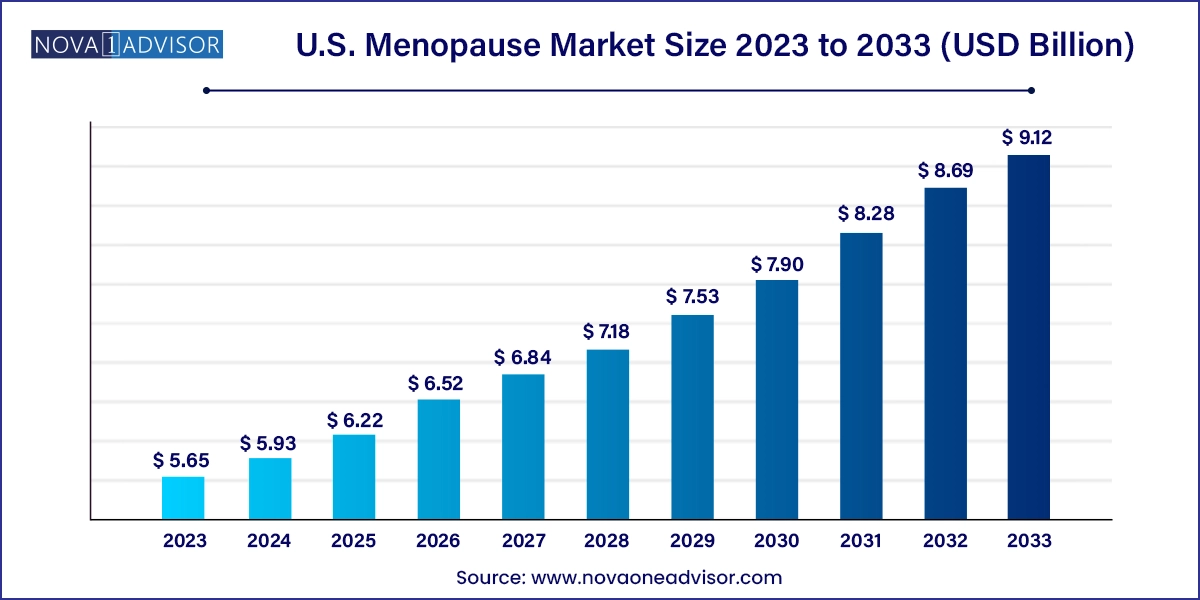

The U.S. menopause market size was exhibited at USD 5.65 billion in 2023 and is projected to hit around USD 9.12 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

The U.S. menopause market is undergoing a notable transformation, reflecting the increasing medicalization, awareness, and personalization of midlife health in women. Menopause, a natural biological phase typically occurring between ages 45 and 55, marks the end of menstrual cycles and is associated with a variety of physiological and psychological symptoms. These include hot flashes, night sweats, mood swings, vaginal dryness, fatigue, sleep disturbances, and cognitive shifts, all of which can significantly impact a woman’s quality of life.

Historically under-discussed and underserved, menopause is now receiving heightened attention from the medical community, wellness industry, digital health startups, and pharmaceutical companies. This shift is being driven by a cultural renaissance in women’s health, supported by increasing openness in discussing menopause, an empowered consumer base, and demand for safe, effective, and convenient treatment options. In the United States alone, an estimated 50 million women are in or approaching menopause—a demographic representing significant unmet medical and commercial needs.

The U.S. menopause market includes hormonal treatments, non-hormonal over-the-counter (OTC) medications, and a fast-growing category of dietary supplements such as phytoestrogens, adaptogens, vitamins, and herbal remedies. This evolving landscape is characterized by the convergence of evidence-based medicine and holistic wellness approaches, enabling a diversified portfolio of products catering to symptom relief, hormonal balance, and overall midlife wellness.

Pharmaceutical companies, such as Pfizer and TherapeuticsMD, continue to advance hormone replacement therapies (HRT), while newer players are pioneering natural, non-hormonal alternatives and lifestyle-based interventions. Meanwhile, telehealth platforms are offering accessible prescription-based and OTC menopause care, empowering women to manage their symptoms from home. This growing ecosystem suggests a bright future for innovation and commercialization in a historically underdeveloped area of healthcare.

Rise of Personalized Menopause Care: AI-driven health platforms and diagnostics are enabling customized treatment plans based on symptom profiles and hormone levels.

