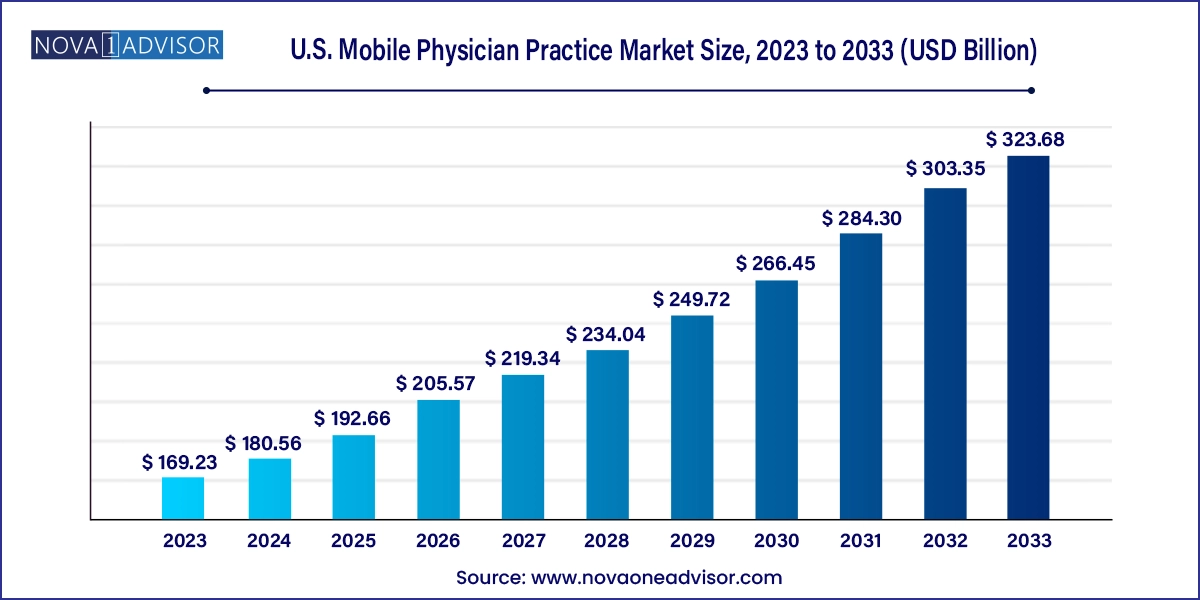

The U.S. mobile physician practice market size was exhibited at USD 169.23 billion in 2023 and is projected to hit around USD 323.68 billion by 2033, growing at a CAGR of 6.7% during the forecast period 2024 to 2033.

The U.S. mobile physician practice market is experiencing a significant transformation, fueled by a combination of demographic shifts, technological advancements, and changing patient expectations. Mobile physician practices refer to the delivery of medical care through physicians who travel to patient homes, assisted living facilities, nursing homes, or offer remote care via digital platforms such as telehealth. These practices emphasize convenience, accessibility, and continuity of care, especially for populations with mobility challenges, chronic conditions, or a preference for home-based services.

Traditionally limited to house calls for the elderly or terminally ill, mobile practices have evolved into a comprehensive service ecosystem, encompassing everything from primary care and diagnostics to rehabilitation, wound care, and palliative support. The pandemic accelerated this transformation by demonstrating the feasibility and efficiency of decentralized care delivery. Moreover, government-backed initiatives to reduce hospital readmissions and improve long-term care outcomes have further legitimized mobile medical models.

As health systems seek to improve care delivery in cost-effective ways, the mobile physician model is becoming central to value-based care strategies, particularly within Medicare Advantage plans, accountable care organizations (ACOs), and integrated care networks. Additionally, the U.S. healthcare system's increasing emphasis on chronic care management and post-acute services is driving demand for physician services that extend beyond clinical walls.

Rapid expansion of telehealth integration within mobile practices

Increasing adoption of remote patient monitoring tools and home diagnostics

Growing focus on palliative and chronic care management for aging populations

Integration of multidisciplinary teams including nurse practitioners, therapists, and social workers

Rising partnerships between mobile practices and value-based care organizations

Emergence of AI-powered scheduling and routing platforms for physician mobility

Shift from episodic care to longitudinal, preventive mobile care models

Private equity investments in mobile physician service startups and roll-ups

| Report Coverage | Details |

| Market Size in 2024 | USD 180.56 Billion |

| Market Size by 2033 | USD 323.68 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Services, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Mobile Physician Services, Inc.; TeamHealth; Doctor On Demand by Included Health, Inc.; Florida Mobile Physicians, LLC; PriveMD; PatientPop, Inc.; SOS Doctor Housecall |

A primary driver of the mobile physician practice market in the U.S. is the growing elderly population and the surge in chronic diseases that require continuous, accessible care. According to the U.S. Census Bureau, by 2030, all baby boomers will be older than 65, making seniors one of the fastest-growing segments of the population. This demographic shift is accompanied by increased prevalence of conditions such as diabetes, congestive heart failure, COPD, and dementia, many of which demand ongoing medical attention and monitoring.

Mobile physician practices cater directly to this need by bringing care to the patient, thereby reducing unnecessary ER visits and hospitalizations. The convenience and personalized approach of home visits are particularly appealing to elderly patients, those with mobility issues, and individuals living in rural or underserved areas. Moreover, CMS programs like Independence at Home Demonstration Project have shown that mobile primary care can reduce Medicare spending while improving quality of life.

Despite the market's growth, reimbursement uncertainty and state-specific regulatory barriers remain key restraints. Mobile physician services often fall into complex billing categories, especially when combining telehealth, in-home care, and collaborative care models. While Medicare covers many mobile visits, documentation requirements and reimbursement rates can vary widely across private insurers and state Medicaid programs.

