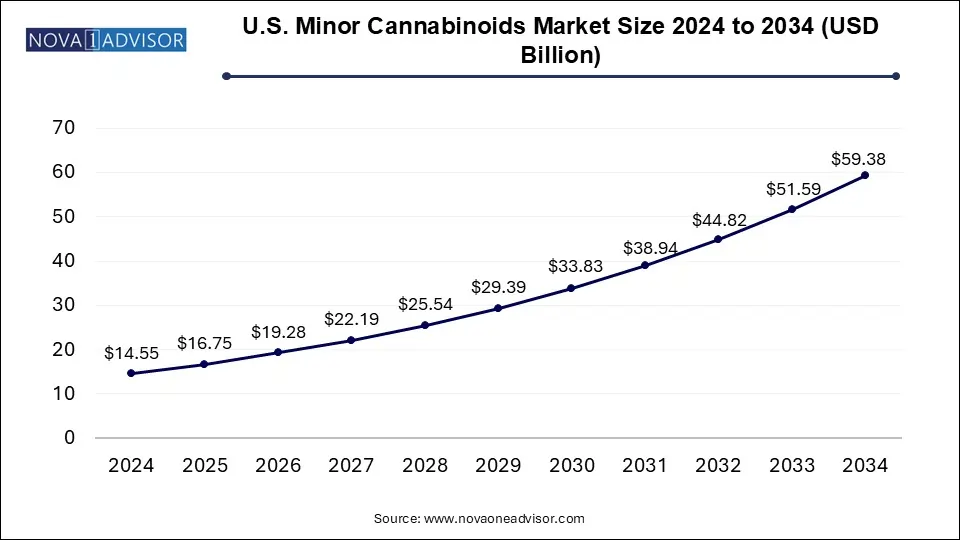

The U.S. minor cannabinoids market size was exhibited at USD 14.55 billion in 2024 and is projected to hit around USD 59.38 billion by 2034, growing at a CAGR of 15.1% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 16.75 Billion |

| Market Size by 2034 | USD 59.38 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Mile High Labs; GCM Holdings, LLC; GenCanna.; CBD. INC.; Rhizo Sciences; Laurelcrest; Fresh Bros Hemp Company; BulKanna; High Purity Natural Products.; ZERO POINT EXTRACTION, LLC |

Consumers have access to a wide range of products containing minor cannabinoids, which cater to their specific health needs. The market is being propelled by the growing demand for alternative therapeutic options and the increasing legalization of cannabis-based products. Moreover, extensive research in the field of minor cannabinoid uses and the surge in demand for such products has contributed to the overall growth of the market.

Minor cannabinoids are increasingly incorporated into wellness products, including tinctures, topicals, and supplements. These products are marketed as natural remedies for various health issues and are popular among consumers looking for alternatives to traditional medications. Furthermore, minor cannabinoids are used to prepare various skincare and personal care products. For instance, Amyris, Inc., a synthetic biotechnology company, manufactures clean CBG (Cannabigerol) to address consumer skincare concerns.

The main focus of cannabis industry is to provide more accessible information to consumers, aiming to educate them on the advantages of minor cannabinoids, including cannabigerol (CBG), Tetrahydrocannabivarin (THCV) and cannabinol (CBN), in product formulations. Manufacturers are increasing the production of CBN, THCV and CBG-enhanced products as they realize the market potential, contributing to market growth. In January 2022, Sugarmade, Inc. signed a binding Letter of Intent (LOI) with GenCann, Inc., the licensor for a set of cannabis chemovars. Under this LOI, Sugarmade and its cannabis cultivator partners have been granted permission to cultivate strains that are believed to contain some of the highest levels of THC-V for a period of 5 years.

In addition, the approval of the Farm Bill in 2018 has led to a rise in the awareness and adoption of cannabis-derived products in the U.S. It has opened a lot of opportunities for advance research studies on cannabis and its derivatives. Minor cannabinoids have also gained momentum in the past few years owing to positive research outcomes and numerous health benefits. For instance, numerous studies are being conducted to analyze the effect of minor cannabinoids on medical conditions such as alopecia, arthritis, epidermolysis bullosa, diabetes, and arthritis.

Despite highly expensive extraction and purification procedures, several manufacturers have boosted their production capabilities due to higher demand for minor cannabinoids. In November 2021, Hempsana Holdings Ltd., a leader in cannabis extraction, announced commercial production of CBG with its largest commercial run of cannabigerol. In addition, other market players such as Fresh Bros Hemp Company, GVB Biopharma, and Extract Labs also facilitated the production of minor cannabinoid isolates to strengthen their avenues.

Increasing preference of medical professionals for cannabinoid-based formulations to treat numerous health conditions is another major factor supporting the country's market and creating a positive influence on consumer minds, thereby boosting the adoption and popularity of these products.

The tetrahydrocannabivarin (THCV) segment dominated the market with a revenue share of 25.% in 2024. This can be attributed to the rising application of THCV in the management of conditions such as metabolic disorders, arthritis, diabetes, epilepsy, Alzheimer’s disease, neurological disorders, and pain management.

Moreover, various organic and inorganic developments done by market participants in clinical trials, innovative product launches, capacity expansions, and others are also anticipated to cater to segment growth. For instance, in June 2022, InMed Pharmaceuticals Inc., a manufacturer of rare cannabinoids, introduced B2B sales of rare cannabinoid delta 9-dominant tetrahydrocannabivarin (d9-THCV) into the health and wellness sector via its wholly owned subsidiary, BayMedica LLC.

