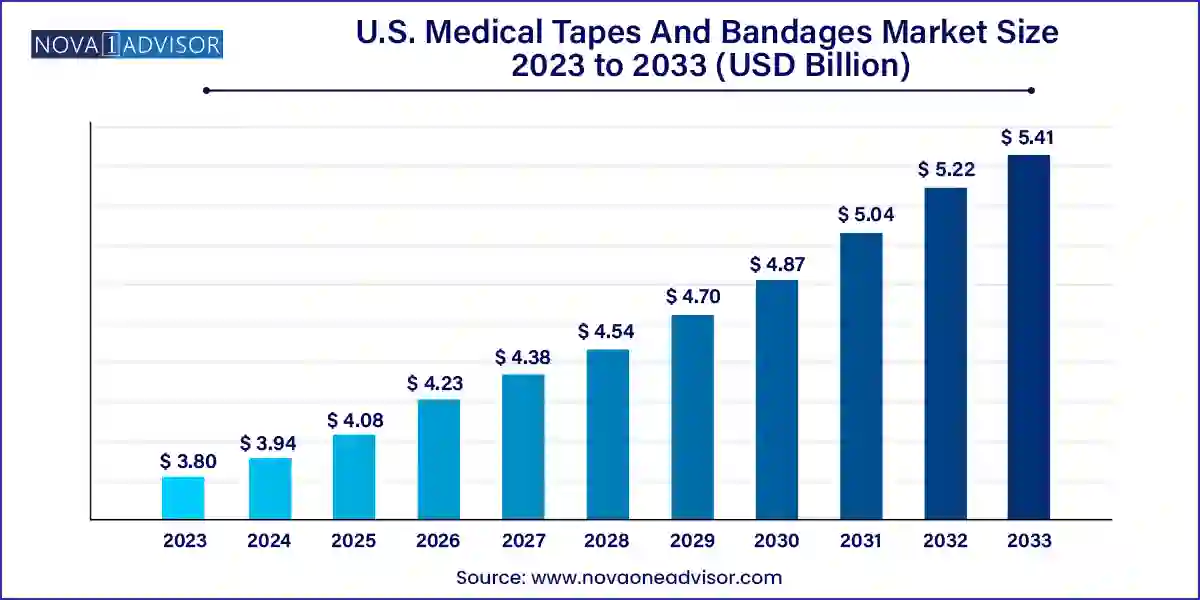

The U.S. medical tapes And bandages market size was exhibited at USD 3.80 billion in 2023 and is projected to hit around USD 5.41 billion by 2033, growing at a CAGR of 3.6% during the forecast period 2024 to 2033.

The U.S. medical tapes and bandages market has long played a crucial role in the broader healthcare ecosystem, providing essential wound care solutions across a multitude of clinical, sports, and at-home settings. Medical tapes and bandages are fundamental to the healing process—they help protect wounds, prevent infections, manage moisture levels, and support injured body parts. From post-surgical applications to sports-related injuries and chronic ulcer care, the utility and demand for these products are persistent and expanding.

In recent years, the growing prevalence of chronic wounds, increasing incidence of surgeries, and rising elderly population have significantly boosted the market demand. According to the CDC, over 46.7 million surgical procedures were conducted in the United States in 2022, and each of these often requires appropriate dressing solutions during the post-operative care phase. Furthermore, lifestyle diseases like diabetes and obesity—linked closely with slow-healing ulcers—have fueled a consistent demand for advanced wound care products, including medical tapes and specialized bandages.

The U.S. market also benefits from a highly developed healthcare infrastructure, strong reimbursement frameworks, and ongoing innovation in dressing materials such as silicone-based adhesive tapes and breathable bandages. Leading companies are focused on offering skin-friendly, latex-free, and hypoallergenic options, catering to the needs of sensitive skin and pediatric patients. Additionally, the emergence of antimicrobial-infused tapes and bandages reflects the growing emphasis on infection control amid rising hospital-acquired infection (HAI) rates.

Increasing preference for advanced wound care: Modern products like hydrogel bandages and breathable silicone tapes are becoming popular due to better healing outcomes and patient comfort.

Shift toward hypoallergenic and latex-free products: With increasing skin sensitivity issues, both healthcare professionals and consumers prefer gentle, allergy-free options.

Growing adoption of antimicrobial bandages and tapes: Designed to prevent infection, these are gaining traction especially in hospitals and trauma centers.

Rise in home healthcare and self-care wound management: Particularly among elderly and chronic disease patients, there is increasing reliance on self-application of bandages and tapes at home.

Customization and design innovation: Companies are introducing ergonomically designed tapes and bandages that are easier to apply, more secure, and adapted for specific body parts.

Sustainability-driven materials: Eco-conscious consumers are influencing manufacturers to explore biodegradable or recyclable dressing materials.

