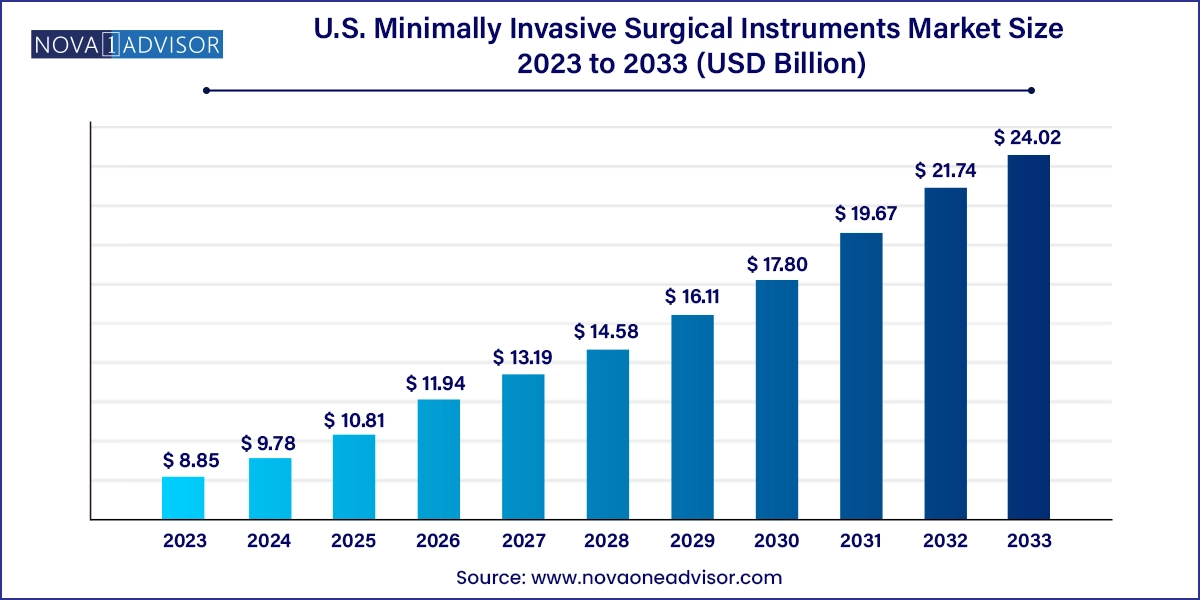

The U.S. minimally invasive surgical instruments market size was exhibited at USD 8.85 billion in 2023 and is projected to hit around USD 24.02 billion by 2033, growing at a CAGR of 10.5% during the forecast period 2024 to 2033.

The U.S. Minimally Invasive Surgical (MIS) Instruments Market has evolved into a critical domain in the surgical landscape, reshaping how surgeries are performed across various specialties. Unlike traditional open surgeries, MIS techniques involve smaller incisions, resulting in less tissue trauma, quicker recovery, and reduced pain. These benefits have led to a strong inclination among surgeons and patients alike toward minimally invasive solutions. The growing need for shorter hospital stays, increased surgical precision, and better post-operative outcomes has made MIS instruments an integral component of modern healthcare delivery in the United States.

Surgeons today are equipped with a variety of instruments ranging from precision-cutting devices and visualization systems to electrosurgical tools and guiding catheters. These tools support diverse applications, including cardiac surgery, orthopedics, gynecology, gastrointestinal procedures, and cosmetic enhancements. The expanding elderly population, coupled with a rising burden of chronic diseases, such as arthritis, cardiovascular disorders, and cancer, has significantly influenced the demand for MIS instruments in the country.

Additionally, increasing awareness among patients about available surgical alternatives and the broadening insurance coverage for minimally invasive procedures are further accelerating this shift. Hospitals and ambulatory surgical centers (ASCs) across the U.S. are actively investing in modern surgical suites and acquiring advanced instrumentation to meet this rising demand. The market is also seeing considerable contributions from tech-driven medical startups, fostering innovation through robotic systems, augmented reality in surgeries, and ergonomically enhanced tool designs.

