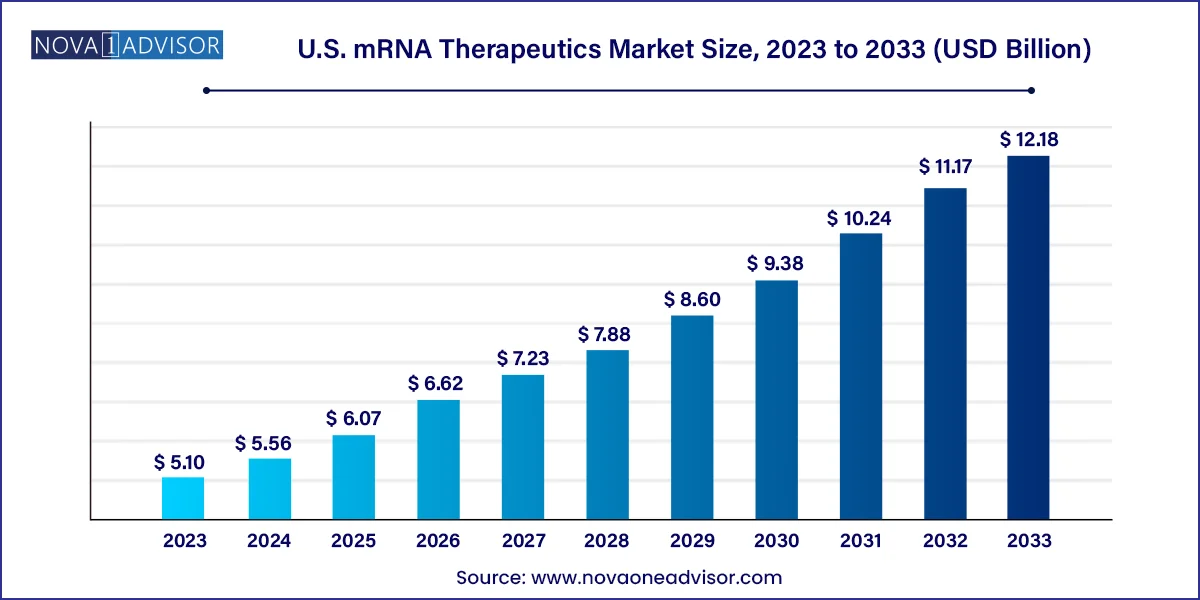

The U.S mRNA Therapeutics market size was estimated at USD 5.10 billion in 2023 and is expected to be worth around USD 12.18 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 9.1% during the forecast period 2024 to 2033.

The mRNA therapeutics market in the United States refers to the pharmaceutical industry segment that develops, produces, and commercializes mRNA-based therapies. mRNA treatments use messenger RNA (mRNA) molecules to send genetic instructions to cells, causing the synthesis of therapeutic proteins that treat or prevent disease.

mRNA therapy is a type of medical treatment that uses messenger RNA (mRNA) molecules to direct cells in the body to create certain proteins. mRNA is a form of genetic material that transports instructions from DNA to the cellular machinery responsible for protein production. In the context of therapies, synthetic or modified mRNA is intended to encode a specific protein with therapeutic properties.

The basic principle underlying mRNA therapies is to inject exogenous mRNA into cells, causing them to create specific proteins that have therapeutic effects. This approach differs from typical medication development, which frequently includes producing and injecting proteins directly.

