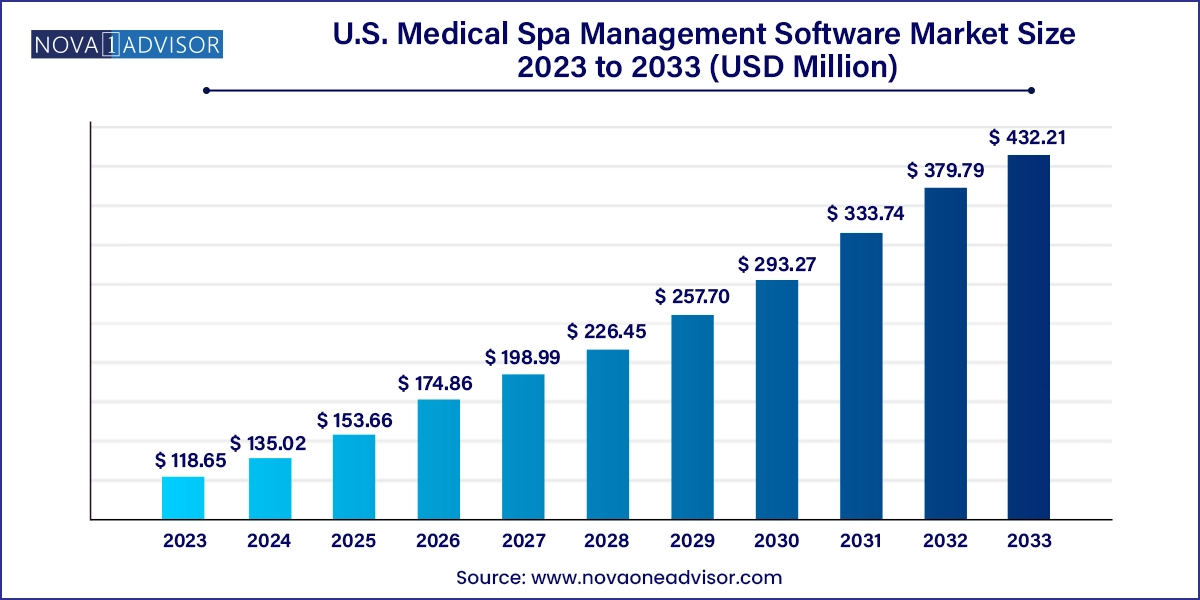

The U.S. medical spa management software market size was exhibited at USD 118.65 million in 2023 and is projected to hit around USD 432.21 million by 2033, growing at a CAGR of 13.8% during the forecast period 2024 to 2033.

The U.S. Medical Spa Management Software Market is experiencing rapid transformation as the medical aesthetics and wellness sectors expand. Medical spas hybrid facilities combining traditional spa experiences with medically supervised cosmetic treatments have seen a significant surge in popularity across the U.S., driven by growing consumer demand for non-invasive procedures such as laser treatments, injectables, and skin rejuvenation therapies. This evolution has created a parallel demand for efficient, secure, and scalable software platforms capable of managing end-to-end operations within these practices.

The modern medical spa is no longer just a luxury indulgence but a structured clinical business. From HIPAA-compliant client records and online appointment scheduling to targeted marketing automation and payment integrations, spa operators now rely on comprehensive digital solutions to manage increasingly complex operations. As competition intensifies and patient expectations rise, software systems that offer data-driven insights, seamless client engagement, and real-time business intelligence have become crucial for sustained profitability and growth.

Moreover, the convergence of telehealth, mobile payment systems, and artificial intelligence is rapidly reshaping the operational backbone of medical spas. Cloud adoption has enabled spa professionals to manage their business remotely, access live performance dashboards, and deliver personalized services at scale. With a growing number of med spas opening in suburban and even rural areas, there's an increasing push to digitize all customer-facing and backend functions for enhanced efficiency and patient experience. The market outlook is positive, with software platforms playing a central role in the continued professionalization of the medical spa industry.

Shift toward cloud-based and SaaS solutions for remote access, automatic updates, and scalability across locations.

Integration of AI-powered analytics and client profiling, enabling spas to personalize services, promotions, and follow-ups.

