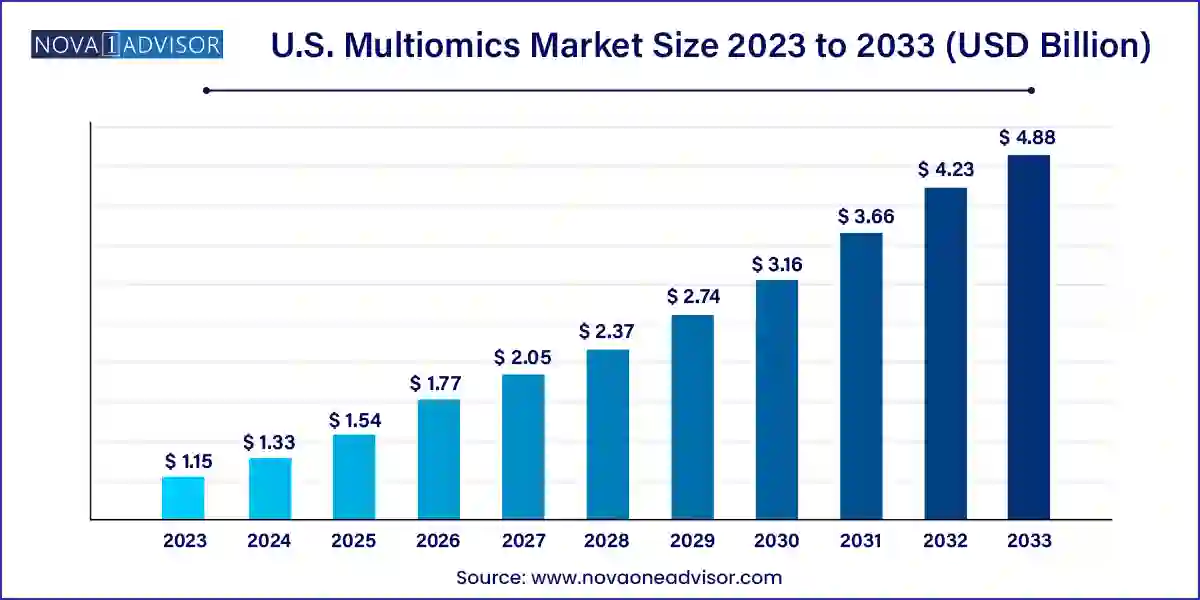

The U.S. multiomics market size was exhibited at USD 1.15 billion in 2023 and is projected to hit around USD 4.88 billion by 2033, growing at a CAGR of 15.56% during the forecast period 2024 to 2033.

The U.S. multiomics market is emerging as a cornerstone of modern biomedical research and clinical diagnostics, integrating multiple layers of biological information such as genomics, transcriptomics, proteomics, and metabolomics. This convergence enables researchers and clinicians to understand complex biological systems more holistically and precisely. Multiomics approaches support early disease detection, personalized medicine, and drug development by providing comprehensive datasets that reveal the interplay between various molecular mechanisms.

In the United States, the market is being fueled by a surge in investments from both public and private sectors. Significant advancements in high-throughput technologies, computational biology, and bioinformatics are enabling scalable and cost-efficient analysis of omics data. Moreover, the presence of top-tier research institutions, well-established healthcare infrastructure, and a proactive regulatory environment encourages adoption across pharmaceutical companies, research centers, and clinical laboratories.

A notable shift in healthcare from reactive to predictive and preventive models is also playing a pivotal role in expanding the market. Multiomics tools are increasingly being employed to detect diseases at an earlier stage, tailor therapies to individual patients’ molecular profiles, and understand disease progression with greater clarity. This paradigm shift is opening up expansive avenues for multiomics platforms and services in the U.S. market.

Rising Integration of AI and Machine Learning in Omics Analysis: AI-driven algorithms are being increasingly used to process and interpret large multiomics datasets for actionable insights.

Expansion of Single-cell Multiomics: Single-cell sequencing combined with other omics layers is transforming cell-level disease modeling, especially in oncology and immunology.

Growing Popularity of Cloud-based Bioinformatics Platforms: To manage the computational complexity of multiomics data, organizations are rapidly shifting to scalable, cloud-enabled solutions.

Pharmaceutical Collaborations with Tech Startups: A growing number of partnerships between pharmaceutical giants and multiomics startups is accelerating drug discovery and development.

Increased Application in Personalized Cancer Therapies: Multiomics is at the core of developing personalized cancer treatments, combining genetic and proteomic data for targeted intervention.

Government-funded Multiomics Initiatives: Initiatives such as the NIH’s All of Us program are promoting longitudinal studies involving genomics, proteomics, and metabolomics data.

