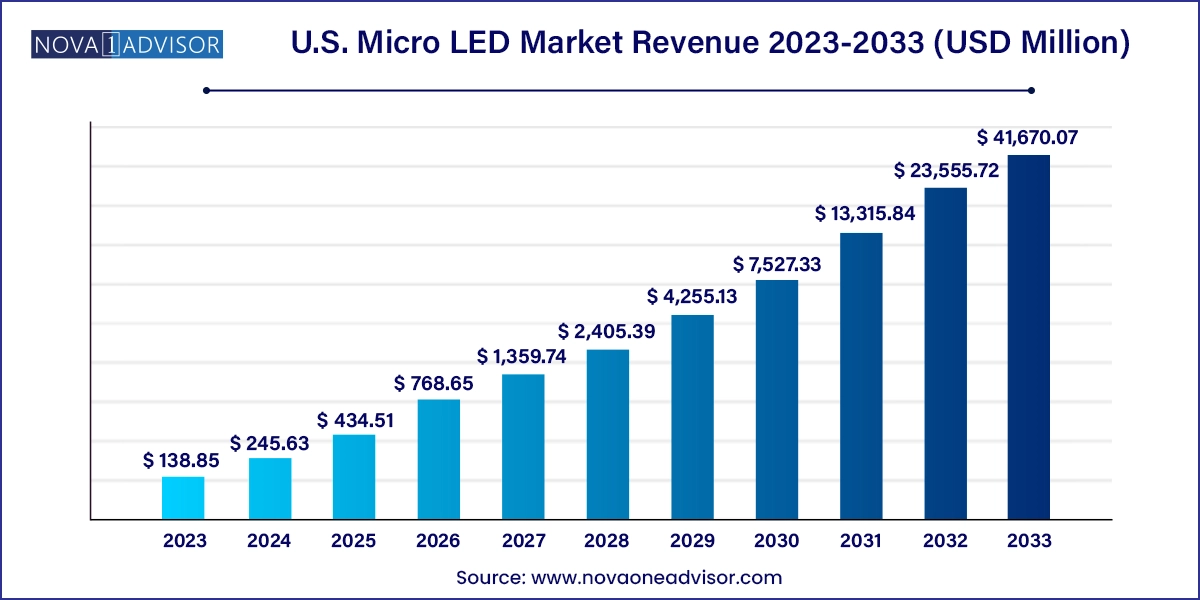

The U.S. micro LED market size was exhibited at USD 138.85 million in 2023 and is projected to hit around USD 41,670.07 million by 2033, growing at a CAGR of 76.9% during the forecast period 2024 to 2033.

The U.S. Micro LED market is emerging as a transformative force in the next-generation display and lighting ecosystem. Micro Light-Emitting Diode (Micro LED) technology represents a paradigm shift in how visual content is delivered, offering advantages that extend far beyond traditional OLED and LCD technologies. With characteristics like ultra-high brightness, wide color gamut, longer lifespan, and superior energy efficiency, Micro LED is fast becoming the go-to solution for applications demanding high performance—ranging from consumer electronics to automotive, healthcare, aerospace, and beyond.

The journey toward Micro LED adoption has been marked by rapid innovations in chip manufacturing, substrate integration, mass transfer technologies, and driver circuitry. In the U.S., both startups and tech giants are driving Micro LED commercialization, investing heavily in miniaturization, yield improvement, and ecosystem development. Apple’s investment in Micro LED for future smartwatches, VueReal’s fabrication breakthroughs, and Rohinni’s flexible display tech collaborations highlight the nation’s leadership in this space.

Currently, Micro LEDs are being trialed in high-end televisions, AR/VR headsets, automotive HUDs (Heads-Up Displays), and smartwatch displays. The technology is also making headway into specialty lighting applications such as advanced automotive lighting and general illumination systems. The U.S. market is particularly buoyed by strong R&D capabilities, a robust semiconductor supply chain, and a growing push toward energy-efficient, high-resolution, and durable display systems.

Integration of Micro LEDs into Wearables: Companies are integrating Micro LEDs into smartwatches and fitness bands due to their superior brightness and low power draw.

AR & VR Acceleration: Demand for lightweight, ultra-bright, high-resolution displays in AR/VR devices is rapidly increasing, with Micro LED being the leading candidate.

Automotive Heads-Up Displays (HUDs): High luminance and transparency make Micro LEDs ideal for use in advanced HUDs, instrument clusters, and ambient lighting.