According to the US Census Bureau, the number of Americans 65 and older increased five times faster than the country as a whole over the 100 years between 1920 and 2020. In 2020, senior persons made up 55.8 million of the US population, or 16.8% of the total population.

| Report Attribute | Details |

| Market Size in 2024 | USD 5.56 Billion |

| Market Size by 2033 | USD 12.18 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, and By End User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | GSK plc., BioNTech SE, CureVac N.V., Sangamo Therapeutics, Inc., Translate Bio, Inc., Moderna, Inc., Argos Therapeutics Inc., Arcturus Therapeutics, AstraZeneca plc., Pfizer Inc., CRISPR Therapeutics AG and Others. |

Driver: Developments in bioinformatics and synthetic biology

The creation and improvement of mRNA therapies have been made possible by the quick speed at which synthetic biology and bioinformatics are developing. The development of more efficient mRNA therapeutics has been facilitated by advances in genomics knowledge, gene editing skills, and the application of advanced computer models to forecast the structure and behavior of mRNA. These developments significantly increase the range of possible uses for mRNA technology, extending beyond infectious illnesses to encompass, among other things, genetic abnormalities, and cancers. Because of the expanding use and effectiveness of modern technologies, the U.S. mRNA therapeutics market is also fueled by ongoing advancements in the domains of synthetic biology and bioinformatics.

Restraint: Storage & stability and delivery challenges

mRNA molecules are not as stable as conventional small molecule medications by nature. Certain COVID-19 mRNA vaccines require storage at extremely low temperatures, which presents logistical hurdles for distribution, especially in areas with limited access to sophisticated cold storage equipment. Furthermore, one of the biggest challenges is delivering mRNA to target cells efficiently. Although delivery has improved with the introduction of lipid nanoparticles, research is still ongoing to address concerns with tissue-specific targeting, cellular absorption, and potential off-target consequences. Thus, this is expected to hamper the U.S. mRNA therapeutics market growth.

Opportunity: Increasing demand for personalized medicine

The goal of personalized medicine is to customize care to each patient's particular genetic profile and medical needs. This method of providing healthcare has gained popularity recently and is a considerable divergence from the one-size-fits-all paradigm. Because mRNA technologies may be tailored to target specific disease variants or specific genetic profiles, they have great potential in this area.

In the context of personalized medicine, mRNA vaccines and therapies are especially appealing because of their potential for customization, which also increases their therapeutic effectiveness and safety profile. The need for individualized medicine is growing as a result of this. The market for mRNA technologies is impacted by the growing demand for these technologies as more patients and healthcare professionals become aware of the advantages of customized medicine.

Based on the type, the prophylactic vaccines segment dominated the U.S. mRNA therapeutics market in 2023. The mRNA platform's ability to facilitate rapid vaccine development has been a key advantage, particularly in responding to emerging infectious diseases. The mRNA technology allows for a quicker response to evolving pathogens by designing and producing vaccines in a shorter timeframe compared to traditional vaccine development methods. The success of mRNA prophylactic vaccines has attracted significant investment in the mRNA therapeutics market. Pharmaceutical companies and biotech firms are increasingly focusing on the development of mRNA-based vaccines for various infectious diseases, driving market growth.

A growing number of mpox cases that later turned into an international outbreak in May 2022 brought the disease to the attention of the world. Up to $90 million in financing will be made available by CEPI to aid in the development of vaccine candidates based on mRNA.

Based on the application, the oncology segment held the largest share of the U.S. mRNA therapeutics market in 2023. The adaptability of mRNA allows for the development of personalized cancer therapies. By tailoring mRNA sequences to a patient's specific tumor mutations or antigens, researchers aim to create targeted and individualized treatments for different types of cancers. Moreover, the growing prevalence of cancer in the country also propels the segment growth.

Based on the end-use, the hospital and clinics segment led the U.S. mRNA therapeutics market in 2023. The segment is observed to sustain its dominance throughout the forecast period. Hospitals and clinics play a central role in the administration of mRNA vaccines. The widespread distribution of COVID-19 mRNA vaccines, such as those developed by Pfizer-BioNTech and Moderna, has been facilitated through healthcare institutions. These vaccines have been administered globally to prevent the spread of the virus.

Hospitals and clinics provide patients with access to innovative therapies, including mRNA therapeutics. As these therapies advance through clinical trials and receive regulatory approval, healthcare providers may integrate them into treatment protocols for specific diseases. Thus, this is expected to propel the market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S mRNA Therapeutics market.

By Type

By Application

By End-use