Increased usage in sports medicine: The growing popularity of fitness activities and sports has boosted the use of elastic and orthopedic bandages among athletes.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.94 Billion |

| Market Size by 2033 | USD 5.41 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Smith & Nephew PLC; Mölnlycke Health Care AB; 3M; Ethicon Inc. (JOHNSON & JOHNSON); McKesson Corporation; B. Braun SE; Paul Hartmann AG; Coloplast; Integra Lifesciences; Medline Industries |

Growing Incidence of Chronic Wounds and Surgical Procedures

One of the most significant drivers of the U.S. medical tapes and bandages market is the increasing prevalence of chronic wounds and the rising number of surgical interventions. Chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers require consistent and specialized wound dressing for long-term healing. With the CDC estimating that over 34 million Americans are living with diabetes as of 2023, the probability of developing related complications that require dressing care is substantial.

Additionally, an aging population contributes to this driver. Older adults are more susceptible to slow wound healing, falls, and surgical interventions like hip or knee replacements—all requiring appropriate dressings. Medical bandages and tapes are a staple in post-operative care, and innovations such as moisture-retentive bandages or stretchable tapes are improving recovery outcomes. The healthcare system's pivot toward minimally invasive procedures has also expanded outpatient care, furthering the use of these dressing products in ambulatory and home care settings.

Skin Irritation and Allergic Reactions

Despite advancements in material science and formulation, skin irritation remains a significant restraint in the U.S. medical tapes and bandages market. Some tapes, particularly those using strong adhesives or synthetic materials, can cause redness, itching, blisters, or dermatitis, especially when worn for extended durations. Elderly patients and those with pre-existing skin conditions like eczema or psoriasis are particularly vulnerable.

Even products labeled as "hypoallergenic" sometimes fail to completely eliminate allergic reactions due to differences in individual skin sensitivity. Moreover, aggressive removal of tapes can lead to skin stripping, which not only increases patient discomfort but can also lead to secondary complications like infections. These concerns necessitate repeated product testing and more careful usage, which can deter both clinical staff and consumers from using certain products, thus hindering broader market adoption.

Rise in Home-based and Retail Wound Care Demand

The increasing preference for home-based care presents a major opportunity for growth in the medical tapes and bandages market. With the growing aging population and the high costs of hospital stays, patients are increasingly managing minor wounds, post-operative healing, and chronic ulcers at home. This trend has significantly boosted the demand for easy-to-use, over-the-counter wound care products that offer clinical efficacy with consumer-level simplicity.

The proliferation of retail healthcare through pharmacies and e-commerce platforms has also widened access. Brands offering consumer-friendly packaging, instructional videos, and subscription-based delivery services are tapping into this expanding market. The U.S. government's encouragement for telehealth and remote care solutions further supports this shift. Products specifically tailored for self-application—such as stretchable elastic bandages or repositionable silicone tapes—are increasingly viewed as essential tools in home first-aid kits and chronic care management routines.

Medical bandages dominated the market in 2023, driven by their extensive usage in hospitals and outpatient settings.

Among the two primary categories medical tapes and medical bandages—bandages represent the larger market share in the U.S. This dominance is attributed to the widespread application of muslin and elastic bandage rolls for post-operative wound care, orthopedic support, and general trauma management. Orthopedic bandages, in particular, have been in high demand, fueled by the rise in bone fractures, sports injuries, and age-related degenerative diseases like osteoporosis. Triangular and elastic plaster bandages are also highly favored in emergency care settings for their versatility and firm support. The wide range of options—from pressure-relieving to conformable designs makes bandages indispensable in both clinical and home care use.

Plastic tapes are emerging as the fastest-growing product segment due to their superior adhesion and waterproof qualities.

Plastic-based medical tapes, particularly those made of propylene, have witnessed a notable uptick in adoption. Their resistance to moisture and durability makes them ideal for use in wet environments or during prolonged use. These tapes are preferred in surgical and sports settings where wound protection must be uncompromised. Additionally, newer plastic tape formulations incorporate microporous properties for breathability without sacrificing adhesion. The introduction of easy-tear and hypoallergenic plastic tapes has further improved patient compliance, propelling the segment’s rapid expansion.

Surgical wound applications held the dominant position due to high surgical volumes and routine post-operative dressing requirements.

Surgical wounds represent the largest application segment for medical tapes and bandages in the U.S., supported by the country’s advanced surgical capabilities and healthcare infrastructure. Most surgical procedures—from cardiac operations to cosmetic surgeries—require multi-layered bandaging and secure tapes to stabilize wounds and prevent infection. Given that wound care may extend from hospital stay through outpatient recovery, the demand for long-lasting and skin-friendly products remains strong. Additionally, the risk of surgical site infections (SSIs) places pressure on providers to adopt superior-quality dressings with antimicrobial or absorbent features.

Ulcer treatment is the fastest-growing application segment, propelled by the increasing burden of diabetes and venous insufficiency.

