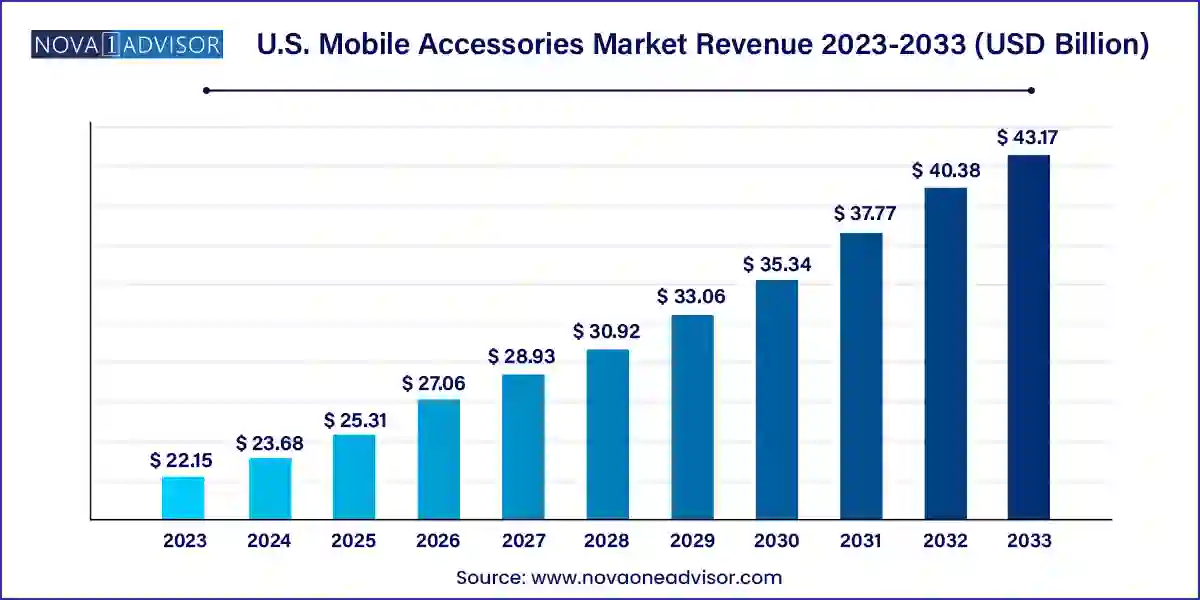

The U.S. mobile accessories market size was exhibited at USD 22.15 billion in 2023 and is projected to hit around USD 43.17 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The U.S. mobile accessories market is a dynamic and rapidly evolving sector that complements the broader consumer electronics and mobile device industries. As smartphones become increasingly integral to everyday life—serving as tools for communication, productivity, entertainment, fitness tracking, and even remote work—the demand for complementary accessories has surged. These accessories enhance functionality, provide convenience, and reflect users’ personal styles, making them indispensable in the modern digital ecosystem.

The market spans a wide variety of products, including protective cases, screen protectors, power banks, chargers, headphones, earphones, and emerging devices like wireless earbuds and gaming accessories. With a penetration rate of smartphones exceeding 85% among adults in the U.S., the accessories market is poised for consistent growth. Moreover, the frequency of smartphone upgrades, which tends to average around every two to three years, continuously drives repeat purchases of accessories.

Consumer preferences are influenced by trends in fashion, technology, and lifestyle. For example, the shift toward wireless technology, driven by the removal of headphone jacks in many flagship smartphones, has propelled demand for Bluetooth-enabled earphones and wireless chargers. Similarly, rising environmental awareness is encouraging the adoption of biodegradable phone cases and recyclable materials in packaging.

Retail strategies in this sector are also undergoing transformation. While traditional retail outlets remain relevant, e-commerce has emerged as a dominant channel, offering broader variety, competitive pricing, and convenient delivery. This evolution is further accelerated by social media-driven brand discovery and the influence of tech influencers promoting accessories.