Miniaturization and Portability of Multiomics Instruments: Hardware innovation is leading to compact instruments suitable for point-of-care and decentralized testing environments.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.33 Billion |

| Market Size by 2033 | USD 4.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.56% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product & Services, Type, Platform, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | BD; Thermo Fisher Scientific, Inc.; Illumina, Inc; Danaher (Beckman Coulter); PerkinElmer, Inc; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI Genomics |

One of the strongest drivers in the U.S. multiomics market is the growing emphasis on precision medicine. As healthcare systems strive to move away from the one-size-fits-all approach, multiomics platforms provide a powerful toolkit for customizing treatments based on an individual's molecular profile. The integration of data across multiple biological layers enables clinicians to predict disease risks, diagnose conditions earlier, and prescribe therapies that are most likely to be effective for a specific patient.

For instance, in oncology, multiomics can identify specific mutations, expression patterns, and metabolic profiles of tumors, which in turn influence the choice of chemotherapy or immunotherapy. These insights are invaluable for monitoring drug efficacy and detecting resistance mechanisms. The growing body of clinical evidence supporting the efficacy of personalized treatment strategies is driving widespread adoption of multiomics in precision medicine initiatives across leading U.S. hospitals and research networks.

Despite its promise, one of the significant restraints in the multiomics market is the complexity associated with data integration and interpretation. Each omics layer be it genomics, proteomics, or metabolomics generates vast, heterogeneous datasets with unique formats, scales, and biological relevance. Combining these data into a coherent, interpretable structure remains a technological and analytical bottleneck.

Moreover, the lack of standardized data formats and inadequate interoperability among various software tools can lead to inconsistencies in findings. Interpreting integrated multiomics data requires interdisciplinary expertise in biology, statistics, and data science, which is still in limited supply. These challenges not only impact research timelines but also introduce regulatory hurdles for clinical adoption, especially for diagnostics and therapeutics relying on multiomics data.

The application of multiomics in immunology and autoimmune disorders presents a compelling growth opportunity in the U.S. market. Diseases such as lupus, rheumatoid arthritis, and multiple sclerosis are complex and multifactorial, involving genetic predispositions, environmental triggers, and dysregulated immune responses. Multiomics approaches can unravel these complexities by analyzing interactions between various molecular entities across different omics layers.

Emerging studies utilizing transcriptomics and proteomics in immune cells are helping researchers identify biomarkers for disease progression and treatment response. Companies and academic labs are now focusing on integrating omics data to better stratify patients and tailor immunotherapies. Given the growing incidence of autoimmune conditions in the U.S. population and the rising demand for precision immunology, this segment holds substantial untapped potential.

The services segment dominates the U.S. multiomics market due to the increasing outsourcing of omics data processing, integration, and interpretation tasks to specialized service providers. Many academic institutes and biopharma companies prefer outsourcing due to the lack of in-house expertise and the high cost of setting up multiomics workflows. Contract research organizations (CROs) offer bundled services ranging from sample collection and sequencing to data analysis and visualization. The rise in longitudinal studies and clinical trials integrating multiomics data is further strengthening the demand for customized services.

Meanwhile, the software segment is emerging as the fastest-growing due to the critical need for data interpretation and visualization platforms. With the increasing volume of multiomics data, advanced software platforms are necessary to perform integrative analyses, enable collaboration, and generate predictive models. Software equipped with machine learning and artificial intelligence capabilities is being rapidly adopted, especially by research institutions looking to extract deeper insights from complex datasets.

Single-cell multiomics has taken the lead in the market, driven by its ability to deliver high-resolution insights at the cellular level. In fields like oncology, this technology is revolutionizing tumor heterogeneity analysis, enabling the identification of rare cancer cell populations and therapeutic targets. The U.S. has been a major adopter of this approach, especially in research labs focused on cancer immunotherapy and neurodegenerative diseases. Major companies like 10x Genomics are pioneering single-cell platforms that combine transcriptomics and epigenomics, further expanding its application base.

On the other hand, bulk multiomics is gaining traction in population-scale research and longitudinal studies. While it lacks the resolution of single-cell approaches, bulk multiomics is cost-effective and suitable for analyzing tissue-level responses. Its scalability makes it ideal for clinical research and drug development pipelines, particularly in studies involving thousands of samples across timepoints or patient cohorts.

Genomics has remained the dominant platform within the multiomics landscape, owing to its foundational role in identifying disease-associated variants and biomarkers. Advancements in next-generation sequencing (NGS) technologies and cost reduction in genome sequencing have significantly expanded the scope of genomics-based diagnostics and therapeutics in the U.S. Genomics serves as the entry point for most multiomics workflows, often layered with transcriptomics or proteomics data for enhanced resolution.

The integrated omics platform is the fastest-growing segment due to its ability to synthesize data from multiple omics layers into a cohesive framework. These platforms are increasingly being used in systems biology, translational research, and complex disease modeling. Startups and software vendors are focusing on building integrated platforms that cater to both academic researchers and commercial pharmaceutical clients, enabling more holistic data interpretation.

Oncology is the dominant application area for multiomics in the U.S. market. Cancer is a multifaceted disease involving genetic mutations, epigenetic changes, protein expression variability, and metabolic shifts. Multiomics analysis enables oncologists to decode this complexity by integrating data from various biological layers. It allows for better tumor characterization, personalized treatment plans, and the identification of resistance mechanisms. Companies like Tempus and Foundation Medicine are at the forefront of integrating genomics and transcriptomics in cancer diagnostics.