Rise of Modular Micro LED Displays: Wall-scale displays are being developed using modular Micro LED panels for advertising, retail, and command centers.

Micro LED Fabrication Breakthroughs: Startups are focusing on overcoming mass transfer and defect density issues through novel approaches like microprinting and quantum dot integration.

Green Technology Push: With energy consumption reduction becoming a priority, Micro LED is favored for its low energy use compared to LCD and OLED.

U.S. Government R&D Funding: Federal support for domestic semiconductor and display innovation indirectly accelerates Micro LED development.

Miniaturization of Pixel Density: Increasing pixel density, particularly for wearables and AR devices, is leading to innovations in sub-10-micron chip sizes.

| Report Coverage | Details |

| Market Size in 2024 | USD 245.63 Million |

| Market Size by 2033 | USD 41,670.07 Million |

| Growth Rate From 2024 to 2033 | CAGR of 76.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Display Pixel Density, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | eLux, Inc.; Shoei Electronic Materials, Inc. (Nanosys); VerLase Technologies; Alphabet, Inc.; Lumiode; Plessey Semiconductors; VueReal |

A major growth catalyst for the U.S. Micro LED market is the rising demand for displays that offer superior visual performance combined with lower energy consumption. In industries such as consumer electronics, automotive, and defense, displays must perform in diverse lighting conditions, resist burn-in, and offer high reliability over extended usage. Micro LED delivers all these attributes, making it particularly attractive for next-gen devices like Apple's rumored Micro LED-based smartwatches or military-grade AR glasses. Compared to OLEDs, Micro LEDs provide brighter output, better contrast, and do not degrade over time due to organic material fatigue. As devices become thinner and more power-sensitive, Micro LED is positioned as a key enabling technology.

Despite its promising capabilities, the U.S. Micro LED market faces significant barriers due to the high complexity and cost of manufacturing. The mass transfer of thousands—or even millions—of tiny LED chips onto a backplane requires extreme precision and speed. Even minor misalignments or yield losses can render a batch unusable, driving up production costs. Moreover, assembling RGB Micro LED arrays with consistent brightness and color quality requires tight binning and calibration processes, which add further logistical challenges. These issues have slowed commercialization timelines, particularly in consumer-grade devices where pricing pressure is intense. While pilot production is expanding, full-scale commercialization is still several steps away for most applications.

The rise of AR/VR devices and spatial computing platforms presents a massive opportunity for Micro LED technology in the U.S. The technology’s high brightness, fine pixel pitch, and excellent color accuracy make it ideal for near-eye displays where clarity and comfort are paramount. Companies like Meta, Apple, and Microsoft are investing heavily in headsets and smart glasses that require compact, high-performance displays. Micro LED not only offers lightweight and thin form factors but also operates efficiently without heating up—a major benefit for wearable tech. As the metaverse, immersive gaming, and industrial training applications scale up, the demand for Micro LED in these ecosystems is expected to soar.

Display applications dominate the U.S. Micro LED market, primarily due to the broad demand across televisions, smartwatches, smartphones, and AR/VR headsets. In the display segment, premium televisions and modular wall screens are among the first to adopt Micro LED. Samsung’s “The Wall” and Sony’s large-format Micro LED displays have captured early interest in luxury and commercial segments. In wearables, Apple is reportedly planning to transition from OLED to Micro LED in its upcoming Apple Watch models, citing better brightness and battery life. Smartwatches benefit significantly from Micro LED’s power efficiency and outdoor visibility. Smartphones and tablets remain a longer-term target due to manufacturing constraints and cost sensitivity.

AR/VR is the fastest-growing display sub-segment, as companies race to build lightweight headsets with vibrant, pixel-dense displays. Meta’s Reality Labs, Apple Vision Pro, and Magic Leap are investing in Micro LED as the next leap in immersive visual experiences. These displays enable precise rendering of virtual content with minimal latency, even in bright environments. Automotive display applications—including HUDs and in-dash displays—are also gaining traction, with Micro LED preferred for its robustness and readability under sunlight and extreme conditions.

Displays with less than 3000ppi currently dominate the market, as this pixel density range supports existing use cases such as televisions, automotive dashboards, and wearable screens. Displays in this range are easier to manufacture, with fewer challenges in yield and transfer. Commercial installations like digital signage or large public displays typically do not require ultra-high pixel density, keeping costs manageable.