The cannabigerolic acid (CBGA) segment is expected to witness the fastest CAGR from 2025 to 2034. The exhaustive therapeutic coverage of CBGA, rising demand from pharmaceutical companies, and increasing numbers of players aiming for CBGA production support this segment’s growth. For instance, in January 2022, Hometown Hero CBD unveiled its new CBDA + CBGA Tincture. This 30ml tincture features CBGA, CBDA, CBG, and CBD at 600mg each. Cannabinoids in tincture are hemp-derived and the product is legal in all 50 states.

The neurological disorders segment held a significant revenue share in 2024. The increasing prevalence of neurological disorders and benefits of cannabinoids in managing neurological disorders are expected to drive the segment’s growth. For instance, synthetic cannabinoid compounds such as Nabiximols have proven health benefits in spasticity-associated symptoms for patients with multiple sclerosis. Furthermore, rising research activities on minor and synthetic cannabinoids further fuel the market growth.

The others application segment held the largest revenue share in 2024. This segment comprises medical conditions such as diabetes, arthritis, and cardiovascular diseases. For instance, synthetic cannabinoid compounds and endocannabinoids have proven health benefits in cardiovascular disorders. CBGA has been found to have a critical role in managing heart conditions and epilepsy. Moreover, ongoing research studies about the use of minor cannabinoids in a range of disorders and the presence of extensive funding organizations are further fueling segment growth.

The pain management segment is anticipated to grow at significant CAGR from 2025 to 2034. Cannabinoids such as CBC, CBN, and CBG have shown promising outcomes in pain management, including chronic pain. Thus, the promising effects of CBN and CBG in managing chronic pain have facilitated market players to use such derivatives in formulating pain management remedies. For instance, Precision Plant Molecules provides a range of Cannabigerol (CBG) cannabinoid products ideal for consumer-packaged goods companies to manufacture unique and effective health and wellness products.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. minor cannabinoids market

By Product Type

By Application

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product Type

1.2.2. Application

1.2.3. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product type outlook

2.2.2. Application outlook

2.3. Competitive Insights

Chapter 3. U.S. Minor Cannabinoids Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. U.S. Minor Cannabinoids Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. U.S. Minor Cannabinoids Market: Product Type Estimates & Trend Analysis

4.1. Product Type Market Share, 2025 & 2034

4.2. Segment Dashboard

4.3. U.S. Minor Cannabinoids Market by Product Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.4.1. Cannabigerol (CBG)

4.4.1.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2. Cannabichromene (CBC)

4.4.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3. Cannabinol (CBN)

4.4.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.4. Tetrahydrocannabivarin (THCV)

4.4.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.5. Cannabigerolic acid (CBGA)

4.4.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.6. Others

4.4.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 5. U.S. Minor Cannabinoids Market: Application Estimates & Trend Analysis

5.1. Application Market Share, 2025 & 2034

5.2. Segment Dashboard

5.3. Global U.S. Minor Cannabinoids Market by Application Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.4.1. Inflammation

5.4.1.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.4.2. Pain Management

5.4.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.4.3. Neurological Disorders

5.4.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.4.4. Cancer

5.4.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.4.5. Others

5.4.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company/Competition Categorization

6.3. Vendor Landscape

6.3.1. Mile High Labs

6.3.1.1. Company overview

6.3.1.2. Financial performance

6.3.1.3. Product benchmarking

6.3.1.4. Strategic initiatives

6.3.2. GCM Holdings, LLC

6.3.2.1. Company overview

6.3.2.2. Financial performance

6.3.2.3. Product benchmarking

6.3.2.4. Strategic initiatives

6.3.3. GenCanna.

6.3.3.1. Company overview

6.3.3.2. Financial performance

6.3.3.3. Product benchmarking

6.3.3.4. Strategic initiatives

6.3.4. CBD. INC.

6.3.4.1. Company overview

6.3.4.2. Financial performance

6.3.4.3. Product benchmarking

6.3.4.4. Strategic initiatives

6.3.5. Rhizo Sciences

6.3.5.1. Company overview

6.3.5.2. Financial performance

6.3.5.3. Product benchmarking

6.3.5.4. Strategic initiatives

6.3.6. Laurelcrest

6.3.6.1. Company overview

6.3.6.2. Financial performance

6.3.6.3. Product benchmarking

6.3.6.4. Strategic initiatives

6.3.7. Fresh Bros Hemp Company

6.3.7.1. Company overview

6.3.7.2. Financial performance

6.3.7.3. Product benchmarking

6.3.7.4. Strategic initiatives

6.3.8. BulKanna

6.3.8.1. Company overview

6.3.8.2. Financial performance

6.3.8.3. Product benchmarking

6.3.8.4. Strategic initiatives

6.3.9. High Purity Natural Products

6.3.9.1. Company overview

6.3.9.2. Financial performance

6.3.9.3. Product benchmarking

6.3.9.4. Strategic initiatives

6.3.10. ZERO POINT EXTRACTION, LLC

6.3.10.1. Company overview

6.3.10.2. Financial performance

6.3.10.3. Product benchmarking

6.3.10.4. Strategic initiatives