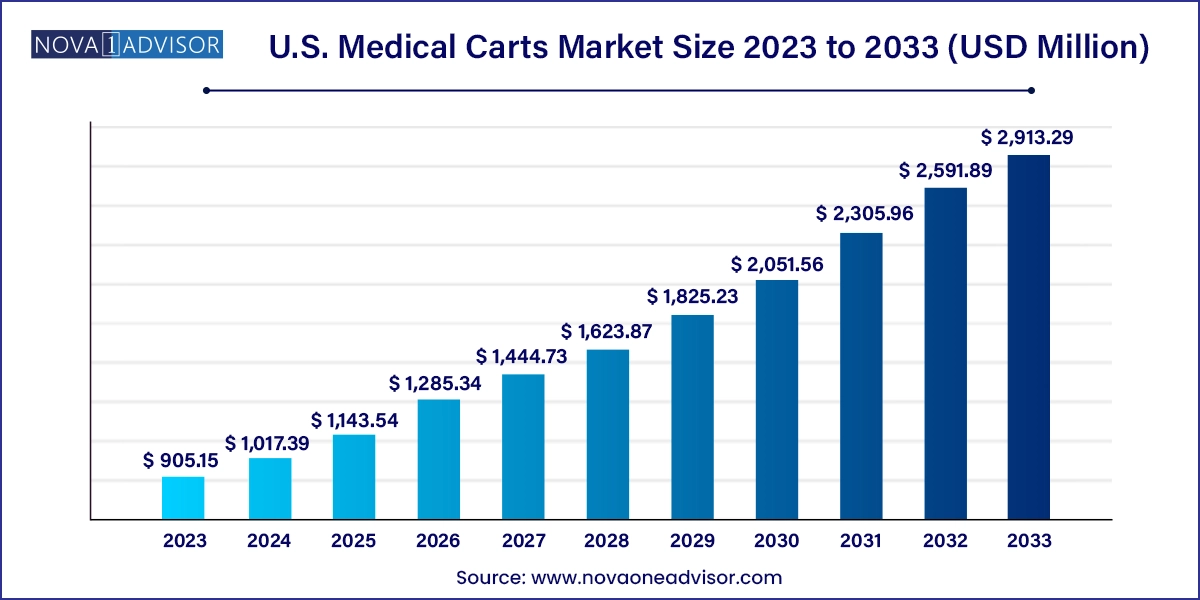

The U.S. medical carts market size was exhibited at USD 905.15 million in 2023 and is projected to hit around USD 2,913.29 million by 2033, growing at a CAGR of 12.4% during the forecast period 2024 to 2033.

The U.S. medical carts market is a vital segment within the country’s rapidly evolving healthcare ecosystem. Medical carts, also known as healthcare carts or mobile workstations, are used extensively across clinical and non-clinical environments to support healthcare delivery with mobility, efficiency, and safety. These carts are fundamental tools that house critical supplies, medications, electronic health record systems, and emergency response tools, streamlining patient care and reducing manual handling of equipment or data.

Driven by growing hospital digitization, rising demand for workflow efficiency, and the surging focus on infection control, medical carts have evolved from basic rolling shelves into sophisticated, tech-enabled workstations. In particular, integration with electronic health record (EHR) systems, mobile diagnostic devices, and telehealth functionalities has revolutionized their utility. The rising prevalence of chronic diseases, increasing surgical procedures, and need for rapid medication administration have further emphasized their relevance.

From hospitals and skilled nursing facilities to ambulatory surgical centers and physician clinics, healthcare providers depend on different types of carts medication carts, anesthesia carts, computer workstations, and emergency carts to respond to clinical demands in real time. Innovations in mobility, ergonomic design, and power supply systems are enhancing usability and safety. With the healthcare sector embracing mobile point-of-care solutions, the U.S. medical carts market continues to expand across both public and private domains.

Growth in Telehealth Integration: The emergence of telehealth workstations on wheels enables mobile consultations, diagnostics, and virtual rounds inside healthcare facilities.

Increased Demand for Powered Workstations: Battery-operated medical carts with power management systems are enabling longer uptime and seamless device operation.

Focus on Ergonomics and User Safety: Height-adjustable carts and lightweight materials are being introduced to reduce strain and improve user satisfaction among nurses and technicians.

