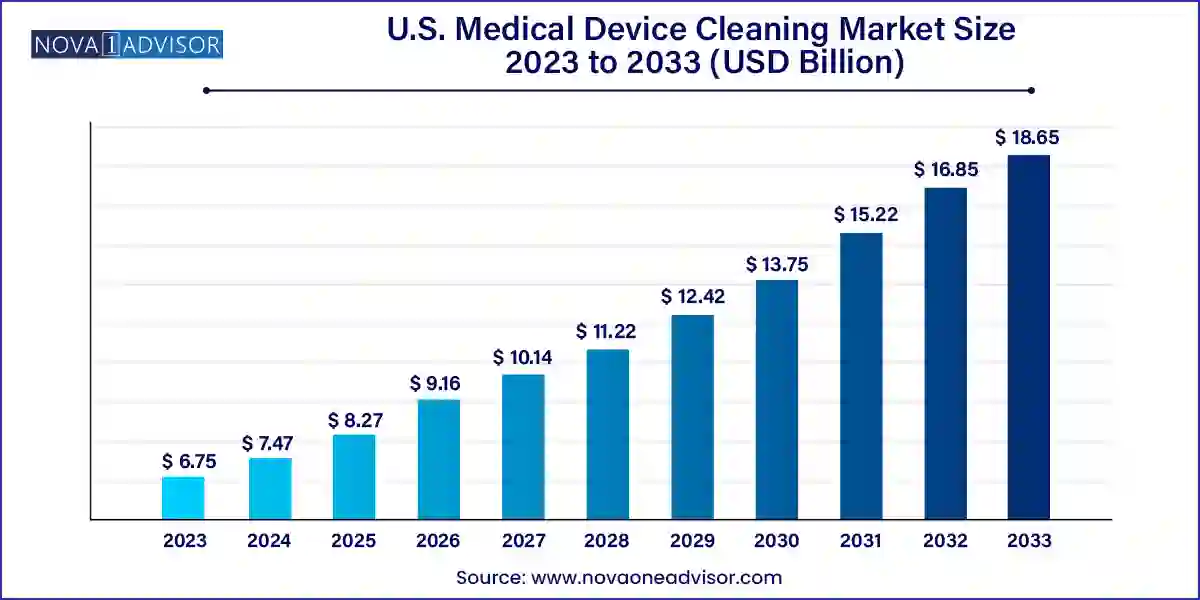

The U.S. medical device cleaning market size was exhibited at USD 6.75 billion in 2023 and is projected to hit around USD 18.65 billion by 2033, growing at a CAGR of 10.7% during the forecast period 2024 to 2033.

The U.S. medical device cleaning market represents a vital pillar in the broader medical device lifecycle and infection prevention ecosystem. It encompasses a diverse array of processes, techniques, and products specifically designed to clean, disinfect, and sterilize medical instruments, ensuring they are safe for reuse and do not become vectors for healthcare-associated infections (HAIs). This market is crucial not only from a clinical standpoint but also for regulatory compliance and operational efficiency in healthcare facilities.

Every year, millions of surgical procedures and diagnostic tests are performed using reusable instruments ranging from endoscopes to orthopedic tools. Each of these devices must undergo rigorous cleaning processes between uses to eliminate microbial contamination, organic debris, and chemical residues. The U.S., with its high volume of surgical interventions, aging population, and expansive hospital infrastructure, presents a mature yet dynamically evolving market for medical device cleaning.

Increased awareness regarding HAIs, particularly post the COVID-19 pandemic, has further underscored the need for robust decontamination protocols. The Centers for Disease Control and Prevention (CDC) estimates that approximately 1 in 31 hospital patients in the U.S. contracts at least one healthcare-associated infection daily. This risk has compelled hospitals, ambulatory surgical centers, and diagnostic labs to invest more in high-grade cleaning agents, advanced sterilization technologies, and standardized operating procedures.