Adoption of mobile-first platforms with self-service booking, digital consent forms, and client portal access.

Expansion of CRM capabilities to support loyalty programs, automated messaging, review solicitation, and lead conversion.

Increased emphasis on HIPAA compliance and secure data storage as medical spas deal with confidential patient data.

Omnichannel marketing automation built into management platforms to support social media engagement, retargeting, and email campaigns.

Embedded financial tools including integrated payment gateways, installment plan management, and POS systems.

Growing focus on analytics and real-time dashboards for monitoring staff performance, inventory levels, revenue trends, and customer satisfaction metrics.

| Report Coverage | Details |

| Market Size in 2024 | USD 135.02 Million |

| Market Size by 2033 | USD 432.21 Million |

| Growth Rate From 2024 to 2033 | CAGR of 13.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Agilysys NV LLC; Birch Medical & Wellness; Booksy (Versum); PatientNow/EnvisionNow; Mindbody; Nextech Systems, LLC, Rosy Salon Software, SpaSoft (Gary Jonas Computing Ltd.), Square (Block, Inc.), Silverbyte LTD, Vagaro Inc; and Zenoti Software Solutions Inc. |

A primary driver fueling the growth of the U.S. medical spa management software market is the explosive expansion of the medical aesthetics industry. Over the past decade, there has been a cultural shift in how people perceive cosmetic treatments—procedures like Botox, microneedling, and body sculpting are now considered routine beauty maintenance for many Americans. This normalization, paired with increased affordability and widespread awareness, has led to a substantial uptick in the number of medical spas and independent aesthetic practitioners across the country.

However, running a successful medical spa is increasingly complex. Unlike traditional salons or day spas, these establishments must adhere to medical regulations, maintain detailed patient records, and ensure physician supervision for certain services. These operational demands have created a pressing need for software solutions that not only streamline scheduling and billing but also ensure compliance, enhance client retention, and manage clinical documentation securely. As patient volumes rise and competition grows fiercer, spa owners are turning to software tools to automate tasks, improve efficiency, and deliver better client experiences—fueling a surge in demand for robust, intuitive management platforms.

Despite the clear advantages of medical spa management software, one of the key restraints limiting full-scale adoption across the U.S. market is the fragmented nature of the industry, particularly among smaller or independent operators. Many single-location spas still operate with manual or semi-digital systems relying on spreadsheets, basic booking platforms, or free CRM tools due to budget constraints or limited technical know-how. The transition to a fully integrated management suite often seems daunting in terms of cost, training, and implementation.

This hesitation is compounded by concerns around data privacy, system downtime, and vendor reliability. For smaller businesses that rely heavily on word-of-mouth and repeat clientele, disruptions in service due to software bugs or data loss can be highly detrimental. Additionally, some spa owners may find comprehensive platforms to be overly complex for their immediate needs. Without clear demonstrations of ROI or scalable pricing models, adoption remains uneven, particularly in non-urban markets. Overcoming this barrier will require vendors to offer simpler onboarding, flexible subscription plans, and dedicated customer support.

One of the most promising opportunities in the U.S. medical spa management software space lies in the integration of artificial intelligence (AI) and machine learning to deliver predictive insights and hyper-personalized experiences. In an industry that thrives on relationship building and tailored services, AI-driven systems can dramatically enhance engagement and retention. For instance, AI tools can analyze client behavior to suggest personalized treatment plans, identify upselling opportunities, or send timely reminders for follow-up sessions based on usage patterns and seasonal trends.

Moreover, predictive analytics can help spa owners forecast demand, optimize staffing, and prevent inventory shortfalls. AI-enabled chatbots can manage appointment bookings and FAQs, freeing up staff for high-value tasks. These intelligent systems are especially valuable for growing multi-location operators looking to maintain consistency while scaling their customer experience. As the technology becomes more accessible and affordable, AI integration will become a powerful differentiator for software platforms in the market unlocking smarter, more profitable spa operations.