Growth of Non-Hormonal OTC Products: With concerns over HRT risks, non-hormonal options are gaining popularity, especially those containing black cohosh, soy isoflavones, and adaptogens.

Integration of Menopause into Telehealth and FemTech: Digital health platforms are increasingly offering specialized menopause care, including prescriptions, virtual consultations, and symptom tracking.

Consumerization and Direct-to-Consumer (DTC) Models: Women are seeking autonomy in health management, leading to a surge in online menopause product sales and DTC brand launches.

Shift Toward Holistic Wellness: Menopause is now viewed not just as a clinical condition but a life phase, driving demand for supplements, sleep aids, skincare, and mental health support.

Focus on Mental Health and Cognitive Support: Products targeting mood changes, anxiety, and brain fog are emerging as new niches within the broader menopause market.

Regulatory Reevaluation of Hormonal Therapies: New evidence and improved formulations are prompting the FDA and health professionals to revisit guidelines on HRT safety.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.93 Billion |

| Market Size by 2033 | USD 9.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Treatment |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Pfizer Inc.; Novo Nordisk A/S; TherapeuticsMD, Inc.; Bayer AG; AbbVie, Inc.; Pure Encapsulations, LLC.; PADAGIS LLC |

A critical driver of the U.S. menopause market is the growing societal awareness and normalization of menopause, which is catalyzing demand for both traditional and alternative treatment options. In the past, menopause was often stigmatized or neglected, leading many women to silently endure symptoms without seeking medical help. Today, that paradigm is shifting rapidly.

Celebrities, media influencers, and healthcare advocates are championing open dialogues around menopause, shedding light on the severity and range of its symptoms. This cultural shift has led to an increase in medical consultations, Google searches, and product purchases related to menopause management. Employers are also beginning to recognize the importance of menopause support in workplace wellness programs. As women take a more active role in midlife health decisions, demand for safe, effective, and transparent solutions is increasing. This awareness-driven growth is fueling innovation, investment, and market expansion across all treatment categories.

Despite its effectiveness in managing severe menopausal symptoms, hormone replacement therapy (HRT) continues to face safety-related hesitations, restraining its full potential in the market. Following the Women’s Health Initiative (WHI) study in the early 2000s, concerns about an increased risk of breast cancer, cardiovascular disease, and stroke linked to certain HRT regimens led to a sharp decline in use.

Although subsequent studies have nuanced these findings emphasizing that age, health status, and timing of initiation play critical roles many healthcare providers and patients remain cautious. Regulatory scrutiny and litigation risks also contribute to conservative prescribing practices. This climate of uncertainty slows adoption of newer, potentially safer HRT formulations and keeps a significant portion of the menopausal population reliant on suboptimal or non-prescription alternatives. Rebuilding trust in HRT, through education, improved formulations, and personalized risk assessment, remains a challenge for the market.

A significant opportunity in the U.S. menopause market lies in the expansion of non-hormonal, plant-based, and natural therapies that appeal to health-conscious consumers seeking alternatives to pharmaceuticals. Many women are turning to botanicals like black cohosh, red clover, dong quai, maca root, and flaxseed, as well as nutrients such as vitamin D, calcium, and omega-3s, to alleviate symptoms ranging from hot flashes to anxiety.

This preference is reinforced by a broader wellness movement that favors "clean label," organic, and non-toxic products. Companies that can combine scientific validation with natural ingredients are well-positioned to gain consumer trust. Additionally, these products often bypass regulatory burdens associated with prescription medications and are widely available online, in pharmacies, and wellness retailers. The convenience, perceived safety, and accessibility of these therapies make them an ideal entry point for new brands and investors targeting the burgeoning menopausal demographic.