Moreover, compliance with guidelines from the U.S. Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and the Association for the Advancement of Medical Instrumentation (AAMI) necessitates the use of validated and traceable cleaning protocols. Medical device cleaning, thus, plays a central role in achieving regulatory adherence and maintaining patient safety standards. As device designs become more complex (e.g., robotic-assisted surgical tools), the demand for highly specialized cleaning solutions is poised to grow significantly in the coming decade.

Rise of Automated Cleaning Systems: Adoption of automated washer-disinfectors and ultrasonic cleaners is growing across hospitals to reduce manual errors and enhance consistency.

Integration of Robotics and AI: Robotic cleaning arms and AI-based disinfection monitoring systems are gaining traction for precision and validation.

Focus on Eco-friendly Cleaning Agents: Hospitals are shifting toward biodegradable, non-toxic detergents to align with sustainability goals and reduce exposure risks.

Shift from Low-level to High-level Disinfection: With increasing complexity in reusable devices, healthcare centers are emphasizing high-level disinfection and sterilization.

Customization Based on Device Type: Customized cleaning protocols and agents tailored to semi-critical or critical devices are being developed to ensure effectiveness without compromising device integrity.

Growing Use of UV and Metal-based Disinfection: Ultraviolet light and silver ion-based technologies are being incorporated into disinfection systems for non-chemical microbial control.

Increased Outsourcing to CSSD Providers: Central sterile services departments (CSSDs) and third-party reprocessing centers are increasingly being used to standardize and streamline cleaning processes.

Regulatory Audits Driving Innovation: Frequent audits from CMS and FDA have pushed healthcare providers to adopt trackable, validated cleaning systems with digital recordkeeping.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.47 Billion |

| Market Size by 2033 | USD 18.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Device, Technique, EPA Classification |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Steris plc.; Getinge AB; Advanced Sterilization Products (ASP); The Ruhof Corp.; Sklar Surgical Instruments; Sterigenics International LLC; Biotrol; Metrex Research, LLC; Cantel Medical Corp.; Ecolab; 3M |

A powerful driver for the U.S. medical device cleaning market is the heightened focus on infection prevention due to the growing incidence of HAIs. These infections, often preventable, can lead to extended hospital stays, additional treatment costs, and even fatalities. According to the CDC, more than 680,000 cases of HAIs occur annually in the U.S., with nearly 75,000 deaths attributed to these infections.

Reusable medical devices, if inadequately cleaned, can harbor pathogens like Clostridioides difficile, Staphylococcus aureus (including MRSA), and Pseudomonas aeruginosa. As a result, healthcare providers are investing heavily in validated cleaning procedures and technology. The COVID-19 pandemic further amplified this concern, with respiratory and contact-based pathogens drawing attention to every touchpoint in medical procedures. From pre-cleaning at point-of-use to final sterilization in centralized departments, thorough and consistent cleaning has become a non-negotiable aspect of medical care. This growing awareness is directly driving demand for specialized cleaning agents, surface decontamination technologies, and training modules focused on infection control.

One of the major constraints facing the market is the high cost associated with implementing comprehensive cleaning protocols, particularly for smaller hospitals and outpatient clinics. The investment required for advanced sterilizers, ultrasonic washers, and automated endoscope reprocessors can be prohibitive for low-volume centers. Additionally, the recurring cost of purchasing validated detergents, enzymatic cleaners, and high-level disinfectants significantly impacts the operational budgets of healthcare facilities.

The cost of compliance with regulations is also high. Maintaining documentation, training staff, participating in audits, and validating each step of the cleaning process all contribute to resource burden. Moreover, single-use devices, although costly on a per-use basis, are being adopted in some facilities as a way to avoid these capital expenditures, indirectly limiting growth in reusable device cleaning solutions. These cost-related pressures can hinder market penetration in budget-constrained environments, especially rural hospitals or independent surgical centers.

