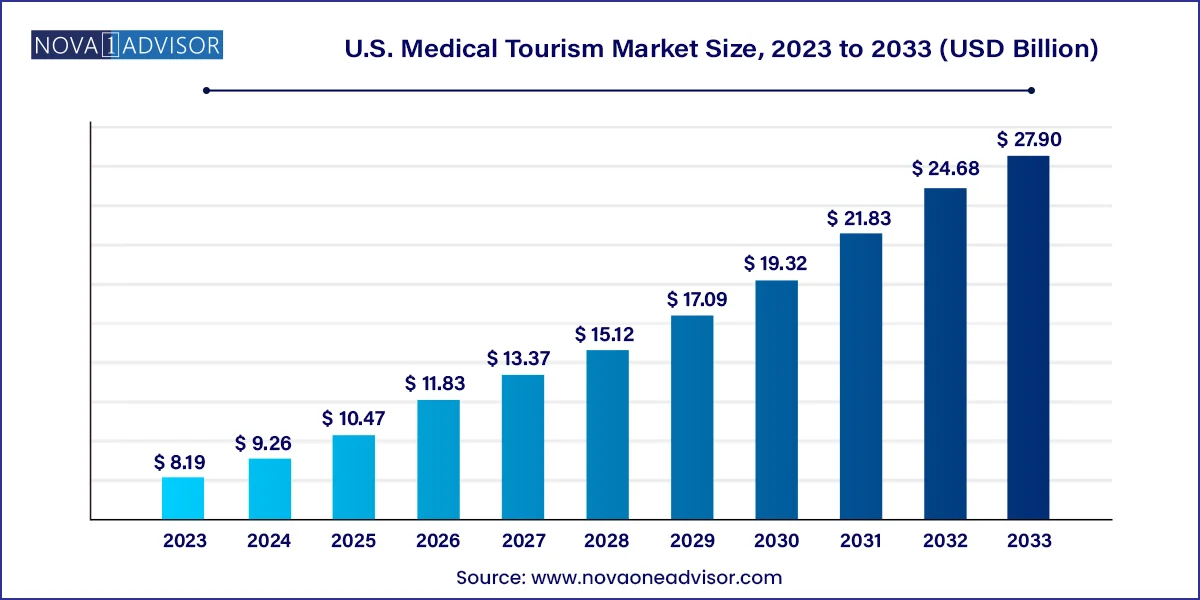

The U.S. medical tourism market size was valued at USD 8.19 billion in 2023 and is anticipated to reach around USD 27.90 billion by 2033, growing at a CAGR of 13.04% from 2024 to 2033.