Additionally, licensing restrictions can limit the reach of mobile practices, particularly those that seek to operate across multiple states. Physicians must often obtain state-specific medical licenses and comply with varying telehealth policies. Moreover, the high cost of onboarding physicians, equipping mobile units, and managing logistics can strain the profitability of mobile practices, especially smaller or independent providers.

One of the most promising opportunities in this market is the integration of mobile physician services with digital health technologies, particularly remote patient monitoring (RPM), AI diagnostics, and digital therapeutics. By equipping patients with wearable devices or home-based diagnostics, mobile physicians can access real-time health data, enabling proactive interventions, medication adjustments, and chronic disease management.

The convergence of mobile visits with virtual consults and cloud-based health records enables the creation of hybrid care models that are scalable, personalized, and cost-effective. Startups and established healthcare providers are investing in platforms that offer end-to-end solutions including scheduling, EHR access, virtual triage, and AI-powered risk assessments.

This opens up new revenue streams through remote monitoring CPT codes, subscription models, and partnerships with employers, insurers, and population health programs. Additionally, hospital-at-home models, backed by CMS waivers, are gaining traction, further legitimizing and expanding mobile physician practices.

Telehealth is currently the dominant modality in the mobile physician practice ecosystem, especially following the widespread adoption during the COVID-19 pandemic. It allows physicians to remotely assess, monitor, and consult patients from anywhere, making it especially useful for follow-up visits, mental health evaluations, and medication management.

The flexibility of telehealth reduces travel time, increases appointment volumes, and enables physicians to serve patients in geographically dispersed or rural regions. It has also been instrumental in managing episodic care needs, such as viral infections or urgent consults. Integration with RPM and AI-based decision support systems further enhances the efficacy of virtual care.

Emergency medicine in mobile settings is gaining rapid momentum, particularly for services like urgent care, wound suturing, diagnostic evaluations, and acute symptom management. This model, often termed "urgent care at home," is being adopted by both private equity-backed groups and hospital systems as an alternative to high-cost ER visits.

Patients with non-life-threatening conditions such as dehydration, minor injuries, or acute infections are increasingly being treated by mobile physician teams dispatched directly to the home. These services are supported by portable diagnostic kits, point-of-care testing devices, and mobile ultrasound systems, allowing near-clinic-level evaluations.

Primary care is the backbone of mobile physician practice, accounting for the largest share of services offered. These include annual wellness checks, chronic condition management, preventive screenings, vaccinations, and medication adjustments. Mobile primary care improves continuity, enhances outcomes, and increases patient satisfaction, particularly among elderly and disabled populations.

Providers often build long-term care relationships through scheduled home visits and teleconsultations, leading to improved medication adherence and fewer hospitalizations. Additionally, value-based care contracts and ACO participation further incentivize primary care delivery in home settings, expanding the market for mobile primary care models.

Palliative care and rehabilitation services are emerging as the fastest-growing offerings, especially as patients seek comfort-focused treatment at home. Mobile palliative teams provide pain management, emotional support, and advanced care planning for terminally ill patients, minimizing the need for institutionalization.

Similarly, post-operative and stroke recovery patients benefit from in-home rehabilitation services, including physical, occupational, and speech therapy, under physician oversight. This integrated approach enables faster recovery, reduced readmission rates, and higher patient compliance, particularly among high-risk or mobility-impaired groups.

Home healthcare is the leading end-use category, aligning perfectly with the mobile physician model. Home healthcare agencies collaborate with mobile doctors to deliver coordinated medical, nursing, and therapeutic care, often covered by Medicare or private insurance.

Patients recovering from surgeries, managing chronic illnesses, or requiring medication adjustments are prime beneficiaries of this setting. Home healthcare offers a holistic, patient-centered approach, improving both clinical outcomes and quality of life while reducing institutional care burdens.

Assisted living facilities are experiencing rapid adoption of mobile physician services, as they bridge the gap between independent living and skilled nursing. These facilities often lack on-site physicians but face rising resident acuity, making scheduled or on-demand mobile visits essential.

Mobile providers offer routine checkups, diagnostic reviews, and urgent consults, improving access and minimizing emergency transfers. Additionally, partnerships between assisted living operators and mobile care providers are being formalized into service agreements and tech-enabled workflows, enabling proactive population health management.

The United States represents the entire scope of this market, with nationwide expansion of mobile physician practices evident across rural and urban geographies. Federal initiatives such as CMS’s Hospital at Home, Medicare Part B reform, and telehealth parity laws have paved the way for the proliferation of mobile models.

Key urban hubs like Los Angeles, Chicago, Miami, and New York City have witnessed rapid growth in concierge-style mobile practices, while rural areas are increasingly being served through telehealth-enabled mobile clinics and nurse-practitioner-led teams.

State-by-state regulatory updates continue to influence service availability, particularly for telemedicine licensing, nurse practitioner autonomy, and cross-border care delivery. Ongoing efforts to expand broadband and 5G infrastructure also support mobile practice growth in underserved regions.

April 2025 – Heal, a prominent mobile physician startup, announced expansion into 10 new U.S. cities, supported by a $50 million Series D funding round.

March 2025 – DispatchHealth launched a new partnership with Humana to deliver mobile acute care and telemedicine follow-up visits for Medicare Advantage members.

February 2025 – ConciergeMD USA introduced hybrid care packages combining home visits with wearable-enabled monitoring for high-risk patients.

January 2025 – Seniors First Medical Group added in-home palliative and rehabilitation services to its mobile care offerings in Florida.

December 2024 – CMS issued extended waivers for hospital-at-home services, enabling physician groups to expand mobile ER-alternative programs into 2025.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mobile physician practice market

Type

Services

End-use