Greater than 5000ppi is the fastest-growing pixel density segment, driven by near-eye display requirements in AR and VR headsets. At close viewing distances, especially in immersive environments, pixel density must exceed 5000ppi to prevent visible pixelation or screen door effects. Manufacturers are leveraging micro-lens arrays and AI-enhanced optics to further improve visual fidelity. As AR/VR headsets scale from prototypes to consumer-grade devices, this segment is expected to experience exponential growth.

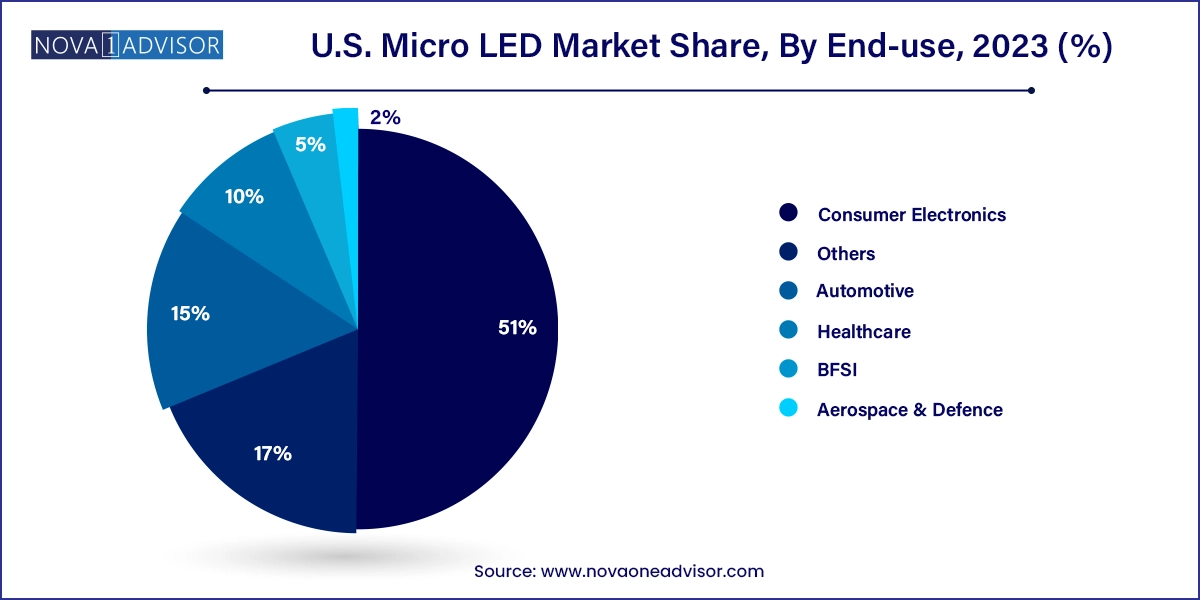

Consumer electronics dominate the end-use landscape, driven by the proliferation of smartphones, smartwatches, TVs, and wearables. Tech giants like Apple, Samsung, and LG are pushing the boundaries of visual experience with Micro LED. Smartwatches are at the forefront due to the small display size and high performance needs. While smartphone integration is still in R&D phases, foldable and rollable display concepts based on Micro LED are in development.

Aerospace & defense is the fastest-growing end-use segment, as military applications prioritize robustness, brightness, and high-resolution displays for battlefield and pilot interfaces. Helmet-mounted displays (HMDs), cockpit HUDs, and night-vision-compatible screens are ideal use cases for Micro LED. Additionally, the healthcare sector is exploring Micro LED for medical imaging displays due to its high contrast and accuracy. Sectors like BFSI are using Micro LED displays in ATMs, trading terminals, and retail banking kiosks for longer-lasting, high-brightness screens.

The U.S. remains a global leader in Micro LED innovation due to its dominant tech ecosystem, semiconductor R&D infrastructure, and consumer electronics market. Silicon Valley startups and major corporations alike are driving advancements across the Micro LED value chain—from chip design and substrate integration to equipment manufacturing and testing. Notably, California is a hub for emerging Micro LED firms, while Texas and Arizona support fabrication and pilot manufacturing.

Federal support via the CHIPS Act and related semiconductor revitalization programs has indirectly supported display innovation, including Micro LED. Research partnerships between national labs, universities, and private firms are tackling technical challenges like mass transfer and defect management. Moreover, the strong presence of display-intensive verticals—automotive (Tesla, GM), defense (Raytheon, Lockheed Martin), and consumer tech (Apple, Meta)—ensures sustained demand. The U.S. also serves as a testbed for Micro LED-based retail and advertising signage in urban centers like New York and Chicago.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. micro LED market

Application

Display Pixel Density

End-use