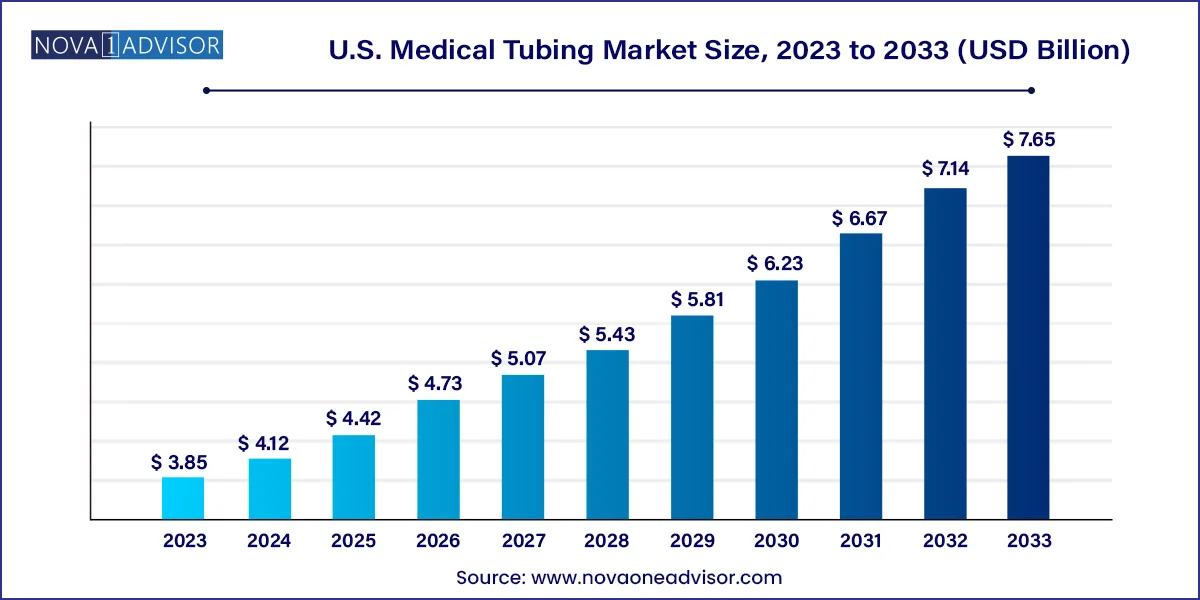

The U.S. medical tubing market size was exhibited at USD 3.85 billion in 2023 and is projected to hit around USD 7.65 billion by 2033, growing at a CAGR of 7.11% during the forecast period 2024 to 2033.

The U.S. medical tubing market is an integral pillar supporting the broader medical device and healthcare industry. As medical procedures become increasingly precise, less invasive, and more personalized, the demand for high-performance medical tubing has expanded across applications such as fluid management, drug delivery, catheters, respiratory devices, and laboratory equipment. Medical tubing serves as a conduit for air, liquids, or other substances and must meet a stringent combination of physical performance and biocompatibility criteria.

Over the years, this market has grown beyond mere volume to emphasize functionality, safety, and regulatory compliance. Hospitals, clinics, diagnostic laboratories, and home healthcare settings all rely on specialized tubing configurations tailored for diverse uses. With an aging population and an increase in the incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, there is a corresponding surge in long-term and outpatient medical care. This evolution in care models is bolstering the need for reliable, sterile, and adaptable tubing systems.

In parallel, manufacturers are continuously exploring innovative material compositions, such as silicone blends, polyimide layers, and advanced fluoropolymers, to create tubing that can withstand chemical exposure, sterilization cycles, and mechanical stress. Environmental sustainability, precision extrusion techniques, and the growing role of tubing in drug-device combination products are further reshaping the U.S. medical tubing market’s strategic trajectory.

Material Innovation Is Redefining Performance Benchmarks

Medical tubing manufacturers are exploring materials like polyimide, thermoplastic elastomers, and advanced fluoropolymers to improve flexibility, heat resistance, and bioinertness.

Miniaturization in Catheters and Endoscopic Tools

As minimally invasive surgeries become the norm, tubing designs are being miniaturized to enable enhanced maneuverability and patient comfort.

Adoption of Co-Extrusion and Multi-Lumen Technology

Advanced tubing with multiple internal channels is gaining traction in diagnostic and infusion procedures, enabling multi-functionality within a single device.

Eco-conscious Production Processes

Sustainability concerns are driving a shift toward recyclable or bio-based tubing alternatives, and cleaner manufacturing practices.