Shift Toward Modular and Customizable Carts: Facilities are requesting carts tailored for specific departments—ICU, ER, OR—allowing configuration of drawers, bins, and accessories.

Infection Control Prioritization: Antimicrobial surfaces, easy-to-disinfect materials, and sealed designs are being prioritized in response to infection prevention protocols.

Wireless Connectivity and Smart Integration: Medical carts now feature built-in Wi-Fi, RFID scanners, and patient identification modules to align with smart hospital initiatives.

Adoption of Lean Inventory and Storage Systems: Storage carts are being optimized for rapid restocking, inventory scanning, and space utilization in high-traffic hospital corridors.

Sustainable Materials and Green Procurement: Eco-friendly, recyclable, and long-lifecycle materials are gaining attention in procurement decisions aligned with hospital sustainability goals.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,017.39 Million |

| Market Size by 2033 | USD 2,913.29 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Type, End-use, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Medline Industries, Inc.; Ergotron, Inc.; Midmark Corporation; The Harloff Company; Waterloo Healthcare (Bergmann Group); AFC Industries, Inc.; Capsa Healthcare; Enovate Medical; GCX Corporation (Jaco, Inc.); Altus, Inc.; TouchPoint Medical |

One of the most prominent drivers of the U.S. medical carts market is the ongoing digitization of healthcare services and the increasing integration of electronic health records (EHR) into point-of-care operations. As hospitals shift toward digital workflows, caregivers must frequently input patient data, access records, and scan medications during rounds or procedures. Mobile computer workstations have become critical tools in this transformation, acting as rolling digital portals that allow clinicians to perform charting, medication verification, and patient education on the go.

These carts eliminate the need for stationary data entry or documentation post-care, thus saving time, reducing errors, and improving compliance with regulatory documentation requirements. Their integration with bar code scanners and electronic medication administration records (eMARs) also supports “closed-loop” medication processes, which are essential for patient safety. As more institutions aim for HIMSS Stage 7 compliance, the demand for advanced mobile carts continues to grow, supporting seamless and secure digital healthcare delivery.

While the clinical benefits of advanced medical carts are widely acknowledged, cost remains a major limiting factor, especially for small and mid-sized healthcare facilities. Fully loaded powered workstations with integrated displays, secure drawer modules, wireless connectivity, and battery backup can cost several thousand dollars per unit. For larger hospitals with hundreds of beds, outfitting every care team with such equipment can become prohibitively expensive.

Additionally, ongoing maintenance including battery replacement, software updates, wheel repair, and infection control compliance adds to the total cost of ownership. Budget constraints, especially in rural or underfunded facilities, often result in delayed upgrades or procurement of lower-end carts with limited functionality. Moreover, integrating carts into existing IT infrastructure often requires collaboration with vendors, increasing implementation time and training needs. As a result, the full adoption of medical cart innovations can be restricted by upfront capital investment and long-term servicing costs.

A key opportunity in the U.S. medical carts market lies in the rapid expansion of ambulatory care and decentralized medical delivery models. With the healthcare system shifting more procedures to outpatient settings, urgent care centers, physician offices, and office-based labs, the demand for compact, versatile, and mobile workstations is accelerating. These care sites often lack fixed infrastructure but still require support for medication management, digital documentation, and portable diagnostics.

Medical carts that are lightweight, space-efficient, and offer multi-functionality such as combined medication delivery and charting are particularly valuable in such environments. Additionally, the growing use of telehealth carts for remote specialist consultations or mobile diagnostics in outpatient settings expands the cart’s utility beyond traditional roles. Manufacturers that offer modular solutions tailored to smaller practices stand to capture market share in this fast-growing segment, especially as policymakers push for more community-based healthcare access.

Computer Workstations dominated the product segment, reflecting their indispensable role in the digitization of healthcare services. These workstations serve as mobile EHR terminals, enabling caregivers to chart in real-time, access diagnostics, and consult clinical decision support tools directly at the bedside. Hospitals and large clinics often deploy computer workstations throughout medical-surgical units, ICUs, and emergency departments to support high patient turnover and rapid documentation requirements. With powered configurations offering long-lasting battery operation and smart cable management, these workstations help reduce documentation lag and prevent data loss, making them integral to efficient clinical workflows.