The U.S. mobile accessories market is not just about add-ons—it represents a multi-billion-dollar industry with a vibrant ecosystem of established brands, tech startups, private-label players, and third-party manufacturers competing for consumer attention.

Shift to Wireless and Bluetooth Accessories: Rapid growth in wireless earphones, chargers, and smart wearables driven by convenience and improved connectivity standards like Bluetooth 5.2.

Eco-Friendly and Sustainable Products: Demand is increasing for accessories made from biodegradable plastics, bamboo, and recycled materials.

Rising Popularity of MagSafe and Magnetic Attachments: Apple’s MagSafe-compatible accessories, including cases, wallets, and mounts, are reshaping the charging and carrying experience.

Multi-functional Accessories: Hybrid products like phone cases with integrated stands or cardholders, and power banks with wireless charging and built-in cables are gaining traction.

Gaming and Streaming Influences: The boom in mobile gaming and video content creation is driving demand for accessories like cooling fans, ring lights, external mics, and ergonomic grips.

5G Compatibility Influence: Higher data speeds and reduced latency are increasing demand for power-efficient, fast-charging accessories and low-latency earphones.

Influencer-led Personalization: Custom accessories like personalized phone skins and bespoke cases promoted by influencers are influencing youth purchasing behavior.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.68 Billion |

| Market Size by 2033 | USD 43.17 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Apple Inc.; Samsung Electronics Co., Ltd.; Bose Corporation; Anker Innovations; ZAGG Inc.; Otter Products, LLC (Otterbox); Belkin International, Inc.; CG Mobile; Speck Products; Spigen Inc.; RAVPower; and Nomad Goods Inc. |

The single most powerful driver of the mobile accessories market is the ever-expanding smartphone ecosystem in the United States. With nearly every demographic owning at least one mobile device—and many owning multiple—the opportunity for ancillary products is immense. According to the Pew Research Center, over 95% of Americans aged 18–49 own a smartphone, and that figure continues to rise, especially with newer generations coming of age.

This growing base creates a built-in demand for accessories that enhance smartphone usability, protect against wear and tear, and match individual lifestyles. As manufacturers like Apple, Samsung, and Google roll out new models annually, consumers are prompted to upgrade not only their phones but also the accompanying gear. Additionally, features like higher-resolution cameras, edge-to-edge displays, and more advanced sensors necessitate the use of high-performance screen protectors, cases, and storage-enhancing peripherals. In short, the smartphone’s omnipresence fuels a continual and evolving demand for its accessories.

While the mobile accessories market offers high-volume opportunities, it is also plagued by intense price competition and product commoditization. Many accessory categories, such as chargers, screen protectors, and basic phone cases, have become saturated with similar offerings. This abundance of products often results in consumer confusion, margin pressures, and low brand loyalty.

Moreover, consumers increasingly expect lower prices for these items, especially when bundled with phone purchases or sold by generic brands on e-commerce platforms. Even premium accessory brands must frequently offer discounts to stay competitive, impacting profitability. The rise of counterfeit and low-cost imports further erodes market share for legitimate players. Additionally, changes in device design—like unified charging ports or the elimination of headphone jacks—can render certain accessories obsolete, creating inventory and supply chain challenges for retailers and manufacturers alike.

Amid competition and saturation, one of the most promising opportunities lies in the development of smart and multi-functional accessories. These are products that go beyond basic use and integrate intelligent features or serve dual purposes. For instance, wireless earbuds with active noise cancellation and fitness tracking features appeal to both casual listeners and fitness enthusiasts. Similarly, power banks that double as phone stands or smart wallets with Bluetooth tracking capabilities offer added value.

Smart accessories aligned with wellness and safety trends—such as UV-sanitizing phone cases or temperature-sensing cases—are also gaining attention. These innovations offer differentiation in a crowded market and appeal to tech-savvy consumers willing to pay a premium. As the Internet of Things (IoT) continues to expand, mobile accessories can evolve into interconnected devices that play a role in health monitoring, smart home control, and remote work setups, opening up lucrative possibilities for market players.