The rising incidence of chronic ulcers, particularly diabetic foot and pressure ulcers, has significantly driven demand in this segment. Effective treatment often involves multilayer compression bandages and moisture-retentive dressings, which facilitate healing while minimizing infection risks. The chronic nature of these wounds calls for ongoing dressing changes, which translates to recurring product demand. This trend is further accentuated by the aging U.S. population, which is more prone to such ailments. Companies that provide tailored ulcer management solutions, such as extra-large adhesive tapes and conformable bandages, are seeing rapid market penetration.

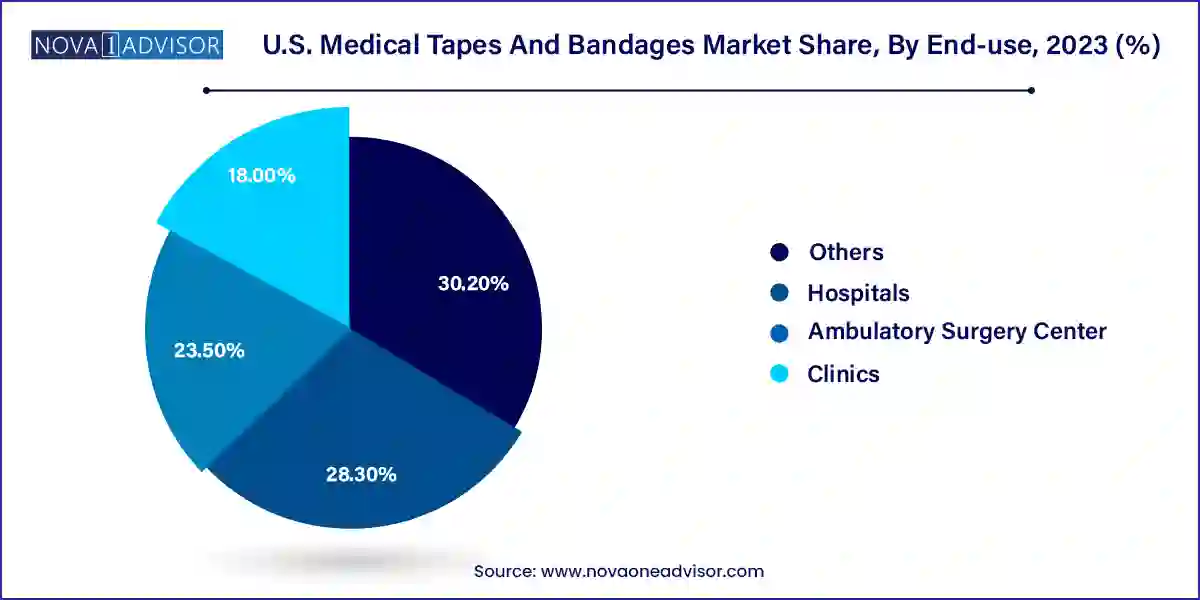

Hospitals dominated the market due to higher patient volume and extensive procedural demand for tapes and bandages.

Hospitals remain the primary end-users of medical tapes and bandages, accounting for the largest share of product utilization. Whether it is for post-surgical wound care, emergency trauma treatment, or dressing chronic wounds, hospitals rely on a continuous supply of high-quality tapes and bandages. These institutions often partner with major suppliers for bulk procurement, which ensures consistency in product performance and cost-effectiveness. Furthermore, hospitals are quick to adopt innovations such as antimicrobial-infused bandages or repositionable tapes, making them trendsetters in the space.

Retail emerged as the fastest-growing end-use segment, driven by consumer preference for over-the-counter wound care solutions.

Retail pharmacies, drugstores, and e-commerce platforms are increasingly becoming vital distribution channels for medical tapes and bandages. The rise in self-treatment of minor injuries and the growing prevalence of chronic illnesses managed at home have contributed to this shift. Brands are tailoring their product designs and packaging to suit the retail environment—focusing on ease of application, aesthetic appeal, and clear instructions. The COVID-19 pandemic accelerated this trend as people sought to avoid clinical settings for non-critical issues, a behavior that has persisted even as restrictions eased.

The United States represents a mature yet dynamic market for medical tapes and bandages. Key drivers include robust healthcare expenditure, advanced surgical infrastructure, and a growing emphasis on chronic wound care. The U.S. also benefits from a strong regulatory and innovation ecosystem. The FDA's role in approving novel dressing materials ensures both safety and clinical efficacy, which boosts consumer confidence.

There is significant variability in usage patterns across states. Urban centers like New York and California have high surgical volumes, while southern states such as Texas and Florida report elevated cases of diabetes-related wounds. These regional differences influence product demand, procurement policies, and consumer preferences. The increasing integration of technology in wound care management—such as mobile apps for dressing schedules—is also gaining momentum, positioning the U.S. as a leader in digital-first medical dressing solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical tapes And bandages market

Product

Application

End-use