Medical Storage Columns, Cabinets, and Accessories are the fastest-growing product segment, especially as hospitals adopt lean inventory and supply chain practices. These modular storage systems help reduce time spent retrieving equipment, optimize space utilization, and ensure compliance with medical supply tracking requirements. For example, anesthesia carts with locking drawers and modular bin configurations help organize high-value items, while columns in supply rooms enable fast access to restock carts or procedure kits. The growth of supply automation and RFID-enabled inventory control is accelerating innovation in this segment, with solutions designed to integrate into hospital logistics systems.

Medical Documentation is the dominant application, driven by the need for point-of-care data entry and compliance with regulatory documentation standards. Nurses, physicians, and technicians rely on mobile carts to update charts, input orders, and document clinical interactions at the patient’s bedside. Integrated barcode scanners and touchscreen interfaces on carts support medication verification, blood draw identification, and time-stamped activity logs, reducing documentation errors and enhancing audit readiness. The use of carts for documentation aligns with CMS quality initiatives and electronic medical record (EMR) optimization.

Telehealth Workstations are the fastest-growing application, as healthcare organizations embrace hybrid care models. These mobile units are equipped with cameras, audio systems, and diagnostic tools that allow real-time video consultations between patients and remote specialists. During the COVID-19 pandemic, hospitals rapidly adopted telehealth carts for rounding in isolation wards. Today, they’re being used in outpatient oncology clinics, mental health centers, and skilled nursing facilities. The ability to expand specialist access and improve care continuity while reducing patient transfer costs makes telehealth carts a key area of future growth.

Emergency Carts led the market by type, underscoring their critical role in rapid-response situations. Often referred to as “crash carts,” these mobile units are designed to carry defibrillators, resuscitation drugs, airway equipment, and other life-saving supplies. Emergency carts are found in every hospital department, from operating rooms to maternity wards, ensuring that staff can respond instantly to cardiac arrests or respiratory failure. Their standardized drawer layouts, locking systems, and easy mobility are essential for high-stakes environments where every second counts.

Procedure Carts are experiencing the fastest growth, reflecting an increase in bedside procedures and decentralized treatment models. These carts are typically customized to specific functions—wound care, catheterization, IV insertion, or phlebotomy—and reduce the need for staff to retrieve supplies from centralized stores. By bringing tools directly to the patient, procedure carts reduce setup time, enhance infection control, and allow providers to manage higher patient volumes efficiently. Their adaptability makes them popular in both inpatient and outpatient settings, supporting improved workflow and clinical consistency.

Hospitals continue to dominate the end-use segment, due to their scale, diverse clinical needs, and emphasis on efficiency. From ICUs and operating rooms to emergency and pediatric departments, hospitals utilize a wide range of medical carts to facilitate medication administration, documentation, emergency response, and supply handling. Many have standardized cart configurations for different clinical units and are investing in powered carts integrated with EHR systems, particularly in large urban hospitals. Hospitals are also early adopters of telehealth carts and infection control-enhanced models.

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-use setting, as more surgical procedures move out of hospitals and into high-efficiency outpatient centers. These facilities require carts that can support anesthesia delivery, post-op monitoring, and emergency intervention—often in compact and highly regulated environments. The demand for mobile, sterilizable, and user-friendly carts is particularly high, as ASCs prioritize rapid patient turnover and regulatory compliance. Custom cart configurations for specific procedures like cataract surgery or orthopedic implants are also gaining traction.