Home-based Therapeutics Fuel Demand for Lightweight, User-friendly Tubing

The expansion of home healthcare services has led to the development of tubing optimized for comfort, safety, and ease-of-use in non-clinical environments.

Customization and Application-specific Design

End users increasingly seek application-specific tubing, customized in terms of lumen size, durometer, color coding, and material compatibility.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.12 Billion |

| Market Size by 2033 | USD 7.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product and Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Hitachi Cable America Inc,; NewAge Industries Inc.; Spectrum Plastics Group; Bentec Medical; Kent Elastomer Products; The Hygenic Company, LLC; Nordson Corporation |

One of the most influential forces accelerating the U.S. medical tubing market is the growing prevalence of minimally invasive and non-invasive therapeutic procedures. These techniques have become preferred treatment modalities across disciplines, from cardiology and oncology to urology and gynecology. They offer numerous patient-centric advantages: reduced trauma, quicker recovery, shorter hospital stays, and lower complication rates.

Medical tubing plays an indispensable role in such interventions. It acts as a support mechanism for devices such as catheters, endoscopes, drainage systems, and stents. For example, in laparoscopic surgery, tubing delivers irrigation fluids, removes waste, and provides access to surgical tools. Similarly, in interventional cardiology, microtubing guides catheters to specific areas within the vascular system with extreme precision. As these techniques become widespread, demand for tubing that supports higher flexibility, kink resistance, and durability has risen sharply.

Despite its growth trajectory, the U.S. medical tubing market faces critical hurdles related to material regulation and supply chain complexity. Tubing used in medical applications is subject to stringent regulatory approvals to ensure safety, sterility, and compatibility with human tissues or fluids. Any change in material formulation—even as a response to supply limitations—can trigger long validation cycles. Manufacturers must not only maintain compliance with agencies like the FDA but also anticipate revisions in standards due to emerging research or global events.

Moreover, the market is vulnerable to fluctuations in the supply of key polymers such as silicone or fluorinated resins. Geopolitical factors, trade restrictions, and raw material shortages can delay production or elevate costs. In an industry where precision and timing are paramount, such disruptions can impact not just manufacturers but also hospitals, clinicians, and patients who rely on consistent device availability.

The rise of home-based healthcare represents a promising avenue for expansion in the medical tubing domain. Driven by cost-efficiency goals, technological advancements, and patient preference, many therapeutic regimens—including dialysis, insulin delivery, respiratory support, and infusion therapy—are transitioning from hospitals to homes. This trend has intensified after recent global health crises which emphasized remote and decentralized care.

Tubing that is integrated into portable or wearable devices must meet several specific criteria: it must be lightweight, non-toxic, kink-resistant, and compatible with compact device designs. Manufacturers have the opportunity to innovate tubing for mobile nebulizers, infusion pumps, or wearable drug delivery systems that enhance autonomy and safety for patients in non-clinical environments. Companies capable of engineering such user-centric, ergonomic tubing solutions will have a competitive edge in this expanding segment.

Bulk Disposable Tubing Dominated the Application Segment

Bulk disposable tubing accounted for the largest share of applications, primarily due to its universal use in standard hospital procedures, diagnostic labs, and outpatient centers. These include IV infusion lines, suction systems, respiratory circuits, and fluid drainage systems. The preference for disposable tubing stems from its sterility, ease of use, and elimination of contamination risks. Especially during times of heightened infection control, hospitals often rely heavily on single-use components.

This dominance is reinforced by procurement models that favor bulk purchases and centralized sterilization standards. Furthermore, bulk disposable tubing is often the first product line into which newer materials and sustainable practices are trialed due to its volume-driven economics.

Drug Delivery Systems Are the Fastest Growing Application

As pharmaceutical innovation produces increasingly targeted therapies—especially in oncology, neurology, and endocrinology—the need for precise, consistent, and safe drug delivery systems is escalating. Tubing used in infusion pumps, insulin pens, or auto-injectors must meet stringent flow accuracy, chemical compatibility, and patient safety standards.

This segment is benefiting from the convergence of digital health and drug delivery technology. Smart infusion pumps, for example, use microtubing to regulate flow rates according to real-time data. Wearable injectors, gaining popularity for self-administered biologics, also rely heavily on advanced tubing designs. The increasing sophistication of combination devices and the FDA’s encouragement for innovative drug-device platforms are catalyzing this segment’s growth.