Integration of Robotic-Assisted Surgery: Advanced robotic platforms are increasingly used for precision and control in complex MIS procedures, reducing human error.

Smaller, Lighter, and Ergonomic Instrument Designs: Manufacturers are focusing on developing lightweight and user-friendly devices to reduce surgeon fatigue and improve efficiency.

Surge in Outpatient Procedures: A growing preference for same-day surgeries is driving the adoption of compact and mobile MIS instruments suited for ambulatory settings.

Hybrid Operating Rooms: Integration of imaging, robotic control, and digital surgery tools in one surgical suite is enhancing procedure planning and execution.

Tele-surgical Innovation: With digital health accelerating, remote-assisted surgeries are being explored through smart surgical instruments and AR/VR technologies.

Customized Instrumentation: Personalized instruments tailored to specific anatomy or procedural needs are gaining ground, especially in orthopedics and spinal surgery.

Energy Efficiency and Multi-functionality: Instruments that combine multiple actions—cutting, coagulation, suction—are being developed for efficiency and reduced tool changes.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.78 Billion |

| Market Size by 2033 | USD 24.02 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Device, End-use, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Medtronic; Siemens; Healthineer AG; Ethicon, Inc. (Johnson & Johnson); Depuy Synthes; GE Healthcare; Abbott Laboratories; Intutive Surgical, Inc.; Nuvasive, Inc.; Zimmer Biomet |

Handheld Instruments Dominated the Market

Handheld instruments, including graspers, scissors, and needle holders, represent the foundational components of most MIS procedures and have historically dominated this market segment. Their straightforward functionality, reusability, and adaptability to various surgical scenarios make them indispensable across specialties. Even with the advent of robotic systems and automated tools, handheld instruments remain critical in procedures where tactile feedback and manual control are essential. Furthermore, advancements in design—such as anti-fatigue handles and rotatable tips—have further enhanced their usability.

Electrosurgical Devices are the Fastest Growing Segment

In contrast, electrosurgical devices have emerged as the fastest-growing category due to their ability to perform dual functions: tissue dissection and hemostasis. Surgeons favor these tools for their efficiency in minimizing bleeding and reducing the need for tool exchange during operations. Electrosurgical instruments now offer programmable energy levels, advanced insulation, and integrated safety checks, making them suitable for a broad range of procedures from cardiac ablation to laparoscopic hysterectomy. As surgical precision becomes more critical, these devices are being adopted in both inpatient and outpatient settings.

Orthopedic Applications Held the Largest Market Share

Orthopedic surgery leads the application segment, owing to the widespread use of arthroscopic techniques for joint repairs, ligament reconstruction, and cartilage restoration. Minimally invasive approaches are especially valuable in orthopedics because they limit muscle disruption, reduce postoperative pain, and allow patients to mobilize sooner. Surgeons now use miniature cameras and fluid-controlled instruments to treat injuries that once required full joint exposure. The rising incidence of sports injuries and age-related joint degeneration in the U.S. makes this a cornerstone of MIS adoption.

Cosmetic Surgery is the Fastest Growing Application

Cosmetic surgery has seen a dramatic rise in minimally invasive techniques, making it the fastest-growing segment in this market. Tools such as cannulas for liposuction, RF-based skin tightening instruments, and endoscopic brow lift systems have become popular alternatives to traditional surgeries. Patients increasingly demand quick, aesthetic procedures with minimal downtime—a trend particularly noticeable in facial rejuvenation and body contouring. Surgeons are capitalizing on this demand by investing in specialized MIS tools that deliver high precision and minimal scarring.