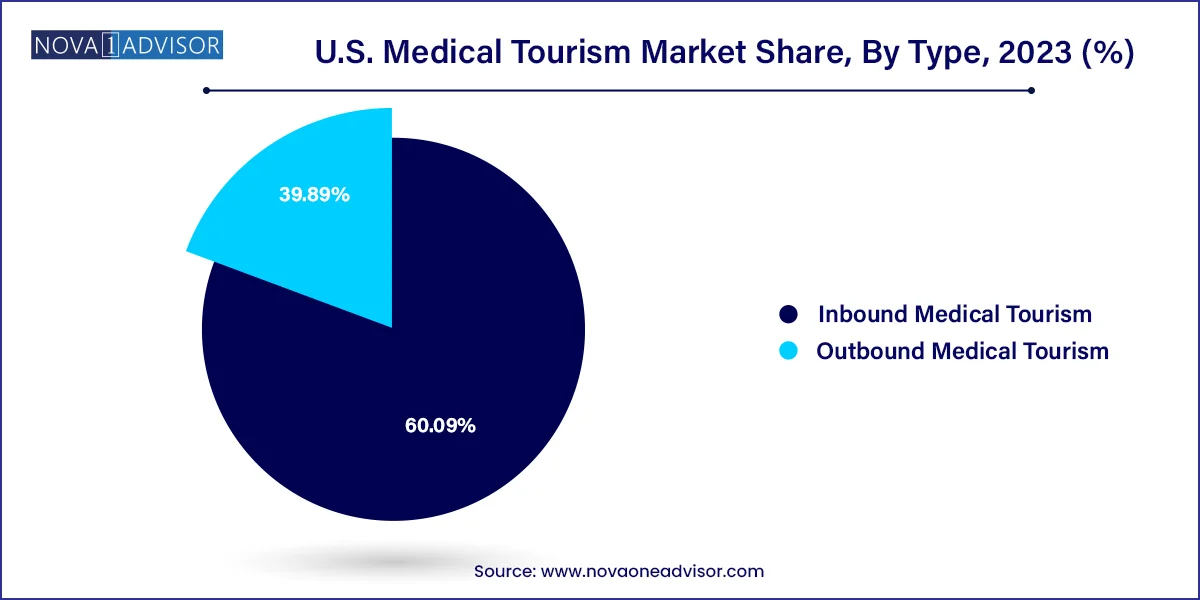

The U.S. medical tourism market represents a unique and increasingly dynamic aspect of the nation’s healthcare and international travel sectors. Unlike traditional health systems that focus solely on domestic patients, the U.S. medical tourism landscape operates in two distinct streams: inbound tourism where patients travel to the U.S. for advanced or specialized care and outbound tourism where U.S. citizens travel abroad to seek affordable medical treatments not covered or undercovered by their insurance policies.

With one of the most technologically advanced healthcare infrastructures globally, the U.S. remains an attractive destination for high-net-worth individuals, foreign nationals, and diplomatic personnel seeking premium care, particularly in specialized areas such as oncology, cardiovascular surgery, orthopedics, and advanced diagnostics. Meanwhile, an increasingly significant number of U.S. residents are opting to travel abroad for elective procedures such as dental surgeries, cosmetic treatments, and fertility services due to high out-of-pocket expenses at home.

The dual nature of this market has created a complex but opportunistic environment, where healthcare providers, insurance companies, medical facilitators, and travel agencies intersect. On one end, the U.S. benefits from its reputation for clinical excellence and technological leadership; on the other, it faces rising outbound traffic due to cost disparities and systemic inefficiencies.

As international mobility resumes post-pandemic, digital healthcare expansion, global accreditation practices, and price transparency are playing a pivotal role in shaping the future of medical tourism to and from the United States. Furthermore, policy shifts, immigration dynamics, and insurance reform continue to add layers of influence, positioning this market for evolution, disruption, and strategic reinvention.

Technological Integration in Medical Facilitation: Platforms leveraging AI and telemedicine are increasingly used for virtual consultations and cross-border pre-surgery evaluations.

Bundled Healthcare Travel Packages: Hospitals and medical travel facilitators offer all-inclusive packages covering treatment, accommodation, translators, and post-care follow-ups.

Growing Role of Concierge Medicine: High-end concierge services are making the U.S. more appealing to wealthy foreign patients by providing personalized care and luxury medical experiences.

Insurance Support for Medical Travel: U.S.-based insurers are beginning to offer partial or full coverage for treatments conducted overseas, fueling outbound traffic.

Expansion of Cross-border Accreditation: More international hospitals are attaining U.S.-based certifications (e.g., Joint Commission International), increasing U.S. citizens’ confidence in receiving care abroad.

Surge in Dental and Cosmetic Outbound Tourism: Due to lack of insurance coverage, dental implants, veneers, and cosmetic surgeries are being outsourced to countries like Mexico, Costa Rica, and Turkey.

Demand for Reproductive Health Services: Medical travel for IVF, surrogacy, and gender selection is on the rise, both inbound and outbound, due to regulatory variation and cost.

| Report Attribute | Details |

| Market Size in 2024 | USD 9.26 Billion |

| Market Size by 2033 | USD 27.90 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.04% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital |

One of the most powerful drivers for the U.S. medical tourism market specifically the inbound segment is the global reputation of the U.S. for providing world-class healthcare, particularly in complex, high-risk, or advanced treatments. The United States is home to numerous globally ranked hospitals such as Mayo Clinic, Cleveland Clinic, Johns Hopkins Hospital, and MD Anderson Cancer Center, which are regarded as leaders in medical innovation and clinical outcomes.

Patients from the Middle East, Asia, Africa, and Latin America travel to the U.S. for second opinions, advanced diagnostics, cancer treatment, organ transplants, and robotic-assisted surgeries. These individuals often seek technologies not available in their home countries or prefer the expertise of U.S.-trained physicians for rare or severe conditions. High-net-worth individuals and state-sponsored patients from oil-rich nations frequently receive treatment in U.S. centers under international care agreements. Additionally, the perception of safety, transparency, and regulatory oversight contributes to the appeal, despite high costs.