Web and cloud-based software solutions currently dominate the U.S. medical spa management software market due to their flexibility, scalability, and ease of deployment. These systems require no extensive local infrastructure, making them ideal for both startups and multi-location enterprises. Cloud systems allow spa managers to access real-time data from any device, enabling remote monitoring, performance analysis, and client communication. The shift to web-based systems has been accelerated by the COVID-19 pandemic, which increased the need for touchless check-ins, digital intake forms, and mobile appointment scheduling—features most effectively delivered via cloud platforms.

Moreover, cloud-based solutions offer continuous updates, robust data encryption, and lower upfront costs compared to on-premises systems. They integrate easily with third-party applications such as email marketing tools, payment processors, and EMR platforms, giving spa owners a modular approach to business management. Many leading vendors also offer dedicated mobile apps, ensuring staff and clients can interact with the system on the go. As remote work and decentralized spa ownership models grow more common, the dominance of cloud-based solutions is expected to continue.

.webp)

On-Premises Solutions Are Growing Slowly but Steadily

While cloud-based platforms are the market leaders, on-premises software continues to maintain a foothold, particularly among well-established spas with robust IT infrastructure and a preference for complete control over their data. On-premises systems are viewed as more secure by some operators, particularly those handling a high volume of sensitive client data or complex integrations with legacy systems. These setups are also favored in regions with poor internet connectivity or strict internal compliance frameworks.

That said, growth in the on-premises segment is slower due to the higher initial capital outlay, maintenance responsibilities, and lack of flexibility. As cybersecurity tools improve and data migration becomes more seamless, many businesses are reevaluating their commitment to on-premises systems. For the segment to remain competitive, vendors may need to offer hybrid models that combine the best of both worlds—local data storage with cloud backup and mobility features.

Appointment Management Remains the Most Widely Used Application

Appointment management stands as the most utilized application within medical spa management platforms, as booking, scheduling, and calendar coordination are the foundational elements of spa operations. From managing new client appointments and allocating provider time to sending reminders and handling cancellations or no-shows, this feature streamlines the day-to-day workflow of front-desk operations. Modern systems include online self-scheduling, automated reminders via SMS/email, and integration with Google Calendar or iCal to help staff manage their time efficiently.

Moreover, intelligent scheduling tools now allow providers to automatically recommend time slots based on staff availability, treatment duration, and room occupancy. With the rise of multi-location spas, centralized appointment dashboards have become invaluable for businesses juggling multiple calendars and client bases. As a result, appointment management tools continue to be a primary driver of software adoption among both small and large spa businesses.

CRM and Analytics Are the Fastest Growing Application Areas

Customer Relationship Management (CRM) and Analytics & Reporting are the fastest-growing application areas in the market, propelled by the industry's shift toward data-driven personalization. CRM tools help spas track client preferences, history, loyalty programs, and communication records, enabling tailored experiences and improving retention. These systems also integrate with email marketing tools, feedback platforms, and lead nurturing workflows—helping spas stay connected with clients beyond appointments.

Meanwhile, advanced analytics modules provide business intelligence through real-time dashboards, revenue tracking, and staff productivity reports. Spa owners can view performance trends, identify bottlenecks, and make informed decisions. Combined with AI features, analytics modules can even predict high churn risk or suggest the best-performing upsell strategies. As the industry matures, these tools are becoming indispensable for businesses looking to grow strategically and sustainably.

The U.S. is at the forefront of the global medical spa industry, home to thousands of aesthetic practices ranging from boutique med spas to nationwide franchises. California, Texas, Florida, and New York lead in the number of spa establishments, reflecting the intersection of high disposable income, beauty-conscious clientele, and a wellness-driven culture. With increasing demand for aesthetic treatments from both men and women, the number of licensed aestheticians, nurse injectors, and cosmetic dermatologists has surged fueling the need for efficient business management tools.

The U.S. regulatory environment also supports growth in medical spas, with clear guidelines around practitioner credentials, treatment scope, and data privacy requirements. HIPAA compliance, in particular, drives the need for secure software platforms that can protect sensitive patient data. Additionally, U.S. consumers are tech-savvy and expect seamless digital experiences—from booking to payment to post-treatment follow-ups. This expectation sets a high bar for software vendors and continually drives innovation in user experience, mobile capabilities, and feature depth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical spa management software market

Type

Application

Regional