Protective cases dominate the U.S. mobile accessories market in terms of volume and value. With each new smartphone release, demand for compatible, stylish, and durable cases surges. Consumers often purchase multiple cases to suit different outfits, seasons, or functions (e.g., waterproof for beach trips, rugged for outdoor activities, sleek for work). Brands like OtterBox and Spigen have cultivated strong followings by offering military-grade protection and trendy designs. Customization is also a major draw, with brands enabling users to personalize cases with photos, logos, or initials, especially among Gen Z and millennial shoppers.

The fastest growing category is headphones and earphones, particularly wireless earbuds. The phasing out of headphone jacks has revolutionized this space. Brands like Apple (AirPods Pro), Samsung (Galaxy Buds), and Google (Pixel Buds) have led the shift, supported by third-party players like Bose, Jabra, and Anker. Features such as noise cancellation, spatial audio, and water resistance are driving upgrades. Additionally, the rise of podcasting, Zoom meetings, and on-the-go media consumption supports repeat purchases and upgrades. As more users seek seamless, wireless, and ergonomic audio solutions, this segment is set to experience sustained growth.

Online channels have emerged as the dominant sales platform for mobile accessories in the U.S. Amazon, BestBuy.com, Walmart.com, and direct-to-consumer websites offer unparalleled convenience, a wider selection, and competitive prices. Online shoppers can access real-time reviews, compare features, and enjoy same-day or next-day delivery. Influencer marketing and targeted social media ads have also made online platforms a primary channel for brand discovery, especially among younger audiences. Furthermore, subscription services and flash sales on accessories drive urgency and increase basket size.

Electronic specialty stores represent the fastest growing offline distribution channel. As consumer electronics become more specialized and integrated with smart home ecosystems, shoppers increasingly turn to stores like Best Buy, Apple Stores, and Verizon outlets for curated advice and compatibility assurance. These outlets provide the opportunity for product testing, expert guidance, and bundling options that appeal to consumers looking for high-quality accessories. Interactive displays and tech demonstrations at these stores create a hands-on shopping experience that builds consumer trust and loyalty.

The mobile accessories market in the U.S. exhibits diverse consumer behavior across different states and demographics. Tech-savvy metropolitan regions such as California, New York, and Washington show higher per capita spending on premium and smart accessories. Consumers in these states tend to adopt innovations faster, including MagSafe chargers, smart rings, and wireless power banks. The proliferation of co-working spaces, high-income professionals, and tech events in these regions fuels demand for accessories that blend productivity and style.

Meanwhile, states in the Midwest and South—including Texas, Illinois, and Florida—represent significant volume markets, driven by high smartphone penetration and strong retail networks. In suburban and rural areas, hypermarkets and electronic stores remain preferred retail formats, while online penetration is increasing due to improved logistics and promotional campaigns. Educational institutions and enterprises also play a key role, particularly in the demand for headphones, screen protectors, and protective gear for devices issued to students and employees.

March 2025: Belkin announced the launch of its new BoostCharge Pro Magnetic Power Bank compatible with MagSafe, featuring 15W fast charging and a pass-through USB-C port for simultaneous charging.

January 2025: OtterBox unveiled a collaboration with Marvel Studios for a limited edition line of Avengers-themed protective cases aimed at Gen Z and collectors.

December 2024: Apple introduced new AirPods Pro (3rd Gen) with temperature and heart rate sensors, opening new use-cases in health and wellness tracking.

October 2024: Anker launched its Soundcore Liberty 5 earbuds with integrated ChatGPT-powered voice assistant for enhanced AI user interaction.

August 2024: Spigen rolled out its Eco Armor series—a sustainable phone case collection made from biodegradable plastics and soy-based ink packaging, targeting eco-conscious consumers.

July 2024: Nomad Goods partnered with Tesla to release minimalist wireless chargers and phone stands inspired by the Tesla Cybertruck design.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mobile accessories market

Product

Distribution Channel