary preferences and previous orders to improve personalization.

Factor, owned by HelloFresh, launched its first-ever “Quick Fuel” protein meal series in December 2024, targeting gym-goers and fitness enthusiasts.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. meal kit delivery services market

Offering

Service

Platform

Meal Type