A significant opportunity in the U.S. medical device cleaning market lies in the expanding use of minimally invasive surgical (MIS) devices and complex reusable instruments. Robotic surgical tools, laparoscopes, and flexible endoscopes offer precision and reduced patient trauma but come with intricate designs that are difficult to clean manually. The lumens, hinges, and channels in these devices necessitate the use of specially formulated enzymatic detergents and advanced automated cleaning technologies.

With over 5 million minimally invasive procedures performed annually in the U.S., and continued adoption of robotic-assisted surgery, the need for dedicated cleaning protocols and systems for complex instruments is growing. Device manufacturers and reprocessing firms are now collaborating to design compatible cleaning accessories and validation kits for each device type. Additionally, regulatory focus on proper endoscope reprocessing—particularly following infection outbreaks linked to duodenoscopes—has triggered increased investment in innovative cleaning and drying solutions, creating a highly lucrative growth channel.

Critical devices dominate the U.S. medical device cleaning market, accounting for the highest share due to their direct contact with sterile body areas or the vascular system. These include surgical instruments, catheters, and implants, all of which must be thoroughly sterilized before reuse. Given their risk profile, critical devices demand multi-step cleaning involving pre-treatment, manual cleaning, ultrasonic processing, and terminal sterilization. Hospitals prioritize investment in validated procedures for these instruments, often guided by device manufacturer instructions and AAMI standards. Facilities are also increasingly adopting ATP testing and fluorescence markers to verify cleaning efficacy before sterilization.

In contrast, semi-critical devices such as endoscopes and respiratory therapy equipment represent the fastest-growing segment due to their complex construction and increasing usage in diagnostics and minimally invasive procedures. These devices typically require high-level disinfection using aldehydes, peracetic acid, or UV systems, depending on compatibility. Given recent scrutiny on endoscope-related infections, healthcare systems are updating protocols and procuring automated endoscope reprocessors (AERs) to ensure cleaning consistency. As semi-critical device usage expands across specialties like pulmonology, ENT, and GI, the cleaning solutions segment is expected to witness sharp growth.

Cleaning as a technique dominates the market, particularly with detergents leading within this segment. Detergents are the first line of defense in decontaminating reusable instruments, used to remove organic and inorganic soils prior to disinfection and sterilization. Neutral-pH enzymatic cleaners are especially popular due to their compatibility with various device materials. Multi-enzyme formulas capable of breaking down proteins, lipids, and carbohydrates are widely used in central sterile departments to ensure complete bio-burden removal. Detergent formulations are often customized to support manual soaking, ultrasonic baths, or mechanical washers, highlighting their versatility.

Meanwhile, disinfection represents a rapidly growing segment, with a strong push toward chemical disinfectants such as aldehydes, chlorine compounds, and alcohols. Aldehydes, including glutaraldehyde and ortho-phthalaldehyde (OPA), are preferred for high-level disinfection of endoscopes and respiratory instruments. However, environmental and occupational safety concerns have driven innovation toward chlorine dioxide and peracetic acid formulations. Simultaneously, UV and metal-based disinfection technologies, such as copper-infused containers and silver ion sprays, are emerging as sustainable, low-residue alternatives. As antimicrobial resistance becomes a pressing concern, hospitals are increasingly diversifying disinfection approaches to ensure comprehensive microbial control.

Sterilization, particularly ethylene oxide (ETO) and heat sterilization, remains indispensable for critical device reprocessing. ETO sterilization is used for heat- and moisture-sensitive devices, while autoclaving is standard for metal instruments. As new materials and coatings are introduced in device manufacturing, sterilization protocols must continuously adapt—creating demand for customized and validated sterilization cycles.