Cell biology is emerging as the fastest-growing application, primarily due to its relevance in stem cell research, developmental biology, and regenerative medicine. Multiomics tools are being employed to map the cell differentiation process, understand cellular reprogramming, and design cell-based therapies. Academic researchers are increasingly using multiomics to study disease mechanisms at the cellular level, particularly in developmental disorders and neurobiology.

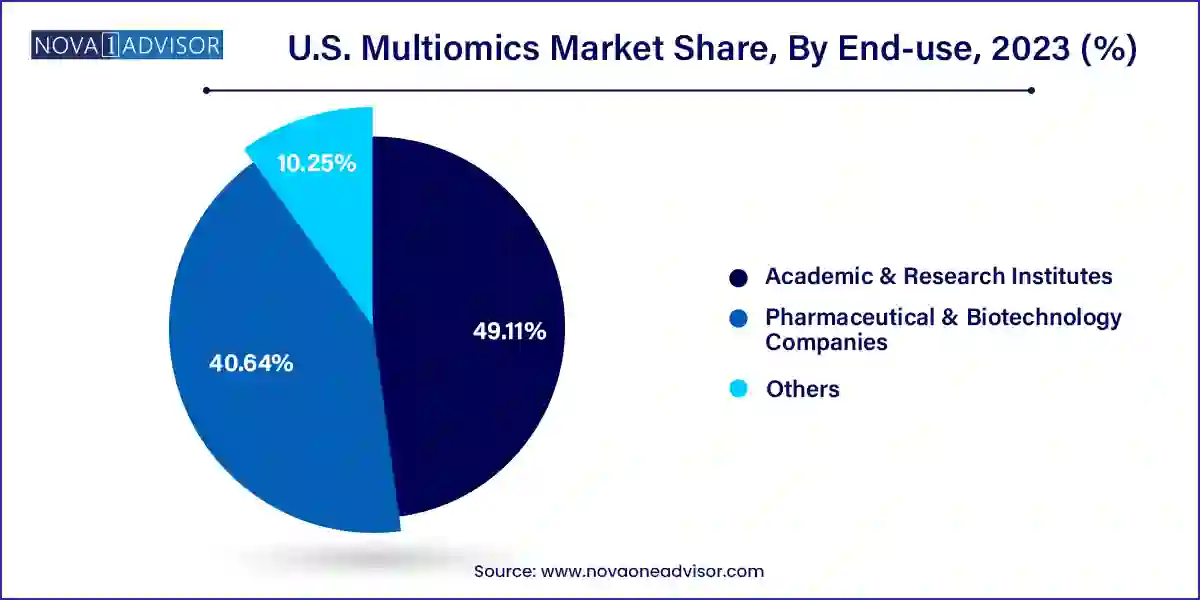

Pharmaceutical and biotechnology companies are the largest end-users in the U.S. multiomics market. They utilize multiomics platforms for target identification, biomarker discovery, patient stratification, and drug efficacy studies. As the industry moves toward precision medicine and biologics, multiomics offers unparalleled tools for streamlining the drug development pipeline. Numerous collaborations and licensing deals between pharma companies and omics tech firms are fueling this trend.

At the same time, academic and research institutes are the fastest-growing segment. With increased federal and state funding for biomedical research, institutions are investing in multiomics technologies to explore disease etiology, develop diagnostic tools, and study treatment mechanisms. The growing emphasis on translational research is further encouraging the use of integrated omics workflows in academic labs across the U.S.

The U.S. has cemented its leadership in the global multiomics ecosystem due to a combination of technological innovation, robust research funding, and a mature biotechnology industry. Government programs like the National Institutes of Health (NIH) and Precision Medicine Initiative have laid the groundwork for large-scale adoption. The country is also home to top universities and research centers Harvard, Stanford, Johns Hopkins, and others that are actively developing and applying multiomics in various domains of healthcare.

Moreover, venture capital firms in the U.S. are investing heavily in multiomics startups focusing on drug development, diagnostics, and AI-powered data platforms. Regions such as Boston, San Diego, and San Francisco are acting as multiomics innovation hubs. With strong regulatory frameworks, reimbursement policies evolving in favor of molecular diagnostics, and increasing patient demand for personalized therapies, the U.S. remains a hotbed of multiomics activity and commercialization.

February 2025 – 10x Genomics announced the release of its next-generation Xenium platform, enabling high-throughput spatial multiomics at single-cell resolution. The platform has already been adopted by several U.S. cancer research centers.

January 2025 – Illumina partnered with Mayo Clinic to co-develop multiomics-based diagnostics for rare genetic disorders, leveraging Illumina’s sequencing technology and Mayo’s clinical network.

November 2024 – Thermo Fisher Scientific launched a new suite of integrated omics instruments and cloud-enabled bioinformatics tools aimed at clinical research applications.

October 2024 – Bruker Corporation expanded its proteomics and metabolomics services portfolio through the acquisition of a U.S.-based AI-powered data analytics company, enhancing its capacity for integrated omics interpretation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. multiomics market

Product & Services

Type

Platform

Application

End-use