One of the most significant restraints in the U.S. medical tourism landscape is the prohibitively high cost of care, which drives the outbound segment and limits accessibility for many potential inbound patients. In 2023, the average cost of a coronary artery bypass graft surgery in the U.S. ranged between $70,000 to $120,000, while the same procedure could cost under $20,000 in India or Thailand. Cosmetic surgeries, dental implants, and fertility treatments often come with minimal or no insurance coverage in the U.S., making them financially out of reach for middle-income individuals.

For inbound patients, despite the prestige of U.S. facilities, many are unable to access care due to lack of international insurance compatibility or high out-of-pocket payment requirements. Visa restrictions and extended administrative procedures also act as deterrents. For outbound tourists, the high cost of U.S. healthcare becomes a catalyst for seeking treatments abroad—though it raises questions about post-treatment continuity, safety, and legal recourse in case of malpractice. These factors create friction in market growth and demand holistic policy interventions.

A transformative opportunity in the U.S. medical tourism market lies in the integration of telehealth services for international pre-treatment consultations. As digital health platforms become more sophisticated and regulatory frameworks evolve, healthcare providers can now offer seamless virtual consultations, diagnostics review, and second opinions across borders. This is particularly useful in pre-travel decision-making, where foreign patients want reassurance regarding treatment plans before booking travel.

Outbound travelers also benefit from telehealth follow-ups after receiving care abroad. For example, a U.S. patient who undergoes dental surgery in Costa Rica can connect virtually with the surgeon for post-procedure guidance. Hospitals are developing hybrid care models that begin with virtual assessments and continue through physical procedures in either domestic or foreign locations. By incorporating telemedicine, U.S. healthcare systems can reduce patient drop-offs, enhance trust, and improve continuity of care, offering a critical value proposition in a highly price-sensitive market.

Outbound medical tourism currently dominates the U.S. medical tourism market, as a significant number of U.S. residents are traveling abroad for affordable healthcare services. This trend has gained momentum due to the high cost of treatment in the U.S. and limited insurance coverage for elective or non-emergency procedures. Countries such as Mexico, Costa Rica, India, and Thailand have become go-to destinations for Americans seeking treatments like dental work, bariatric surgery, cosmetic enhancements, and orthopedic procedures. These destinations often offer packages that combine treatment with vacation experiences, further incentivizing medical travel. The affordability, shorter waiting times, and availability of English-speaking staff contribute to the growing preference for outbound medical travel.

In addition to cost considerations, the rise of digital health platforms has enabled easier coordination with international providers, making the entire medical travel process more transparent and user-friendly. U.S. patients can now research clinics, consult with physicians virtually, and coordinate aftercare before even leaving the country. Some employers and insurers have begun encouraging this practice by covering select international procedures as part of their benefits packages. This formalization is expected to make outbound tourism more mainstream over the next decade.

However, inbound medical tourism is growing steadily, fueled by international patients seeking complex and high-risk treatments that may not be available in their home countries. The U.S. offers some of the most advanced facilities and healthcare technologies globally, drawing patients especially in the fields of oncology, organ transplantation, neurology, and robotic surgeries. The growth of concierge medical services, visa support offices, and hospital affiliations with embassies has made the process more navigable for international visitors.

Countries in the Middle East, South America, and parts of Asia send patients to top U.S. institutions under government funding or private arrangements. Despite the high costs, the prestige and trust associated with American healthcare institutions continue to make the U.S. a destination of choice for those who can afford it or whose governments subsidize such care. Hospitals in cities like Houston, New York, Los Angeles, and Boston are popular medical tourism hubs, and many have dedicated international patient departments to streamline the process.

The United States occupies a complex but pivotal position in the global medical tourism ecosystem. On one hand, it is a top destination for affluent international patients seeking the latest in medical technology and specialist expertise. On the other hand, it is a significant source of outbound medical travelers, driven largely by unaffordable costs and limited insurance coverage for certain procedures domestically.

Several states have carved niches within the market. Texas, particularly Houston, is known for its cardiovascular and cancer care expertise; California attracts medical tourists for orthopedic and cosmetic surgeries; while Florida is recognized for aesthetic medicine and wellness retreats. These states benefit from a mix of top-tier hospitals, international airports, and tourism infrastructure.

However, policy-related hurdles like stringent visa requirements, lack of centralized medical travel frameworks, and fragmented insurance practices limit the scalability of inbound tourism. Outbound tourism, meanwhile, is largely unregulated but thriving through digital channels and informal word-of-mouth networks. A more structured national policy on medical travel both inbound and outbound could help the U.S. unlock significant potential in this niche but growing segment of healthcare and tourism.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Tourism market.

By Type