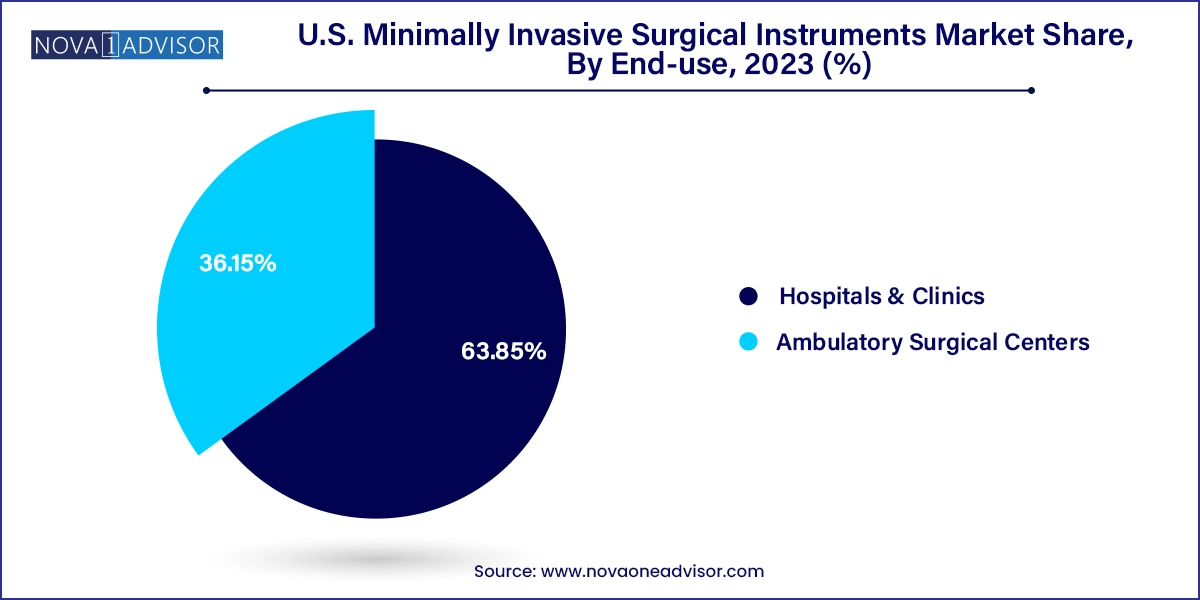

Hospitals and Clinics Accounted for the Largest Market Share

Hospitals and clinics continue to dominate the end-use segment due to their extensive infrastructure, access to multidisciplinary teams, and capacity to manage complex and critical procedures. These facilities are typically the first to adopt new technologies and benefit from partnerships with medical device manufacturers for pilot projects and early product rollouts. High patient volumes and diverse case mixes make them the primary customers for comprehensive MIS instrument portfolios.

Ambulatory Surgical Centers (ASCs) Are the Fastest Growing

Ambulatory Surgical Centers are rapidly becoming major players in the MIS domain due to their focus on short-stay procedures, reduced cost structure, and specialized services. ASCs are particularly well-suited for elective and outpatient surgeries like hernia repair, endoscopy, and cosmetic enhancements, which can be efficiently performed using MIS tools. Their lean operational model, combined with increased patient preference for non-hospital settings, is accelerating the demand for compact, easy-to-use, and cost-effective surgical instruments in this setting.

In the United States, the transformation in surgical practices is clearly visible through the increasing adoption of minimally invasive methods across urban and rural healthcare settings. Major cities like New York, Los Angeles, and Chicago are at the forefront, housing centers of excellence equipped with robotic systems, digital surgery platforms, and highly skilled MIS specialists. These institutions not only perform a large volume of surgeries but also serve as training hubs for new MIS procedures and tools.

Simultaneously, regional and community hospitals are catching up, especially as mobile surgical units and portable instrumentation reduce the capital barrier to entry. Initiatives promoting day-care surgery and outpatient care in the U.S. healthcare framework have also boosted investments in MIS across the country. Furthermore, insurance providers and government programs are increasingly recognizing MIS as a cost-saving alternative due to its impact on reduced readmission rates and quicker recovery times, adding to its widespread adoption.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. minimally invasive surgical instruments market

Device

Application

End-use