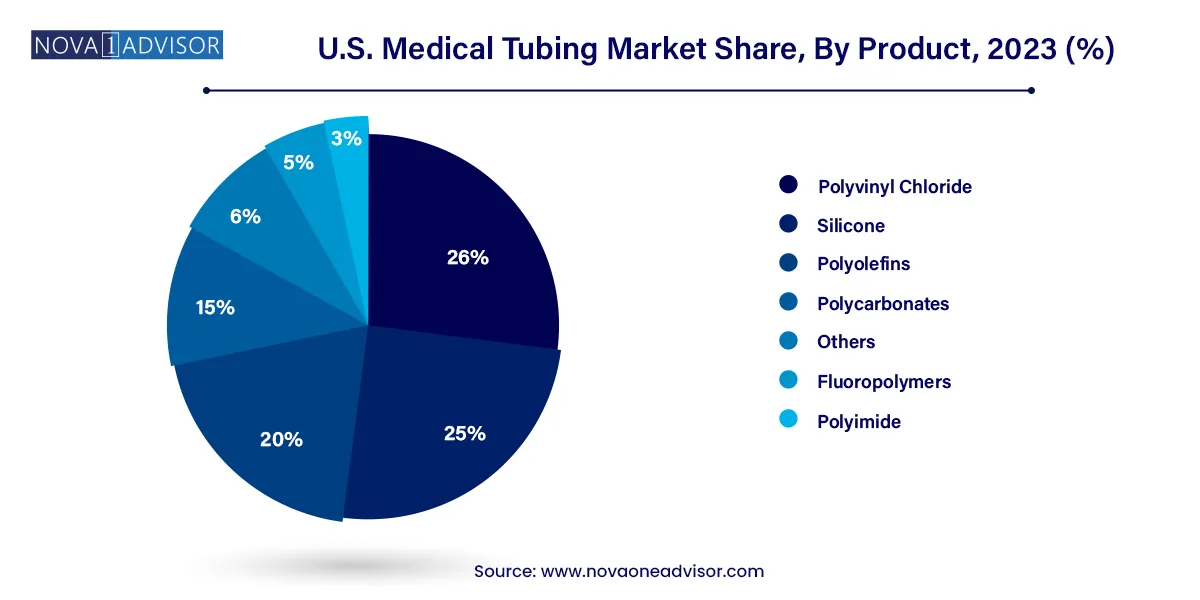

Polyvinyl Chloride (PVC) Dominated the Market

PVC remains the most commonly used material in the U.S. medical tubing market due to its affordability, flexibility, and adaptability across a wide range of applications. It is particularly dominant in the production of disposable tubing used in IV sets, catheters, and suction devices. PVC's ability to be sterilized and extruded into different shapes has kept it as a material of choice for both standard and specialized uses. In addition, manufacturers have developed medical-grade PVC with reduced or alternative plasticizers to meet evolving safety and regulatory requirements.

As the demand for disposable medical equipment rises in response to infection control protocols, PVC’s dominance is expected to persist. However, new formulations of PVC that comply with evolving green chemistry principles are also beginning to shape its future role in the market.

Fluoropolymers Are the Fastest Growing Product Segment

Among newer materials, fluoropolymers—such as polytetrafluoroethylene (PTFE) and fluorinated ethylene propylene (FEP)—are gaining rapid traction. Their superior resistance to chemicals, high temperatures, and moisture makes them ideal for complex medical procedures involving aggressive drugs or sterilization requirements. Fluoropolymer tubing is extensively used in drug delivery systems, laboratory setups, and specialty catheters.

Though these materials are costlier than traditional plastics, their performance benefits and longer lifecycle support their growing adoption. In the coming years, fluoropolymer tubing is expected to penetrate more specialized niches, especially in biopharmaceutical manufacturing and high-end interventional equipment.

The United States is one of the most dynamic and innovation-driven medical tubing markets in the world. With its mature healthcare ecosystem, a high volume of surgical and diagnostic procedures, and a strong base of global medical device manufacturers, the country serves as both a consumer and creator of advanced tubing technologies.

Leading states such as California, Minnesota, and Massachusetts are hubs for medical innovation, housing key players and startups that drive R&D in extrusion methods, polymer science, and catheter design. Stringent FDA regulations ensure that tubing used in medical devices meets the highest safety standards, but also require that companies invest substantially in testing and certification processes.

Further, government health programs and private insurers in the U.S. often influence product adoption by incentivizing value-based care models. This is pushing manufacturers to not only deliver high-performance tubing but to integrate cost-efficiency and environmental consciousness into their offerings. As a result, the country not only leads in consumption but also sets trends that ripple across global markets.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical tubing market

Product

Application