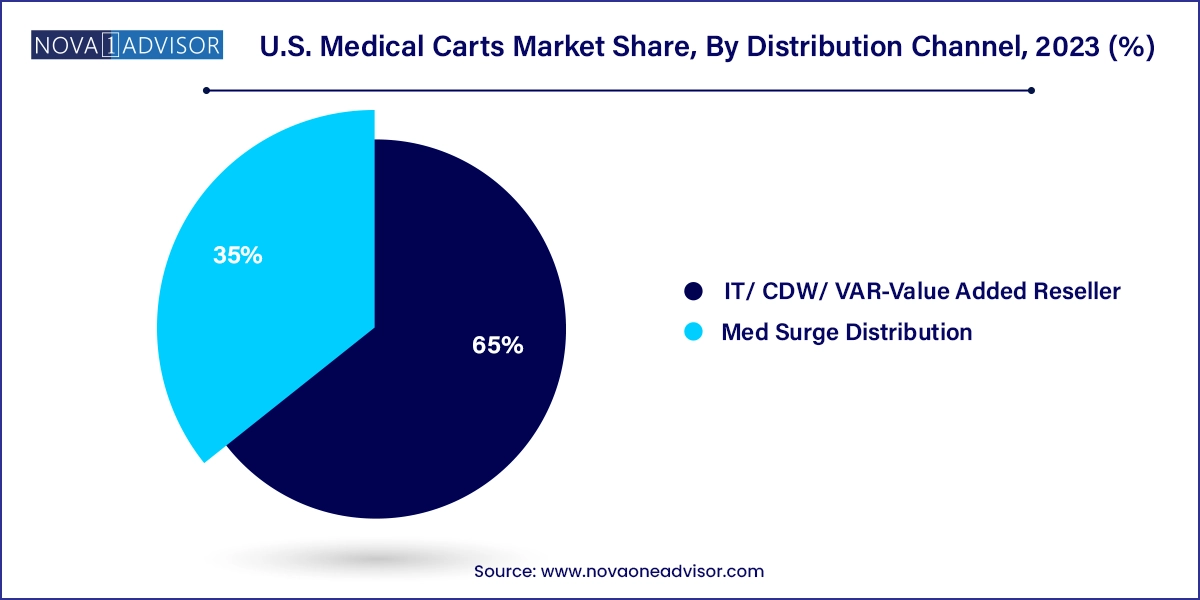

Med Surge Distribution remains the dominant channel, as traditional supply chain providers continue to serve as the primary procurement route for hospitals and health systems. These distributors maintain longstanding relationships with health administrators and offer logistics solutions such as inventory bundling, scheduled deliveries, and contract pricing. Their knowledge of surgical and clinical workflows makes them trusted partners in choosing the right cart solutions.

IT/CDW/VAR (Value-Added Resellers) are growing rapidly, reflecting the digital shift in medical cart procurement. These resellers offer bundled solutions that include software licenses, hardware support, and IT integration for computer workstations. As healthcare systems move toward fully integrated tech platforms, VARs are offering carts with pre-configured software, cybersecurity features, and warranty packages. This channel is particularly effective for CIO-led purchases and telehealth expansion projects.

The U.S. market for medical carts is uniquely shaped by a combination of advanced healthcare infrastructure, robust funding for hospital modernization, and a high focus on workflow optimization. Federal initiatives like the HITECH Act and Meaningful Use have encouraged hospitals to digitize care processes, leading to widespread deployment of mobile computer workstations. Moreover, infection control guidelines from the CDC and The Joint Commission have driven the need for carts that are easy to clean and designed to minimize cross-contamination.

U.S. hospitals and health systems are also more likely to invest in customized and high-end cart configurations compared to many global counterparts. With strong capital equipment budgets, American providers often procure powered carts with integrated power management systems, multiple accessory mounts, and touchscreen displays. Furthermore, the growth of outpatient care in the U.S.—from urgent care chains to retail health clinics—has created a broad market for compact and efficient carts.

Medical cart procurement is also influenced by strong labor union advocacy for ergonomic and safe tools. This has led to widespread adoption of carts with height-adjustable features, lightweight materials, and easy maneuverability to reduce strain on clinical staff. From a regulatory standpoint, U.S. manufacturers must comply with FDA device classification, UL standards, and infection control best practices—ensuring high product quality and safety.

April 2025 – Ergotron launched its new ergonomic “CareFit Pro” series of mobile workstations, integrating antimicrobial surfaces and modular accessory options for nursing documentation.

February 2025 – Capsa Healthcare introduced a telehealth cart platform optimized for behavioral health settings, with integrated HD camera, ambient noise cancelation, and EHR compatibility.

December 2024 – Advantech partnered with Intel to launch a smart hospital cart platform with AI-assisted medication tracking and patient data capture tools for ICU units.

October 2024 – TouchPoint Medical expanded its manufacturing facility in Florida to meet increased demand for customized anesthesia and emergency carts from ambulatory surgery centers.

August 2024 – Altus Inc. announced a strategic collaboration with a large Midwest health system to deploy over 1,000 powered mobile computer workstations across its network.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical carts market

Product

Application

Type

End-use

Distribution Channel