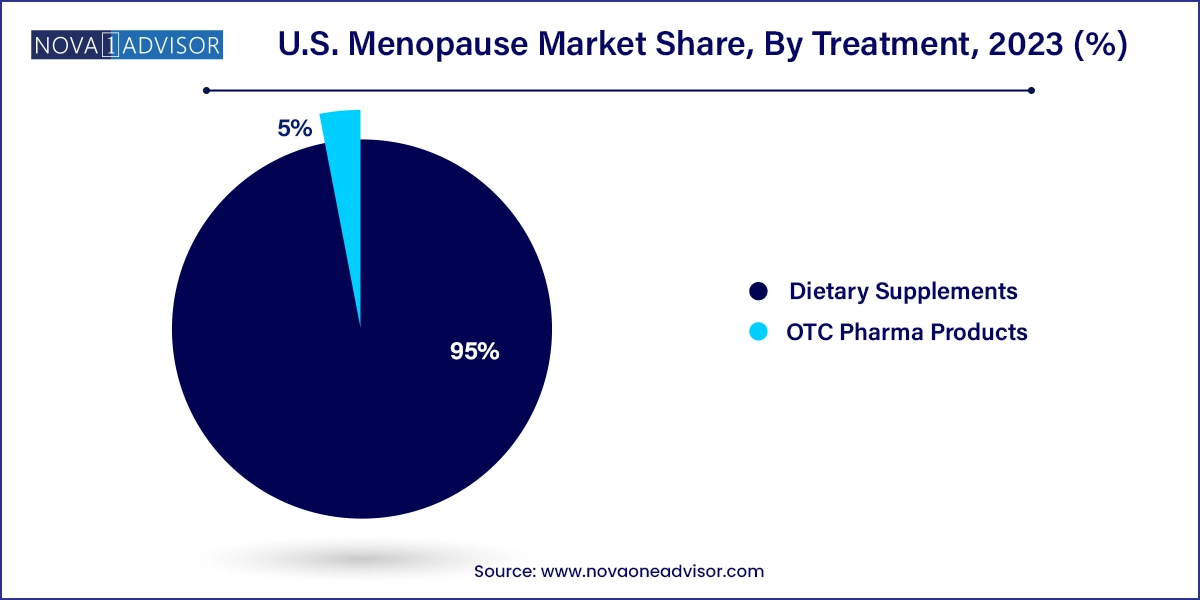

Dietary supplements dominated the U.S. menopause market by treatment type, reflecting a strong consumer trend toward natural and preventative health solutions. These supplements typically include herbal ingredients (such as black cohosh or ashwagandha), phytoestrogens (from soy or flax), vitamins (like D, E, and B-complex), and minerals that support hormonal balance, bone health, mood, and sleep. Women are increasingly self-managing menopause through lifestyle adjustments and supplementation, supported by online communities, health blogs, and DTC brands promoting non-hormonal options. Brands like Bonafide, Womaness, and Estroven have gained popularity due to their holistic positioning and accessible retail presence.

While dietary supplements currently lead the market in volume, OTC pharma products are the fastest-growing treatment segment, especially non-hormonal options that bridge the gap between supplements and prescription medication. These include vaginal moisturizers, non-estrogenic lubricants, antihistamine-based hot flash relief, and neuroactive compounds targeting sleep and anxiety. The growing focus on evidence-based formulations is prompting increased innovation in the non-hormonal OTC category. Additionally, hormonal OTC options such as low-dose estrogen creams are seeing renewed interest, particularly as regulatory frameworks evolve and patient education improves. This segment is expanding rapidly in retail pharmacies, e-commerce platforms, and personalized health services.

The United States is uniquely positioned as both the largest and most dynamic market for menopause-related treatments and products. The country’s healthcare system is undergoing a reevaluation of women's midlife care, with increased inclusion of menopause in mainstream medical discussions, insurance policies, and wellness programs. The high level of health literacy among American women, combined with their purchasing power and digital engagement, creates an ideal environment for both pharmaceutical and consumer health companies to innovate.

Clinically, leading medical institutions such as the Mayo Clinic, Cleveland Clinic, and Mount Sinai have established dedicated menopause centers offering integrated care. Digital platforms like Evernow and Alloy are reshaping how women access HRT, offering convenient teleconsultations and home delivery. The consumer wellness boom has made menopause a focal point for startups and eCommerce brands offering supplements, skin care, sexual wellness, and cognitive health solutions tailored for perimenopausal and postmenopausal women.

Government agencies and nonprofit organizations are also beginning to advocate for more inclusive research and education around menopause. The National Institutes of Health (NIH) is funding new clinical trials on midlife health, while private sector investments in menopause tech (or "menotech") continue to rise. Collectively, these developments make the U.S. a hub for menopause-related innovation, commercialization, and public health evolution.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. menopause market

Treatment