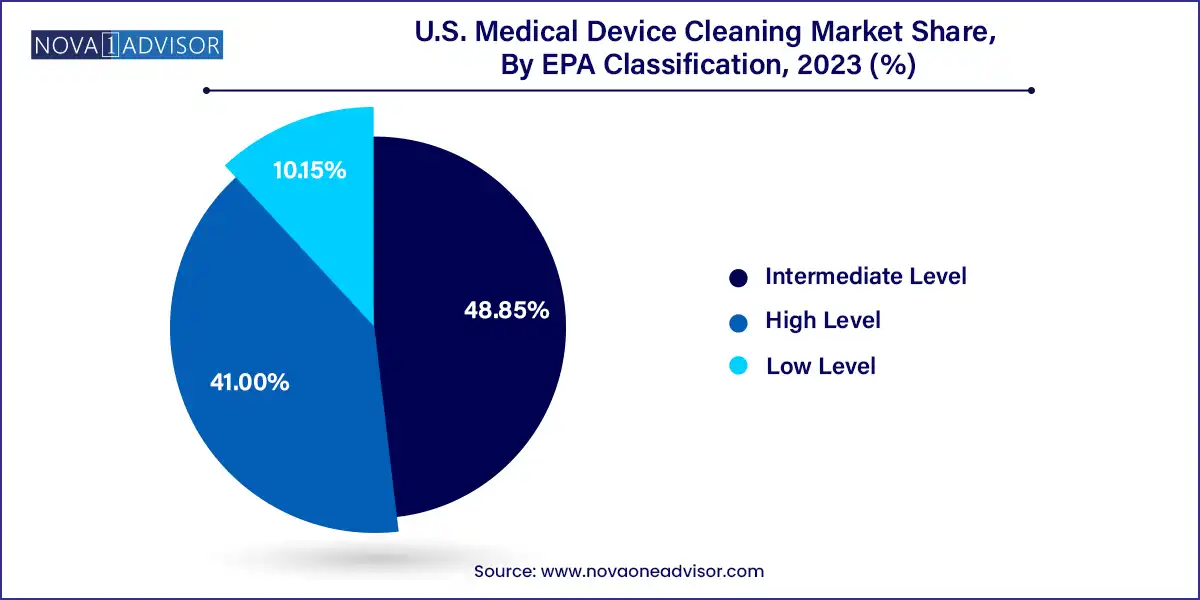

High-level disinfectants dominate the market owing to their critical role in reprocessing semi-critical and critical devices. These agents are effective against all microorganisms, except high levels of bacterial spores. Aldehyde-based solutions, peracetic acid, and hydrogen peroxide compounds are widely adopted for their broad-spectrum efficacy and compatibility with a variety of medical device surfaces. Given their importance in cleaning devices like bronchoscopes, duodenoscopes, and transesophageal echocardiography (TEE) probes, hospitals allocate a substantial portion of their cleaning budget to high-level disinfectants.

Intermediate-level disinfectants such as phenolics and alcohols are gaining adoption for non-critical devices like blood pressure cuffs and stethoscopes. With more emphasis on contact infection prevention post-COVID, routine disinfection of non-invasive devices has become common practice. This has led to wider use of disinfectant wipes and sprays suitable for rapid surface cleaning. Low-level disinfectants remain relevant for environmental cleaning and surface preparation, but their use for device cleaning is limited by efficacy constraints. Nevertheless, all EPA classifications are essential within a layered cleaning protocol.

The U.S. medical device cleaning market is driven by its extensive healthcare infrastructure, stringent regulatory framework, and leadership in surgical volume and innovation. States such as California, Texas, New York, and Florida house hundreds of hospitals, surgical centers, and diagnostic labs, all of which demand robust cleaning solutions for a variety of devices. The FDA’s enforcement of reprocessing validation, particularly for complex reusable devices like duodenoscopes and bronchoscopes, has intensified compliance across facilities.

Additionally, the U.S. is home to top sterilization and cleaning product manufacturers who partner with hospitals to offer integrated solutions—from automated cleaning systems to traceability software. Increasing CMS penalties for HAIs and readmissions are also compelling hospitals to strengthen their decontamination processes. Public health emergencies like the COVID-19 pandemic have driven further investments in UV sterilizers, single-use devices, and centralized sterile supply departments. Collectively, the country’s emphasis on infection control, regulatory compliance, and clinical excellence ensures robust and sustainable market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical device cleaning market

Device

Technique

EPA Classification